BTC Keeps Pressing Against 38k Key Resistance

BTC and ETH have faced significant resistance at $38,000 and $2,150 respectively. Breaking these key weekly levels could lead to a broader price range by 2024, a year with many positive drivers.

Recent trends show a consistent inflow of institutional investment into cryptocurrencies. For example, last week, digital asset investment products received $346 million, marking the highest inflow in a nine-week streak. Bitcoin’s inflow was $312 million, totalling over $1.5 billion year-to-date. Meanwhile, Ethereum’s inflow reached $34 million last week, totalling $103 million over four weeks.

CME futures positions are heavily biased towards long positions, with open interest hitting record highs and commanding massive premiums. In fact, Bitcoin’s next-month contract has rarely traded at higher premiums than its front-month contract since its 2020 debut. Ethereum's next-month contract also shows a premium. It was only higher once in March 2021, indicating strong bullish sentiment too.

Furthermore, the resolution of Binance’s legal issues in the US is seen as positive for the market, avoiding worst-case scenarios and reducing uncertainty.

Upcoming events like the Bitcoin halving and a potential shift in the Federal Reserve’s interest rate policy next year are likely to further boost cryptocurrency prices, as the macro-economic environment remains favourable with robust growth and declining inflation.

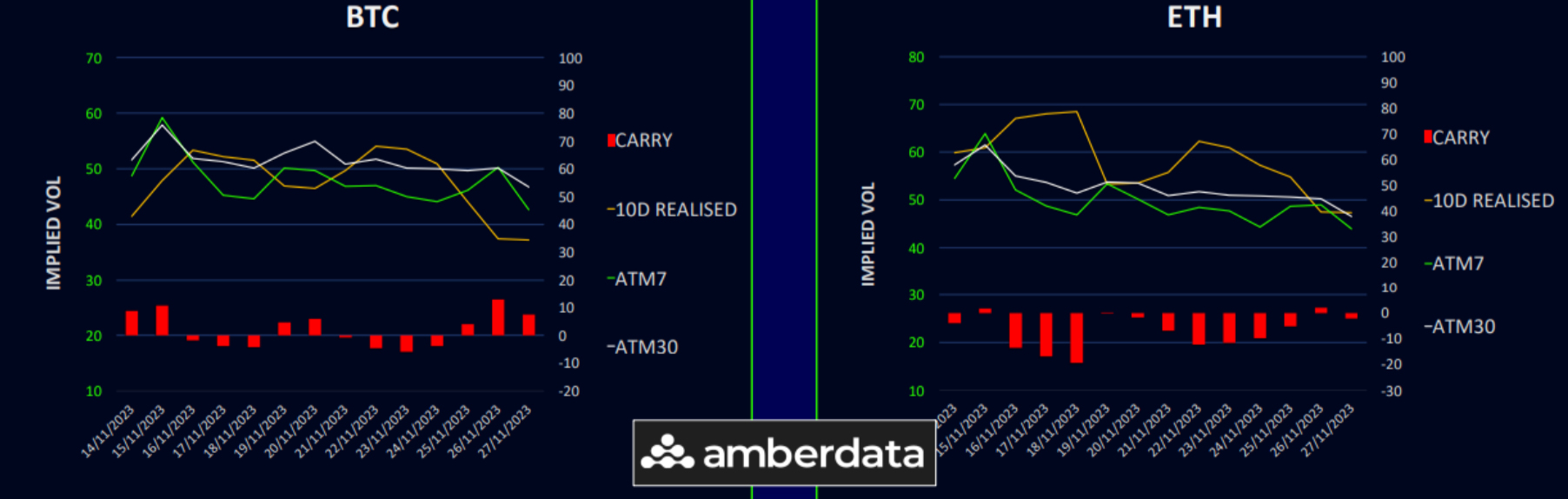

Realized Vol Lower Over Holiday Period

This week saw a decline in realized volatility for both BTC and ETH by approximately 10 points, influenced by the Thanksgiving holiday and strong resistance levels. Consequently, spot prices returned to the middle of their recent range.

Implied volatilities also decreased, particularly in front-month options, as traders sought to capitalize on THETA during the anticipated calm period.

While BTC continues to exhibit positive carry, ETH’s carry is slightly negative. This suggests BTC gamma selling might be more profitable, though there’s a recent shift in ETH’s positioning dynamics with an increased appetite for upside selling.

Employing short-dated weekly calls as a systematic overwrite against long positions has proven effective lately. With the market indicating a higher probability of a breakout in January 2024, this strategy may could be viable into the year’s end provided key resistances are not breached.

