The past few weeks have been very active for Bitcoin in most aspects except for its price. In terms of news, Bitcoin garnered stamps of approval from multiple major organizations.

PayPal confirmed that it has been working on plans to add cryptocurrency buying and selling services since March. Mastercard granted London-based startup Wirex principal membership, giving it authority to directly issue cryptocurrency-backed cards on Mastercard’s network. More recently, American banks received approval to provide custody services for cryptocurrencies. Finally, as anyone reading this probably knows, an already-infamous Bitcoin scam was promoted through Twitter after accounts of Barack Obama, Elon Musk, and more encouraged users to send Bitcoin to the scammers’ address.

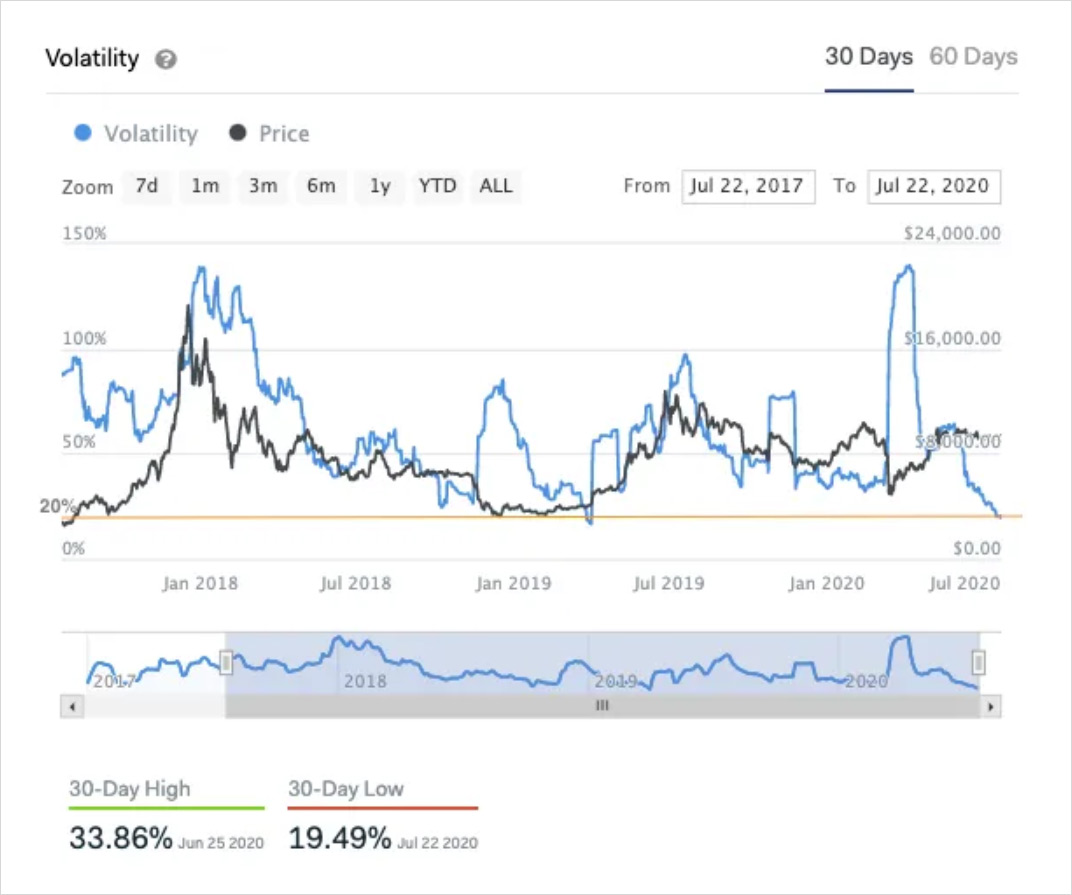

Despite all of this Bitcoin news coming out in just a couple of weeks, its price has remained stagnant, hovering in $9,000 to $10,000 range for approximately 90 days. This uncharacteristic stability in Bitcoin’s price has led its 30-day volatility to drop below 20% for the second time in its history. Despite the remarkable price stagnation, key on-chain and derivatives indicators have been flashing active signs indicating how Bitcoin investors are positioning themselves and what may come next.

