Summary: While TradeFi billionaires appeared to be in hibernation while Bitcoin traded below $30,000 – with the recent price increase, those billionaires are back in the media and emphasizing Bitcoin’s value as a store of value or, in the case of Larry Fink, Bitcoin’s attractiveness as a flight to quality. The price performance of traditional “flight to quality assets” has been the opposite of what many old- school traders would have expected. Bitcoin was the best “flight to quality asset” after the Russian Invasion of Ukraine on February 24, 2022. Bitcoin’s best days might still be ahead, especially if the world is heading for war.

Analysis

In 2012, BlackRock CEO Larry Fink started the shareholder activism war against companies perceived as facilitating climate change. Ten years later, 11% of BlackRock’s funds had a defined ESG target (environment, social, and governance) – roughly $1 trillion in their assets under management. BlackRock’s impact on the investment management world cannot be underestimated.

Mr. Fink has called Bitcoin’s recent rally a “flight to quality,” with “pent-up interest in crypto from clients worldwide about the need for crypto.” Since BlackRock’s ETF application in mid-June 2023, he has frequently returned to the media and promoted Bitcoin. This has and will significantly impact the acceptance by TradeFi investment managers to use Bitcoin in their multi-asset portfolios.

In May 2020, when a Bitcoin traded for less than $8,000, billionaire Hedge Fund manager Paul Tudor Jones called Bitcoin the “fastest horse” in an environment of expected inflation due to excessive fiscal stimulus. Mr. Jones trail-blazed for other investment managers to put Bitcoin into their portfolios, and the result was a nearly 700% increase in the price of Bitcoin. Other Hedge Fund managers followed his chorus – from Stanley Druckenmiller to the family office of George Soros.

And while those TradeFi billionaires appeared to be in hibernation while Bitcoin traded below $30,000 – with the recent price increase, those billionaires are back in the media and emphasizing Bitcoin’s value as a store of value or, in the case of Larry Fink, Bitcoin’s attractiveness as a flight to quality.

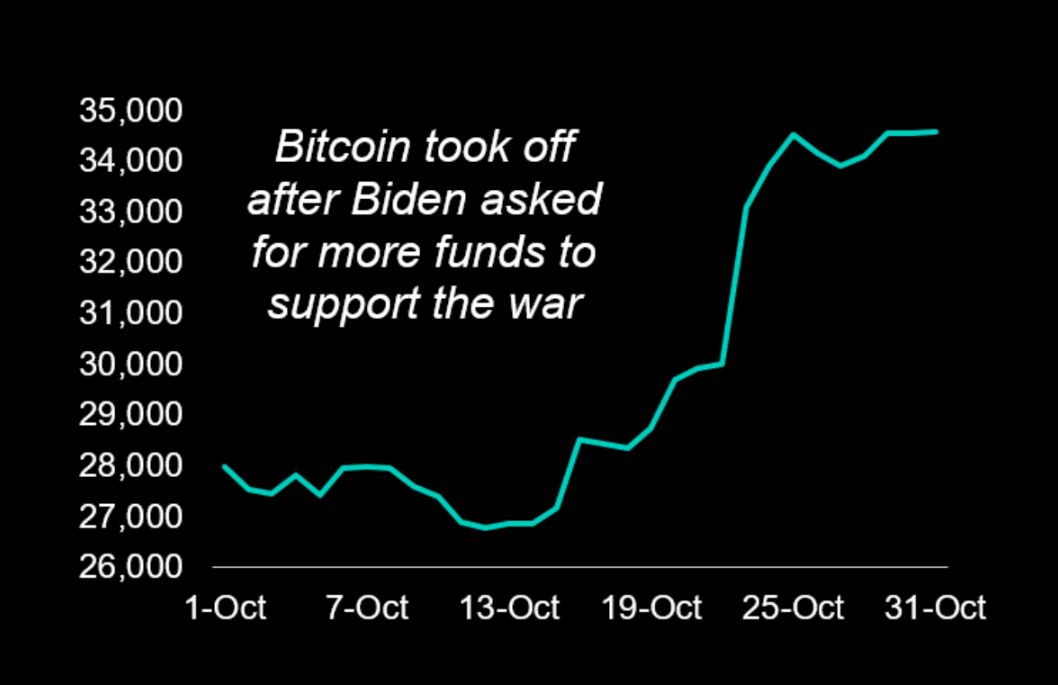

This “flight to quality” appears to have ignited to an incredible +28% Bitcoin return in October, outpacing the +22% expected return based on the average 10 years of returns for October. This year, most of the returns occurred after October 13. The date coincides with when U.S. President Biden was expected to ask U.S. Congress for another $100 billion to finance the support of another war.

The Russian invasion of Ukraine occurred on February 24, 2022, and after more than eighteen months, there is no end in sight in human suffering and financial support for the war. The Biden administration has, so far, committed at least $75 billion in assistance to Ukraine, and many fear that another conflict in the Middle East could continue to drain the U.S. balance sheet.

