ETH Rips Higher As ETF Approval Gets Priced In

We are gearing up for a major week in ETH with spot ETF deadlines approaching. The evidence is starting to mount that the SEC might approve ETH ETFs, turning a low-key and “written off” event into a hot topic.

Exchanges are reportedly updating filings, hinting at imminent approval. Bloomberg has upped the approval odds to 75%, pushing ETH spot prices up over 20% to $3,800.

If approved, ETH could soar tthrough $4,000, but a denial might drop it to $3,000. Key deadlines include VanEck on May 23 and Ark Invest/21Shares on May 24. The ETHBTC spread has also surged. The spread could easily rally another 20% in short order if the ETF is approved.

ETF News Leads To Spike In Realized Vol

ETH is on fire as news of a potential ETF approval has driven the prices up nearly 20% in a day. This sudden spike has pushed 10-day ETH realized volatility into the 80s, highlighting renewed event risk in crypto. Implied vols had been slightly higher than realized, benefiting gamma sellers.

The approval speculation has created market uncertainty, with ETH volatility expected to stay high until we get more clarity from the SEC. The decision could have broad implications, and it’s uncertain how the SEC will handle potential approvals.

ETH Term Structure Inverts As Price Surges

BTC term structure is rising, with most maturities up 4-5 vols as spot/vol correlation returns. A break to new highs could further boost front-end volatility. Skew moved higher for calls as you’d expect.

ETH term structure is inverted due to a price surge, with weekly vol up nearly 40 points and back-end up 6 vols. High event risk means volatility will stay elevated, especially for gamma sellers. The curve has flipped back into call skew, driven by front-end demand.

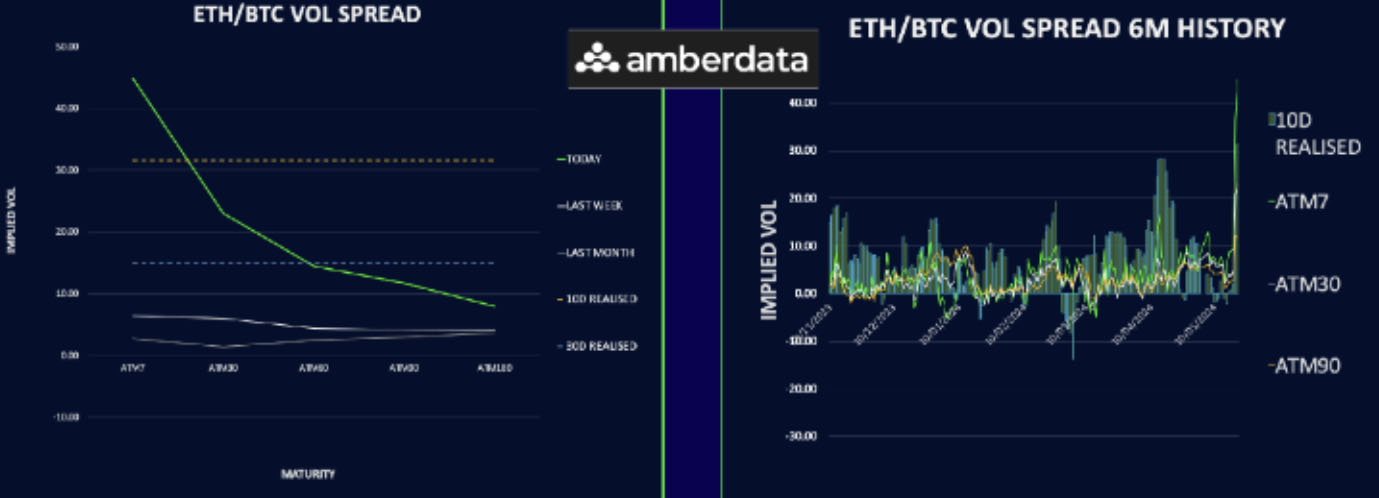

ETH/BTC Vol Spread Explodes Higher

The ETH/BTC vol spread has surged above 40 vols after ETH’s massive repricing, reminiscent of the ‘Merge’ days. This is justified by the expected move and consequent ETF flows if we get an approval.

The ETH/BTC spot spread rebounded to 0.054, potentially rising another 20%. Selling ETH gamma proved wrong; the landscape has shifted, emphasizing the need for proper position sizing to survive such moves. Over-leveraging can lead to significant losses in this environment.

Big Shift In Skew

ETH skew has shifted back to a call premium, catching up to BTC. Front-end ETH skew hit 20 vols for calls but has settled around 10 points. The curve remains inverted, with short-term call skew steeper than long-term. BTC skew is more stable, with front-end trades around 3 vols and back-end at 6 vols for calls. The upcoming ETF decision will keep ETH skew elevated, but if ETH hits $4,000 and prices in the approval, skew might start to normalize.

Option Flows And Dealer Gamma Positioning

BTC option volumes surged 40% to $7.9Bn, driven by bullish flows as spot surpassed $70k. Short- dated calls were popular in the 65-70k range, with call spreads bought in June and December. Some bearish risk reversals appeared in June 60k/80k strikes.

ETH volumes were flat at $3.5Bn last week but hit $2.7Bn already this week on the price spike. Before the move, May calls were sold in the 3000-3100 zone, now rolled up to 4400 calls. There’s interest in 31May 4000 calls and 28Jun 4000/5000 call spreads.

BTC dealer gamma is near neutral with spot at $70k, while ETH dealer gamma is highly positive up to $3,700. This shows that dealer gamma is not big enough to hold the market when major spot impacting news hits the tape.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)