In this article we take a deeper look into the trends, innovations and developments in crypto that will shape growth in the space going forward.

Are we in a Crypto Supercycle?

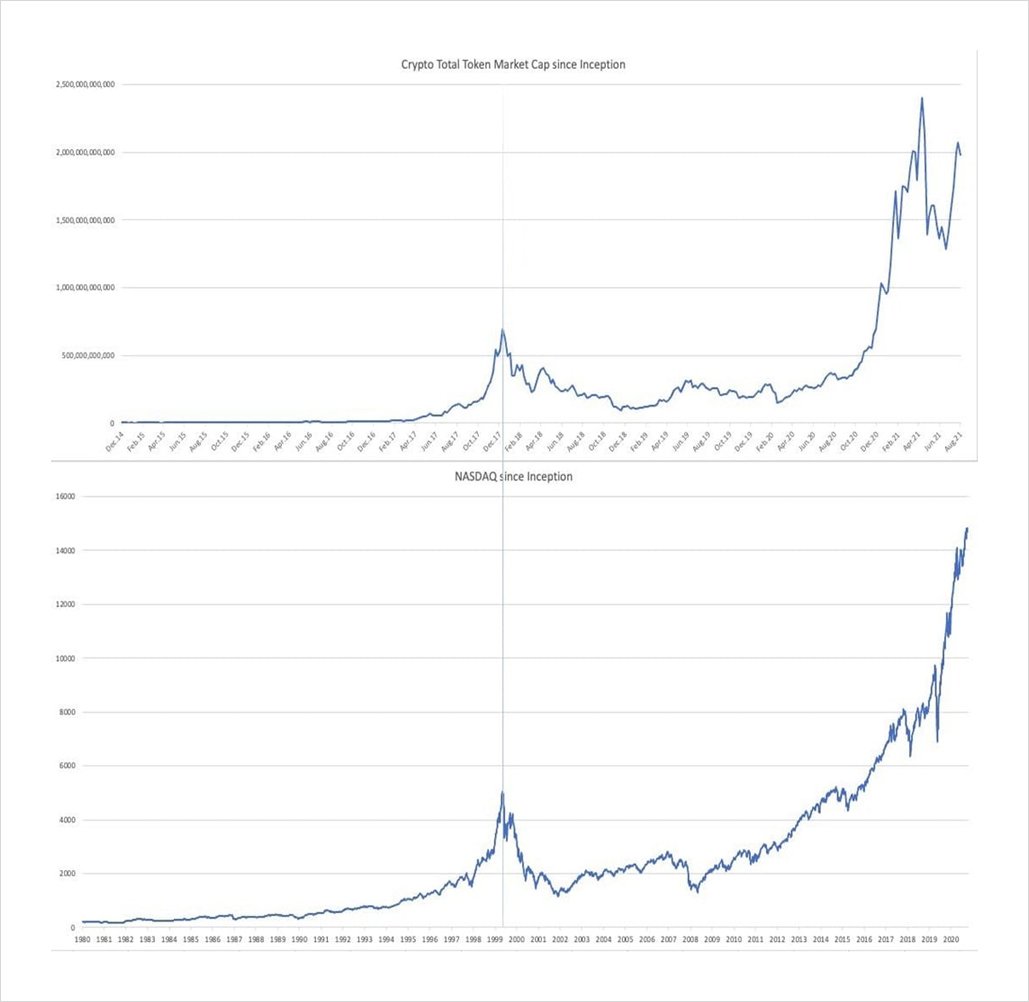

A side-by-side comparison of crypto versus NASDAQ market capitalisation (over different time periods) suggests that we are in a supercycle.

Chart 1

Both markets have followed similar developmental phases typically seen in supercycles.

Phase 1: Awareness and initial adoption (Slow upwards trend)

The disruptive potential of a new technology starts to capture the imagination of the market and valuations balloon in the rush that follows. For crypto, this was the 2017 bull market and for NASDAQ, the dotcom run-up into 2000.

Phase 2: Bubble bursts (Rapid sell off)

The bull market ends violently with asset prices crashing to pre-hype levels. For NASDAQ, this was the bursting of the dotcom bust and for crypto it was the 2018 crash.

Phase 3: Consolidation (Sideways trading)

An extended bear market or consolidation period follows, leading many to disregard the asset class or segment despite ongoing developments.

