Crypto Prices Spike Triggered by Trump

Donald Trump’s failed assassination attempt has ignited a surge in the crypto market, with BTC hitting $65K and ETH $3.5K respectively. The market anticipates increased support for Trump, recalling Reagan’s similar boost in 1981. Trump’s pro-crypto stance and the exhaustion of Germany’s BTC supply have also fueled the rally. Watch for the ETH ETFs launch on July 23rd for more potential upside action if the inflows become higher-than-anticipated.

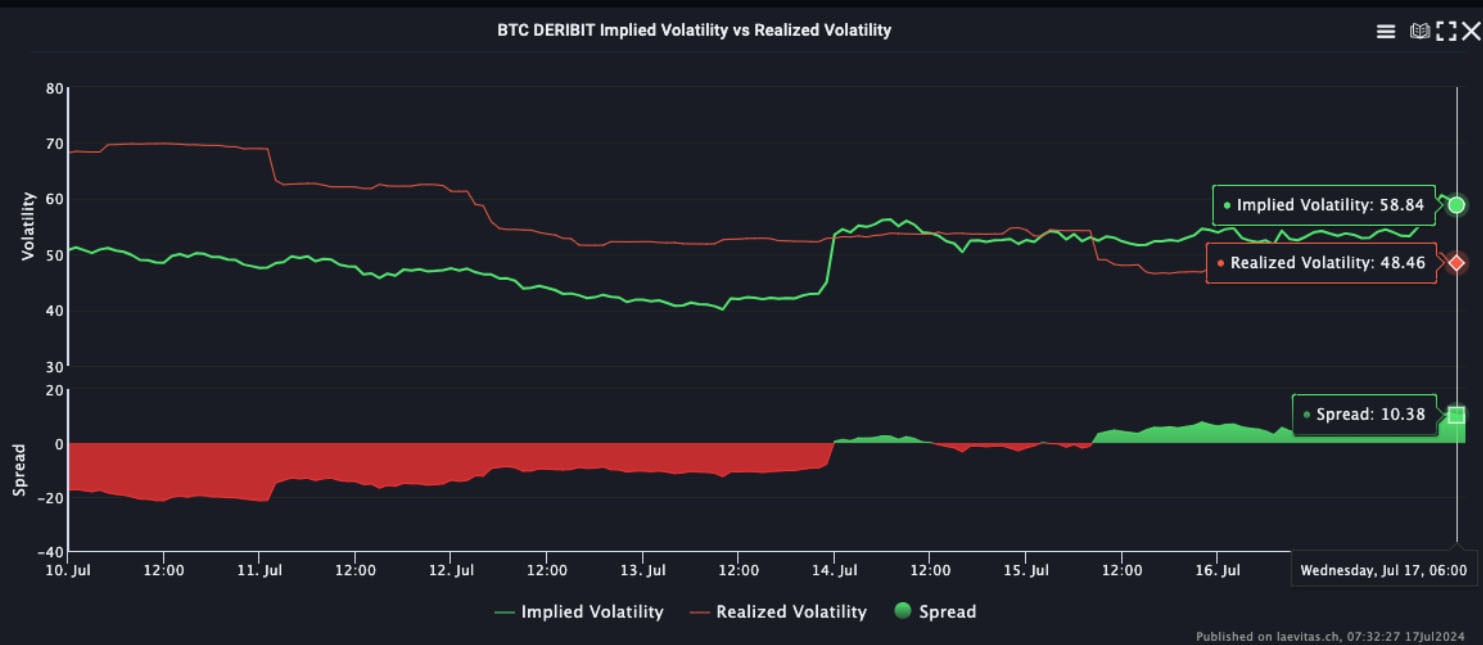

Implied Vol Spikes

Crypto realized volatility has decreased to the mid-40s, while implied volatility spiked due to Trump’s assassination attempt, pushing BTC and ETH into positive carry. Despite range-bound trading, significant headline risks make it unwise to short gamma. Macro fundamentals, politics, and flow dynamics will keep crypto active. Monitor the upcoming ETH ETF launch on July 23rd for potential volatility.

