Bearish Pressure Mounts

While BTC is still in a consolidative phase, the dangers on a downside airpocket if $60k breaks are significant.

ETH is also showing signs of weakness after the launch of the ETH spot ETF in HK attracted tepid inflows.

Recent narratives such as the BTC halving or hot US BTC ETF flows have eased.

The focus is shifting back to macro with the risks mounting for the Fed to hike rates again this year.

On top of that, fears of an escalation of the Middle East conflict are another aspect to deal with.

Vol Levels Dependent on $60k Support Holding

With the exception of Tuesday’s sell-off, the realized volatility for BTC and ETH had dropped off a cliff, bringing positive carry back into the readings. Short-term implied volatility, particularly for BTC, had also decreased significantly. Maintaining the $60k support level in BTC is now crucial; otherwise, we might see increased selling and volatility kicking in. This week’s economic events such as QRA, FOMC and NFP could impact crypto markets. Hedging downside risks with options seems wise.

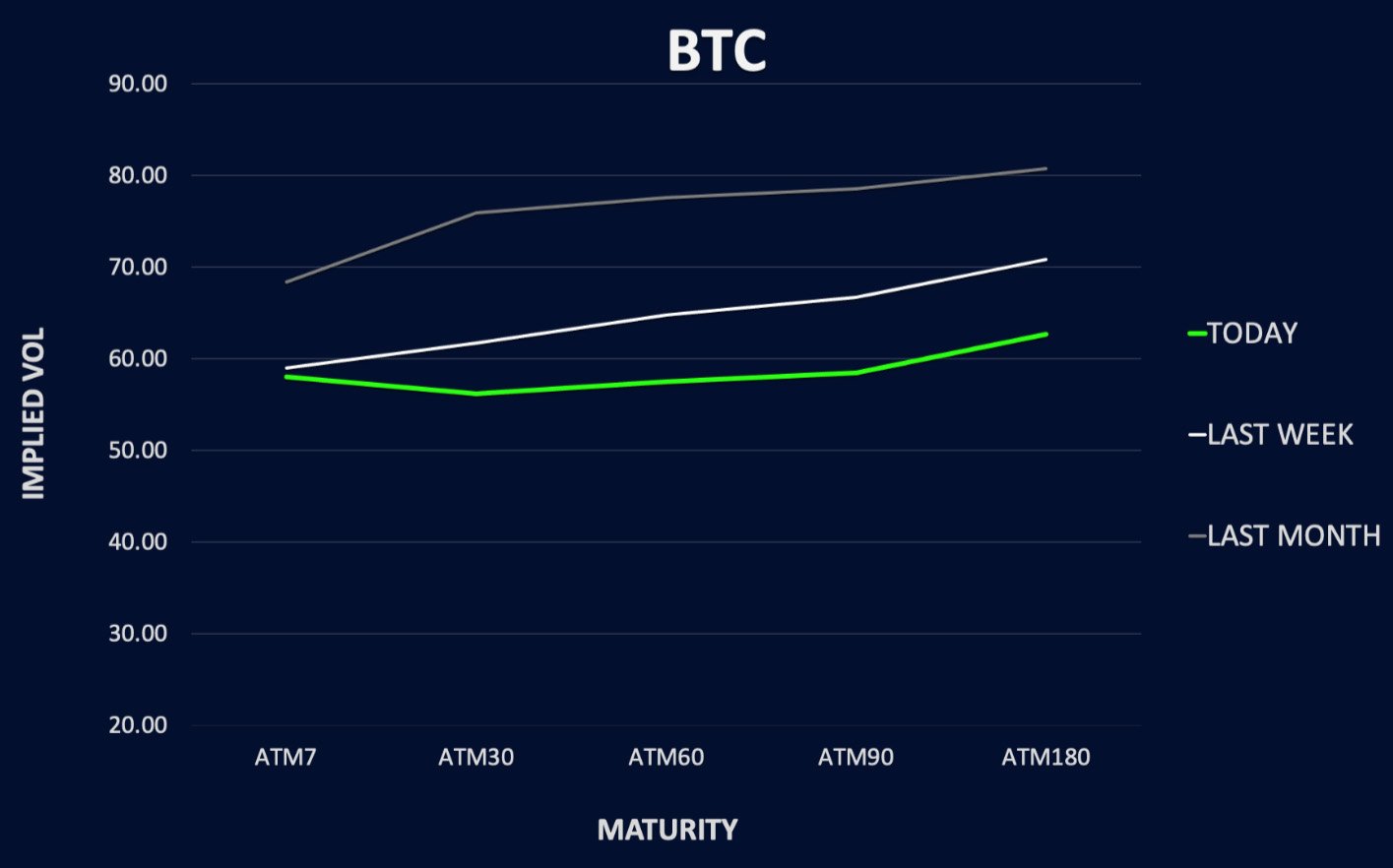

Term Structures Shifting Lower

BTC term structure has shifted lower, but the recent pop in front-end vol leaves most of the losses in long term implied vol. Put options are in demand for protection. ETH term structure was affected similarly, but with firmer weekly expiry due to gamma demand. Protecting against downside risks remains a priority, especially in weekly options.

