Officials from the Federal Reserve and other central banks of multiple countries have repeatedly put pressure on the risk asset market, further squeezing the upward room of the crypto market, and the strengthening of the USD has put additional pressure on the risk asset market. In the coming months, BTC and ETH may have difficulty breaking through their previous highs, but as inflation continues to decline, the crypto market may gradually rebound at the end of the year.

Author: Matt, Blofin CEO

“We Still Need More Rate Hikes”

Officials from the Fed and the ECB seem to have a genetic fear of inflation. The repeated inflation and economic stagnation of the 1970s deeply impacted Western countries’ economies. After various methods, such as freezing wages and prices or maintaining austerity policies, proved ineffective, the Fed eventually solved the inflation problem by significantly raising interest rates at the cost of several years of recession.

At that time, the current policymakers were still young: Powell had just graduated from university in the early 1970s, while Lagarde was still a student. The impact of the “decade of inflation” permeated their best years, so faced with the inflation situation in 2021, the Federal Reserve and the European Central Bank chose a solution of “rapidly raising interest rates and suppressing inflation as soon as possible.” This approach can be seen as an improved version of the “Volcker Solutions.” Under the premise of “avoiding recession as much as possible,” the economy is “cooled down” through high-interest rates, ultimately achieving inflation control. Of course, the recession is still an option; as Powell said, “A mild recession is not impossible, but we have a range of tools to deal with it. However, if inflation continues or even evolves into ‘stagflation,’ the situation will be out of control.”

The attitude of the Fed is now clear. Although the banking crisis in March caused traders to bet on a “Fed surrender,” the Fed successfully maintained the unchanged interest rate policy through textbook-style expectation management while soothing market sentiment and controlling the spread of the crisis. Powell emphasized “making decisions based on data,” while other officials frequently stated that “inflation has not yet subsided.” The announcement of core PCE data in April gave Fed officials sufficient reasons to raise interest rates further to suppress inflation. Whether “data-based” or “view-based,” further interest rate hikes are already a foregone conclusion; traders’ hopes have been dashed. The interest rate may remain above 5% until the end of the year.

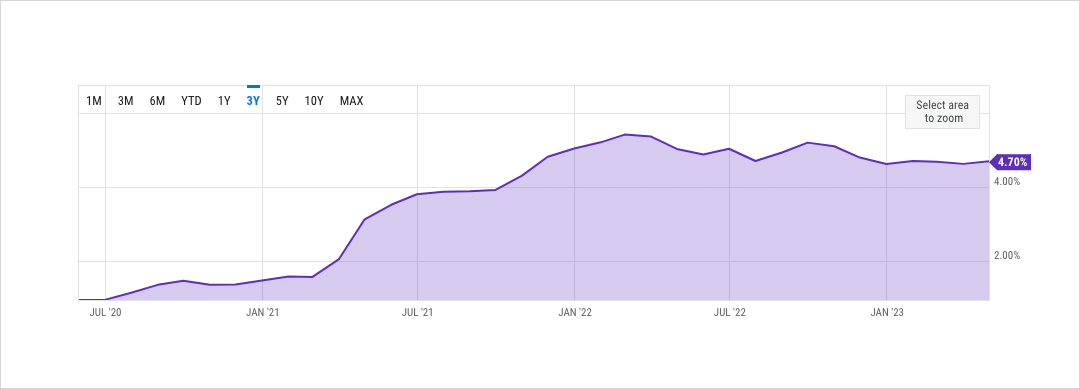

Changes in U.S. PCE YoY data over the past 3 years, as of April 2023. Source: Ycharts