Phase 4: Mania (Rapid price increase)

Material adoption of the technology that rapidly exposes a valuation gap. The market chases this gap, resulting in mania that sees prices blowing past prior highs by more than 5 times.

The main difference between these Supercycle phases playing out in both markets is the length of time; over 40 years for NASDAQ versus within 6 years for crypto to date.

The accelerated phases could be a function of the exponentially growing money supply combined with the unprecedented access to trading instruments and leverage that comes with digital assets. If so, we should be prepared for market boom/bust cycles in crypto to get shorter and faster going forward.

The Next Supercycle – Decentralized finance & NFT (non-fungible tokens)

The Defi and NFT markets seem to be just beginning their own initial Awareness/Adoption phases with many still ignorant of the opportunities within the ecosystem. As BTC matures into an investment asset (even with a tradfi ETF now), Defi and NFTs are only just getting started.

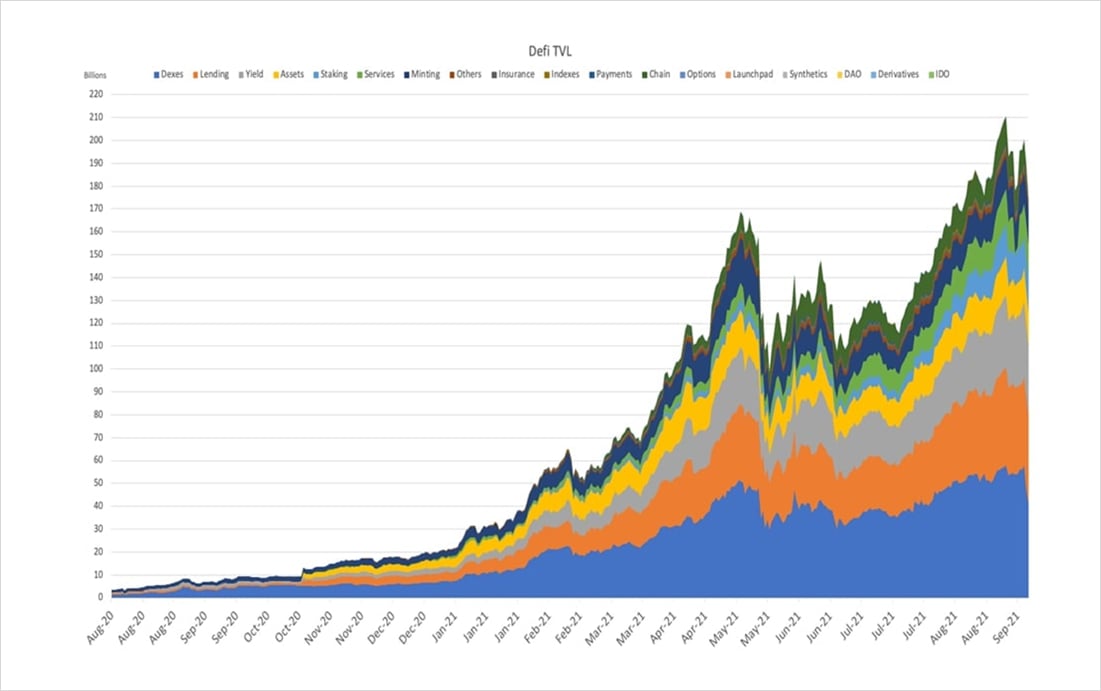

Defi

Decentralized finance (Defi) currently has $200 billion total value locked (TVL) across over 500 separate platforms now. Roughly half of TVL flow into Lending & Decentralized exchange protocols with a combined $100 billion TVL (Chart 2).

Decentralized exchanges are unique to crypto and are peer-to-peer exchanges that are non-custodial and with an automatic market maker instead of order books.

Chart 2

Decentralized exchanges (Dexes) and Lending protocols are currently the main attraction in Defi but more innovative and increasingly practical protocols have contributed significantly to the growth of the ecosystem. These new innovative protocols include Insurance, Payment plans, Derivatives trading and other Services with new protocols being launched daily by numerous teams.

The increasing amount of innovative projects directly result in more TVL being attracted into the Defi ecosystem as a whole.

We expect Defi to be a primary growth pillar in the crypto space going forward. Even Goldman Sachs has chimed in on this!