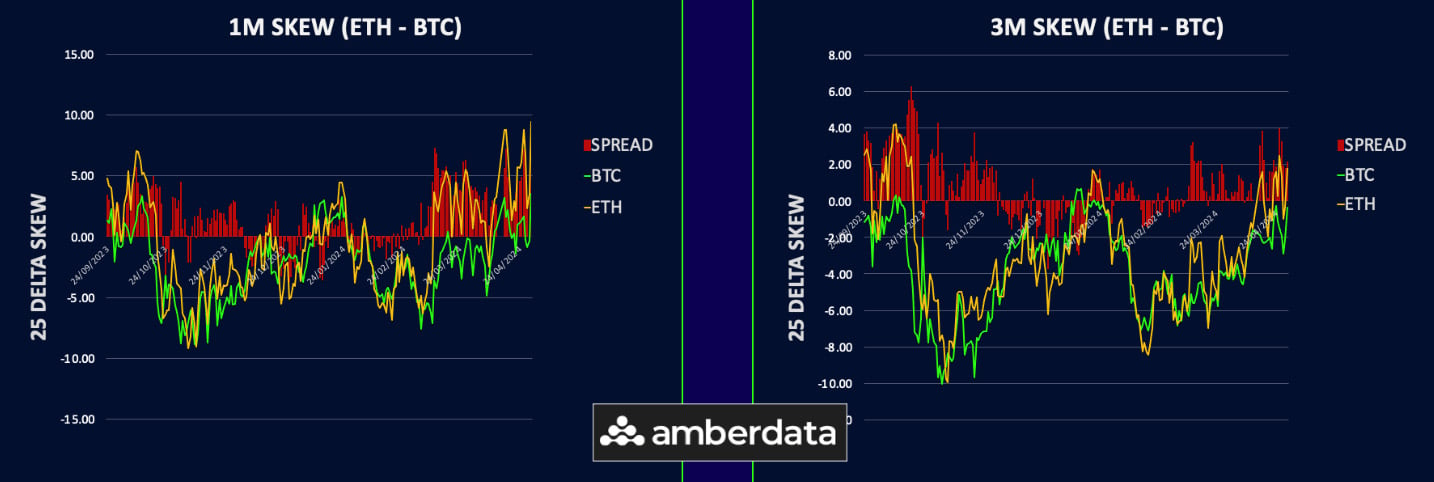

ETH/BTC Spread Moving Up

ETH’s volatility remains higher compared to BTC, suggesting a preference for ETH options, which has caused the vol spread to move up, especially on the front end. The true relative value opportunity is in owning ALT coin vol versus large cap vol. For those who can trade OTC and source the liquidity. Lower ETH/BTC spot spreads would be welcomed to enter long RV trades via ETH call vs BTC calls trades later this year.

Skew Reverts Back Down

Skew was reverting back to zero until Tuesday’s selloff that took out supports. Put skew increased as spot prices fell, indicating a potential downside break as traders rushed for hedges. ETH skew is trading with a 15 vol put premium in the front-end weeklies, compared with around 10 vols in BTC. Long-term bullish sentiment remains, but short-term downside risks are likely before long-term value buyers re-enter.

Option Flows And Dealer Gamma Positioning

BTC & ETH options volume decreased, notable flows were short-dated put buying activity in May expiries to hedge downside and selling of longer term calls.

Dealer gamma for BTC is less short as we move down to dealer long strikes at 60k, but so far this is not providing any support. ETH dealer gamma has dropped to zero as we slide lower into dealer short put territory.

Strategy Compass: Where Does The Opportunity Lie?

We think the current breakdown in prices has the potential to shake out some weaker longs and using options to hedge at least half your holdings makes sense here. Puts have become more expensive overnight, so maybe put spreads collar line up better for those willing to sell upside. For peace of mind, just owning some short-dated puts, despite the increase of premium can still make sense to allow yourself to hold positions through the turbulence. Good Luck!

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)