GSR is commenting on the latest movements in the crypto space and how to get the best possible benefits out of it.

For further information about GSR, please visit GSR’s website here, or go directly to their OTC Trading Desk here.

Macro + Crypto Summary

The markets were quiet over the holidays, with the exception of the recent DXY sell off that some attributed to a reversal of year-end window dressing. Yields are slightly softer, and the remainder of the market is rather unremarkable. Investors will now focus on the Fed, where current odds of a 25 bp hike are 78% and the rest for a 50 bps hike. Thursday’s US CPI report will be particularly important, and we expect the Fed to remain the main driver of macro themes this quarter.

Rates, Funding and Basis

The collapse of FTX and BlockFi in Q4 2022 brought the unsecured lending markets to a near standstill as lenders tried to side-step the contagion and protect capital in an increasingly uncertain market. Liquidity dried up across both OTC lending markets and DeFi platforms that facilitate permissioned or permissionless lending.

As we enter 2023, we are starting to see activity gradually pick back up. The reality is that there is on-chain capital that is mandated to earn a yield, and in low-vol directionless markets, lending is one of the few ways to do that, even though principal is at risk. We expect there to be increased due diligence and greater borrower scrutiny as the market slowly comes back to life. It’s hard to posit where rates may end up – while one could argue that the risk premium has gone up, the need for cash from borrowers in the current market has gone down.

Rates in the traditional markets continue to inch higher, with risk-free rates already in the low 4s and expected to increase further as the Fed continues its hiking campaign. Several firms are looking to introduce T-bills and bonds in an on-chain format that will give on-chain USD capital a way to earn a low-risk yield that is substantially higher than rates at Aave and Compound. This may be a game changer by creating a long needed bridge between traditional assets and on-chain capital, and will likely impact pricing of not only debt in crypto, but also futures and perp funding rates.

Derivatives

BTC Derivatives

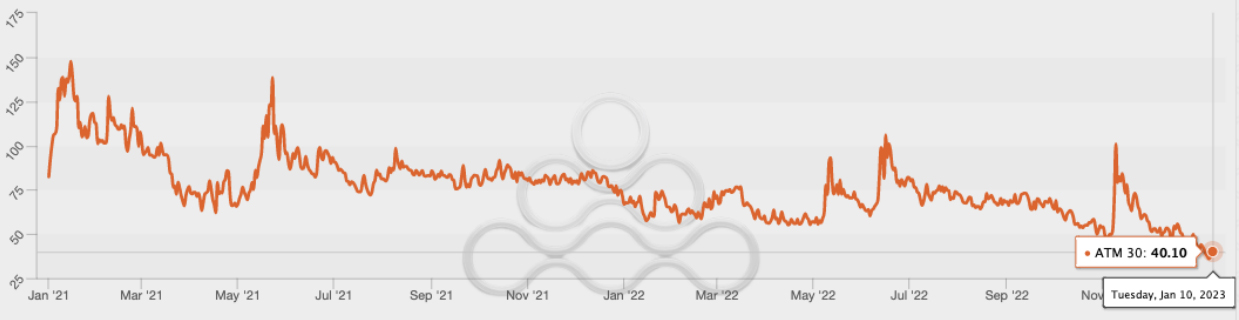

BTC implied vol continues to make new all-time lows with 30 day IV currently at 40.1%. Carry, however, remains expensive with 30-day realized vol at 26%. Even with the 2023 rally, realized vol is not picking up, and the 30 day implied versus realized ratio is 1.60.

