Institutions Are Rewriting the Playbook

While Bitcoin continues to dominate in size, the spotlight is shifting. Ethereum is quickly becoming the institutional favourite, thanks in part to the GENIUS Act, which has introduced long-awaited regulatory clarity for stablecoins. This has strengthened ETH’s role as the foundation of tokenized finance.

In the past week, ETH perpetual open interest surged more than 55%, and for two days in a row, ETH spot ETF inflows outpaced BTC. With ETH’s correlation to the broader crypto market nearing one, it’s proving to be a strong asset for barbell portfolio strategies.

Solana is also gaining ground, now leading on-chain activity with a 44% share—largely driven by memecoin trading. But there’s more beneath the surface. Corporate treasuries have added over $3.5 billion in SOL and ETH this year alone, positioning for yield and growth. Solana’s roadmap includes significant upgrades like the Alpenglow consensus and enterprise-ready tools such as the Attestation Service.

Bitcoin, meanwhile, remains a store of value—but with falling dominance (now at 60%), the market’s appetite appears to be tilting toward yield, flexibility, and ecosystem potential.

Volatility Diverges: ETH Breaks Out as BTC Consolidates

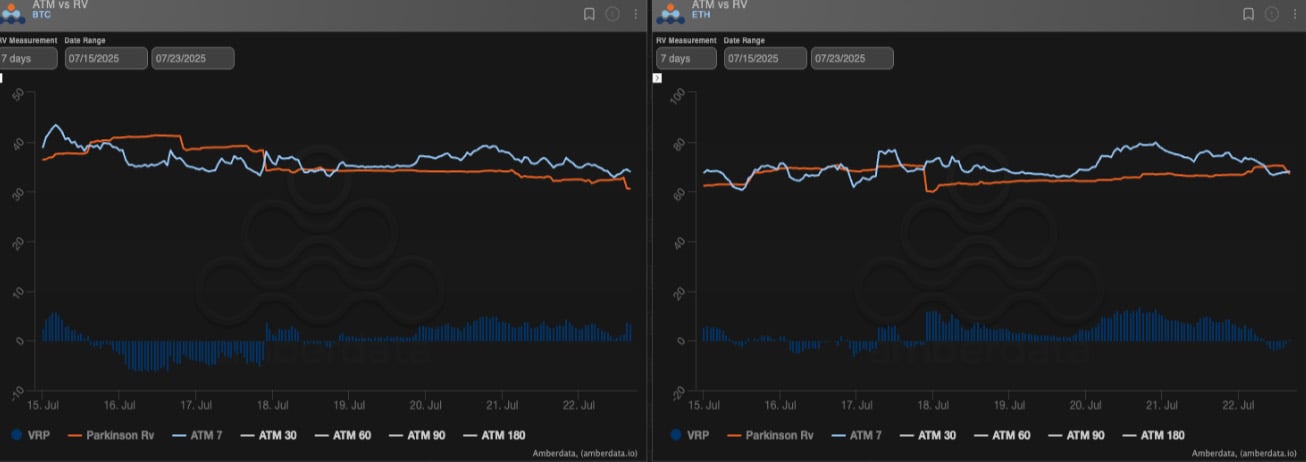

Bitcoin’s realized volatility has dropped to 30% as it consolidates, while Ethereum’s realized vol remains elevated above 60%, fuelled by its parabolic price surge.

Short-dated BTC options saw volatility decline by 6 points, while ETH held steady—despite an earlier spike of 10–15 points. The price action told two very different stories: BTC remained range-bound within implied moves, while ETH repeatedly broke to the upside, closing nine consecutive green candles.

This divergence marks a potential turning point. Altcoins are starting to take over the narrative—and if momentum continues, the next phase of this cycle could get explosive.

Skew Trends Reveal Shifting Sentiment

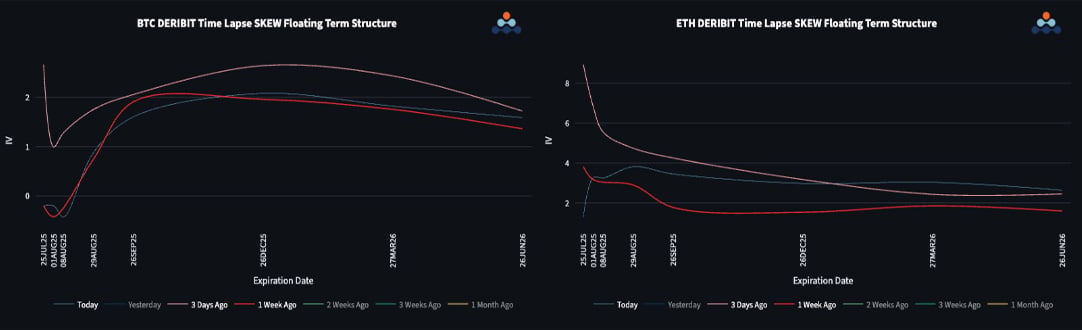

BTC’s skew curve remained largely unchanged over the week, with the front end flat and later expiries showing a minor call premium. A short-lived front-end spike quickly reversed.

Ethereum, however, saw a burst in front-end call demand during its rally to 3800, with skew peaking at 8 vols—now easing to 2–3 vols. In the back end, ETH skew has firmed up by roughly 1 vol from September 2025 onward, signalling growing optimism among traders.

ETH/BTC Breakout Hints at a Larger Reversal

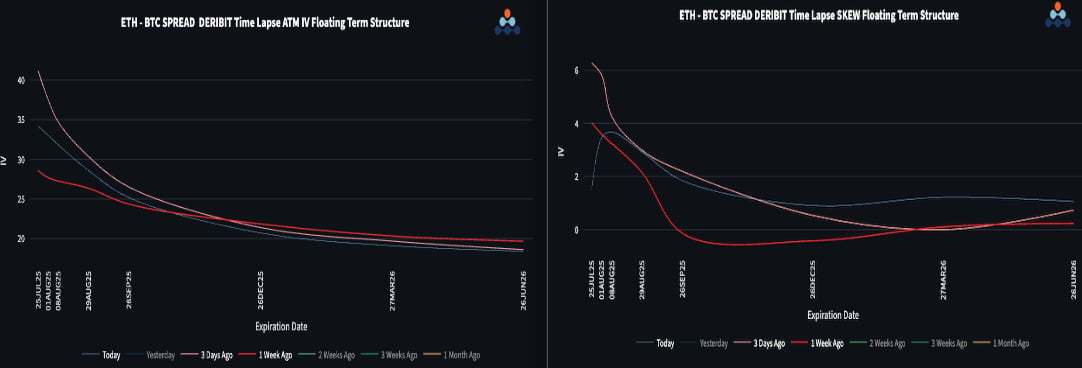

The ETH/BTC pair has finally broken out of a long-standing downtrend that began in 2022. While not yet confirmed, the move is backed by improving fundamentals.

Short-dated ETH/BTC vol spreads jumped to 40 on the breakout, while back-end spreads remain around 20, reflecting stronger demand for gamma over vega. The relative vol skew curve also shows a clear bullish tilt toward ETH across maturities.

My own Dec 2025 ETH/BTC vega spread is currently underwater due to gamma moves, so I’ve been delta hedging the position. If ETH pushes past 4000 soon, I will likely exit the trade with a small loss.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)