NFTs

Between Defi and NFTs, NFTs are by far the stranger of the two with its intermingling of art and technology. NFTs are unique single issue tokens that certify a piece of digital media as unique and cannot be replicated. Think of a unique serial number (chain code) attributed to any digital file or media to guarantee its authenticity as part of a collection or a unique work.

For example, the Mona Lisa or any other priceless work of art. The Mona Lisa can be copied by any capable artist, but it will never be the original. This is the same with a digital work of art, It can be easily copied but as an NFT it can be easily proven to be unoriginal by checking the blockchain. This gives it a leg up from art where an interested party might have to go to great lengths to authenticate a piece with experts which takes much time. In crypto, you may simply check the blockchain within seconds.

However, unlike a simple piece of canvas or block of marble, NFTs can be programmed with function. It could be used as keys or access/permission codes for various functions. For example, the Bored Apes Yacht Club NFTs are also membership cards to exclusive Bored Apes’ events.

Other examples of utility for NFTs are the “keys” given out to early liquidity providers for young defi platform Gfarmv2. These keys are now no longer issued but to the existing holders they now allow for an increase in interest rates when staking on the platform. This allows a secondary market to develop around the ecosystem where not only the tokens are traded but also the NFT keys from yield farmers (stakers) to other yield farmers.

No doubt as the NFT ecosystem continues to develop, more and more innovative use cases will develop like the innovation seen alongside the growth of the Defi sector.

Are NFTs in a bubble? Are prices going to crash?

The insane price movements of NFTs have been the cause of much excitement and hype. The following part is our take on NFT valuations.

A first logical question to ask is whether NFTs create scarcity.

Nansen’s market leading NFT tracker shows that on Opensea right now, there are 1288 separate ETH collections, 700 of which was created in the past month with 200 in the past week alone! This does not even include NFT’s on other chains such as Solana.

Within each collection, the number of circulating NFTs can vary from typically a few thousand, to up to 2 million (Cryptokitties) or even 7 million (Gods Unchained Cards)! The supply depends solely on the discretion of the original architects of the project and manufactured scarcity is a well-known trait in many NFT projects.

The exponential increase in the number of NFTs in the last 3 months really show there is no limit to how quickly unlimited “investible assets” can be created in crypto and begin trading instantaneously.

In the past any collectible, baseball trading cards for example, would have a full production/distribution cycle to navigate before it reaches the very opaque secondary market. For any NFT now, a primary auction mint is followed by secondary trading within seconds – all of which including every transaction and live order are fully transparent on the blockchain.

