Bullish Sentiment Prevails

The market remains bullish despite negative headlines. Bitcoin is above $70K, and Ethereum is above $3.8K, unaffected by three main elements. Firstly, the movement of Mt. Gox’s bitcoins for the first time in over five years, aiming to distribute assets to creditors by Oct 31. Next, Japanese exchange DMM losing $300M worth of Bitcoin, which could be dumped into the market. Lastly, Trump, the pro-crypto candidate convicted. All this has failed to shake long positions. On the flip side, anticipation of the ETH spot ETF trading and its inflows, alongside the potential spot ETF approvals for other cryptocurrencies, such as Solana and Doge, fuels market optimism.

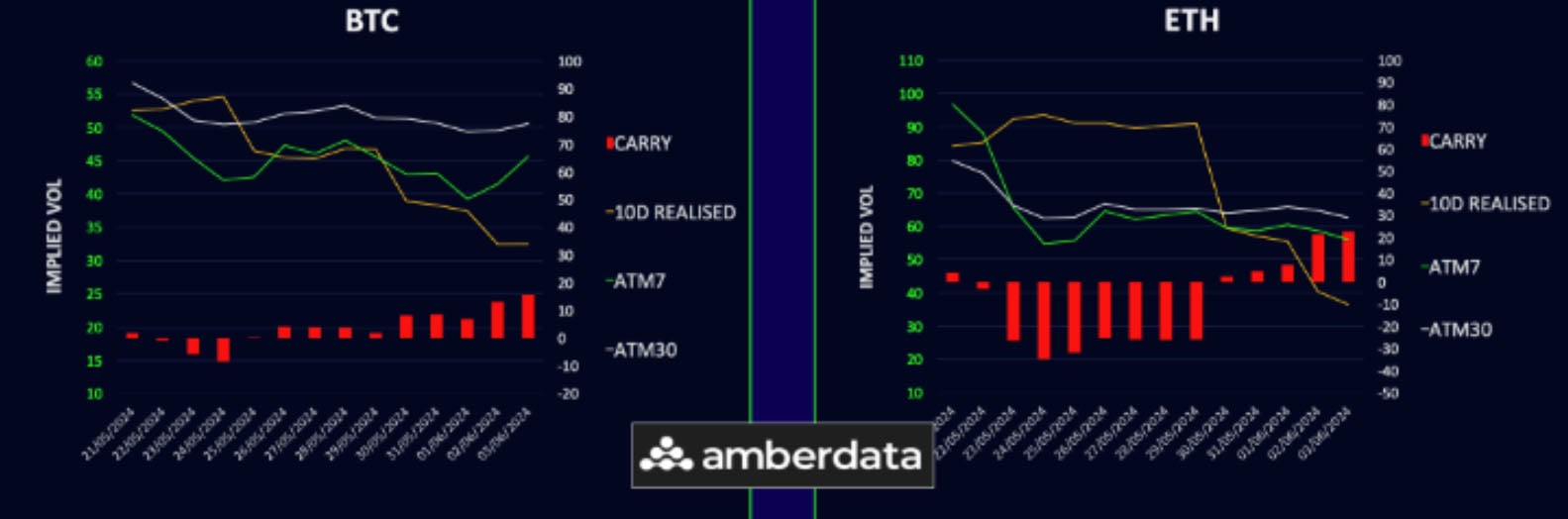

Realized Vol Falls Off a Cliff

Crypto volatility has plummeted, with 10-day realized vol back in the 30s for both BTC and ETH. Implied vols in the 1-month bucket dropped by 2 vols, while weekly BTC vol firmed due to upcoming macro events. Positive carry makes selling gamma attractive for those expecting rangebound markets. Short vol bets should be covered with wing protection at these low vol levels.

Term Structures Into Steeper Contango

BTC term structure is shifting lower, with:

- 7-21 Jun expiries unchanged to higher due to oversold gamma.

- Slightly softer back-end vol.

- Recovering skew for calls across the curve.

ETH term structure continues collapsing into steeper contango, with:

- Weekly vol dropping near 10 points.

- Lower curve in a more weighted fashion.

- Front-end ETH calls catching a bid, but longer-term drifting back slightly.

ETH/BTC: Calm Before the Storm?

ETH/BTC vol spread has pulled back in the front end, with realized vol converging and ETH spot stabilising around 3,800. The whole curve sits in the 8-12 vol range, peaking at 1-month due to ETF launch anticipation. The tight ETH/BTC spot spread signals potential significant movement ahead. A pullback in the vol spread towards 5 vols is a good entry for call switch trades.

Call Skew Edges Higher

Slight uptick in front-end call skew as traders seek upside exposure, with less concern for downside due to strong price action despite the negative headlines. ETH call skew holds its premium over BTC, anticipating a sizable move with incoming ETF inflows. Geopolitical easing, however, reduces BTC’s ‘digital gold’ appeal. With expected rate cuts from Canada and Europe, BTC dominance looks fragile, favouring ALTs leadership.

Option Flows And Dealer Gamma Positioning

BTC volumes are down 30% to under $7Bn, with short-dated upside well-offered in the 7Jun 70-75k zone. Bearish risk reversals bought on 28Jun 64k/80k strikes. Meanwhile, ETH volumes have normalized, falling 70% to $3.5Bn. Bullish flows focus on call spread structures out to June.

BTC dealer gamma is neutral, with big short strikes around 70k and 75k. Net gamma position is insignificant to impact spot price action. ETH dealer gamma has flipped to small negative, with news flow more dominant than gamma positioning. A break above 4100 could shorten positions further.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)