“Show me the incentive and I will show you the outcome” – Charlie Munger

Warren Buffett’s long-time business partner Charlie Munger, eloquently remarks the relationship between present incentives and future results with this quote. The message behind this statement resonates throughout multiple fields including behavioral economics, game theory, and — perhaps less apparently but just as validly — in decentralized finance (DeFi).

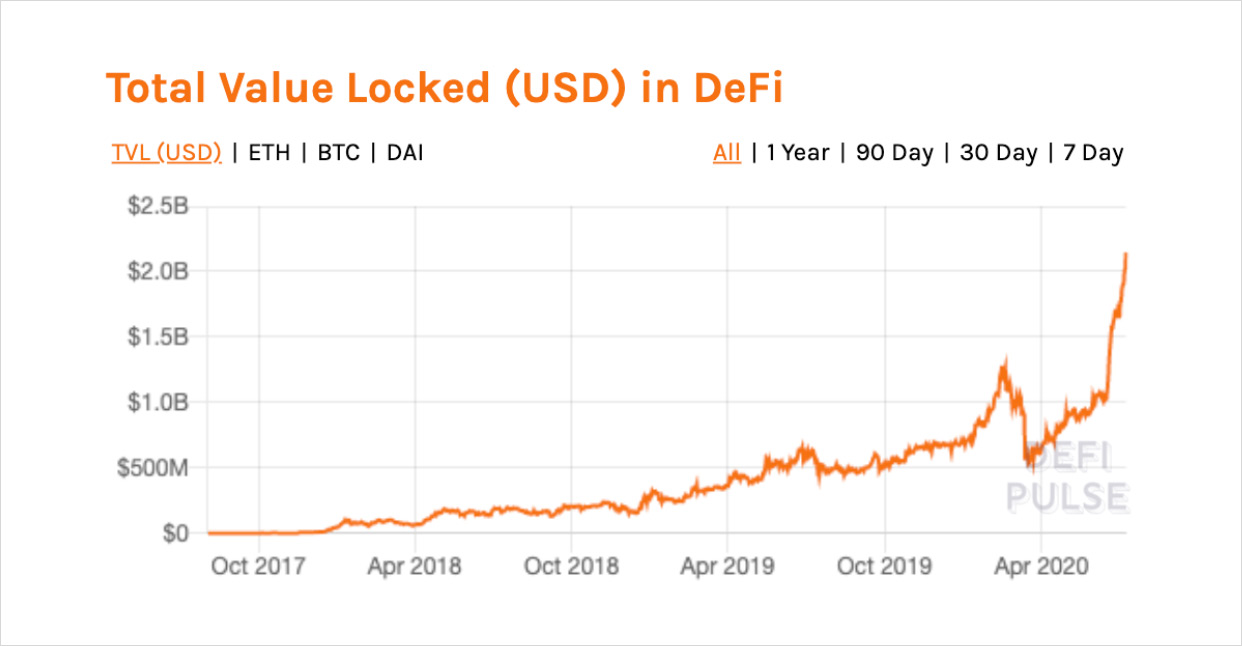

DeFi protocols have seen remarkable growth in terms of adoption, token prices, and total value locked. While websites and social media platforms relying on third-party advertising require a high amount of daily/monthly active users to capture value, decentralized protocols generally do not depend on frequent usage to create value. Instead, the dollar amount held by the smart contracts powering decentralized financial services better reflect the value created by these dapps. As a result, total value locked has become a widely-followed barometer of the DeFi space as the majority of these protocols require a collateral to be locked in order to use their services.

Popular DeFi aggregator DeFi Pulse has been tracking this metric since the fall of 2017. As seen in the image below, it took approximately two and a half years to reach the $1 billion mark in total value locked. Despite decreasing significantly during the market-wide crash dubbed Black Thursday, the total value locked in DeFi continued growing throughout the second quarter of 2020 surpassing $2 billion just 6 months after first passing ten figures.