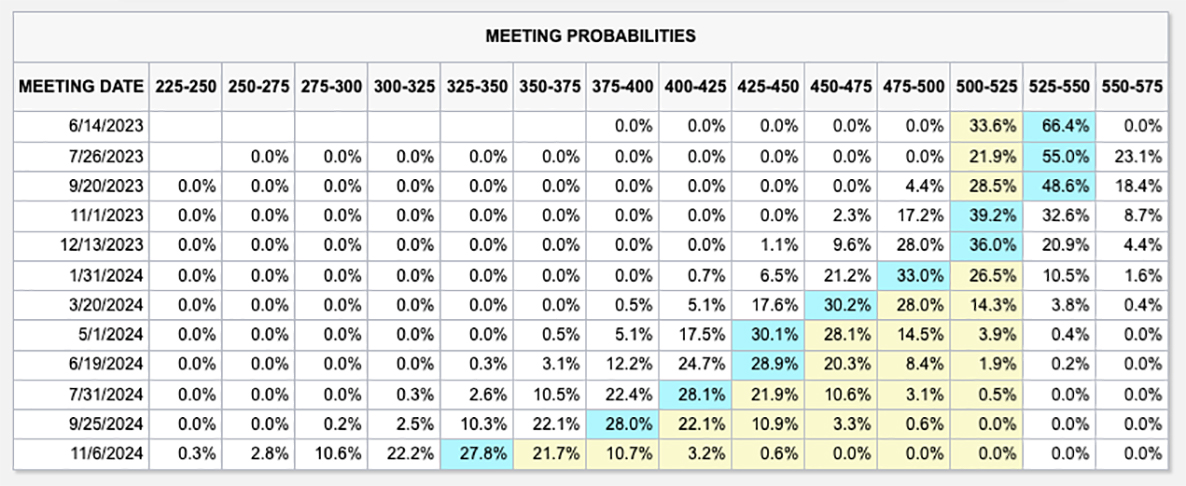

Expected changes in Fed interest rates, as of May 29, 2023. Source: CME Group

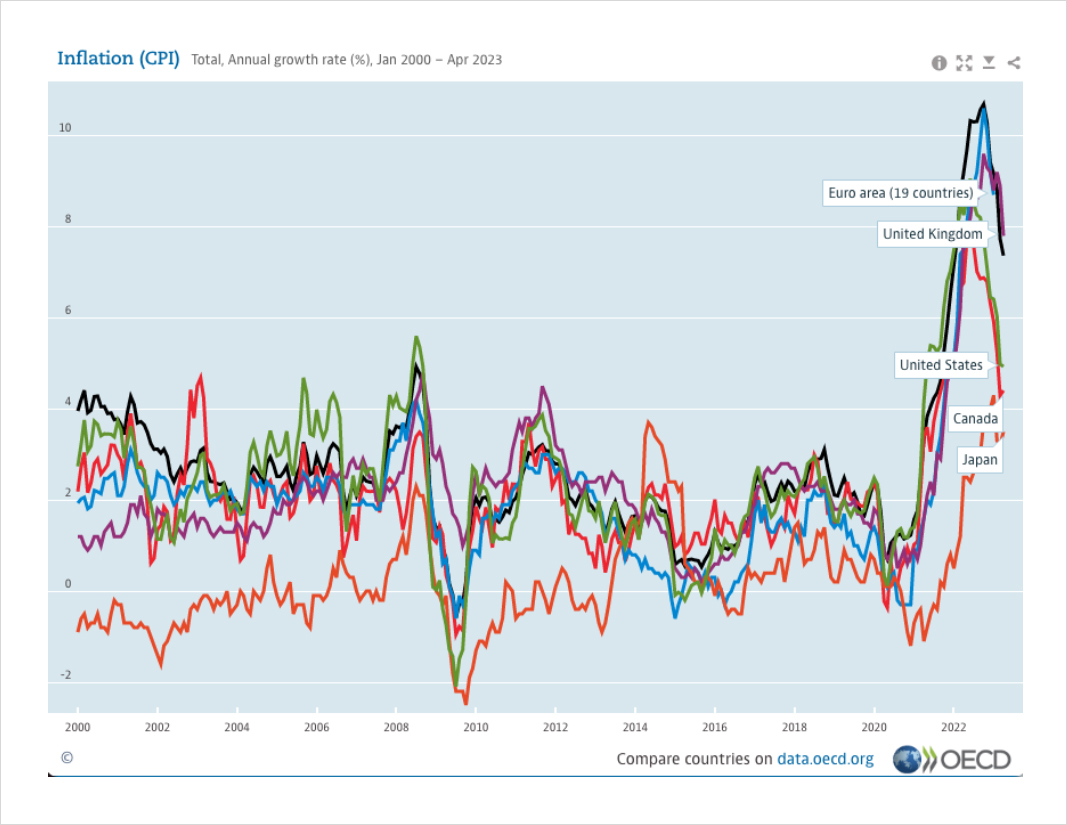

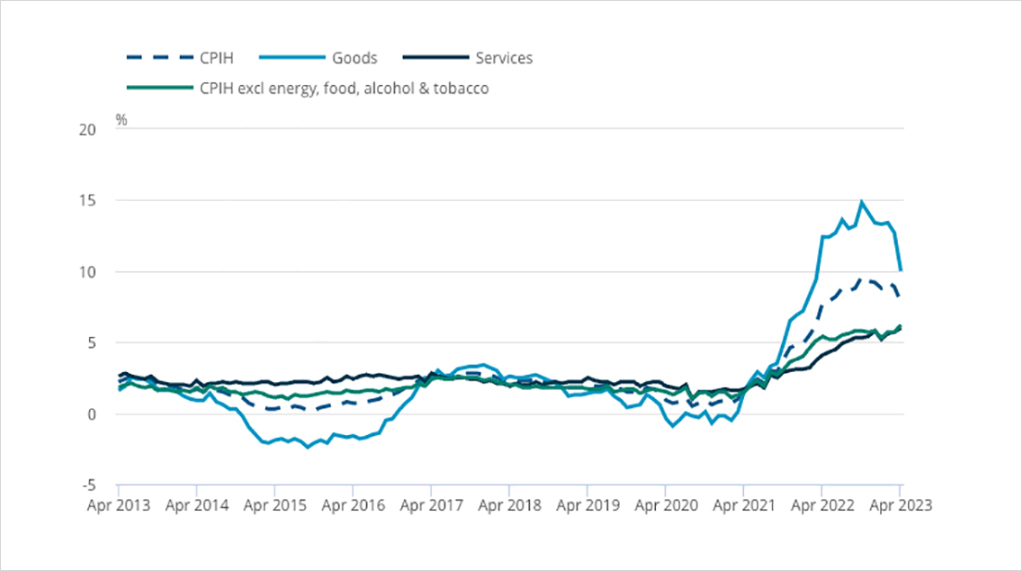

Further rate hikes seem inevitable for the ECB and the Bank of England. Among OECD countries, eurozone inflation is significantly higher than North America’s, and the UK’s core CPIH annual inflation rate for Apr 2023 hit its highest level since Feb 1992. ECB officials have stated that even if the eurozone is experiencing inflation decline, monetary tightening is starting to have an impact, and banks are restricting credit, they must still maintain consistently high interest rates to keep inflation under control:

“We still have to have sustainably high interest rates, so it’s a time when we have to really buckle up and look at this target that we have and deliver on it.” – Lagarde

CPI changes among major OECD countries/regions, as of May 2023. Source: oecd.org

CPIH goods, services and core annual inflation rates for the last 10 years, UK, April 2013 to April 2023. Source: Consumer price inflation from the Office for National Statistics