BTC ATM Implied Volatility (30 Day)

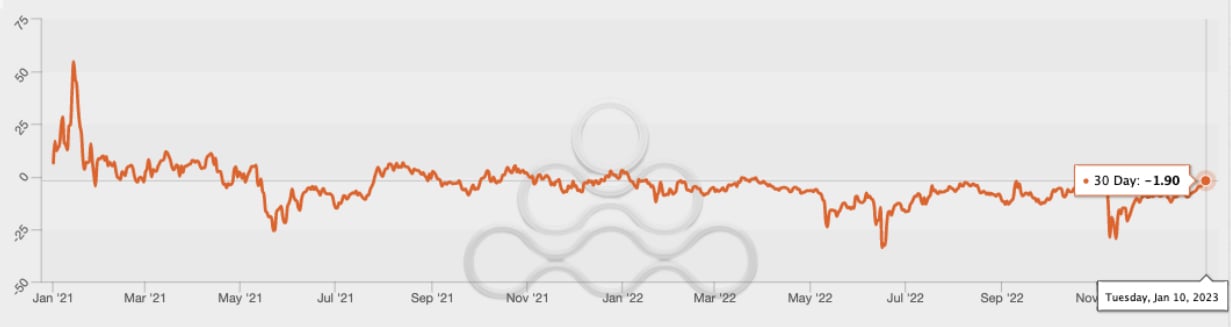

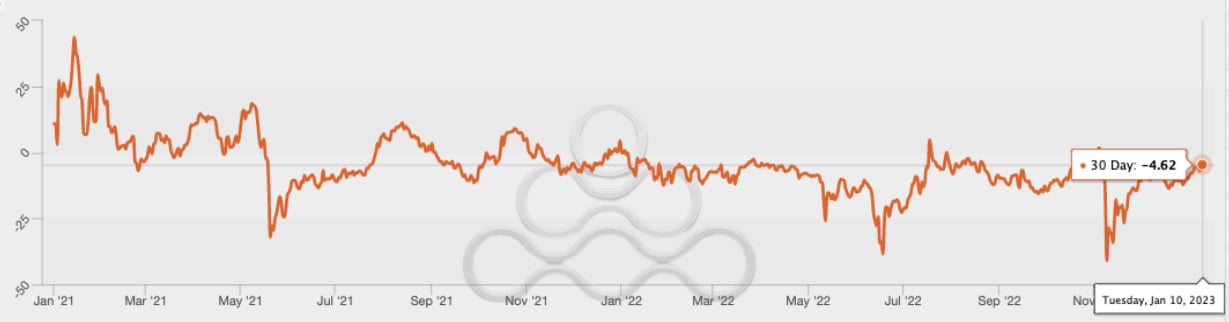

25 delta call skew is firming, now at -1.90. One could conclude with low vol and relatively firm call skew / soft put skew, that puts are quite cheap.

BTC 25 Delta Call Skew (30 Day)

