Calm Before the US CPI Storm?

Bitcoin and Ethereum remain in a state of choppiness. This week, the broader macro environment will likely drive crypto flows, with the critical event being the US CPI report on Wednesday.

A higher CPI could see a retest of recent lows, while a lower CPI might boost the bullish sentiment.

The return of US ETF flows and Trump’s crypto support are the silver linings that could influence market dynamics positively. Note, cooling funding rates and rising stablecoin supplies may also be the precursor we need to see the bullish vibes returning this summer.

Vol Dynamics at the Whim of US CPI

As BTC settled near the low end of the range, realized volatility decreased. Implied volatility remains low but may change with the upcoming US CPI data.

Positive carry makes short gamma positions attractive again.

Despite CPI risks, we suggest structuring short ‘upside’ gamma trades, such as call calendars or short-dated call condors. Long calendars, particularly on ETH, look most attractive due to the flatter term structure that has room to fall into steeper contango.

Little Action in the Term Structure

BTC’s term structure is mostly unchanged, with minor movements. Weekly volatility increased ahead of US CPI data, and September held well compared to other maturities. Skew is shifting towards puts in the near term but favours higher call premiums into the back end of the curve.

ETH’s term structure is slightly lower by 1.5 vols, with July and September outperforming, indicating the potential for “event risk” around those dates. The long end is softer by 1-2 vols. Weekly skews show better bid for puts as technical support is tested, but calls are still bid from July onwards.

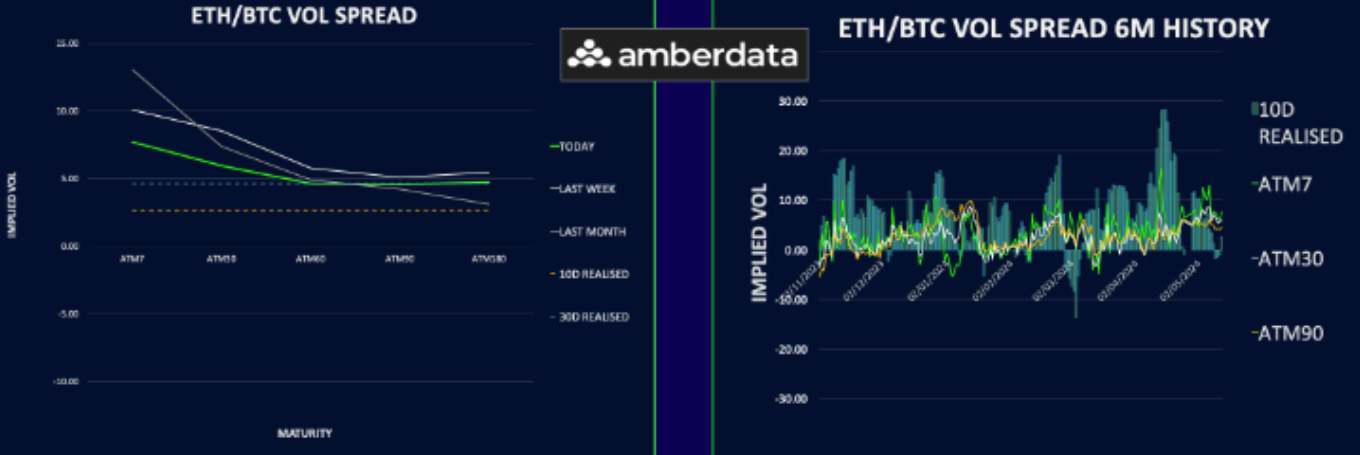

ETH/BTC Vol Spread Pulls Back From Recent Highs

The ETH/BTC volatility spread decreased as the realized spread dropped below 5 vols, with ETH lagging BTC in spot performance.

From 60 days out, the curve is priced well for ETH over BTC, but we favour BTC for short-term pops due to stronger price action.

The ETH/BTC spot spread is near recent lows but losing downside momentum. ETH gamma looks relatively expensive, making it a preferred place to earn THETA.

Skew: Put Premium Short Term Persists

Market skew has calmed, with reduced fear of a sharp downside. Put protection was monetized on BTC, reducing dealers’ short downside vol.

The skew term structure shows flat or put premium in the short term, shifting to call premium from two months out.

We expect the July-September call premium to hold, suggesting a strategy of owning upside in this part of the curve while selling others.

Option Flows And Dealer Gamma Positioning

BTC volumes fell 35% to $5.5 billion. With volatility drifting lower and the CPI catalyst this week, block trades mostly involved options buying. Puts below 60k and calls above 65k were active, focusing on May-June expiries for optimal leverage.

ETH volumes dropped 40% to $3.5 billion, with a dominance of puts. A significant chunk of a 31 May 3000 put was bought for $2 million premium. Lower strikes were also active out to June expiry.

BTC dealer gamma became shorter due to options buying, largest concentration around 65k for 31 May. ETH dealer gamma is nearing neutral as call selling meets fresh put demand.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)