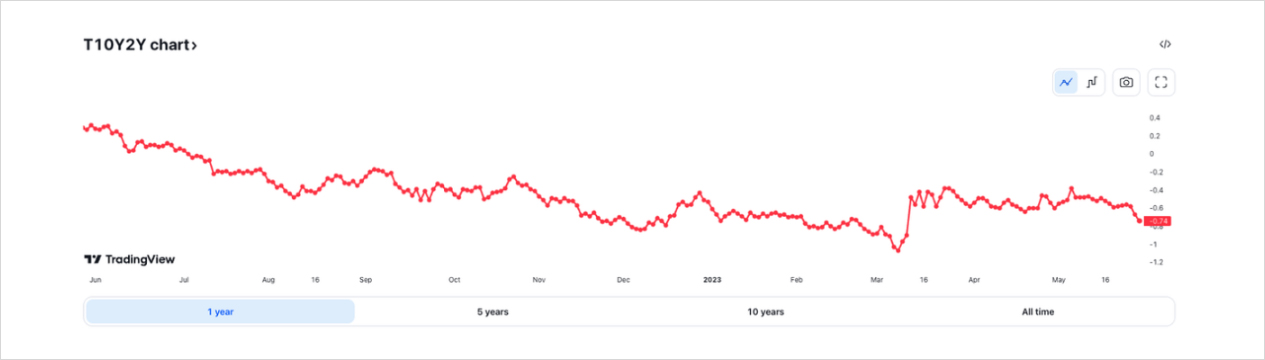

For the risk asset market, the resumption of interest rate hike expectations further suppressed the risk asset market performance ceiling. At the same time, investors’ preference for the US dollar has returned with the temporary lifting of the debt limit crisis. Correspondingly, since May, US bond prices have continued to decline, and the magnitude of the inverted yield curve has risen again. The brief “happy hour” brought by the banking crisis is over; the high-interest rate period continues.

10-year US Treasury yield changes, as of May 2023. Source: Tradingview

10-year vs. 2-year US Treasury yield spread changes, as of May 2023. Source: Tradingview