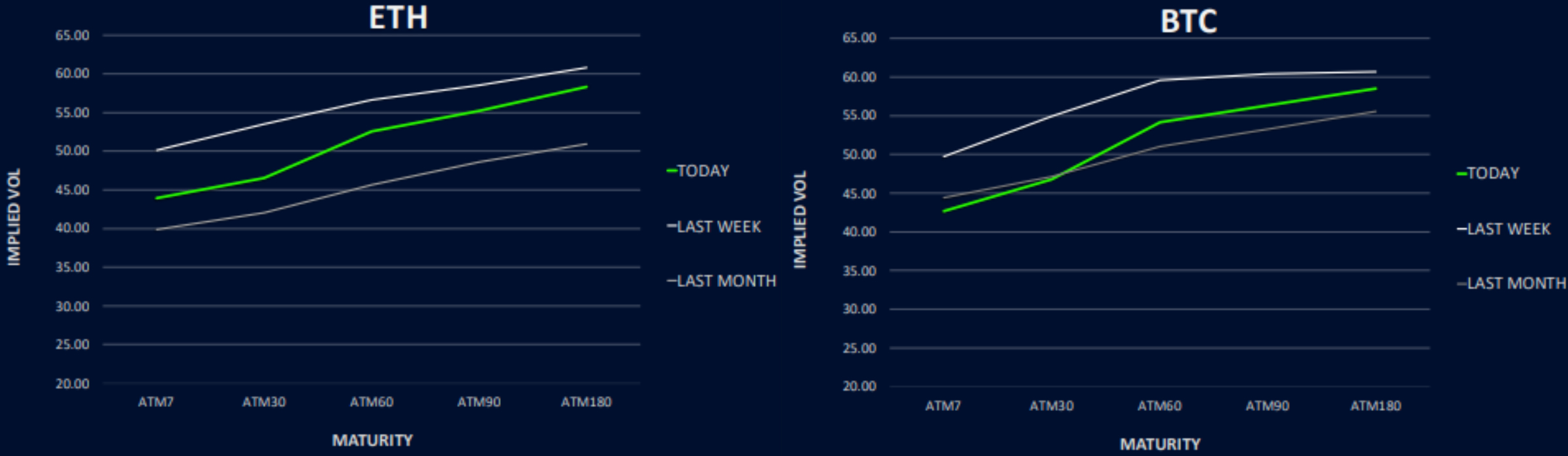

BTC Term Structure Hammered

BTC’s term structure experienced significant pressure this week. Extremely short-dated options were most affected, with GAMMA being actively sold in anticipation of the Thanksgiving weekend. The 26Jan24 expiry was also notably impacted but remains ‘the kink’ in the curve, reflecting market anticipation for ETF approval news in early 2024. The longer end of the curve dropped around one point but remains relatively stable at about 60 vol.

ETH’s term structure also decreased, mirroring BTC’s behaviour. The front-end of ETH’s curve was the hardest hit but fared slightly better than BTC due to stronger recent realized volatility. The long- end volatility of ETH is closely aligned with BTC, as anticipation continues around the ETH ETF narrative.

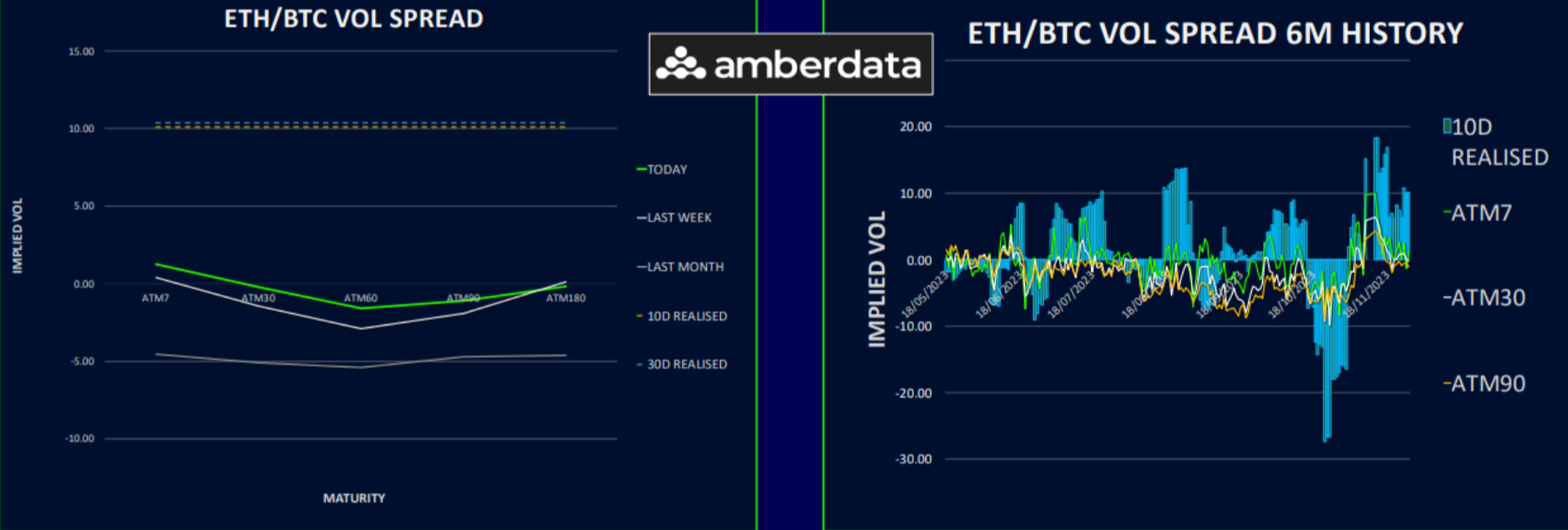

ETH/BTC Vol Spread Has Small Bounce

This week, the ETH/BTC volatility spread saw a slight increase, mainly because BTC volatility getting hit a tad harder due to its positive carry.

