BTC Faces Fragile Balance Between Policy Tailwinds and Corporate Risks

Bitcoin remains under pressure at a critical point.

The Fed has shifted focus toward a weakening labour market, making a September rate cut more likely. While looser policy can support risk assets in the short term, an equity sell-off would still risk de-leveraging by traditional investors.

On the corporate side, adoption momentum is showing cracks. Over 150 listed companies now hold BTC, but institutional buying has slowed to its weakest pace since March. More concerning, nearly 30% of treasury firms now sit with Bitcoin holdings worth more than their market cap — a setup that could force some to sell.

Still, 93% of corporate holders remain net buyers, and aggregate flows are historically elevated. The key question: do these stress points stabilize or accelerate?

Macro easing may help, but positioning risks keep Bitcoin vulnerable. Watch institutional flows and treasury data as the next catalysts.

Volatility Compresses as Markets Consolidate

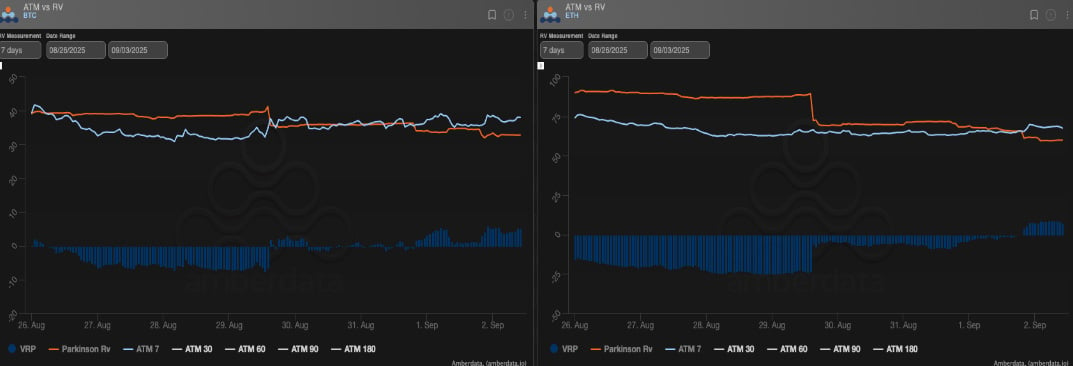

Realized volatility has drifted lower in both BTC and ETH as markets settle into tighter ranges;

- Front-end BTC vol is flat to slightly higher, while ETH shed about 5 vols.

- Carry has turned marginally positive, though not enough to spark significant vol selling in BTC.

- Price action remains orderly, respecting implied ranges, apart from Friday’s BTC drop.

Macro uncertainty lingers, making short gamma exposure risky despite calmer surface conditions.

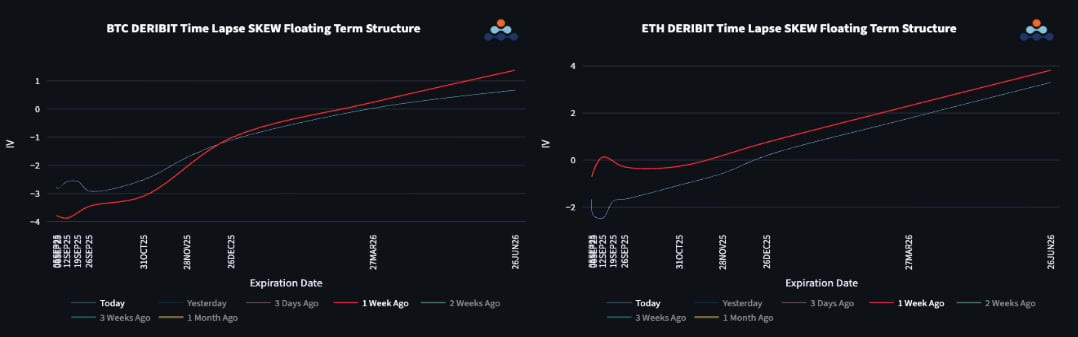

Diverging Skews Flagging Near-Term Risks

Skew dynamics diverged across assets this week;

- BTC front-end puts have lost premium, dropping from 6 vols last week to about 3 vols today, with December call skew easing slightly.

- ETH front-end has shifted from neutral to a put premium as momentum fades, while back-end calls are also losing support.

The curve shift in ETH suggests growing downside risk, with 4000 likely to be tested or broken if pressure persists.

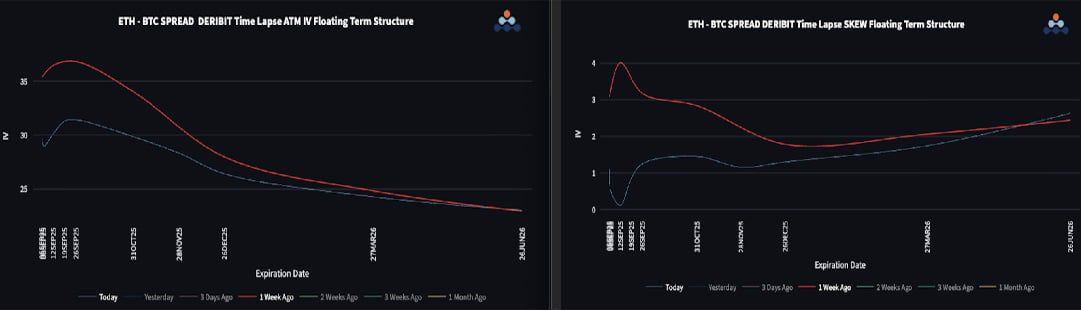

ETH/BTC Consolidates With Potential Upside

ETH/BTC has been consolidating since breaking above downtrend resistance. Holding above 0.038 could open further upside;

- Vol spread has corrected from extreme highs near 35 but remain elevated by historical standards, but justified by realised spread.

- Skew differential has normalized in the front end due to macro risks affecting both assets.

- Further out, ETH retains a call premium of around 2–2.5 vols, pointing to longer-term relative upside potential.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)