Unlike four years ago, bitcoin is a global asset. When headline news hits, bitcoin feels it along with the rest of the global markets. Which is the reason why Bitcoin traders should pay attention to the Presidential election in the United States this year.

The BTC correlation with the traditional markets was on full display in March 2020 during the rush to liquidity. An event where equities, bonds, yields, oil and even bitcoin all got pummeled. Since then, correlation with gold and the U.S. dollar have remained strong.

In fact, since March 21, 2020 bitcoin’s correlation to the U.S. dollar on a 90-day rolling basis is negative. Which means as the dollar goes one way, bitcoin goes the other. It’s a trend getting stronger over time with the highest reading of -0.63 at the beginning of August.

This trend in particular is one we need to be aware of in the run up to the November 3, 2020 election date in the U.S.

The U.S. Dollar is Ripe for Volatility

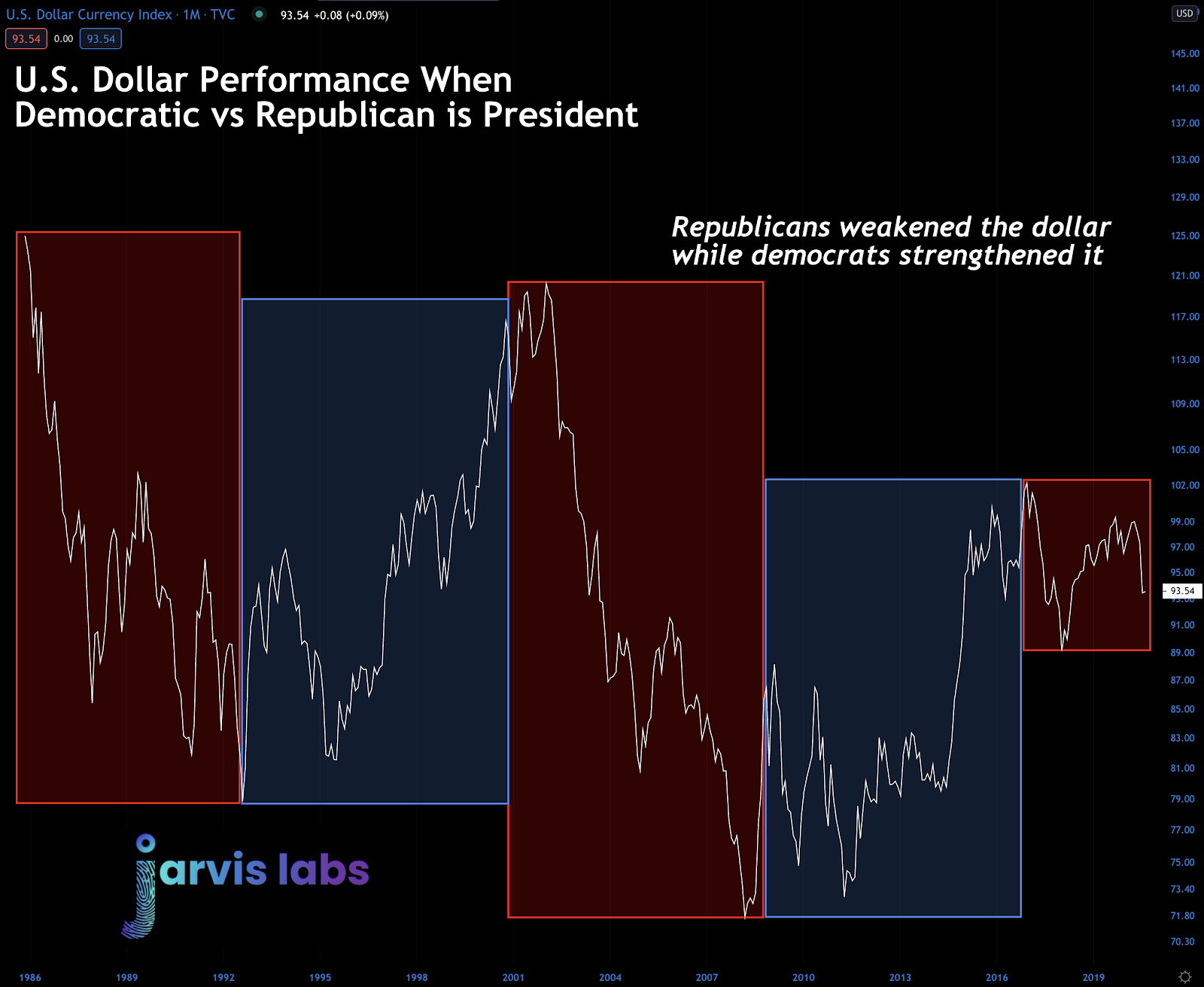

Historically the trend for the dollar goes hand in hand with the political party the president represents. If we look at a chart and section it off to see when a Republican versus a Democrat was in the office, we get a clear view of this relationship.

You can see it in the chart below:

The red boxes refer to the time period when a Republican was in office. During these periods the dollar weakened significantly. As for the Democrats, the opposite holds true as during these terms the dollar strengthened.