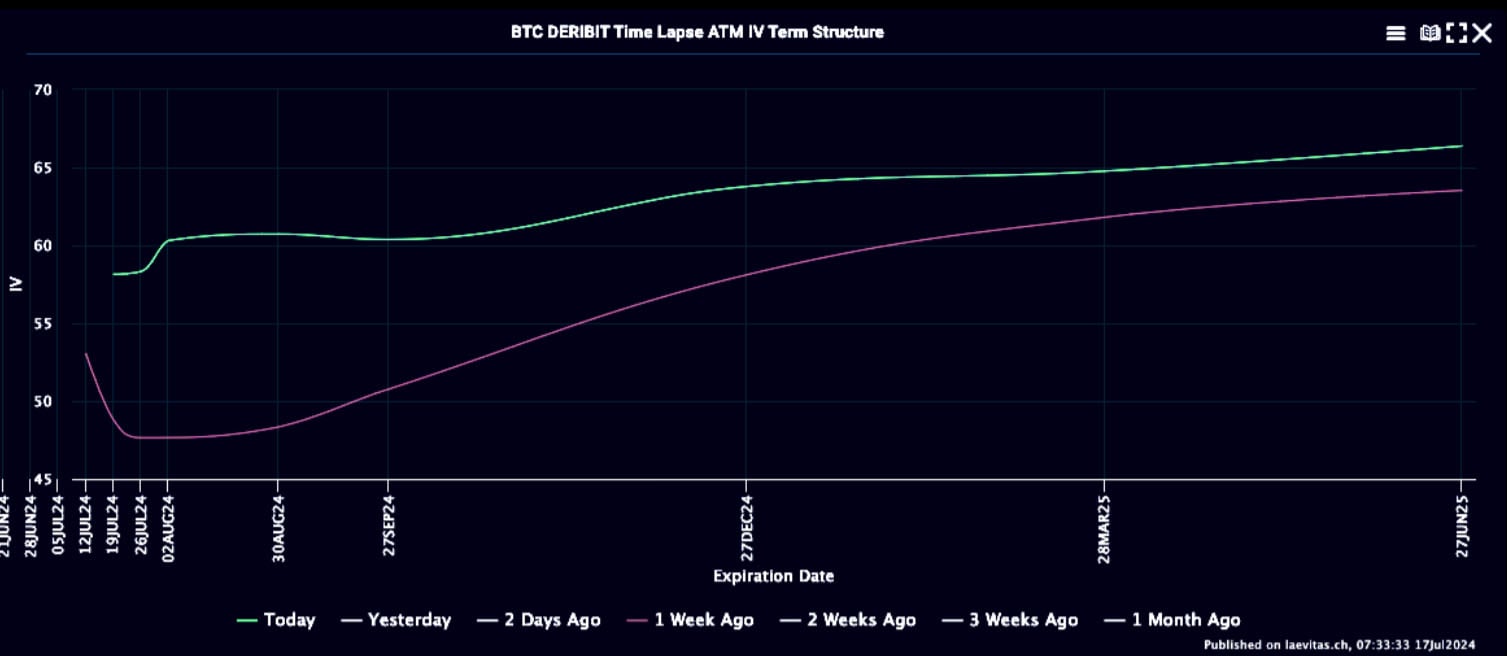

Term Structure

Last week, the curve steepened into contango but since the spike in prices, we’ve see the front end pop and the curve flatten out again. Similar story in ETH but not as dramatic as the front was already more elevated than BTC.