Last time Bitcoin volatility was this low was in March 2019, preceding a 200%+ rally. However, it would be absurd to claim that simply because this was the case last time the same will happen this time around. Instead, by diving deep into blockchain and derivatives data, we can formulate valuable insights to understand how Bitcoin investors are positioning themselves during these times of lackluster volatility.

On-Chain Analysis Suggests Bitcoin’s Growing Appeal as a Store of Value

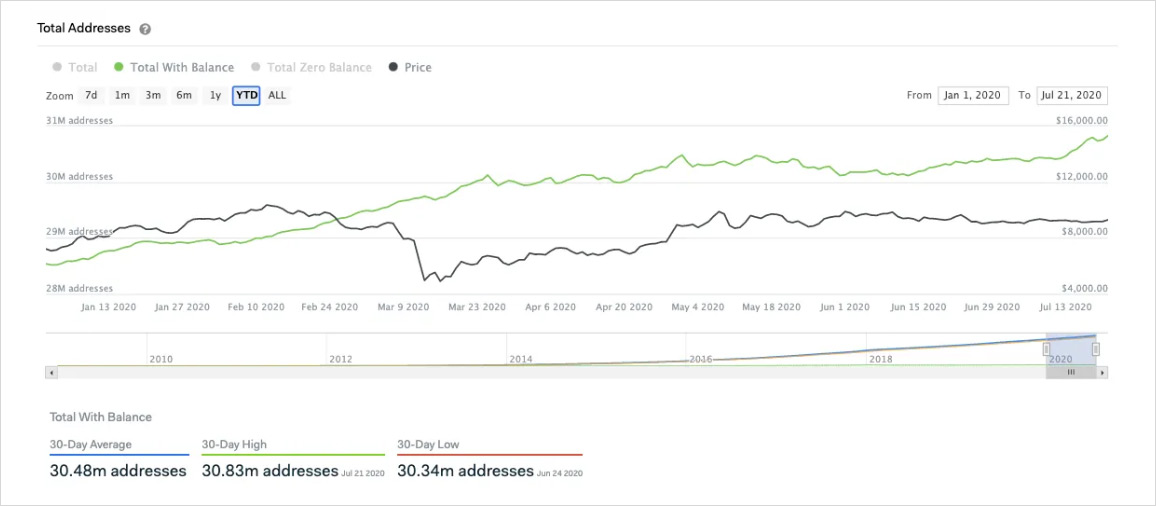

One of the metrics we follow closely at IntoTheBlock is the number of addresses holding a particular crypto asset, in this case Bitcoin. While one address ≠ one user, the number of addresses with a balance offers an approximation of the adoption and number of holders of a crypto asset. Keep in mind that a user can have more than one wallet (and address), but at the same time centralized exchanges tend to group multiple users’ holdings within relatively few addresses.

By taking a closer look at the total number of addresses with a balance for Bitcoin, it becomes apparent that the number of Bitcoin holders had also moved range-bound slightly above 30 million for approximately three months. Having previously peaked at 30.48 million addresses prior to the halving in early May, the number of Bitcoin holders has continued to increase to new all-time highs, accelerating throughout mid to late July.

This spike in the number of Bitcoin addresses coincides with the news releases from PayPal and Mastercard. Despite Bitcoin’s price staying stable, the rise in the number of holders can be interpreted as a bullish sign in anticipation of a wave of new users being able to buy crypto through PayPal and transact in it through Mastercard’s network.