As of July 8, 2020 at 10am EST. Source: DeFi Pulse

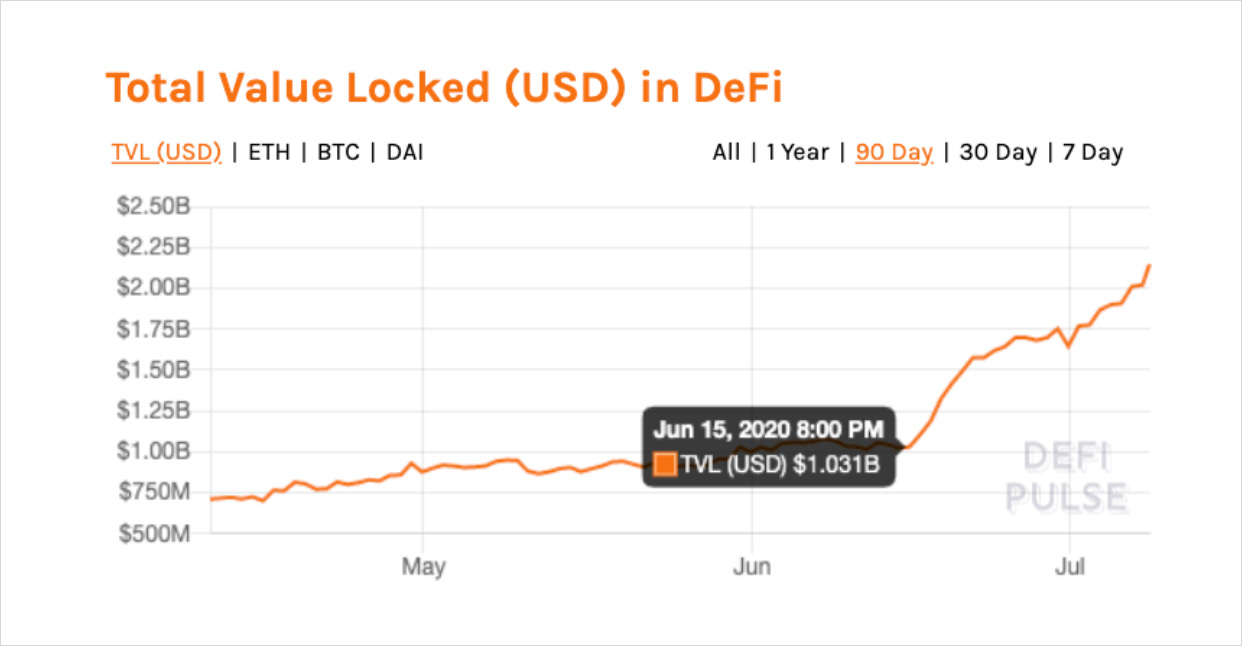

In the image above, readers may have noticed a recent point of inflection for the total value locked. By zooming in, we can determine that this happened in mid-June coinciding with the release of Compound’s COMP token on June 15. Within less than a month, the total value locked in DeFi protocols doubled. This has largely been because of the incentives users receive through so-called yield farming.

As of July 8, 2020 at 10am EST. Source: DeFi Pulse

In a nutshell, yield farming is the process of earning rewards in the form of tokens and/or interest in return for providing liquidity to a DeFi protocol. The concept has been around since the summer of last year when Synthetix — a decentralized derivatives exchange — first experimented rewarding users for providing liquidity to its derivative synthetic Ether (sETH) pair on Uniswap by paying them with their native SNX tokens. However, it was not until the launch of Compound’s native token COMP that this became a popular practice and buzz word within the crypto space.

In Compound’s case, users are able to yield farm by borrowing or lending tokens to the protocol, receiving COMP tokens in return. Given COMP’s current price of around $180, the incentives received in tokens have been large enough for users to profit from borrowing money despite having to pay interests on their loans. As a result, users have rushed into Compound, increasing the total value locked in the protocol by more than 6x since this release to over $650 million.

