A hot point of debate over the past years has been the USD pricing of options on Deribit.

Deribit options are actually priced in their underlying crypto currencies – for example, Bitcoin options are priced in Bitcoin, while Ether options are priced in Ether. No problem there.

The point of debate becomes apparent when the Bitcoin and Ether prices are translated into USD prices…

Historically, Deribit has used the forward Bitcoin and Ether values, as opposed to their spot values. This seems counterintuitive.

Don’t Bitcoin prices today trade at spot, not forwards?

As my good friend says, grocery store prices are quoted at spot.

So where does the alternate argument come from? Why on earth should we even consider forward prices, and are forward prices the correct quote?

Very smart people have argued both sides of the argument to me and readers will surely have strong opinions on the subject too. I’ve gone back and forth on this myself and finally made my own conclusions; I’ll reveal my final opinion at the end.

Forwards (Cash and Carry)

First let’s look at what the forward prices (specifically the cash & carry trade) represent.

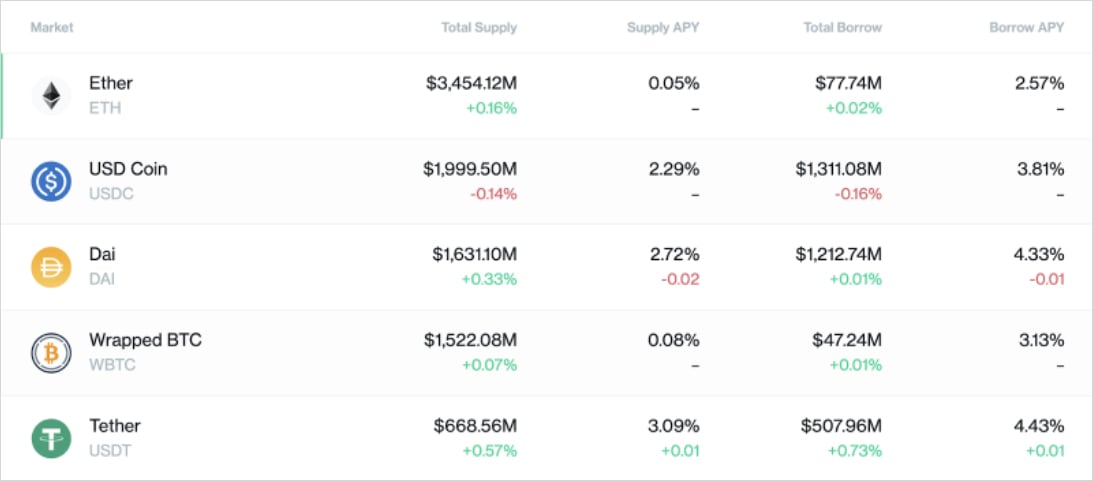

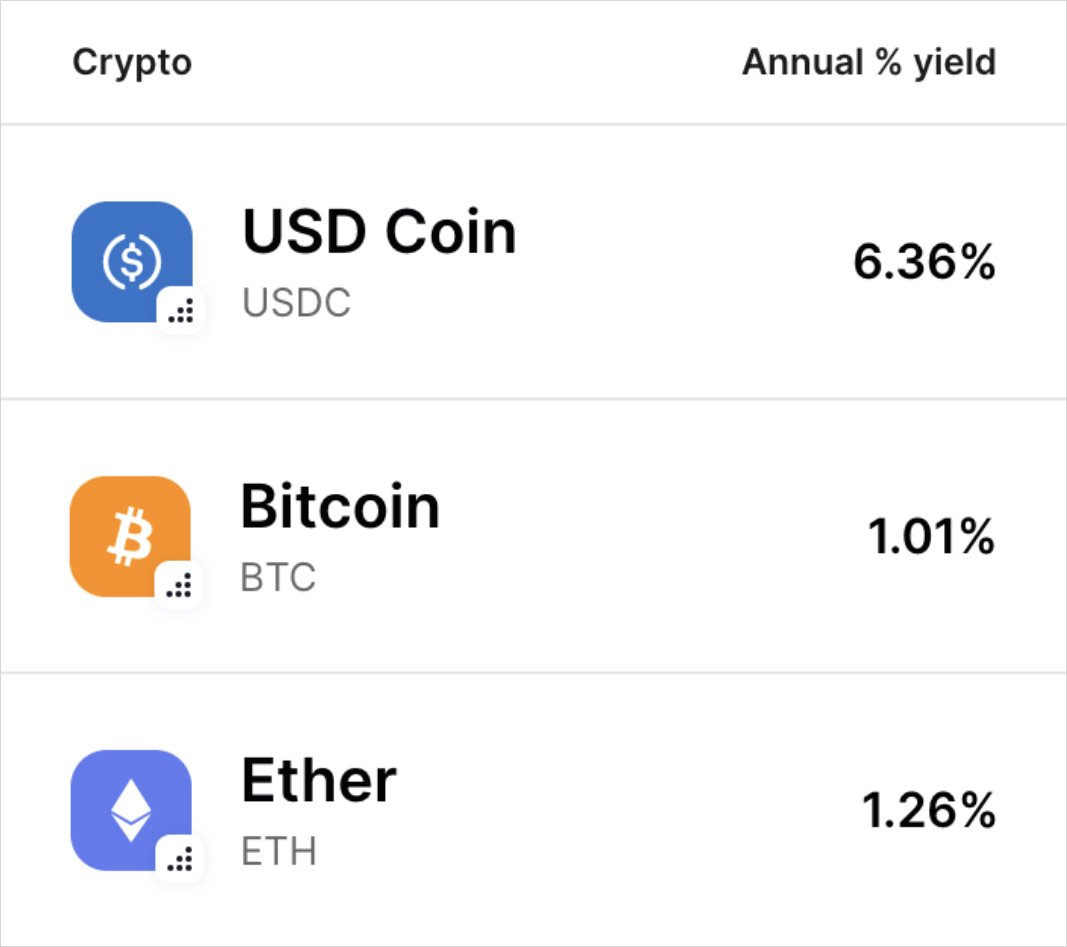

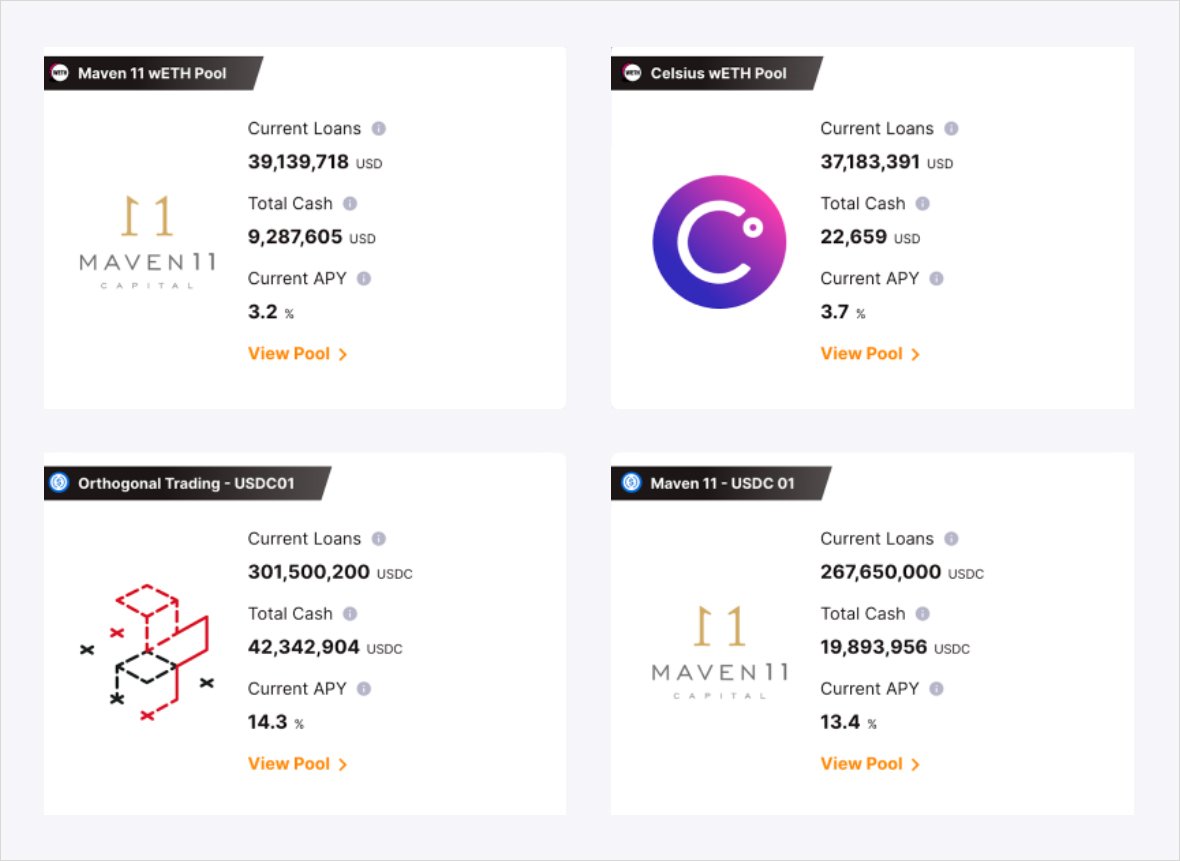

You might have noticed that on lending sites such as Compound, Gemini, or Maple, the lending rate for stable coins is higher than for underlying crypto.

See below.

Source: Compound

Source: Gemini

Source: Maple.Finance

The basis (the cash & carry) trade earns a steady yield, is delta neutral, and merely has counterparty risk. The cash & carry trade has no delta exposure to the underlying crypto. Therefore, the forwards represent a stable coin, cost of capital.