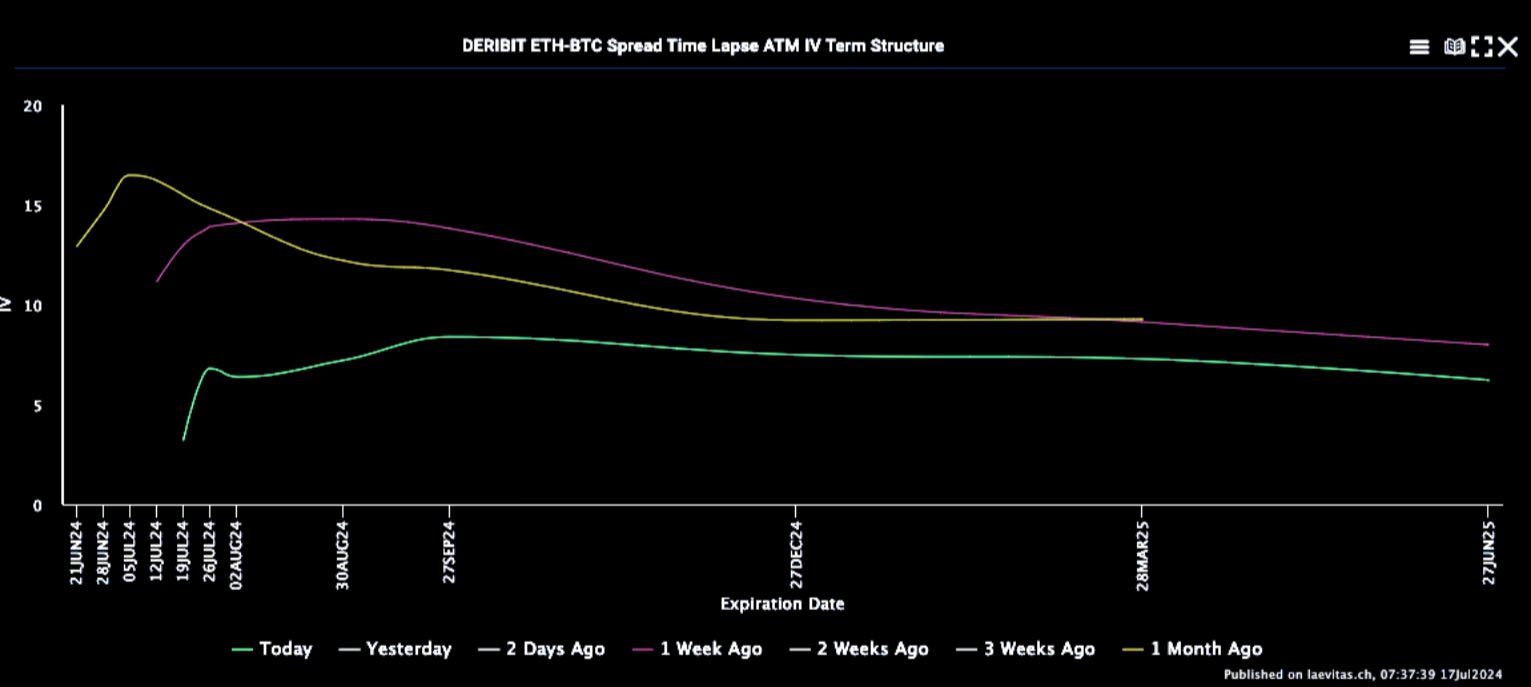

ETH/BTC Vol Spread Elevated

The ETH/BTC vol spread has been high, especially ahead of the ETF launch, predicting a strong ETH rally. This week the spread dropped as BTC vols rose due to the “Trump effect.” Implied spread remains above realized, suggesting more vol reset for ETH post-July 23rd launch.

Skew Convergence

Weekly put skew vanished with rallies in BTC and ETH, notably in BTC, which dropped from 15 vols. Skew across assets converged as the market sees the Trump narrative boosting BTC alongside ETH’s ETF launch. Long-term call buyers are steady, keeping call premiums around 8 vols.

