SEC Remains The Main Upside Suppressor

We had good news for the crypto world as Grayscale won its case against the SEC, which is quite positive for the entire crypto community. However, after a brief visit to $28k, BTC retraced those gains.

This loss is mainly because the SEC has postponed decisions on other spot BTC ETFs until at least mid-October. So, we’re essentially back to where we were two weeks ago after the big market drop.

It seems the second half of this year might be a bit rocky for crypto as the SEC is not expected to twist its arm easily. Despite the short-term ups and downs, the Grayscale victory is promising for the future. It hints at a possible approval for a BTC ETF, although we might have to wait until 2024.

For now, until the SEC makes up its mind about ETFs, there’s no fresh money entering the crypto market. Most institutions are waiting for clearer regulations. Remember, the future growth of crypto largely depends on these institutions bringing in new capital into the space.

Recent court decisions, especially where the SEC faced setbacks in the Ripple and Grayscale cases, suggest that the crypto world is gradually moving towards more regulatory clarity. Moreover, places like the EU, UK, and HK are also working on better rules for digital assets, which is promising.

Vol: Negative Carry May Not Last

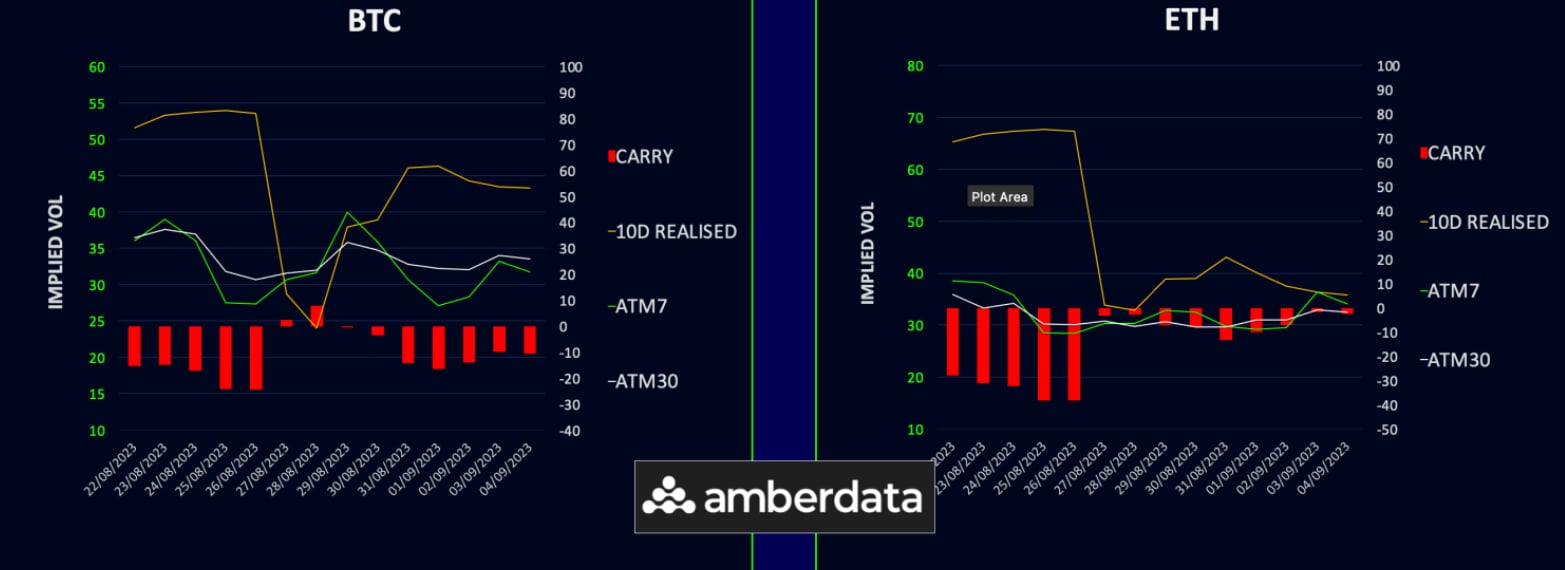

The realised volatility in crypto has been between 35-40%, elevated by the recent news from Greyscale, which caused a bit of a stir. However, the past few days have been rather quiet, much like the calm markets we’ve seen before. If things remain uneventful this week, we might see volatility drop back to the 20s.