The realized volatility difference remains around 10 vols in ETH’s favor, suggesting ETH volatility is better value to own.

If the ETH/BTC spot spread maintains its major support level, about 5% below the current price, there’s potential for this volatility spread to rise in Q1 2024. This is especially likely if market momentum is driven by ETH, which is expected to offer greater opportunities.

Despite some overwriting observed in 29Dec ETH volatility, the supply of 2024 options might be limited due to the substantial upside tail risk.

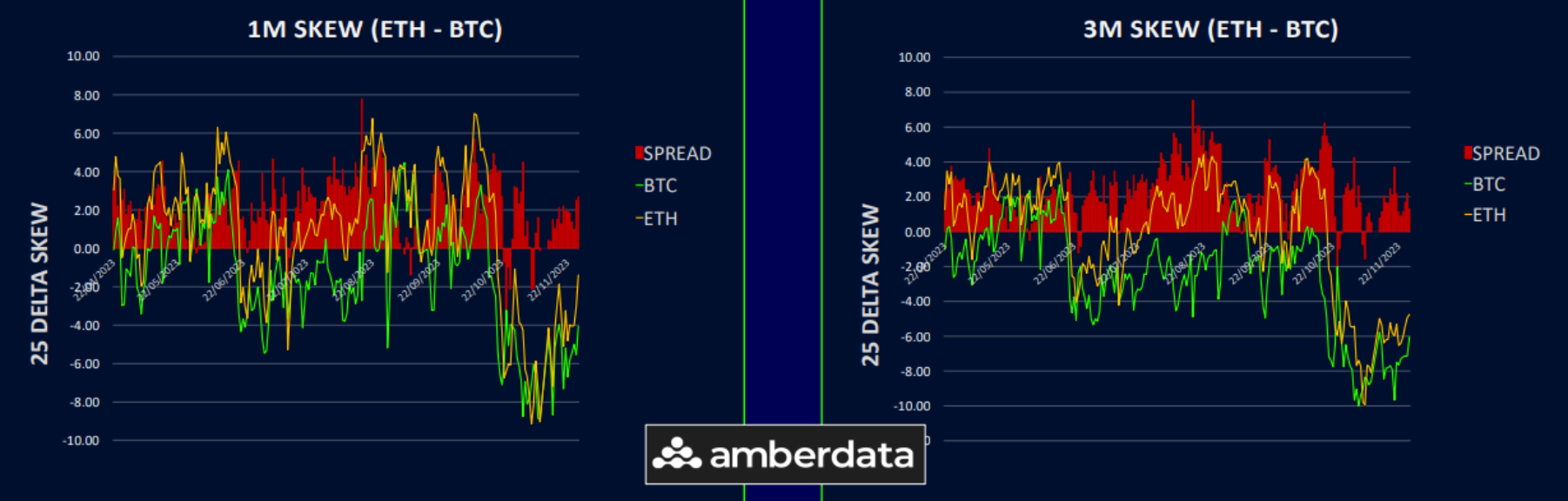

BTC Skew Holding Up Better

This week, BTC’s call skew outperformed ETH’s, as both assets retreated from their peak values. BTC’s skew has dropped to about 4 vol call premium in the short-end and extends to around 9 vols in the longer-term expiries.

ETH’s skew, on the other hand, has largely lost its call premium in the front expiries for 2023 but regains a call bid from January 2024, showing an 8 vol call premium in the long end, similar to BTC.

Option Flows And Dealer Gamma Positioning

Volumes in BTC options have decreased by 8%, retreating to about $6 billion. Notable transactions included a sale of Jan24 32k/27k put ratios (buying the wings), a sale of 08Dec 40k/42k call ratios (also buying the wings), and buys of Mar24 45k calls.

ETH volumes fell by about 10% this week, totalling just under $3 billion. The bulk of the activity was dominated by a few significant trades: a sale of 29Dec 2100 puts, a buy of a Mar24/Jun24 diagonal call calendar, and outright buys of calls for 01Dec at 2300 and 08Dec at 2400 strikes.

BTC dealer gamma positioning is returning to a more neutral stance as spot prices move away from short-dated high strikes, reducing short positions. However, a rise towards 40k could still shift dealer books to short, especially with early Dec 40k strikes being bought.

ETH dealer gamma has shifted back to positive following the sale of a large number of 29Dec 2100 puts to dealers. The positioning now appears more balanced, suggesting less significant market movements before the end of the year without a major news catalyst.

Strategy Compass: Where Does The Opportunity Lie?

Leveraging any relative strength in BTC over the next month for call switches (long ETH/short BTC) remains a strategic preference for 2024. The focus would be on far OTM options, like 10-15 delta, to minimize market noise and target significant relative revaluation in ETH, which seems to be undervalued in the current volatility surface.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)