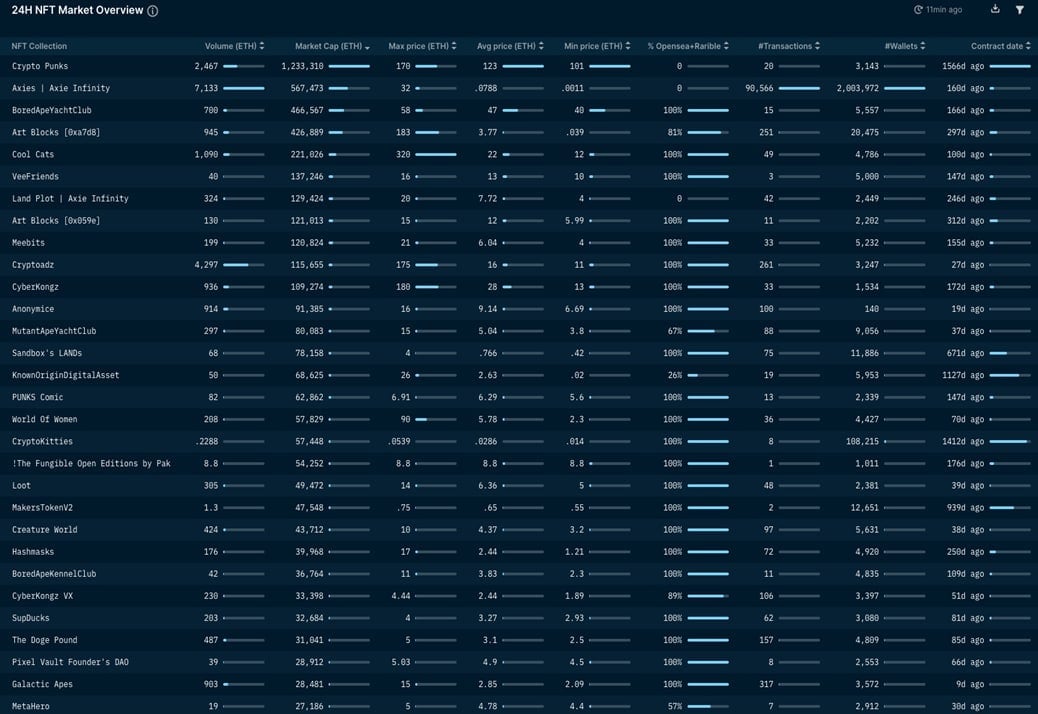

While a large chunk of collections are worthless, the total market cap of all Opensea ETH NFTs are a combined 5.8 million ETH – $19.8 billion. Of which the top 30 collections alone account for 4.6m ETH – $15.7 billion worth.

The ease to which these cryptoArt NFTs can be infinitely increased is due to its utter simplicity – with basic algorithms producing any number of appearance features by randomizing a combination of a few base attributes.

Cryptopunks being the NFT first-mover akin to BTC, perhaps warrants the average 123 ETH ($420,000) being paid for them now – and indeed its value has held up better than any other collection thus far. The BoredApe series is also notable, obtaining a stamp of approval from the greater art community with 107 selling for $24.4 million on Sotheby’s. And of course there is the utility of the runaway success blockchain game Axie Infinity. (Chart 3: Top Opensea ETH collections by Market cap on 5 Oct – Nansen.ai)

Many analysts have tried looking into statistics to determine eventual value of a creation such as launch dates or artists but all this has shown little correlation and strengthened the perception that it all might just be random. Undeniably popularity and community is the driving factor for a collections price increase and all this boils down to cultural and status appeal. Many once anonymous collectors have publicly unveiled themselves to showcase their online collections.

Chart 3

The community plays a huge part in the price growth of a collection. The bored ape NFT collection played host to a type of prisoners dillema among its holders as many bored apes colluded to bid on each others NFTs to increase the floor price playing on the good notion that the other collector would not actually sell. This was done so as to raise the displayed floor price on Opensea and has worked spectacularly in their favor.

Strong community ties and collaboration foster a kind on enthusiasm within the project’s hodler community. These holders begin to represent themselves through their NFT avatars on sites like twitter which piques the interest of those still outside of their micro-NFT community.

As the fervor increases many people find themselves wanting to buy into the project to be a part of something greater. This coupled with a strong refusal for existing users to sell can send prices floors on an upwards trajectory. A good example of that being Solana monkey business on the solana chain and their MonkeDao.

Afterall this is the meme-flex-game generation – where the virtual world often ends up being more real to many than the real world itself. NFTs and by extension almost all art is only valued as much as what someone is willing to pay for it – by this logic there really is no logical ceiling to any of it.

However the current NFT art trend and Play-to-earn (P2E) trend draws close parallels to the Tulip Mania phenomenon. As with all such bubbles, this story will play out to an exponential distribution eventually, with only the top handful of projects or collections surviving, just as in the 2018 ICO crash where 99% of ICOs faded away.

Not all is doom and gloom however, a bubble pop in the NFT sector will purge the junk projects and wise up the everyday consumer similar to how the ICO pop of 2018 strengthened the ecosystem.

The Mania phase for CryptoArt and P2E will coincide with paradigm shift where people’s everyday lives will be more intertwined with the metaverse. This will significantly benefit both these markets.

For NFTs as a whole, its Mania phase will come when it finds itself embedded into everyone’s daily lives across all kinds of real world uses from proof of asset ownership to digital services authentications.

In end-August, a new experiment around the Doge meme NFT has given a glimpse of the immense long-term potentials & widespread implications this current NFT trend provides for the world beyond just eye-gorging valuations.

PleasrDAO bought the original Doge NFT meme picture for 1696 ETH ($5.5 million) and immediately fractionalized it into almost 17 billion NFT shares backing the same number of ERC-20 tokens called $DOG – whereby everyone owning a $DOG token will own a fractional piece of the original NFT. In a way an “asset-backed” security.

$DOG market cap, or by implication that of the original meme NFT alone became worth over $225 million just within days of its launch! Putting aside the incredulous valuations, there are multitude use-cases of this successful experiment in the world of securitization of assets. At no point in history could such a thing have been imagined – instant securitization and distribution.