This is a macro trend most likely to take place this November and one that needs to be considered as we approach the election date. As consensus on the winner takes shape, we’ll witness the markets react. Every market will witness this change… And bitcoin is no exception.

We Expect Volatility

Ideally, we all want to believe we have the crystal ball when determining if Donald Trump or Joe Biden will win. We don’t, however, when it comes to options, it doesn’t matter.

Most traders new into options tend to simply buy calls and puts. Few move past this introductory strategy. Which can significantly limit trader’s trading strategies, as varied options strategies are one of the best tools for reducing risk while maximizing upside.

When it comes to the upcoming U.S. Presidential Election, a strategy greatly beneficial for the event is being delta neutral with gamma scalping. It’s a way to isolate volatility while eliminating time decay. This is a way to profit from the BTC price swings over a long period of time.

An example:

Let’s say bitcoin is trading at $10,000 and you buy a call and a put, both with a strike price of $10,000. In doing so you are said to be delta neutral. (Delta is the amount an option price is expected to move based on a $1 change in the underlying asset.) This means if price goes up by a small amount you theoretically make as much money on your call option as you lose on your put option. The reverse would also be true.

If we take it a step further and fast forward to the date your option contracts expire. If we get a favorable scenario where the price increased MORE than the amount you paid for the put option, your trade is a net winner. The same applies in reverse if price is lower than $10,000.

Now, if you only bought the call and put the trade is referred to as a straddle. It’s a common tactic used before highly volatile event like an earnings announcement for a company.

The delta neutral strategy is a way to manage an initial straddle position over time. And the reason a trader wants to do that is to capture volatility.

The Hidden Profit in Black Scholes

You’ve probably heard of the Black Scholes model. It’s an equation that helps determine the pricing of an option. The model considers several factors like time, strike price, current price, and the risk-free rate. These are all relatively easy to find.

However, there is one variable that isn’t so easy to observe, which is volatility. And it’s where the opportunity exists in the situation we describing today. It’s where we look to profit of price swings.

An example:

If we take our previous example of the straddle at $10,000 and add in a scenario where the price went to $12,000, then down to $8,000, and back to $10,000 in the span of a few weeks. With this straddle position you are most likely to be in profit for both your call and your put. That’s because of volatility.

When it comes to options, if an asset is highly volatile, there’s a higher chance a price fluctuation will place an option in the money. So as volatility increases, option prices increase as well. We saw this recently with Ethereum. Let’s look back at the $350 Put for Ethereum that expired on August 7, 2020.

At approximately 10:00 UTC on August 1 this contract was worth 0.023 ETH. At the time ETH was trading just a hair below $360.

Soon after, the price spiked and then decreased again. Price went on to tap $410 and then down to $300 over the next twenty-four hours. After all the dust settled, on August 2 at 12:00 UTC the price for ETH was back to $360.

Which meant if you didn’t see a line chart and only saw the spot price two times in twenty-four hours, you would have no idea price just whipsawed. That is, unless you saw the price of options. That same contract that was worth 0.023 ETH over twenty-fours earlier was now 0.04 ETH. Up 74% with the underlying asset at the same price.

And it wasn’t just for puts. A similar price action was observed for calls as well.

It was a savvy trade for anybody in a position to profit from it. And it’s a case and point on how an increase in volatility can lead to option prices rising.

How to Approach Election 2020

The example just laid out was a pretty simple showcase on how a trader can use options to profit from volatility.

However, the key to a successful trade is going long on volatility before the price action takes place. And with the U.S. Presidential Election coming up, this will be a high probability event, as Bitcoin is more closely tied to the global financial system than ever before. However, before implementing a strategy like this, you must consider multiple aspects:

Delta Management

Firstly, how do you plan to manage your delta position across multiple contracts across multiple expirations? Will you adjust it weekly, monthly? Or will you adjust it when your delta gets a certain distance from zero? This is essential for the strategy to be successful. And it requires a bit of timing on your part.

BTC Price Target

Secondly, what is your two-week, two month, and end of year price target for BTC? This needs to be considered because the delta neutral strategy can account for this in order to capture more alpha.

An example:

If you think the price will correct in two weeks, but will be higher in two months. Consider accounting for it in the way you structure your portfolio. In the near term, weigh your options slightly delta negative. On the long-term options, weigh them a bit delta positive. It’s a way to juice your gains if your analysis is accurate.

Time

Time decay for a long-dated strategy like this is crucial. If you aren’t managing the effect time can have on your portfolio, you might miss out on some valuable gains and be watching your position shrink if volatility goes flat for a few weeks. Many traders use the futures market to do this. If done correctly, ‘gamma scalping’ is an effective way to counteract time.

In conclusion, it’s essential for a trader to take into account these three aspects for a successful trade management.

However, if this is a strategy you find appealing and would want to have it automated, consider reaching out to Jarvis Labs. We use this exact delta neutral strategy with gamma scalping to build a position over time as the election approaches.

And since our trading system uses artificial intelligence and machine learning to time the adjustment of delta in the face of volatility, we can maximize the upside potential.

AUTHOR(S)