BTC Retests Multi-Month Range Bottom

Last week, BTC dipped to $58k but quickly rebounded despite negative news, including the Mt. Gox Trustee’s planned distribution of 140,000 BTC and BTC sales by Germany and the US.

Market concerns about an oversupply may ease if no major new supply emerges. However, BTC could still test mid to low $50k levels if large scale selling materialises.

Despite this, growing interest from TradeFi, US regulatory easing, and potential pro-crypto candidate Trump in office suggest an encouraging H2. Additionally, the upcoming ETH spot ETF and ongoing BTC spot ETF inflows indicate bullish factors, with BTC historically showing a ~10% return in July.

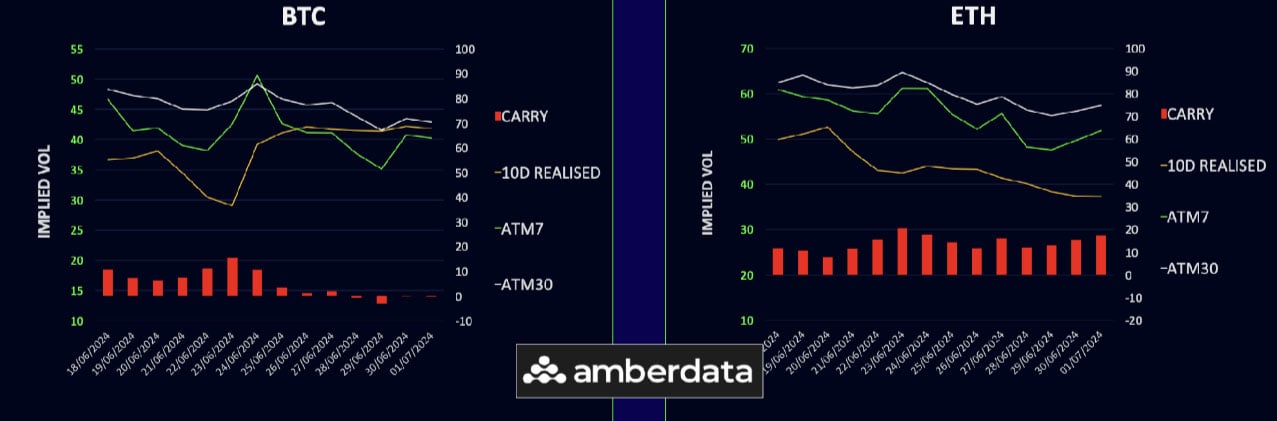

Realized Volatility Keeps Trending Lower

BTC’s volatility remains stable around 40, while ETH’s has dropped to 37. Both BTC and ETH saw lower implied vols in 1-month options, reflecting low realized volatility. With ETH’s ETF launch keeping implied vols high but realized vols low, the ETH vol carry is huge. The spot ranges may still stay tight this week, especially with the July 4th holiday. Upcoming FOMC minutes and NFP data could introduce some volatility but we doubt it’s enough to break ranges.

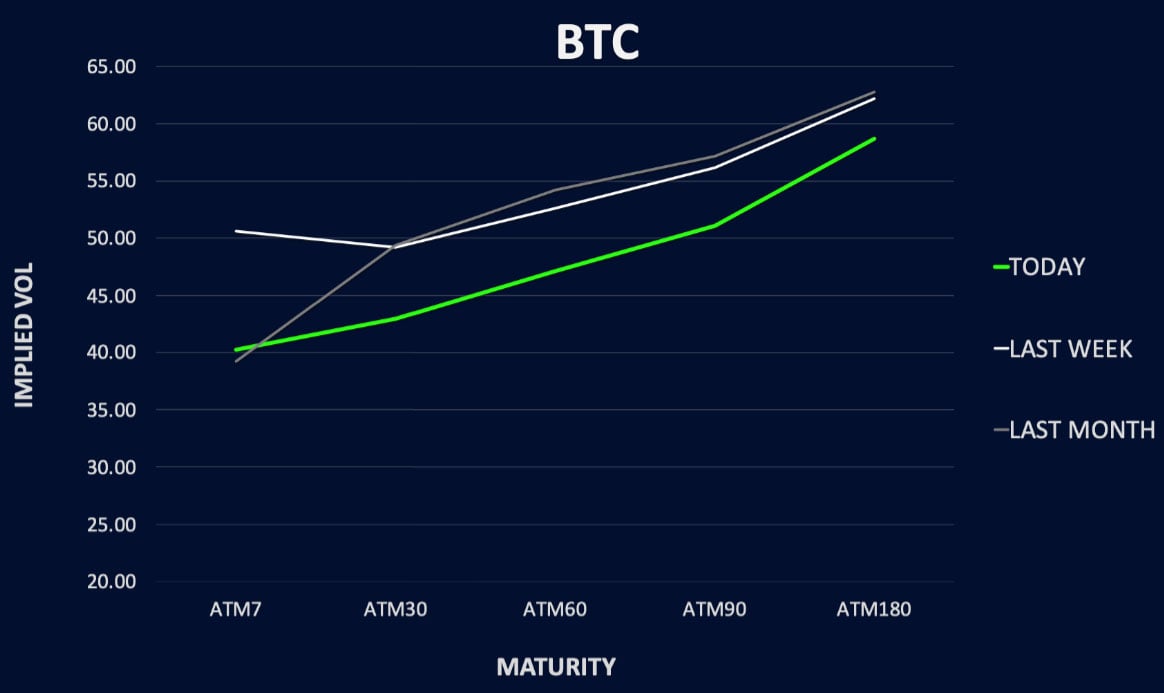

Term Structures Shifting Lower

BTC’s term structure is declining, with short-dated vol dropping significantly and back-end vols also lower but more gradually. Call skew is down 1-2 points across the curve. ETH is following a similar pattern to BTC, with front-end vol hit hard due to the ETF delay and long-dated vol down nearly 5 points. ETH call skew has dropped by around 2 vols.

Vol Spread Drifting Lower Too

ETH/BTC vol spread is slightly lower as ETH vol dropped more than BTC this week. Despite this, ETH’s implied vol remains high due to the anticipated ETF launch. If the launch underwhelms, a vol reset is likely. The ETH/BTC spot spread is stable but poised for a potential breakout, with ETF inflows being the likely catalyst. The delay in the ETF launch hasn’t hurt ETH spot much, as approval seems inevitable. Post-launch, a vol reset in the spread is expected unless ETH’s realized vol spikes significantly.

Call Skew Under Pressure

Call skew is under pressure with no follow-through on the recent rally. ETH maintains a higher call premium than BTC but has softened by 2 points, indicating some doubt about a big ETF rally. BTC’s front-end skew shows a small put premium for July expiries, reflecting hedging against a possible drop below $60k. Skew term structures remain steep, with long-term calls holding a 5-6 vol premium while front-end skew trades near flat.

Option Flows

BTC option volumes increased by 25% to $8.2Bn, with strong interest in upside calls for Sep24 to Mar25 maturities (85k-120k strikes) and Sep24 48k puts. ETH volumes decreased by 20% to $2.6Bn due to the ETF delay, but call flows dominate as traders exploit lower vols for upside plays.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)