Bitcoin Rebounds From Lows

Bitcoin has rebounded to $57k after dropping to $53k last week. Volatility is expected with upcoming events, including the Trump vs. Harris debate on Sept 10 and the CPI report on September 11, both of which could impact markets. The recent crypto sell-off is linked to the repricing of a potential Fed rate cut in September, following weaker-than-expected U.S. payroll data. Market sentiment shifted from expecting a 50 basis point cut to a 25 basis point cut. Additional pressure comes from the Nvidia stock sell-off, large outflows from BTC spot ETFs, Mt. Gox supply concerns, and political uncertainty after Harris replaced Biden as the Democratic candidate.

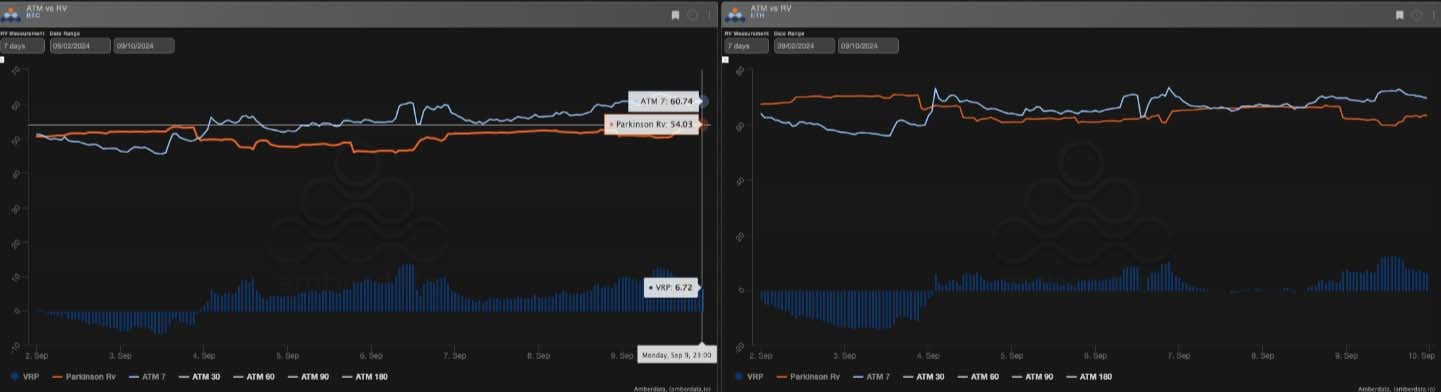

Crypto Realized Vol More Stable

Bitcoin volatility ticked up slightly while Ethereum settled down but remains 10 points higher than Bitcoin. Short-term implied volatility surged due to the recent spot breakdown and anticipation around this week’s presidential debate. Both assets are seeing positive carry at around 10%, and the term structure indicates a potential 10% move around the election.

Steep Skew Term Structure

Both assets show a steep skew, with puts trading at a premium in the short term and calls commanding the back-end. This skew provides insight into market sentiment over different time frames. Recently, the front-end skew for puts deepened during a spot breakdown but has since recovered.

ETH/BTC Spot Remains Heavy

ETC/BTC remains under pressure but hasn’t broken key support at 0.04. With Bitcoin potentially impacted by the election debate, there’s no rush to buy the spread from either a delta or vega standpoint. The front-end vol spread has dropped to 6 points in anticipation of a BTC move, while Ethereum puts remain favored due to weak price action. However, long-term ETH calls are starting to gain traction.

Option Flows

Bitcoin options volume is down 20%, with an even split between calls and puts. Puts were favored for September expiries for protection, while short-term calls have been bought ahead of the presidential debate and inflation data. Ethereum volume is down 12%, with a 60/40 split favoring puts. Short- dated vol is mostly being sold off, with some notable December call spreads being purchased.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)