Currently Deribit only accepts BTC or ETH as the margin for trading. This has been a common practice amongst most popular derivatives exchanges; however, it can impose some trading limitations. Traders should be aware of these, and limit the risk accordingly.

The most noteworthy is that the value of the margin shrinks as the price of the collateral decreases. As most traders also consider the USD value of their trading balance, it is important to learn how to properly manage the USD value of their portfolios.

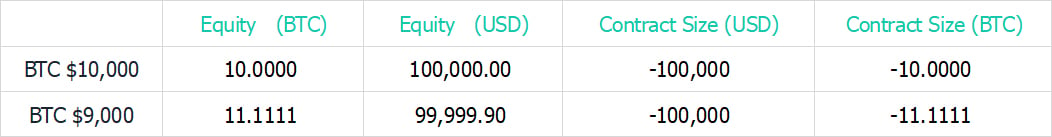

Example:

If a trader has 10 BTC in his account, and the price of BTC is USD 10,000, the total USD value of the account balance is USD 100,000.

When the price of BTC decreases to USD 9,000, the value of the account balance drops to USD 90,000.

In order to keep the fiat value of the balance constant, the trader needs to sell a 10 BTC size perpetual, with the total value of USD 100,000.

When the BTC price will decrease to USD 9,000, the short perpetual position will increase by 100,000/9,000 – 100,000/10,000 = 1.1111 BTC.

This way the trader can eliminate the market risk, and ensure that the equity in USD stays constant.

One concept to emphasize is that the actual size of the perpetual inverse swap contract is always in USD. Contract size in BTC, however, is easier for reorganization and will change in line with the BTC price.

Law of the collateral hedging:

By shorting a BTC contract size equal to equity, the contract size in BTC and equity will always match and keep the fiat value of the trader’s position stable.

In addition, perpetual funding rate is more often positive than negative, namely, long position holders pay the funding rate to the short position holders. The USD base trader will roughly receive a 10% annualized funding reward – increasing in bull market and decreasing in bear market. Or in long periods of price decline, short position holders might have to pay the funding rate to the long position holders.

Funding Rate

If a trader has various futures and options positions, he will find it easier to trade these positions in USD base on Deribit. By looking at the parameter named “Delta Total”, you can trade perpetual to adjust it to the negative value of your equity. For example, if you have a 10 BTC equity in your account, then adjust “Delta Total” to -10 BTC. When equity changes to 11 BTC, make sure “Delta Total” catches up to be -11 BTC.

Because trading futures and options will bring additional profits and losses, this will increase or decrease the value of equity. Therefore, from time to time, traders must adjust the “Delta Total” to the equity, to keep the fiat value of the position stable and reflect the impact of the current trading PNLs.

In the newly released version 1.2.1 Greeks.Live app, we have made “Delta Hedge by one Click in USD base” available, to learn more, click here.

AUTHOR(S)