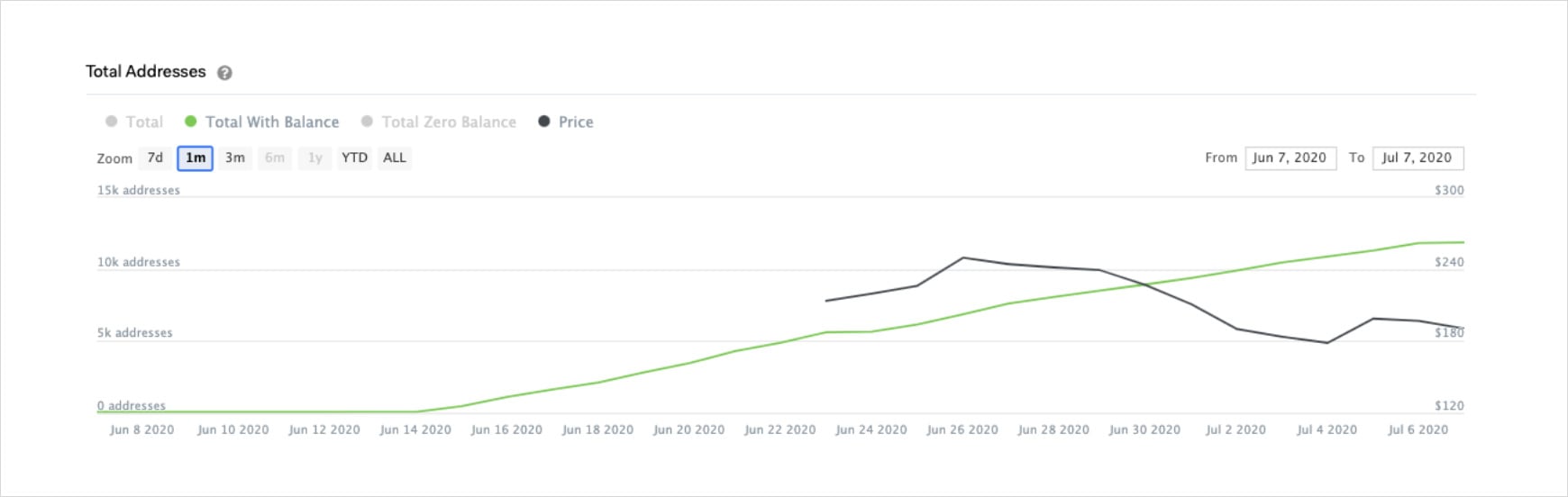

Some people in the space have praised this practice as a DeFi “growth hack”. Analyzing key on-chain insights we can evaluate the effectiveness that yield farming has had in increasing COMP’s adoption. For instance, let’s observe how the number of holders has varied since the token’s inception.

As of July 8, 2020 at 10am (EST) using IntoTheBlock’s newly-added COMP analytics

As can be seen in the graph above, the number of COMP addresses with a balance has quickly risen from near-zero to over 10,000 within less than a month, effectively capturing a sizable community and decentralizing token ownership from the get-go. To put this in perspective, BitFinex’s token LEO has less than 2,000 holders accumulated throughout a year, while MakerDAO’s MKR has 22,000 despite launching in November of 2017.

Asides from yield farming, DeFi protocols have been leveraging other tactics to boost growth and community adoption. One common method to achieve this, that many projects have implemented or are looking to implement, is staking. For example, the popular decentralized exchange Kyberon July 7 launched its Katalyst upgrade, thus enabling holders of Kyber’s native KNC token to stake their tokens to vote in improvement proposals.

Along with this, it ‘restructured’ as a decentralized autonomous organization KyberDAO granting decision-making capacity to members of its community. To incentivize holders to participate, they receive staking rewards in ETH in return for voting or delegating their vote. 65% of the decentralized exchange’s network fees are redistributed to the holders staking their vote through this process, incentivizing active decentralized governance.

Furthermore, being an exchange, Kyber realized that it is also critical to incentivize liquidity in order to build a robust trading infrastructure. Thus, as part of the Katalyst upgrade, 30% of the Kyber network fees are now going towards offering rebates to liquidity providers, known as reserves within the Kyber ecosystem. Through these, Kyber is effectively reducing the costs to perform market-making activities in the exchange, incentivizing the creation of more and higher quality of reserves and strengthening the platform’s liquidity.