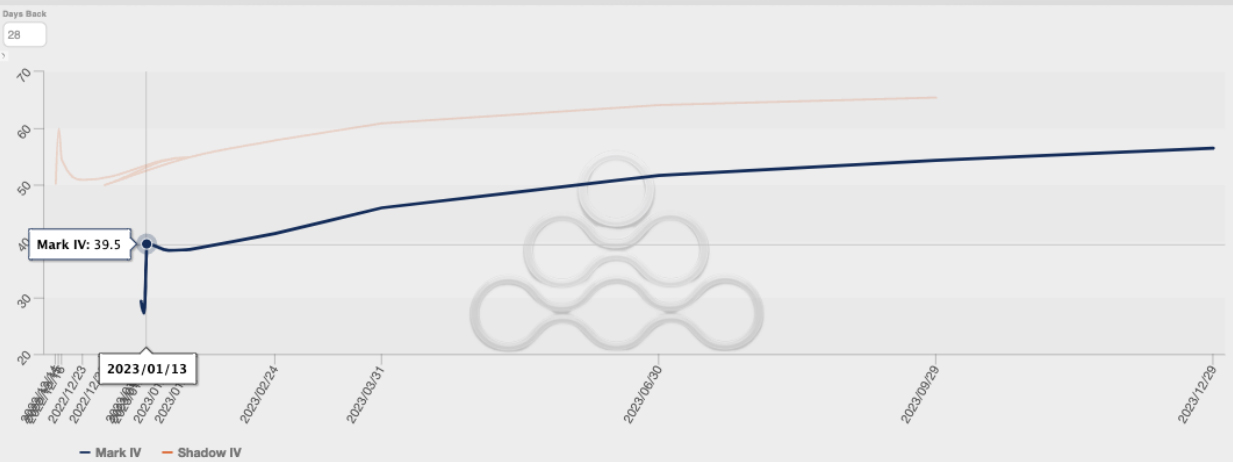

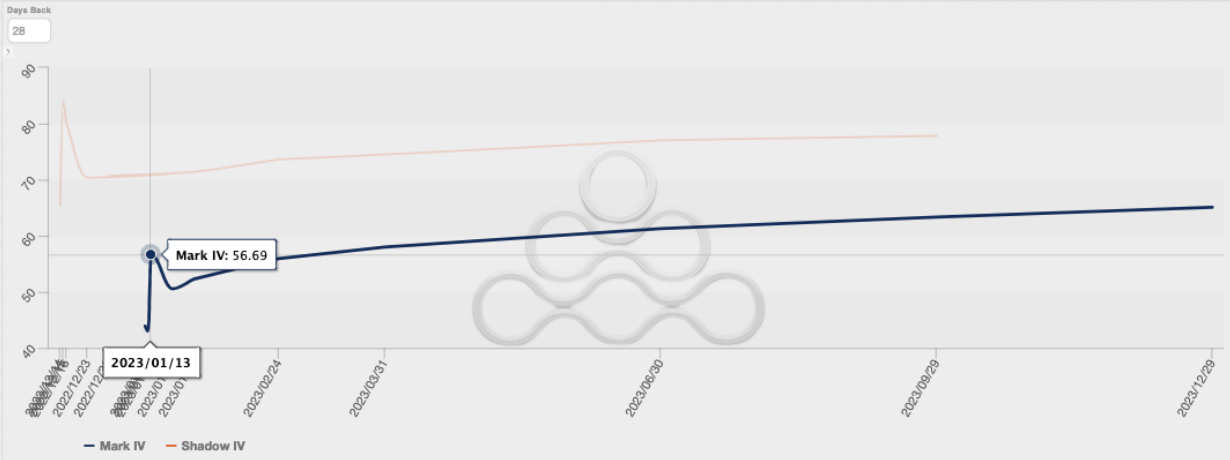

The current term structure is in contango and compared to 28 days ago, shows a significant drop in the entire vol curve. Note the slight premium in the January 13th expiry, as it covers Thursday’s CPI release.

BTC Shadow Term Structure

ETH Derivatives

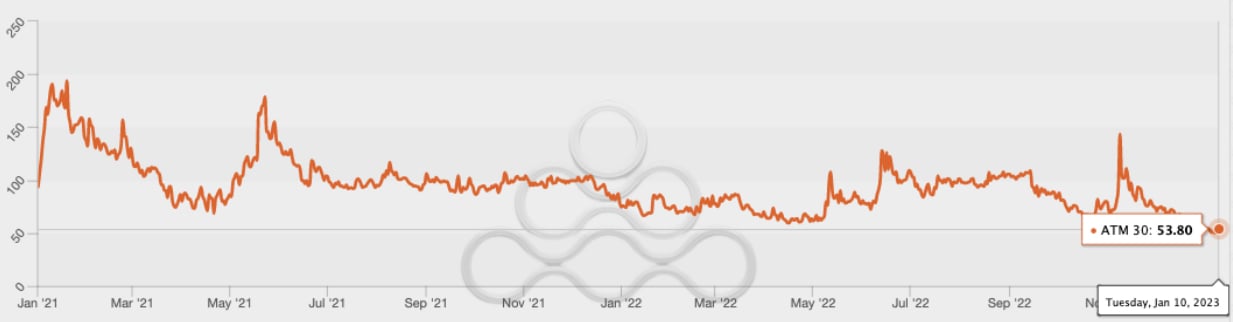

30 day realized vol for ETH is 42% while implied vol also reached new lows of 53.8%. The 30 day implied versus realized ratio now stands at 1.5.

ETH ATM Implied Volatility (30 Day)

ETH 25 delta call skew is in line with recent trends at -4.6.