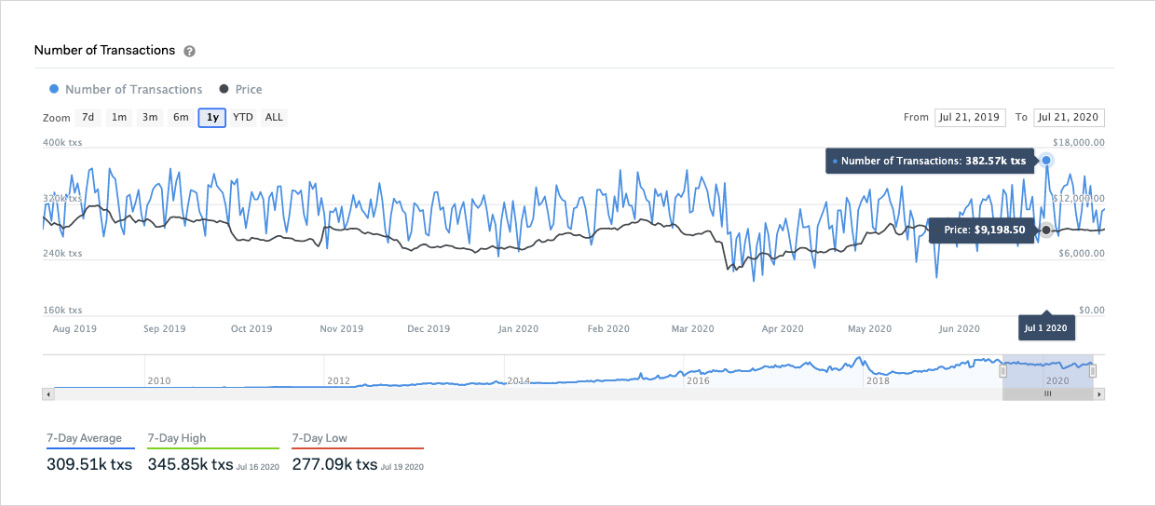

Speaking about crypto transactions, recall that one of the main perceived drawbacks of using Bitcoin as a medium of exchange was that its volatility made it difficult for users to account for the value being transacted. Well, in that case, you may have expected Bitcoin’s transactions to be growing now that its price has been behaving eerily stablecoin-like.

Analyzing the number of Bitcoin transactions we can confirm that Bitcoin transactions reached a yearly high of 382,570 transactions on July 1st in the midst of this low volatility environment. That being said, the spike seems to be a one-off occasion as the average number of daily transactions remains around 310,000, around the same amount as a year ago when volatility was over four times higher than current levels.

One may argue that Bitcoin transactions have not increased because even though volatility is currently at record low levels, the market may expect volatility to revert to its normal values. This very valid argument highlights the difficulty that Bitcoin has to tackle if it ever wants to be accepted as a widespread medium of exchange, given that users’ expectations of volatility will be influenced by its historically volatile price activity all other things being equal.

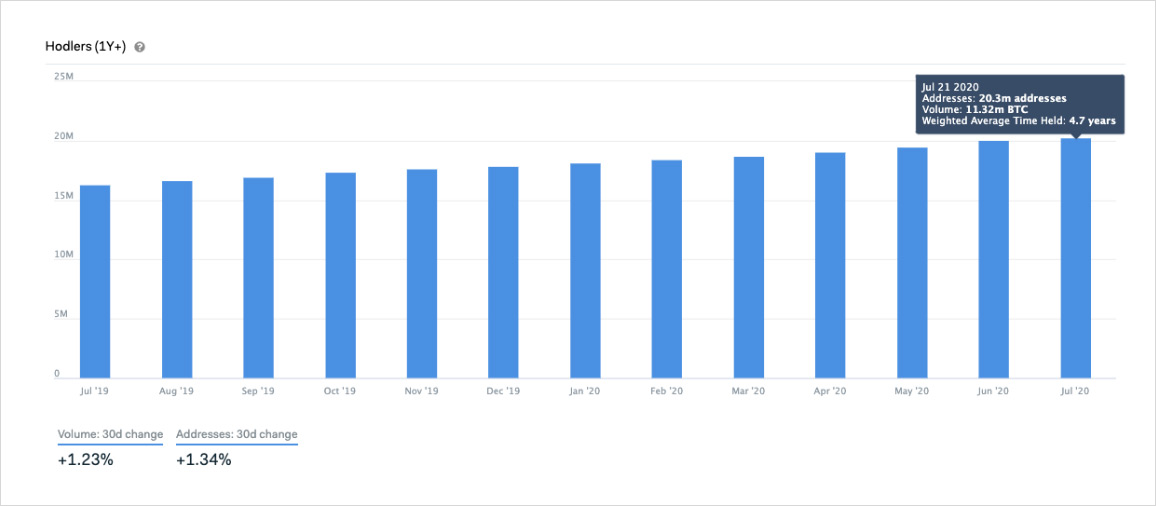

While this raises major question marks surrounding Bitcoin’s proposition as a medium of exchange, on-chain data suggests that Bitcoin’s narrative as a store of value has never been stronger. Using IntoTheBlock’s Hodlers indicator, which tracks the number of addresses that have been holding tokens for over a year, we can estimate the number of users that are investing in Bitcoin with long-term expectations.