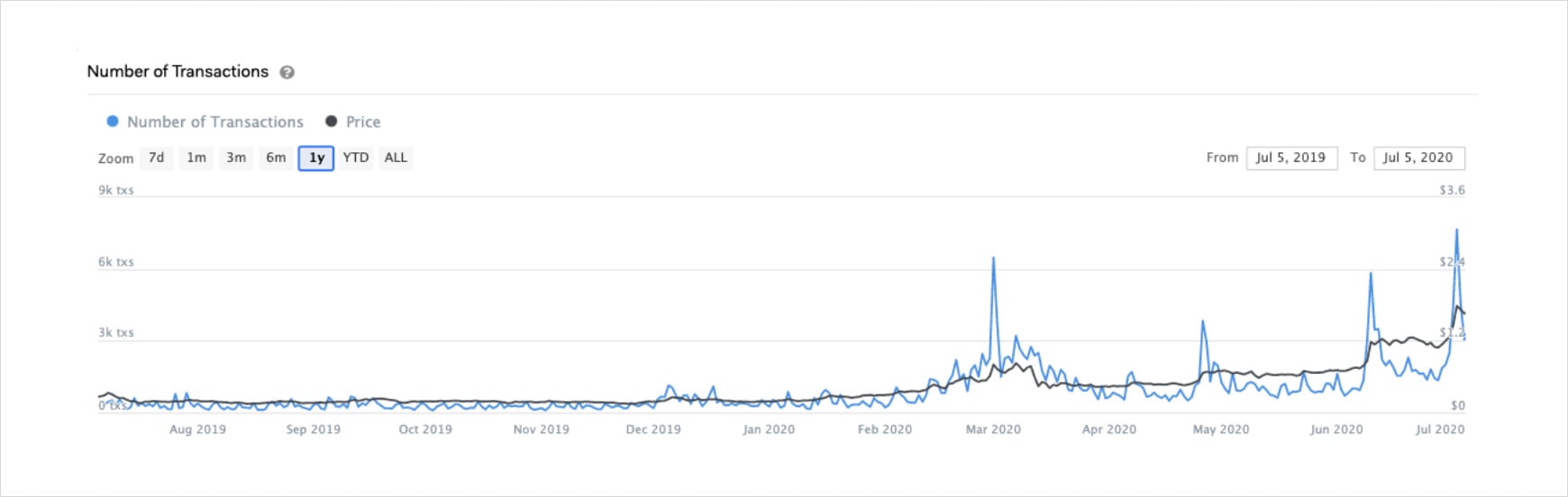

In anticipation of the Katalyst upgrade, crypto markets have been bullish on the KNC token. The price of KNC has increased by over 700% year-to-date, leading the rally of DeFi tokens. Analyzing on-chain activity, though, we can attest that there is an actual increase in the transactions of the KNC token, which have increased by approximately 9x throughout 2020. While it is evident that staking and other updates in the Katalyst upgrade have led to on-chain growth in anticipation of the release, the long-term impact it has on the broader health of the Kyber ecosystem is what will dictate the efficacy of these added incentives.

As of July 8, 2020 at 10am (EST) using IntoTheBlock’s Kyber transaction stats

All of this innovation has been facilitated by DeFi’s permissionless nature. Given Ethereum’s transparent and open-source dynamics, DeFi projects built on top are able to leverage quick and free access to information. In a thread of Compound’s founder Robert Leshner, he highlighted how COMP’s governance is based on what was previously built by MakerDAO, and how the COMP yield farming was inspired by Synthetix’s previous incentive design experiment. Being open-source, Compound and other DeFi protocols are able to freely replicate and improve upon existing solutions, thus accelerating the building and deployment processes.