ETH 25 Delta Call Skew (30 Day)

ETH term structure compared to 28 days ago also shows a significant drop in vol across the curve, with the January 13th tenor at a premium.

ETH Shadow Term Structure

Flows and Liquidations

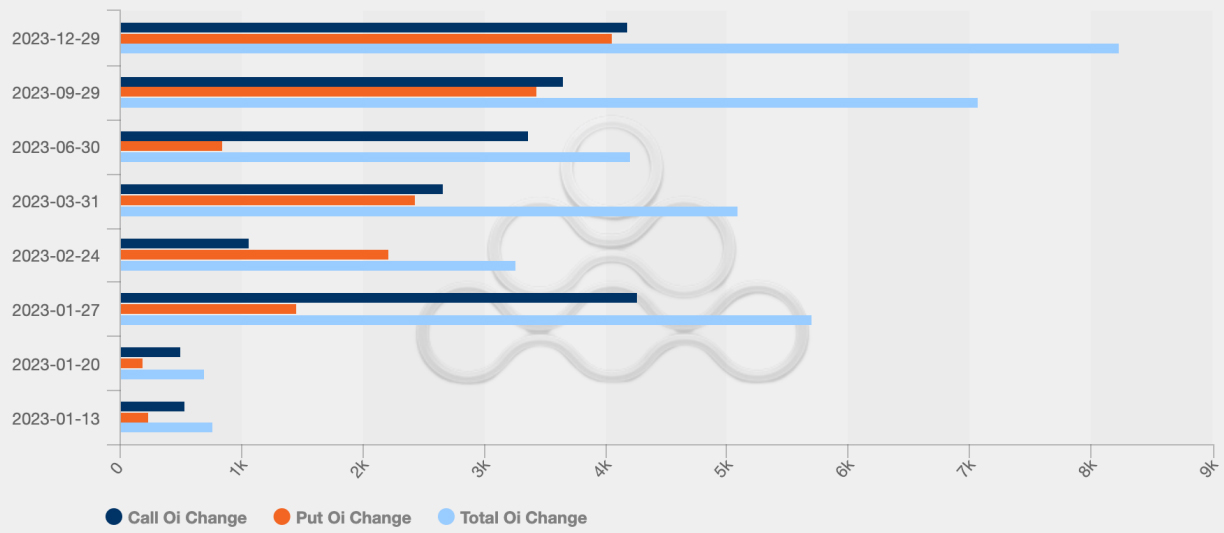

2022 ended with one of the largest option expiries in recent times with over $2.3b in BTC and ETH options expiring on December 30th. The change in open interest by expiration for BTC shows the December 29th 2023 expiry as having the largest increase in open interest, with balanced sentiment between calls and puts. Short dated expiries show call open interest outweighing puts.