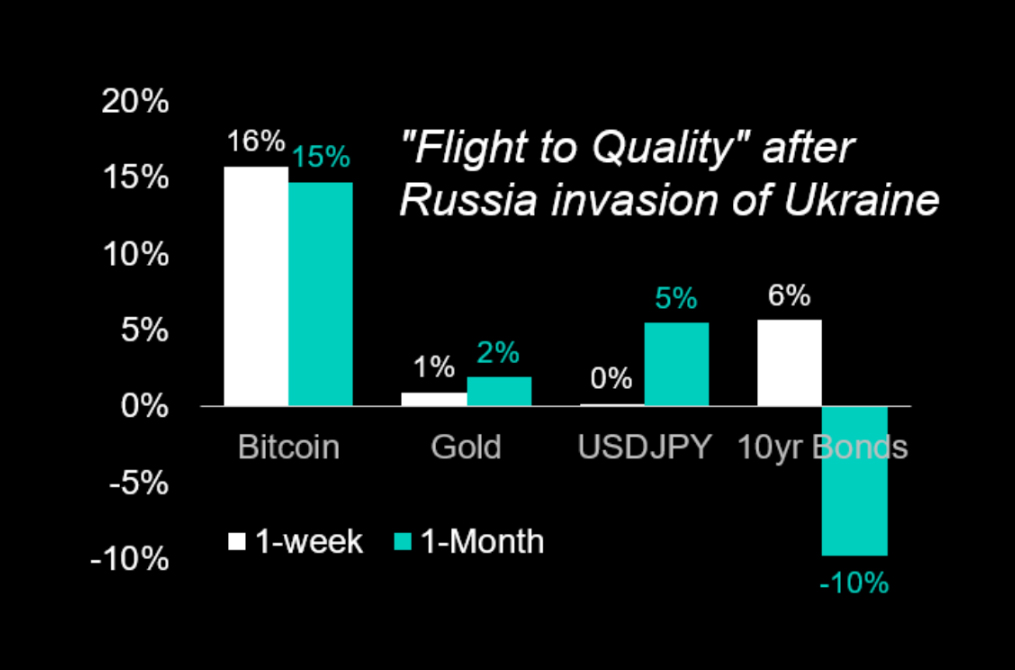

But the price performance of traditional “flight to quality assets” has been the opposite of what many old-school traders would have expected – namely, Bond and Gold prices higher and the US Dollar-Japanese Yen (USD-JPY) exchange rate lower.

One week after the Russian invasion, US 10-year Treasury Bond (prices) rallied by 6% [we are using the Simplify Intermediate-Term Treasury Futures Strategy ETF as a benchmark]. Gold prices were also only +1% higher. At the same time, the traditional safe-haven currency pair USD-JPY was higher – instead of traditionally being lower. Undoubtedly, Bitcoin was the best “flight to quality asset” after the Russian Invasion of Ukraine on February 24, 2022.

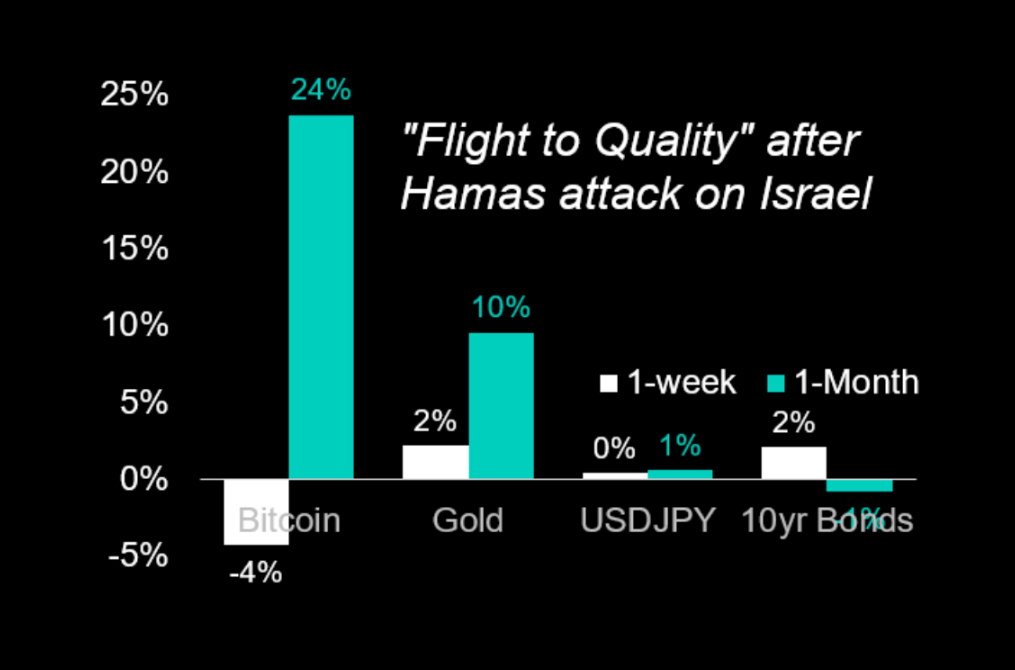

When Hamas attacked Israel on October 7, 2023, the Gold and Treasury Bonds rallied while the USD-JPY exchange rate fell again. The currency market has wholly lost its safe-haven asset, and this is a significant development as many former currency traders have become Bitcoin traders, and adding Bitcoin to investment banks’ foreign exchange trading desks is the most natural progression on the TradeFi side. Twenty-five days after the Hamas attacks, the Bitcoin price is up +24%.

With BlackRock as the world’s largest asset manager supporting Bitcoin and TradeFi billionaires returning from hibernation, we can assume that Bitcoin will be used increasingly as a flight to safety or as a safe-haven asset. Bitcoin’s best days might still be ahead, especially if the world is heading for war.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)