Ultimately, the nuances in the space do not provide an easy answer to the question if prices will crash. Our personal bet is on NFTs in P2E and we are actively seeding promising upcoming games and guilds.

Crypto Valuations

The question about NFT valuations can be applied broadly to crypto assets in general. How exactly does one determine fair value for coins and tokens?

In traditional markets with a connection to the real economy, we can gauge how artificially inflated asset prices are using various metrics relative to the real economy itself.

For example, in equities, comparing the S&P 500’s valuation relative to US GDP vs. M2 right now, we can see how overvalued QE2, 3 and this latest Covid-boosted QE4(ever) has made equities relative to the value of the real economy (Chart 4).

It can be argued based on this that every subsequent QE round following QE1 has had an incredible diminishing effect, but that is another story altogether.

Chart 4

In contrast, there is nothing really anchoring crypto assets outside of usage penetration and the flow of money. This is both a boon in a bull makret (no cap on the upside) but a disaster in a bear market (asset price floor quickly become non-existent).

Crypto pricing and valuations have very little connection to the real economy. There is no reference point for fair value. Any number can be justified in some way. Are we all flying blind?

How should we trade then?

With no valuation anchor, so long as one can stay nimble, crypto probably offers the most alpha opportunities right now of any asset class out there.

But to navigate such a market for the long-haul we tend to go by some general frameworks instead.

Ultimately, we expect that as more widespread utility is developed in the crypto space, there will be greater differentiations in the price of assets within crypto.

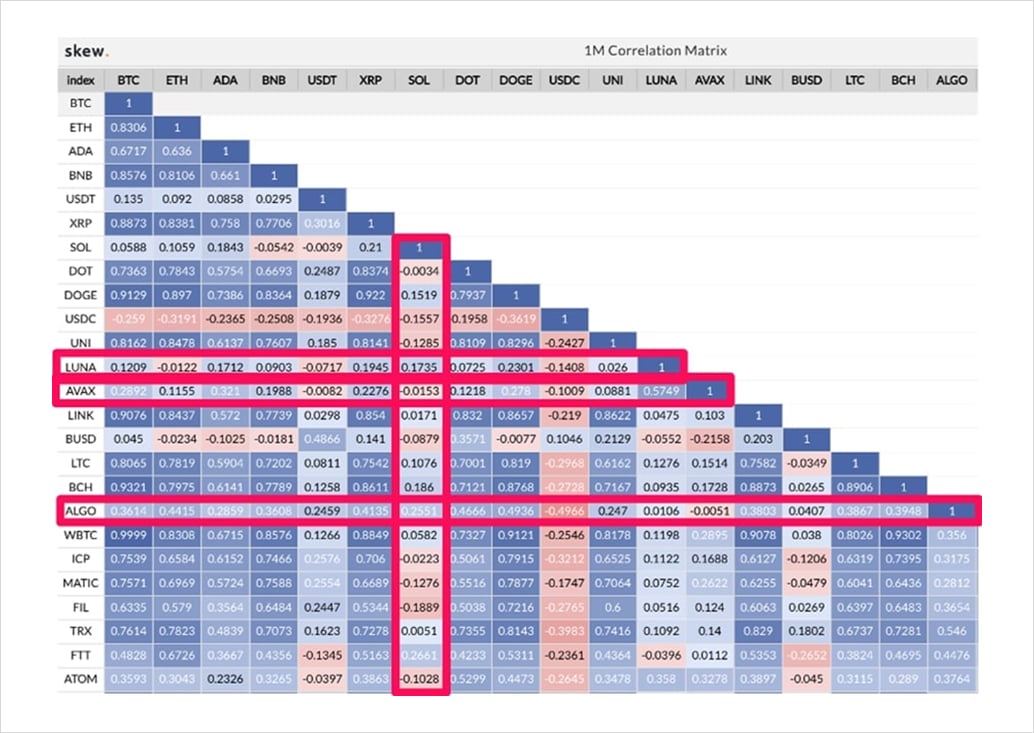

Up till today, BTC has been the overall macro trendsetter for the crypto space. Even now many coins exhibit an extremely high correlation with the price movements of BTC leaving it the de facto market leader. Where BTC points, many others follow.

As of this year however, we are beginning to see correlations as a whole fall sharply as the market begins to trade to themes, something many long-time crypto natives like us have long hoped for (Chart 5).

Many coins have begun to perform well even as BTC is dropping or going sideways which shows how the market is beginning to mature and decouple itself from following the BTC trend blindly.