The number of Bitcoin hodlers has been constantly increasing throughout the last 12 months, even during the 50% crash experienced in March. This continuous growth in Bitcoin’s hodlers in spite of it losing half its value in one month points to the likelihood of most Bitcoiners expecting higher prices down the road. Given the low volatility environment, more and more Bitcoin addresses have opted to invest in it long-term rather than trade it as the number of hodlers recently surpassed 20 million for the first time.

Derivatives Turn Bullish on Bitcoin

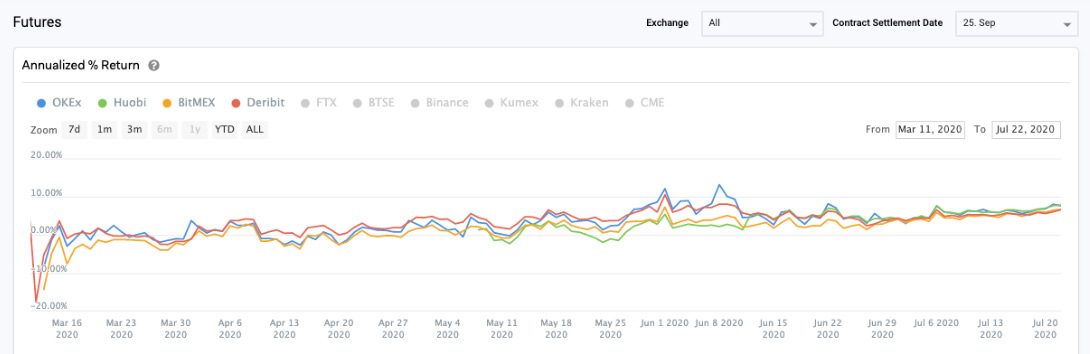

Bitcoin’s growing derivatives markets paint a similar picture to the one we are observing on-chain. Observing the dominant futures contracts for Q3, we can see that the market has gone from neutral to cautiously bullish in the last few months.

The annualized % return indicator calculates the implied return for futures contracts if they were to expire a year from now. While in April most contracts were pricing in a small 0 to 2% annual return%, this has grown to an equivalent of 6% to 8% for futures contracts expiring on September 25. This difference is even greater when you consider that the annualized % return approached -20% in the midst of the Black Thursday panic.

