Bitcoin Breaks All-Time High

Bitcoin has surpassed its all-time high, and its upward trend persists. Despite the short covering that fuelled the latest run up appears to have exhausted, consistent demand for U.S. spot BTC ETFs keeps driving Bitcoin higher.

Bitcoin ETFs report daily net inflows of $400 million over the past fortnight. Microstrategy has expanded its Bitcoin holdings by 12,000, and the London Stock Exchange may soon offer Bitcoin and Ethereum ETNs. These have all been positive contributors to the existing euphoria to buy BTC.

While the ETFs’ net growth in demand triples mining output, one must be mindful that the increasing liquid supply in BTC signals potential selling amid the market rise.

Besides, leverage has increased perpetual futures funding rates by 100% on platforms like Deribit and Binance, inflating future prices, which tends to be a temporary topping signal.

The U.S. CPI data, which came slightly above expectations, did little to influence the prices of BTC or ETH, with the Deneb/Cancun Ethereum upgrade the next event to pay attention to.

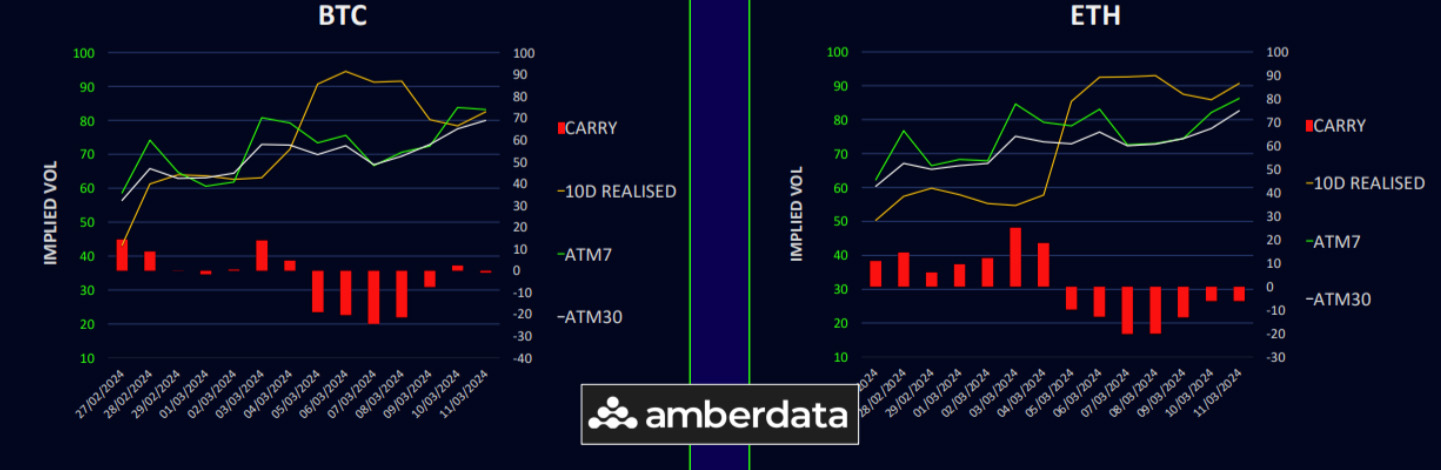

Realized Vol Settles Back

Bitcoin’s realized volatility has calmed since last week’;s surge, but at 82%, it remains robust and has crossed the $70k mark. We expected the market to remain volatile.

For Ethereum, realized volatility continues high up in the 90s, with spot breaching the $4k level.

Implied volatilities have rebounded as Bitcoin flirts with record highs. Volatility carry is even or negative, with high volatility challenging those trying to sell options for profit.

Crypto has so far weathered the hotter US CPI and tech stock downturns, hinting that inflows remain the main story.

Term Structures Keeps Adjusting North

Bitcoin’s term structure keeps shifting higher with ongoing market volatility, with March expiries climbing 2 vol points and the rest of the curve 5 points higher this week. Meanwhile, call skew has decreased slightly.

Ethereum’s term structure also saw an uptick as gamma performs strongly, with front-end moves mirroring Bitcoin and long-dated expiries firming on delayed ETF expectations, resulting in a sharp decline in call skew, primarily due to large April call spreads bought.