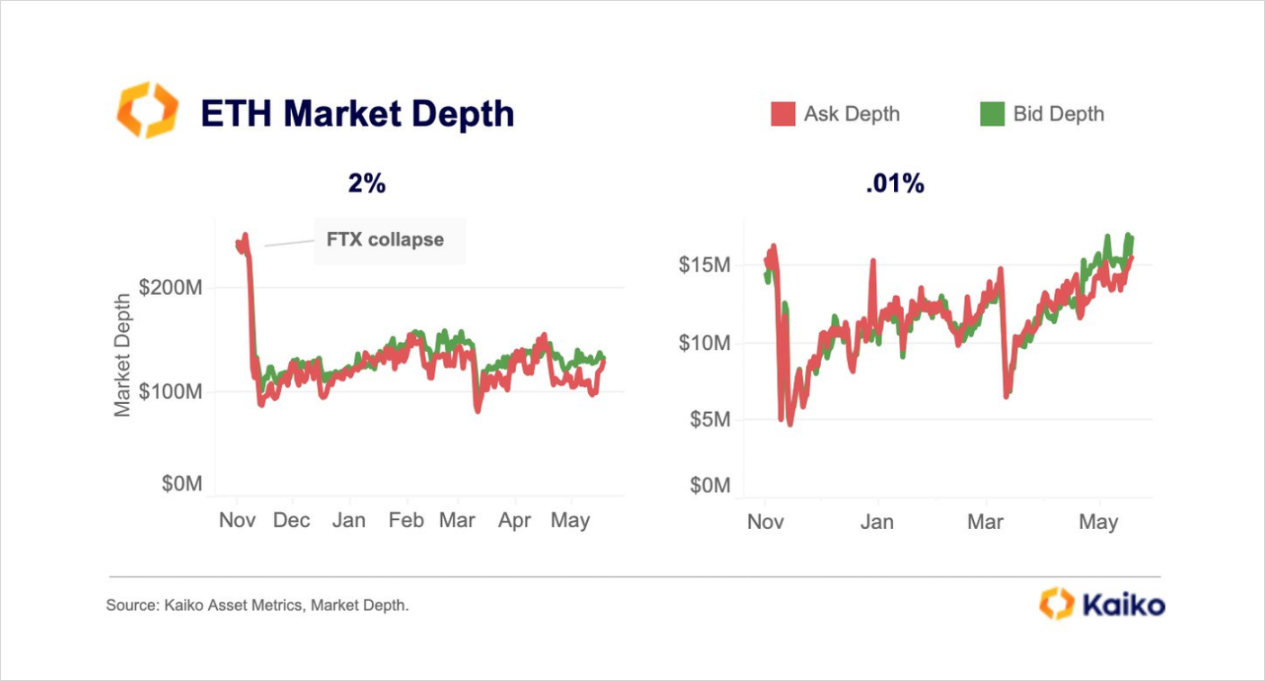

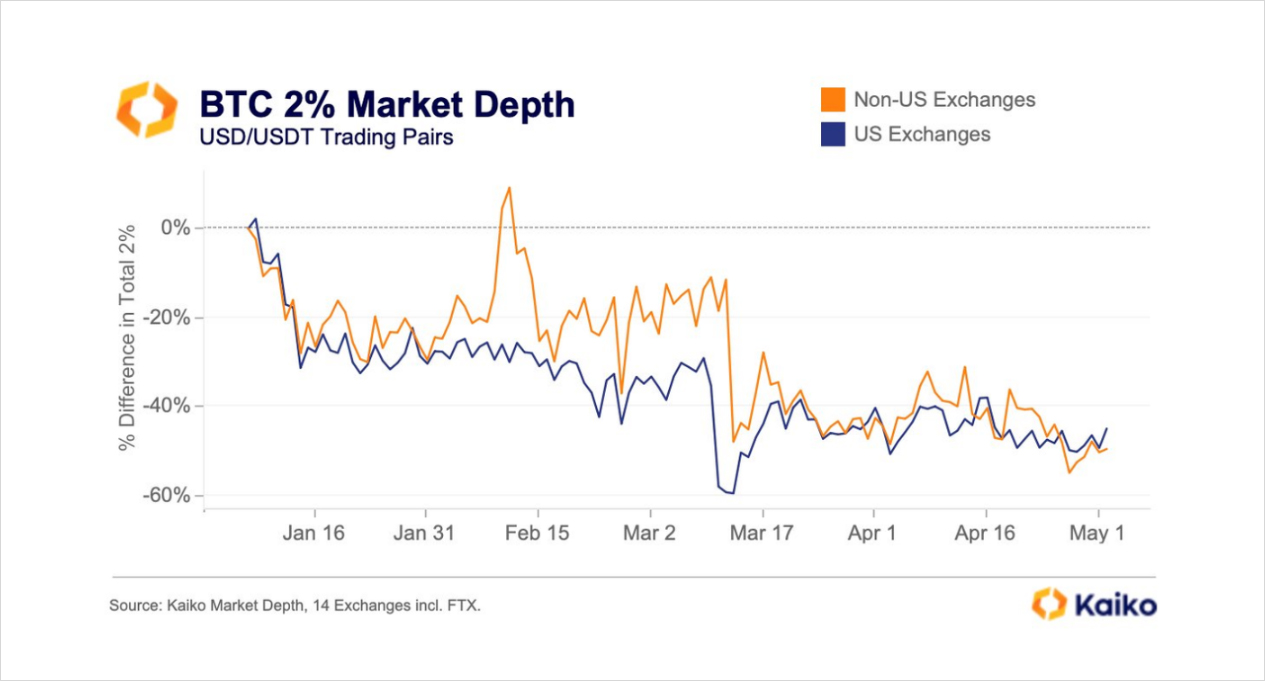

As the liquidity endpoint of the risk asset market, the crypto market’s performance is also hovering near the ceiling. After briefly breaking through the $30,000 mark in April, the subsequent price performance of BTC did not bring much surprise. The lack of liquidity makes the price lack continuous momentum upwards or downwards. Although the current liquidity level is slightly better than the worst moment in the past few months, there is still a long way to go before the “liquidity ceiling” can be shaken.

BTC price changes over the past year, as of May 2023. Source: Coinmarketcap

ETH market depth changes on exchanges, as of May 2023. Source: Kaiko

BTC market depth changes on exchanges, as of May 2023. Source: Kaiko

For crypto traders, it seems that there will be no surprises in the coming time: the worst-case scenario has already been priced in, and the recovery is far away, which means that the volatility that began in April will continue. However, a turning point seems to be coming; inflation may not be as severe as imagined.

Is Inflation Overestimated?

When formulating interest rate policies, the Fed typically focuses on an indicator: the Personal Consumption Expenditure Price (PCE) index. According to Investopedia, the PCE data typically includes the following:

- Durable Goods: Motor vehicles and parts, furnishings and durable household equipment, recreational goods and vehicles, and other durable goods.

- Nondurable Goods: Food and beverages purchased for off-premises consumption, clothing and footwear, gasoline and other energy goods, and other nondurable goods.

- Services: Housing and utilities, health care, transportation services, recreation services, food services and accommodations, financial services and insurance, and other services.

Looks comprehensive, doesn’t it? The Federal Reserve states:

The PCE better reflects changes in consumer spending, such as the substitution of goods in response to price changes, and covers a broader range of expenditures. Additionally, PCE data are subject to revision to incorporate the latest data and its information content.