Chart 5

Our Long-term framework:

1. Global M2 (money supply) has to be increasing for us to see widespread macro asset price appreciation (bull cycle). Since 2017, the only 2 periods when BTC was in consolidation have been periods where global M2 has stagnated (Chart 6 -M2 stagnation in Red boxes & Covid (Red line)).

Despite the noisy day-to-day headlines, ultimately it was just M2 expansion/contraction that was driving the general trend.

Chart 6

2. Comparing BTC with S&P 500 since 2017 shows how they beat to the same drum but just at a different rhythm (Chart 7).

Chart 7

BTC with the higher beta and sensitivity has on both prior occasions topped 9 months ahead of S&P (Yellow lines BTC tops vs. Red lines S&P 500 tops), but both have always bottomed at the same time (Green lines) on the back of fresh global liquidity injections.

This varying macro asset performance reflect a beta to M2 expansion/contraction where higher beta assets are far more sensitive to global liquidity conditions.

The speed, magnitude and lead/lag time to global liquidity injections/withdrawals are all contingent on this. Reasons for differing betas are varied – related to asset liquidity, risk profiles and the asset’s supercycle phase.

3. Ultimately it is demand and supply which drives an asset price, much like everything else in the economy.

While an ever-expanding M2 can provide the constant demand, to generate positive real returns over the long-run, it needs to be coupled with a fixed (maximum) supply, or better yet a deflationary supply in comparison to fiat. This gives us the holy grail of investing – scarcity.

a. Bitcoin’s halving mechanism is widely understood as reducing its supply inflation until it eventually becomes fixed. Accounting for lost coins and dormant wallets, a fixed supply can therefore be regarded as effectively mildly deflationary due to many coins being inaccessible and therefore lost to the general market.

b. The major tokenomic change to ETH with the implementation of EIP-1559 in August and into ETH 2.0 sometime next year means that ETH will soon have an outright deflationary supply as a result of its newly implemented burning mechanism.

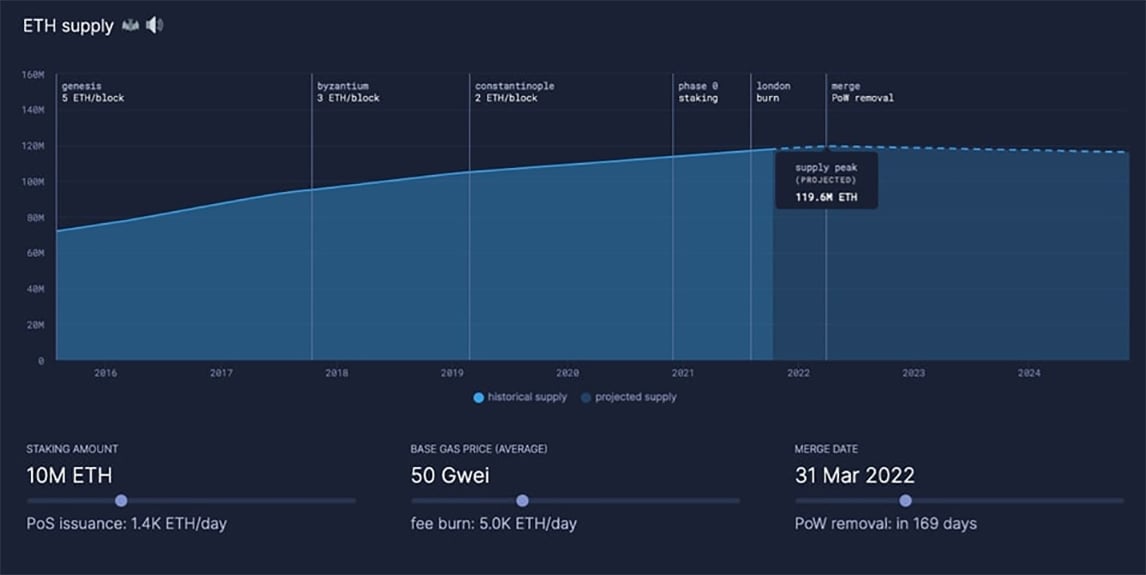

Assuming an average gas price of 50 Gwei along with an estimated end-Q1 ETH 2.0 implementation date, ETH’s supply will peak at roughly 119.4m ETH at the ETH 2.0 launch date, after which total supply would start to contract (Chart 8).