Short-term implied vols had a slight increase over the week, but it’s still less than the actual volatility we’ve observed as of late. This has resulted in a negative carry of about 10 vols in BTC and 2.5 vols in ETH. But as things settle, this should return to a positive difference.

If there’s any significant spike in volatility this week, it is likely to be due to a drop below the weekly support levels.

Steady Pick Up In Vol Across The Curve

The BTC term structure has remained rather steady over the week. The short-term volatility has been robust, given the strong performance of gamma. For the medium term, spanning October to December, there’s been a bit of an increase in supply. As for the long-term volatility leading into 2024, it still remains well supported.

Turning to ETH, there’s a noticeable uptick in the short-term vols. The September maturities seem to be the favoured choice, presenting a good value for those keen on gamma. The long-term volatility remains flat, with the outlook staying much the same.

Vol Spread: BTC Dominant Further Out The Curve

The volatility spread between ETH and BTC has found some support as the spot price movements have declined. In 1-week vol, this spread has returned to a positive stance, even though the 10-day realized volatility still favours BTC by 7 vols.

Across the curve, ETH’s volatility is generally lower. However, the further we go along the curve, the more BTC’s volatility trades over.

The future price movements of this spread will likely hinge on immediate price directions. The correlation between price and volatility for BTC and ETH has shown diverging patterns this year. Specifically, when prices drop, ETH’s volatility might take the lead. Conversely, during price surges, BTC is likely to be the primary driver of volatility spikes.

Long-Term BTC Call Skew Still Present

Last week’s enthusiasm for call options diminished rapidly as the spot price declined, and BTC settled back at 26k. Currently, there’s a clear preference for put options in the near-term, given the perceived risks leaning downwards. For both the weekly and monthly skews, puts are favoured by about 4-6 vols. However, for longer periods (beyond 6 months), there remains a 2 vol skew for calls.

ETH’s skew for calls also receded swiftly after the ephemeral price surge. In the short term, the preference for puts mirrors that of BTC. But looking further ahead, there’s a slight divergence: ETH skew leans slightly towards puts, while BTC remains in favour of calls. This can be attributed to the longer-term supply dynamics in ETH vs the anticipation around BTC’s halving and potential ETF approval next year.

In summary, the rapid shifts in option skew, especially in the short-term durations, highlight the speculative nature of these option flows.

Option Flows And Dealer Gamma Positioning

With the rise in volatility, we’ve seen an increase in BTC options volumes. The trend leaned towards buying protection. Specifically, 29Sep 27k puts were acquired, as well as 29Sep 26k/30k bearish risk reversals.

For ETH, the options volumes were a tad lower. The most substantial trades were generally option buyers, either to buy protection or upside. The downside was focused on the short-term expiries, up to 29Sep.

As per BTC dealer gamma positioning, it became more negative, as there was an influx of put buyers using short-term options to hedge against potential downside risks. Dealers are short strikes for this Friday expiry at 26k and 25k, which might result in some choppiness, especially on the lower side.

On the other hand, ETH dealer gamma is on a decline but remains in positive territory. The shift towards 1600 has sparked some weekly put buying. However, dealers appear to be well-stocked with VEGA for 29Sep and beyond. The current positioning hints that BTC might experience similar, if not greater, downward movements compared to ETH – a sentiment that wasn’t evident until very recently.

Strategy Compass: Where Does The Opportunity Lie?

With short dated implied vol back to the low 30s, and the close proximity to key weekly support at 1600, we think owning ETH 29Sep outright puts offers decent leverage to a potential break lower in the near-term. This could work either for hedging purposes or a speculative bearish trade.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)