Cumberland is commenting on the recent volatility and potential opportunities to take advantage of it.

For further information about Cumberland, please visit Cumberland website here.

October 26

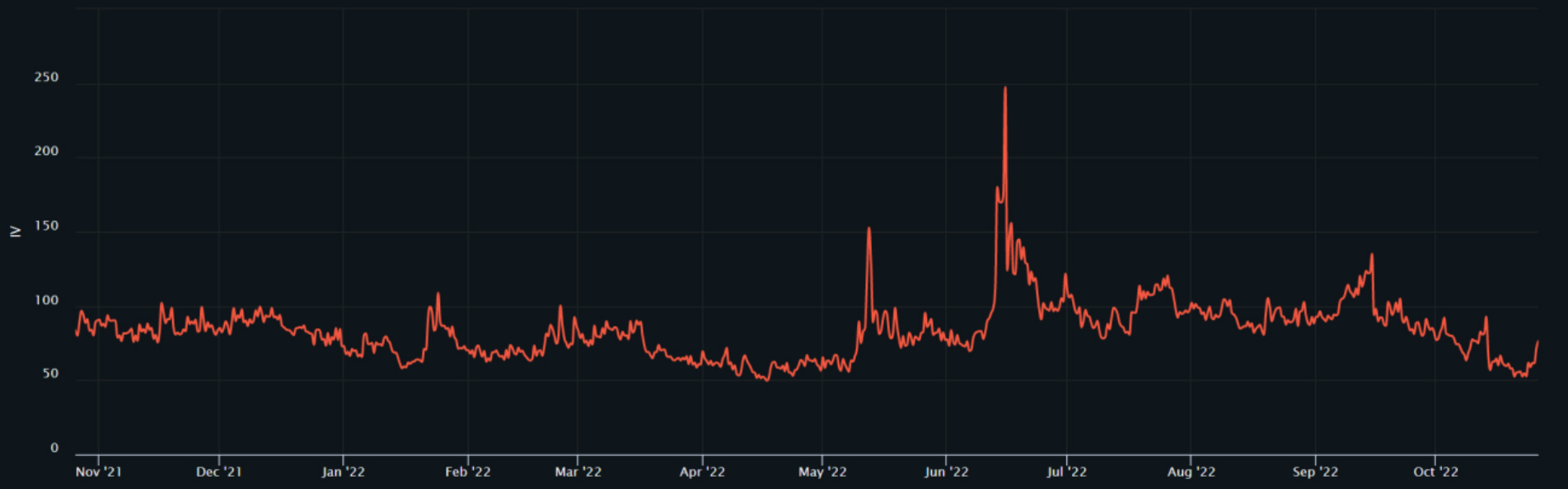

Crypto has finally experienced a regime shift from the depressed realized vol levels of October

1. Equities rallied towards the end of last week, driven by a few central bank speakers toying with the idea of slowing rate hikes to prevent overshooting (Friday saw US 2Y yields down 13bps, S&P up 4%). Crypto initially ignored this as the market extrapolated the October underperformance relative to implied vols and lower correlation with equities.

2. Tuesday finally saw the asset class perform (ETH up 10% and BTC up 5%). We believe the move was technical in nature, with significant reallocation to risk assets as shown by the move in a previously oversold DXY. ETH had been itself depressed relative to BTC, with the cross sitting close to cycle lows despite successful completion of the merge.

3. Despite the outsized moves, vols are still near the lows, with ETH 7-day implied vol at 78. The end of last week saw paper smartly picking up cheap gamma as we approach FOMC and CPI in early November.

4. We believe the bigger macro picture has not changed, thus the probability of a retracement is higher than what the market is implying. The greater than expected CPI readings of midOctober set in stone the expectation of an upcoming 75 basis point rate hike. There has been no data to suggest that the FED will pivot, thus little chance that they will diverge from their firm stance of bringing down inflation expectations (recall Powell’s Jackson Hole speech in August bringing risk assets back to the ground, after markets misread the FED and tried to price in a July pivot). Given the repeated stressing of maintaining contractionary conditions until the data clearly suggests otherwise, we doubt Powell will change his tone enough to meet current market pricing and risk seeing his credibility called into question again.

Buy delta-hedged ETH 11Nov 1400 Put

- The recent rallies have shifted front end skew towards the call, meaning puts are relatively cheaper to buy than before. Given the potential retracement discussed in (4), this could be a profitable time to buy puts.

- As noted in (3), vols are still far below their highs, so buying gamma is also relatively cheaper than before. The 11th Nov expiry captures both FOMC on the 2nd and CPI on the 10th. Consequently, this expiry is going to be naturally bid up in anticipation, especially given that the FED will need to address the current pricing in of a pivot.

- Big tech earnings came in weak on Tuesday after hours, providing further downside.

- The put costs 0.0332 ETH ($50.46) at ref spot 1520, with an implied vol of 80.8.

- Gamma hedging the structure could help capture some of the realized vol leading up to the event, especially given that 10% moves in ETH are back on the table.

- By delta hedging at ref price 1520, the trade becomes a gamma play. Even if the market continues to rally, the trade has the benefit of also making profit if held to expiry and spot rallies to above 1788.

Disclaimer

The information (“Information”) provided by Cumberland DRW LLC and its affiliated or related companies (collectively, “Cumberland”), either in this document or otherwise, is for informational purposes only and is provided without charge. Cumberland is a principal trading firm; it is not and does not act as a fiduciary or adviser, or in any similar capacity, in providing the Information, and the Information may not be relied upon as investment, financial, legal, tax, regulatory, or any other type of advice. The Information has not been prepared or tailored to address, and may not be suitable or appropriate for the particular financial needs, circumstances, or requirements of any person, and it should not be the basis for making any investment or transaction decision. THE INFORMATION IS NOT A RECOMMENDATION TO ENGAGE IN ANY TRANSACTION.

If any person elects to enter into transactions with Cumberland, whether as a result of the Information or otherwise, Cumberland will enter into such transactions as principal only and will act solely in its own best interests, which may be adverse to the interests of such person. Before entering into any such transaction, you should conduct your own research and obtain your own advice as to whether the transaction is appropriate for your specific circumstances. In addition, any person wishing to enter into transactions with Cumberland must satisfy Cumberland’s eligibility requirements.

Cumberland may be subject to certain conflicts of interest in connection with the provision of the Information. For example, Cumberland may, but does not necessarily, hold or control positions in the cryptoasset(s) discussed in the Information, and transactions entered into by Cumberland could affect the relevant markets in ways that are adverse to a counterparty of Cumberland. Cumberland may engage in transactions in a manner inconsistent with the views expressed in the Information.

Cumberland makes no representations or warranties (express or implied) regarding, nor shall it have any responsibility or liability for the accuracy, adequacy, timeliness, or completeness of, the Information, and no representation is made or is to be implied that the Information will remain unchanged. Cumberland undertakes no duty to amend, correct, update, or otherwise supplement the Information.

The virtual currency industry is subject to a range of risks, including but not limited to: price volatility, limited liquidity, limited and incomplete information regarding certain instruments, products, or cryptoassets, and a still emerging and evolving regulatory environment. The past performance of any instruments, products, or cryptoassets addressed in the Information is not a guide to future performance, nor is it a reliable indicator of future results or performance. Investing in virtual currencies involves significant risks and is not appropriate for many investors, including those without significant investment experience and capacity to assume significant risks.

AUTHOR(S)