Macro: Distribution, Not Destruction

Bitcoin’s recent pullback from 110k to just under 100k still looks more like a broad distribution at play than panic selling. On-chain data reveals older, large holders gradually transferring coins to exchanges – classic profit-taking behaviour after long-term gains.

Meanwhile, tight U.S. liquidity (rising TGA and RRP balances, falling bank reserves) has added temporary pressure. These headwinds should ease after month-end, with a key liquidity inflection expected once the Fed’s QT ends on Dec 1, paving the way for balance-sheet expansion.

Despite outflows and reduced corporate accumulation, BTC has absorbed over 400k coins in the past month while still holding 100k, suggesting strong institutional demand through ETFs and funds.

ETH and SOL have suffered deeper damage – ETH testing levels near $3,000 and SOL under its 200-day MA – but history suggests these are more likely shakeouts than trend reversals.

Bottom line: The market is cleansing, removing speculative flows, still under a broad distribution phase. Once liquidity turns, the structure remains constructive.

Realized Volatility: Shockwave Through the Tape

The sell-off triggered a violent repricing of volatility;

- BTC realized vol surged from ~30% to ~50%, while ETH jumped from ~50% to ~70%.

- Short-dated implied vols exploded higher – weekly options gained 20–30 vol points, and even end-of-November expiries rose 8-10 vol points.

- Despite the chaos, realized vol outpaced implied, leaving option carry only marginally positive.

- Most implied ranges held until the final two sessions, when BTC and ETH broke sharply lower – ETH’s drop was roughly 3x its implied move, signalling capitulation.

Vol traders are now paying up for protection, but the worst may already be priced in.

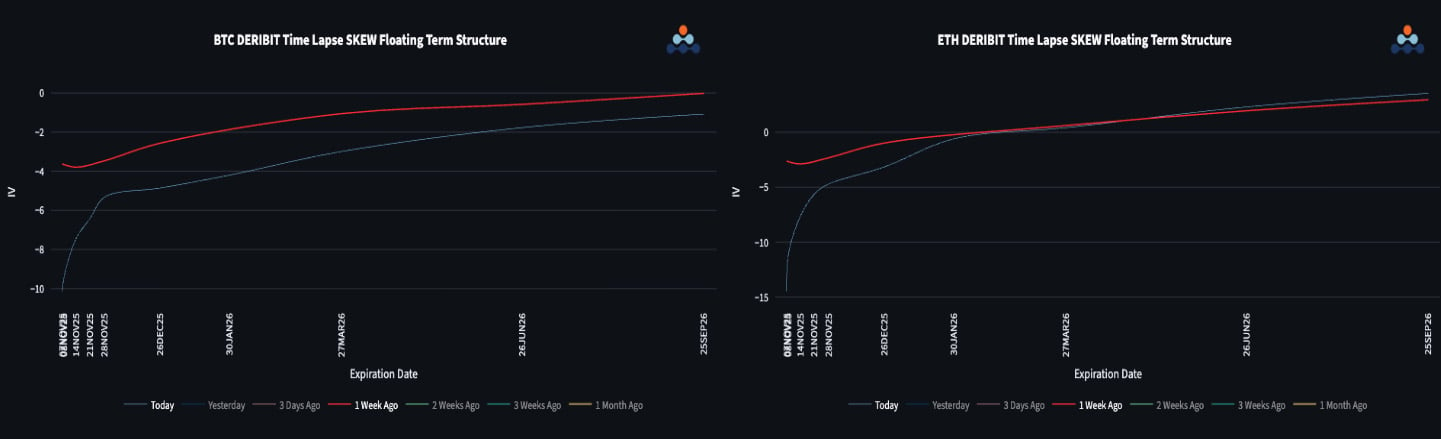

SKEW Term Structure: Front-End Fear, Long-End Faith

Volatility curves steepened dramatically as downside protection demand surged;

- Short-dated puts blew out to -10 vols (BTC) and -15 vols (ETH), driving steep front-end contango.

- The entire BTC curve now carries a put premium, including longer maturities (1–2 vols).

- ETH’s curve shows near-term put dominance but transitions to call skew beyond January 2026 – a key sign that traders expect the sell-off to fade and recovery to resume.

Short-term panic, long-term optimism – a classic volatility term structure signalling a maturing correction.

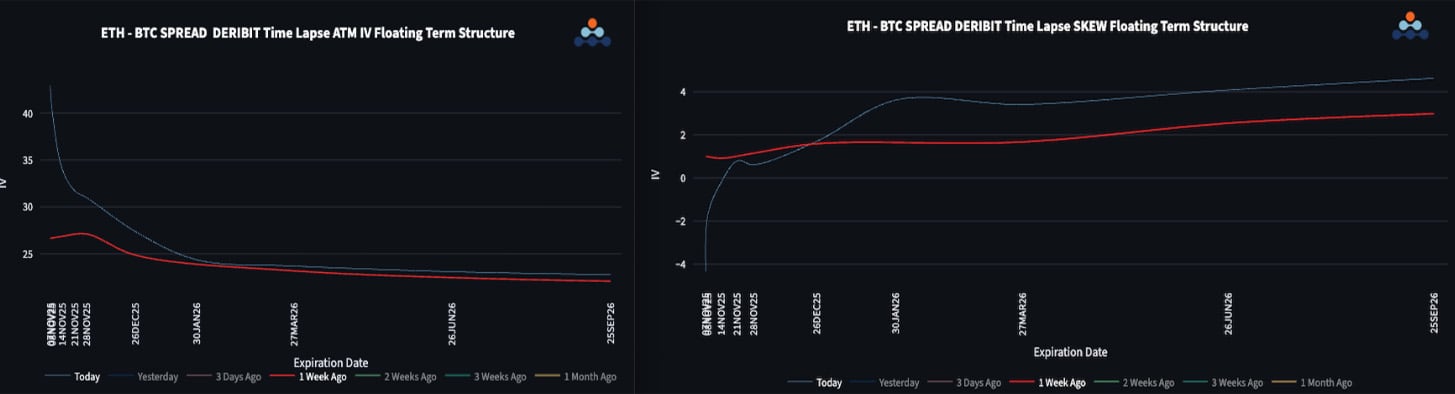

ETH/BTC Dynamics: Ethereum’s Wild Ride Resets the Spread

The ETH/BTC ratio collapsed to 0.032, firmly re-entering a downtrend;

- The ETH-BTC vol spread widened aggressively: front-end at +40 vols, 1-month at +30 vols, while the back end held steady.

- ETH’s short-term put skew is more pronounced due to its deeper price drop, but from mid-term maturities onward, BTC shows heavier downside premium, implying ETH volatility is expected to normalize faster.

Vol markets are reaffirming that ETH trades with higher beta – capable of violent swings both ways – and that elevated ETH vol is likely here to stay.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)