This means that when you buy a Bitcoin option, you could instead hold and lend stable coin. The Bitcoin option price is indeed a spot-price for Bitcoin; but taking real (“fiat”) USD out of your bank account, putting it in the crypto ecosystem, now implies a cost of capital (at a risk-free rate).

In cryptoland, the “risk-free rate” (whatever that means), isn’t US Treasuries; it more closely resembles stable coin lending rates.

In a nutshell, the basis trade – and the associated forwards – are stable coin yields.

The Grocery Store

Now let’s explore present value (PV) versus future value (FV).

Looking at the grocery store example, let’s assume “risk-free rates” are 5% and someone wants to buy a $1.00 soda-pop.

This customer plans to either purchase the soda-pop today, let it sit in the fridge for 1-year, then drink it.

OR

This customer will wait one year, buy the soda-pop, and then immediately drink it.

Assuming that the soda-pop price remains constant at $1.00 – meaning the grocery store does NOT increase its prices – these two choices have different costs:

In the first scenario, we have a PV cost but an FV consumption problem.

In the second scenario, we have a FV cost with a FV value consumption.

The true cost of the soda-pop in the first scenario is $1.05 ($1 + 5% forgone yield).

In the second scenario, the soda-pop cost is truly $1.

Options

Let’s extend this analogy to the options market.

When I purchase a 1-year option today, I receive the final payout in 1-year.

(Assuming a simple scenario).

This presents a PV cost with a FV payout.

To calculate the true PnL, I can either discount the FV “expected payout” to PV, to get a PV cost vs PV payout,

OR

I can convert the PV cost into FV, to compare FV cost to FV payout.