BTC Historical OI Change By Expiration

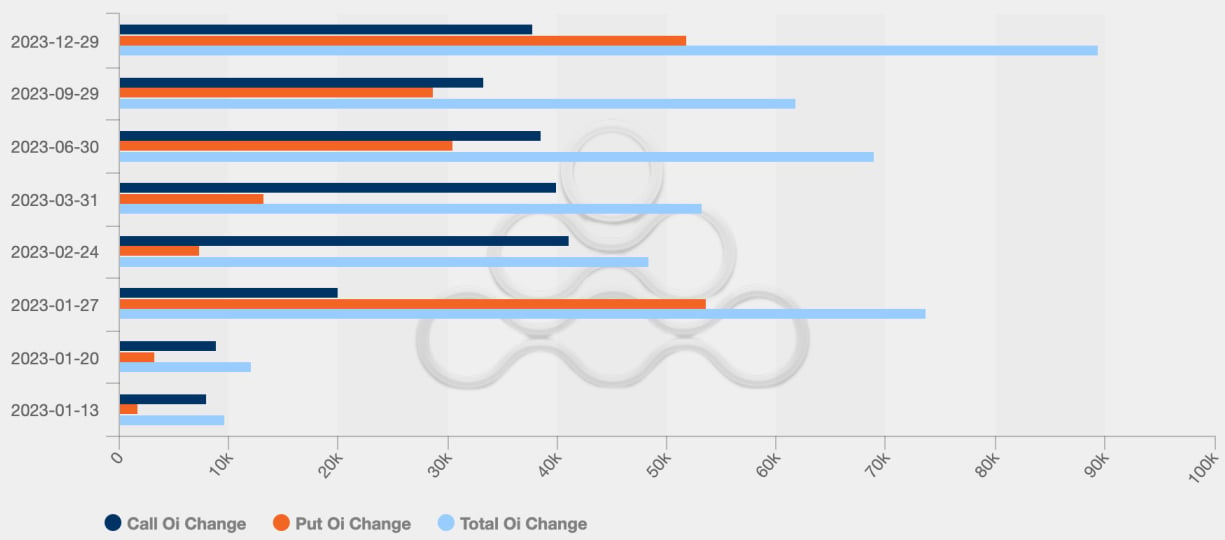

ETH options similarly show December 29th, 2023 as having the largest growth in open interest. However, unlike BTC, the January 27th expiry exhibited a larger amount of open interest in the puts.

ETH Historical OI Change By Expiration

The most popular trade over the past few weeks has been the June 30th 2023 ETH 400 puts purchased on Deribit on January 5th with over 25k lots done and a resting bid persisting for a few days after.

The most popular trade in BTC has been large purchases of January 27th 2023 18/19k calls, which occurred on January 10th.

Liquidations have mainly been concentrated on the short side with January 8th experiencing $160m in overall short liquidations as we break out above current resistances at $17K and $1,300 for BTC and ETH, respectively.

Total Liquidations

DeFi

The crypto markets started the year off right with altcoin volumes on exchanges showing a nice recovery, which was also accompanied by strong on-chain volumes as well.

Liquid staking derivatives (LSD) have been in the spotlight recently. LSDs like LDO, SWISE and RPL saw strong interest as ETH devs confirmed that they are pushing for the Shanghai upgrade, which will enable staked ETH to be unstaked pending a queue. The upgrade is expected to drive more staking volumes to these providers, significantly increasing protocol revenue. Further, LSD protocols have had to give significant incentives for secondary liquidity for their liquid staking tokens, and this cost should also fall if users can instantly unstake.

Elsewhere, NFTs are also seeing some of the strongest volumes in months. Some of these volumes are driven by developments in NFT-Finance (NFT-FI) that have allowed NFT traders to leverage their exposure by borrowing against existing holdings. The launch of the blur.io platform with its innovative liquidity incentive structure has also significantly improved market liquidity for NFTs. As an example, Bored Ape NFTs can now be sold for less than 30 bps slippage, compared to the previous 5%+.

Disclaimer

This material is provided by GSR (the “Firm”) solely for informational purposes, is intended only for sophisticated, institutional investors and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal. The Firm is not and does not act as an advisor or fiduciary in providing this material.

This material is not a research report, and not subject to any of the independence and disclosure standards applicable to research reports prepared pursuant to FINRA or CFTC research rules. This material is not independent of the Firm’s proprietary interests, which may conflict with the interests of any counterparty of the Firm. The Firm trades instruments discussed in this material for its own account, may trade contrary to the views expressed in this material, and may have positions in other related instruments.

Information contained herein is based on sources considered to be reliable, but is not guaranteed to be accurate or complete. Any opinions or estimates expressed herein reflect a judgment made by the author(s) as of the date of publication, and are subject to change without notice. Trading and investing in digital assets involves significant risks including price volatility and illiquidity and may not be suitable for all investors. The Firm is not liable whatsoever for any direct or consequential loss arising from the use of this material. Copyright of this material belongs to GSR. Neither this material nor any copy thereof may be taken, reproduced or redistributed, directly or indirectly, without prior written permission of GSR.

AUTHOR(S)

THANKS TO

Mike Pozarzycki – Macro & Crypto Summary

Ruchir Gupta – Rates, Funding and Basis

John Cole – Derivatives

Christopher Newhouse – Flows and Liquidations

Calvin Weixuan Goh – DeFi