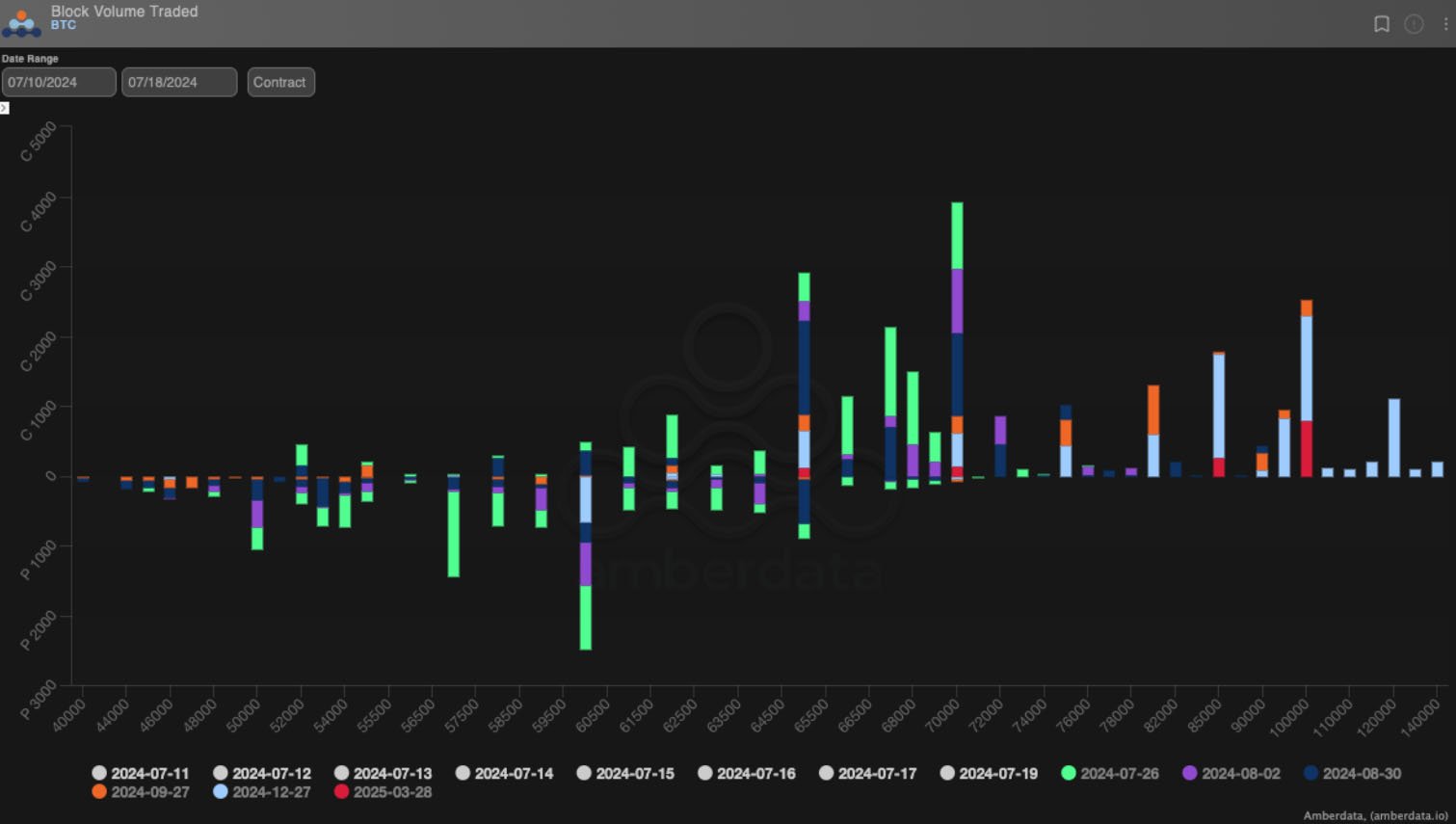

Option Flows

BTC option volumes decreased 25% to $7Bn, with active trading in December upside calls around the 100K strike. Buyers also favoured 85K/120K call spreads and Mar25 100K calls. ETH volumes dropped 33% to $1.8Bn, dominated by call flows, particularly 30Aug 3200 calls for the ETF launch, alongside closer-to-money call selling and 26Jul spreads for sale.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)