We have to match these scenarios to incorporate the cost of capital (or the opportunity cost of stable coins).

Note that this stable coin cost, estimated through the exchange basis (cash & carry trade), also captures counterparty risk.

So, converting premium into FV seems logical.

The Industry Standard

This problem exists for all equity-like option contracts because the premium is transferred immediately from the buyer to the option writer.

The received option premium is worth something.

The stark difference between Deribit and traditional markets is price quotes reflecting PV or FV.

In Deribit, the USD price reflects FV… at Interactive Brokers, the option prices are quoted in PV.

My Final Conclusion

The industry standard quotes prices in PV.

Deribit makes the assumption of quoting in FV.

In the end, I think the PV standard makes the most sense (I’ve gone back and forth on this after many debates).

I think this makes the most sense because everyone has a different cost of capital; although lending rates are an opportunity cost (and great estimate), they are not necessarily the true “cost of capital”.

Other complications arrive when considering alternate option strategies: selling options early, gamma scalping for income along the way, etc. All these differences affect the timing of payouts and, therefore, the PV and FV.

PV spot-prices apply to everyone, uniformly; it’s then up to individual market participants to find their own discount rates and appropriately calculate their terminal PnL.

In the end, I’ve heard that Deribit will offer both views via a toggle, but it’s important to understand why both perspectives exist.

Greg Magadini

CEO of gvol.io

AUTHOR(S)