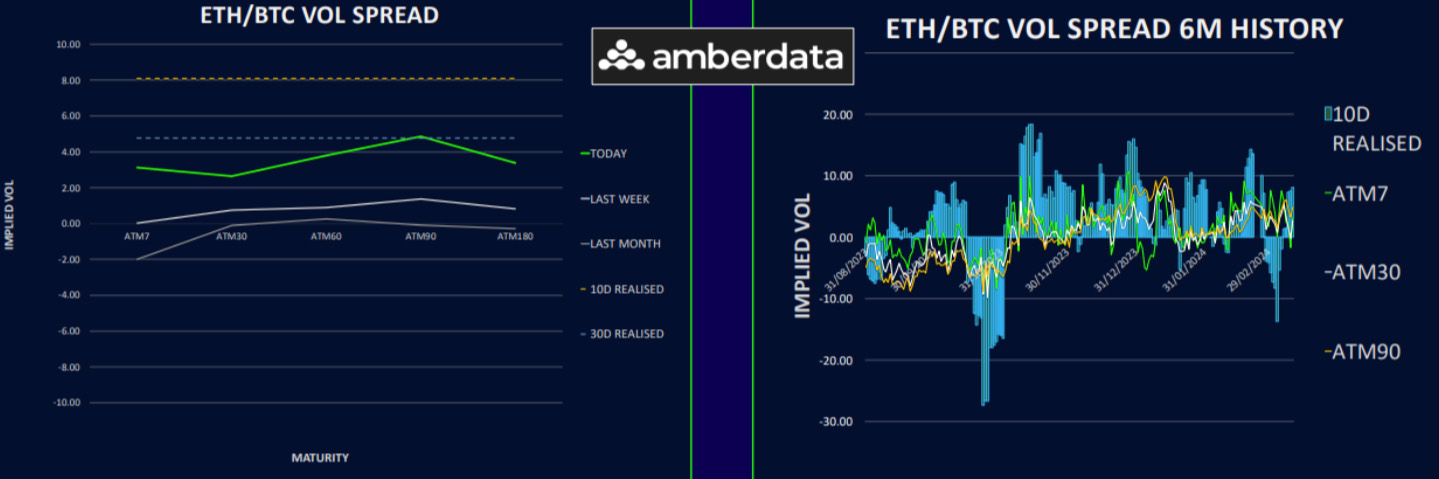

ETH/BTC Spread Shifts Back Higher

The ETH/BTC volatility spread shifted higher as Ethereum’s implied volatility gains over Bitcoin’s. Ethereum also leads in realized volatility, as the ETH/BTC spot spread keeps recovering.

However, this spread is still unstable short-term. It is warranted to wait for a break on the upside before wanting to chase ETH, especially as Bitcoin’s halving narrative and ETF inflows dominate.

We closed out remaining call switch trades as there appears to be little value or edge in playing this choppy spread right now.

Pullback in Call Skew

Despite the bullish spot market, call skew is retreating as targets like $70k for Bitcoin and $4k for Ethereum are reached, with new buying favouring call spreads. This is supplying upside VEGA to the dealers, especially in ETH.

Ethereum’s skew has the most dramatic move, and it has notably shifted to put premium due to ETF approval delays. Put buying is hedging against potential pullbacks pre-Dencun upgrade.

With high futures funding rates, hedging is prudent against leverage risks, but institutional buying from ETFs and Microstrategy makes it to monetise hedges fast enough, so hedges are for the more passive types who want protection if we go down and stay down.

We favour short vol hedges like put spread collars when implied vols are so pumped.

Option Flows And Dealer Gamma Positioning

Bitcoin options volumes remain high at $15bn, with profits taken on certain calls as spot BTC exceeds $70k and implied volatility spikes. New bullish positions are seen in calls and spreads as traders roll up and out.

Ethereum’s volume has increased by 35% with similar profit-taking and fresh call buys and huge April call spreads. The possibility of delayed ETF approvals has led to protective puts being purchased within a strike range between 3600 to 3200.

Dealer gamma for Bitcoin stays long or neutral, as upside selling to dealers on profit taking dominates, while Ethereum’s dealer gamma decreases as significant short strike at 4000 takes dealers short gamma, which should support volatility.

Strategy Compass: Where Does The Opportunity Lie?

Put Spread Collars are the optimal hedging structure with such high implied vols, but sell calls at your own risk. The speed of recovery after last week’s flush out suggests that the underlying demand is so strong and so running partial hedges makes sense but you probably don’t want to give away all your upside just to play a short term correction.

We no longer favour ETH in the near term and think BTC is just as likely to drive more strength.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)