Macro: Positioning Resets After September Washout

Bitcoin has held firm above $112k and Ethereum reclaimed $4.1k despite heavy ETF outflows into quarter-end. That resilience suggests institutional appetite remains intact heading into “Uptober,” a seasonally bullish month.

Macro conditions still matter: U.S. growth looks solid, the labour market isn’t collapsing, the dollar is stronger, and liquidity is tighter – all tempering hopes for imminent Fed cuts. Still, leverage has been flushed out after $4B in liquidations, leaving cleaner positioning and a potential upside window.

Meanwhile, Tether’s reported $15–20B raise and expansion into AI, energy, and neurotech shows crypto’s structural growth story remains alive beyond short-term price action.

Realized Volatility: Carry Trade Squeezed

Volatility picked up around last week’s expiry, but outside of Thursday’s drop, realized moves stayed inside implied ranges;

- BTC front-end vols held steady, while ETH vols dropped about 5 points.

- Carry has compressed to ~5 points, limiting returns for gamma sellers.

- With BTC implied vol near 30 and daily breakevens around 1.5%, there’s little room for further vol compression.

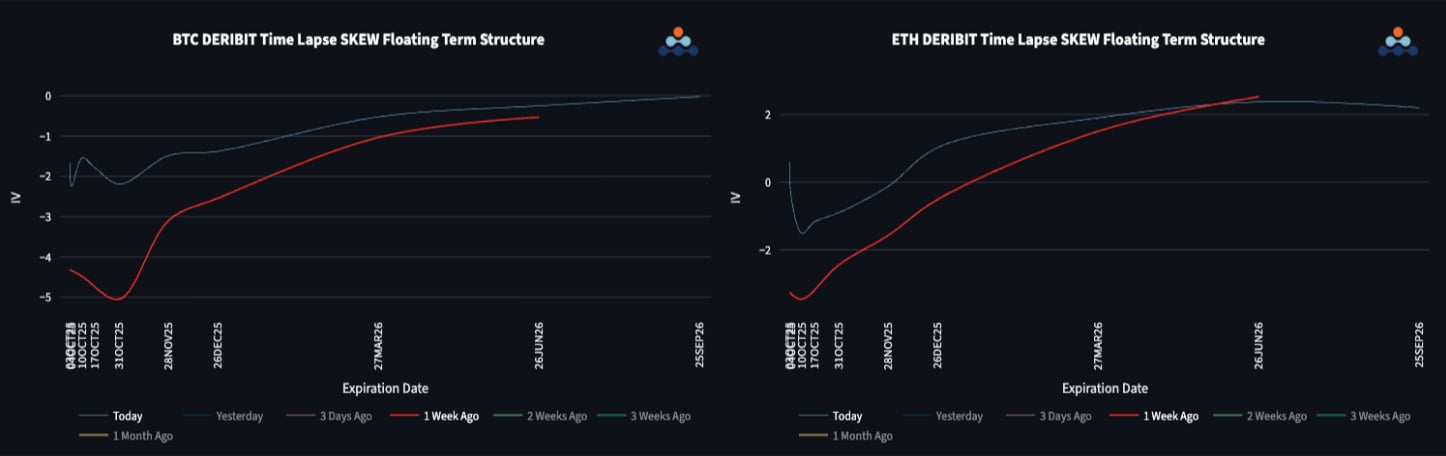

Term Structure: Skews Flatten, ETH Upside Favoured

Both BTC and ETH skew curves flattened after the weekend rally;

- BTC front-end puts now trade at just a 2 vol premium (down from ~6).

- ETH skew is broadly stable, with the back-end showing a steady 2 vol call premium. Takeaway: short-dated skew still tracks spot, but back-end skew is sending a consistent signal—ETH upside is favoured into late 2025.

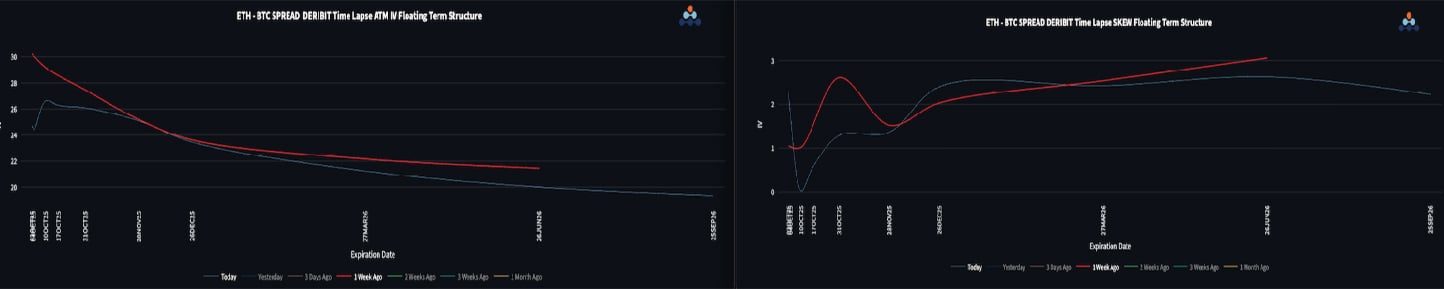

ETH/BTC Dynamics: Wide Vol Spread Persists

ETH/BTC bounced from 0.035 back to its trendline, but options still price a high relative risk in ETH;

- Vol spreads remain wide: ~25 in the front end and ~20 in the back.

- The market remains reluctant to be short ETH gamma after the explosive summer rally. Until institutional adoption deepens and more overwriting emerges, these elevated spreads are likely to stick.

- SOL vol, meanwhile, collapsed from 100 to 70, now looking cheap versus ETH. The options market is effectively saying both assets carry similar upside potential.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)