That’s where the problem lies. First, PCE data is compiled based on price-related data from the previous month, which means it has a lag. Besides, PCE data can be “revised,” – which means the data can be biased towards providing support for policies rather than reflecting actual inflation.

And if you break down the PCE data, according to Dallas Fed analysis, core inflation is mainly driven by rising gasoline prices, as well as rising prices of core goods and services. Let’s take a look at the description of the “rising prices of core goods” section:

…Among core goods, the price index for computer software and accessories (down an annualized 23.2 percent) had the largest negative impact, subtracting about 0.3 annualized percentage points from April’s core rate. At the other end of the spectrum, the price index for used light trucks (up an annualized 68.5 percent) had the largest positive impact, contributing about 0.7 annualized percentage points to April’s core rate…

…Our “big three” price index—aggregating three of the largest and least-volatile components of core services: rent, owners’ equivalent rent (OER) and the price of dining out—rose at a 6.2 percent annualized rate in April, compared with an annualized 6.3 percent increase in March. Individually, the annualized increases were 6.9 percent for rent, 6.8 percent for OER and 4.4 percent for dining out (more formally, “other purchased meals”)…

Hey! Wait a minute: one of the key factors driving up prices is used cars. What does this mean? Under liquidity pressure, more people choose to buy used cars rather than new ones, which keeps the price of used cars high. If we also consider the rise in housing rent prices, it is not difficult to see that the high prices of used cars and renting confirm the possibility of a recession caused by the Federal Reserve’s tough policies, despite the limited increase in actual prices (food prices are stable, and prices of other energy sources except gasoline are falling).

Fortunately, in addition to PCE data, third-party providers such as Truflation are also providing investors with real-time inflation data. As of May 29th, real-time inflation has fallen below 2.9%, just one step away from the 2% target. Obviously, the Fed’s data is lagging behind the “real” inflation.

US real-time inflation data as of May 29, 2023. Source: Truflation

So why did the Fed choose to raise interest rates further? One reason may be the fear of re-inflation. In the 1970s, inflation was once controlled but rebounded quickly as policies were relaxed. Therefore, in addition to suppressing inflation, raising interest rates may also be used to stop the possibility of re-inflation.

Interestingly, the negative impact of further interest rate hikes on the crypto market is gradually dissipating:

- If further interest rate hikes lead to a recession, the Federal Reserve will use a series of policy tools to promote economic recovery (inflation is no longer a problem). The March market proved the role of safe-haven liquidity in driving BTC and ETH prices; in the event of a possible recession, safe-haven investors may prefer crypto assets again, and the liquidity released by the Fed to promote economic recovery will also benefit the performance of crypto assets.

- If interest rates start to decline after further interest rate hikes, the release of liquidity will push investors to adjust their risk preferences. As new liquidity enters, the price of crypto assets will rise again.

- Even in the worst case, further interest rate hikes have not caused a recession. However, the crypto asset prices will be supported by sedimentary liquidity in the high interest rate environment; the market status will not worsen.

Let’s forget about inflation and interest rates for now. Whether it’s further interest rate hikes or maintaining high interest rates, the interest rate cycle is nearing its end, and it’s time to do some asset allocation in the crypto market.

“Slow Bull”