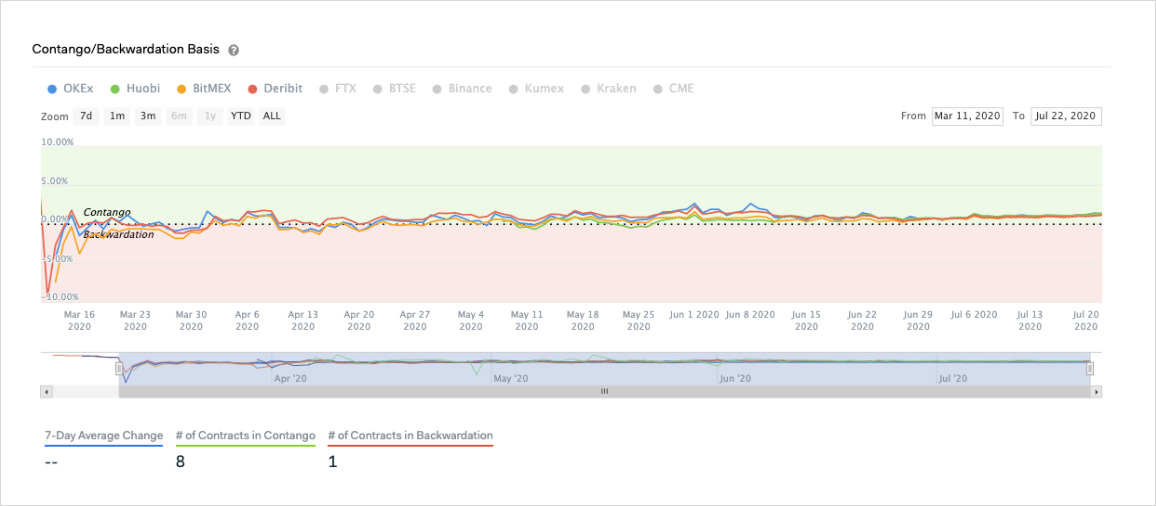

Another angle to look at this change in investor positioning is to see it through the lens of traditional contango and backwardation. Future prices were at a significant discount relative to spot prices on March 12. The situation has now reversed with only one out of the nine reputable contracts expiring on September 25 pricing Bitcoin at a discount. The growth in the number of contracts in contango signals that consensus among derivatives investors is currently bullish.

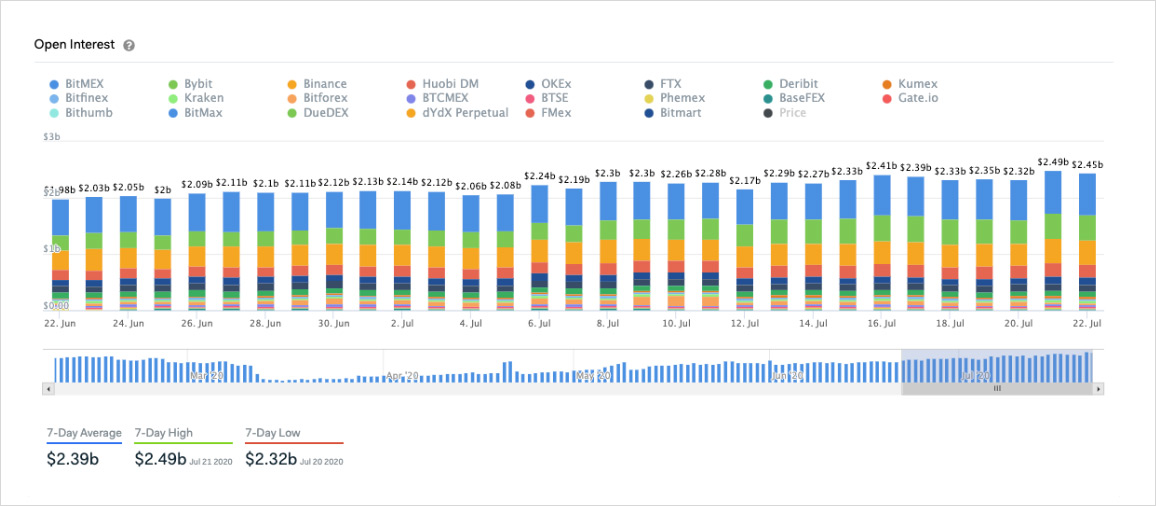

Furthermore, by analyzing perpetual swaps we can reaffirm this stance from derivatives markets. Despite price moving mostly sideways throughout the last 30 days, open interest in Bitcoin perpetual swaps has been constantly increasing. While open interest quantifies the total dollar value of outstanding contracts, both long and short, generally when price increases along with open interest, it can be interpreted as a bullish signal.

On July 21 when open interest in Bitcoin perpetual swaps hit an all-time high, Bitcoin’s price had previously increased by approximately 2.5%. Along with this moderate price increase, open interest spiked by over 7% pointing to the likelihood of more long contracts being open.

At the time of writing this, Bitcoin appears to just have surpassed $9,500 for the first time in a month. On-chain indicators and derivatives markets point out how investors have been positioning themselves for this breakout. Overall, the lack of volatility has not negatively affected investor interest in Bitcoin as evidenced by several market indicators. As prices appear to be breaking out, it is possible that the low volatility environment may be coming to an end propelled by bullish on-chain and derivatives indicators.

To dive deeper into Bitcoin make sure to check out the 60+ indicators and signals we have at IntoTheBlock. Finally, to trade Bitcoin derivatives and analyze market data, make sure to check out Deribit’s Market Data.

AUTHOR(S)