This contrasts to the previously unlimited supply in the old Proof-of-Work structure, which put it on par with fiat in terms of supply dynamics. Of course, the ETH 2.0 implementation date will be the event that could potentially change this timeline drastically.

Chart 8

c. Also why despite recent high-profile fanfare, Doge in its current form with an unlimited supply is unlikely to serve as a good long-term Store-of-Value (SOV).

Vitalik joining as advisor does give hope that perhaps a change in the Doge tokenomics is on the agenda. Or perhaps it is instead the intention of the Doge Army to create a pseudo-fiat digital currency, where supply can be ever expanded, but instead of being a SOV, is developed as a medium of exchange that is widely accepted.

Conversely because of its design, Bitcoin is unlikely to become a widespread medium of exchange in its current form, despite what various South American socialists might hope. However, Doge with enough support from enough powerful groups, could ridiculously enough, fulfil this in future if its transaction speed can be sped up to that of newer tokens like SOL or ALGO.

Overall, we are structurally long BTC, ETH and most layer 1s such as ALGO and SOL. Our shorter-term trading focuses on the inefficiencies in the options and forwards curves these coins. Derivatives is where we see scalable alpha as crypto trading becomes increasingly institutionalised, much akin to equities, bonds and fx markets decades ago.

What comes next? Crypto as the Layer 2 solution to Fiat’s Layer 1 problems

Within the crypto decentralized ecosystem, the definition of Layer 1 refers to the base blockchain layer – like Bitcoin, Ethereum, Polkadot, Solana, Algorand etc. Layer 2 on the other hand, refers to the networks and protocols built on top of this underlying Layer 1 blockchain that greatly improves scalability and efficiency throughout.

The concept of layers can be broken down simply as Layer 1 being a service foundation and layer 2 being the complimentary services built upon the underlying layer 1. In other industries it could be said that the internet is layer 1 (protocol layer) and layer 2 is google which is a service built on top of the internet to help the user more easily navigate the internet.

In the macroeconomic world we live in, there are parallels to the crypto Layer 1 / Layer 2 structure. The current fiat-based monetary system in our economy represents the base Layer 1, and crypto going forward will become the first Layer 2 asset class that builds & expands on top of fiat’s Layer 1.

Meaning to say that the foundation crypto relies on is the traditional monetary system and crypto being a Layer 2 will help make it easier for the everyday person to navigate. This is because crypto removes many of the middlemen in traditional finance. One of the reasons El Salvador has made Bitcoin legal tender is because it helps remove the middlemen like western union from remissions thus removing an additional cost to the everyday El Salvadorian.

We see the current fiat-based monetary exchange rate regime as Layer 1 because every good, service, and asset in the global economy is just a derivative on top of it. The amount of Layer 1 expansion (M2) has implications for the price of everything – most of all asset prices.

Crypto will function as the first Layer 2 for the following reasons:

1. Its ability for its own large-scale value creation through a proven token inflation multiplier.

2. Usage of crypto will eventually extend to all sectors in the real economy – where every person will have access to the crypto ecosystem. Covid has been the catalyst that has no doubt cemented this irreversible shift.

Ultimately it is our view that everything in the real economy will eventually be transitioned and built onto this Layer 2.

Layer 1 serves as the foundational fiat-based layer. Most of the innovation is then developed onto Layer 2 – the decentralised /crypto ecosystem.

There are so many value propositions from crypto – not just as mainstream alternate stores-of-value (SOV), or as an accepted medium of exchange; but applications related to the wholesale democratisation of finance, or in arts, culture, sports, and everyday functions.

Fortunately, we are still early in the first innings of crypto’s evolution to be the economic Layer 2, right now arguably having only ticked off BTC becoming a mainstream SOV.

Should our vision of crypto developing into the economic Layer 2 come true, then there is no doubt that the overall crypto market cap will rise exponentially further.

How much of the total global M2 would realistically flow through Layer 2 in future? We are still debating this. But for the assets in Layer 2 with a fixed or shrinking supply, price appreciation of the assets will be inevitable.

We often get asked if we think it’s too late to invest or jump into crypto. Have prices gone up too much and has the ship sailed?

As the crypto ecosystem continues to develop into the application and interaction layer on top of the fiat-based monetary system, our view is that we are really just getting started.

AUTHOR(S)