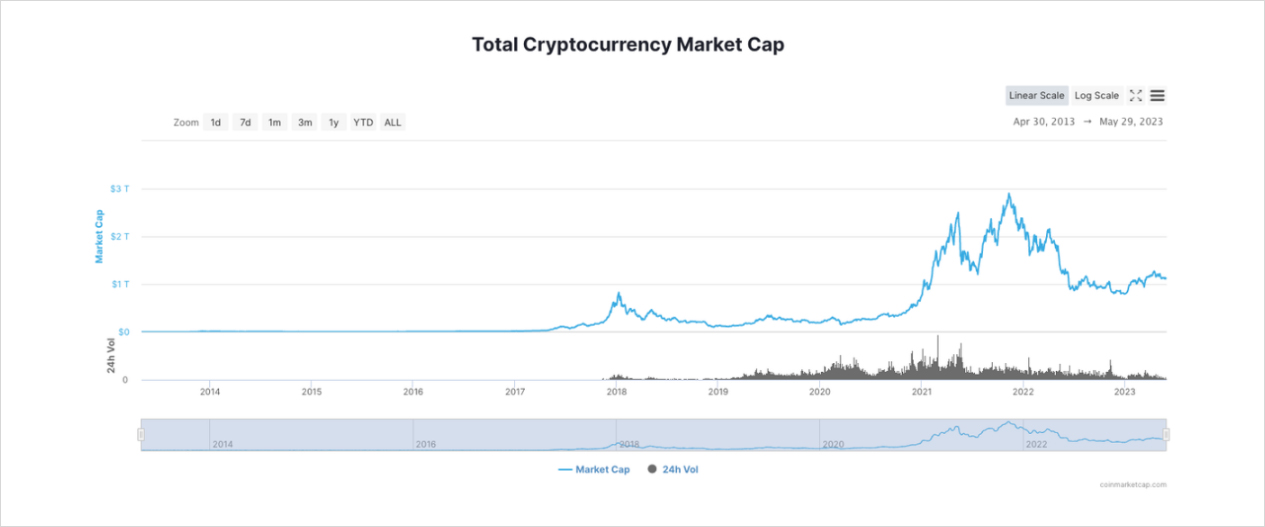

What will happen to the crypto market when the interest rate hike cycle ends? Let’s take a look back at the performance of the crypto market during the last interest rate cycle:

- In 2015, the Fed began normalizing its monetary policy and raised interest rates four times in 2018, pushing rates up to 2.5%. This put an end to the crypto bull market of 2017.

- As interest rates began to decline in 2019, the crypto market began to recover but rebounded only modestly under the pressure of high interest rates.

- The impact of the Covid-19 pandemic led the Fed to rapidly lower interest rates to nearly 0 in the first quarter of 2020, and the resulting liquidity flood pushed the crypto market into a bull market in 2021.

Fed interest rate hike/cut path from 2010 to May 2023. Source: Macrotrends

Total market cap of the crypto market from 2014 to May 2023. Source: Coinmarketcap

Compared to the crypto market of 2018-2020, the performance of the crypto market since the end of 2021 is quite similar: as the Federal Reserve turned to an interest rate hike cycle in 2022, the crypto market shifted from a bull market to a bear market; as the peak interest rate arrived, the crypto market gradually stabilized and began to slowly “regain lost ground.” It is not difficult to judge that the high interest rate environment will not last very long. As the Federal Reserve gradually lowers its interest rate, the crypto market will also usher in a return of liquidity. In addition, the positive factors within the crypto market, such as the Bitcoin halving market, will also stimulate the crypto market’s rebound along with the return of liquidity.

Compared to the crypto market of 2018-2020, the performance of the crypto market since the end of 2021 is quite similar: as the Federal Reserve turned to an interest rate hike cycle in 2022, the crypto market shifted from a bull market to a bear market; as the peak interest rate arrived, the crypto market gradually stabilized and began to slowly “regain lost ground.” It is not difficult to judge that the high interest rate environment will not last very long. As the Federal Reserve gradually lowers its interest rate, the crypto market will also usher in a return of liquidity. In addition, the positive factors within the crypto market, such as the Bitcoin halving market, will also stimulate the crypto market’s rebound along with the return of liquidity.

Considering that the time for the Fed to begin lowering interest rates has been delayed, the crypto market recovery may start at the end of the year. However, suppressing possible re-inflation will affect the speed at which the Fed lowers interest rates. The Federal Reserve hopes that the speed of liquidity return can be “reasonably controlled,” and the occurrence of black swan events such as the Covid-19 pandemic directly pushing interest rates to “zero” may be difficult to repeat.

In summary, the crypto market may undergo a relatively long recovery process, similar to the “slow bull” of the US stock market, which may be a significant feature of the next bull market. However, there is nothing wrong with a “slow bull”; this means the maturity of the crypto market. In the “slow bull,” more value and opportunities belonging to the crypto market will be discovered, and they will shine brightly with the return of liquidity and the participation of more investors. Are you ready, mates?

AUTHOR(S)