While DeFi’s capability to incentivize quick adoption and decentralization of its token has led DeFi’s recent growth, it does not come without risks. Some of the risks to consider with yield farming and DeFi, in general, include potential hacks, loan liquidations, unpegging of stablecoins (which tend to be used as collateral) and depreciation of the tokens received as rewards.

Risks Associated with DeFi

Readers may have heard of recent hacks in the DeFi space, like the dForce attack where the hacker exploited a smart contract vulnerability to steal $25 million and then returned most of the stolen assets. More recently, a hacker attacked the automated market maker platform Balancer using flash loans to drain liquidity of a small token, STA, to manipulate its price and swap it for $500,000 worth of other tokens. While these hacks are not exclusive to the DeFi space, they certainly are an important risk to consider given that over $2 billion is locked in smart contracts held by the major protocols. A silver lining emerging from this threat has been the rise of decentralized insurance protocols such as Nexus Mutual protecting users against the risk of smart contract failure.

Asides from the evident risk of a hacker stealing funds, DeFi users may also be exposed to the risk of liquidation. In order to borrow funds from a lending protocol like Aave, a user has to deposit collateral greater than the amount they wish to borrow. This over-collateralization creates a buffer in the case that volatility brings down the price of the collateral provided. However, in periods of extreme volatility such as the one seen in Black Thursday, the over-collateralization has not been enough to protect borrowers and lenders. During Black Thursday over $8 million in MakerDAO was liquidated at a price of 0 DAI. As a result, many users lost money, prompting lawsuits against the protocol.

Another related risk is the unpegging of stablecoins. As readers probably know, most stablecoins are pegged 1:1 to the US dollar. In the case it varies significantly, there would be negative unintended consequences for those borrowing or lending stablecoins through DeFi protocols. For example, if you are obtaining a loan using a stablecoin as collateral and its peg drops below $1, then the loan may become undercollateralized resulting in liquidation. Conversely, if you are borrowing stablecoins and the value of the peg goes above the dollar mark, then the debt may cause you to pay more in interest than anticipated and also potentially ending up liquidated if it surpasses the amount held as collateral. The latter scenario has become a serious possibility within the Compound ecosystem as the amount of DAI in Compound has surpassed the total amount in circulation.

Finally, as is the case with agriculture, there is the risk of bad harvests. As yield farming launched this new crypto-agrarian age, “farmers” rely on quality products to profit from their endeavors. In other words, if the value of the tokens earned through these incentive systems drops significantly, users may start opting out from providing liquidity to the protocols. Furthermore, if there is a sudden large drop in the prices of these tokens, it could lead to a liquidity shock, which would further exacerbate the protocol’s issues.

Final Thoughts

Overall, there is no shortage of innovation — or risks — within the DeFi space. Leading DeFi protocols have successfully managed to create systems of multi-stakeholder incentives perhaps like nothing we have seen before. Leveraging blockchain’s transparent nature, these projects have been able to permissionlessly improve upon each other and accelerating the pace of innovation.

While the recent frenzy regarding DeFi and its tokens may remind some of the ICO rush in 2017, it is important to note that these protocols have actually shipped products that already create value as evidenced by their on-chain activity. Another distinction is that ICOs for the most part controlled large part of the supply of tokens, instead DeFi protocols are moving towards decentralized governance which diminishes the risks of relying on founders and potentially using the project as an exit scam. Finally, while ICOs facilitated one financial service (fundraising), DeFi protocols are going after broader opportunities tackling use cases such as payments, lending/borrowing, exchanges and derivatives. As demand for ICOs introduced many to Ethereum, DeFi with its incentive mechanisms may actually lead to users actually benefiting from blockchain.

With this wide spectrum of areas where DeFi has been innovating, it is easy to understand why the crypto space has been so enthusiastic about it. Such growth, though, does not come without risks. It is imperative that users are aware of these risks and consider them if they do decide to use DeFi services.

To dive deeper into DeFi and its growth make sure to check out DeFi tokens at IntoTheBlock. Finally, to learn more about Ethereum, the underlying infrastructure powering DeFi, make sure to check out Deribit’s Market Data.

AUTHOR(S)