Bitcoin Remains In Choppy Terrain

Bitcoin briefly surged above $60k before retreating to $58k, following a reported assassination attempt on Trump and a $100 million liquidation of long positions over the weekend. Despite the dip, Bitcoin had previously rallied 15% during a similar assasination event, reaching $66k. Market movements have also been influenced by the recent Trump-Harris presidential election debate, where no mention of crypto was made, and Harris received an endorsement from Taylor Swift. As the FOMC meeting approaches, speculation around a potential rate cut is growing, with a 63% chance of a 50bps cut helping BTC once again climb above 60k.

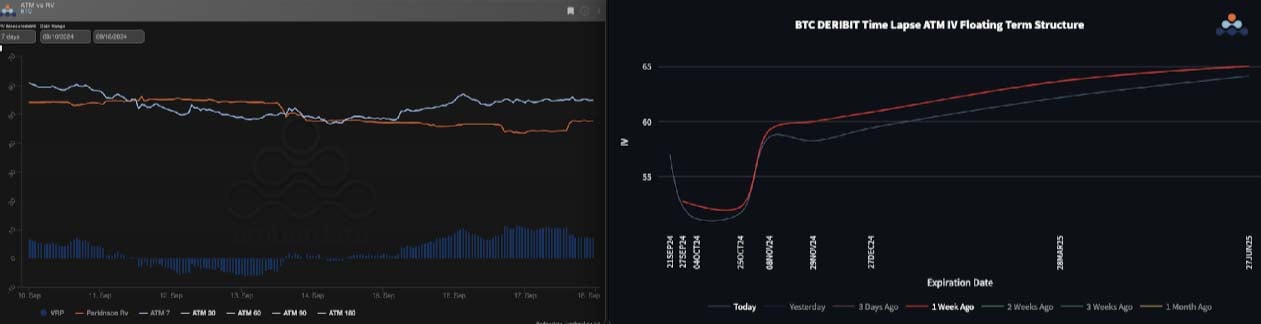

Crypto Realized Vol Back In The 40s

This week, crypto volatility returned to the 40s as the US presidential election debate provided little impact, with no crypto discussion. Implied volatility in front-end contracts dropped by 3-5 vols, while this week's expiry remains firm ahead of the FOMC meeting. ETH is maintaining a strong positive carry at 20 points, with BTC over 10 points. Expect volatility to reset lower by at least 5 vols after the rate decision. The term structure kink suggests an approximate 10% implied move around the November election, but the back end of the curve shifted lower this week.

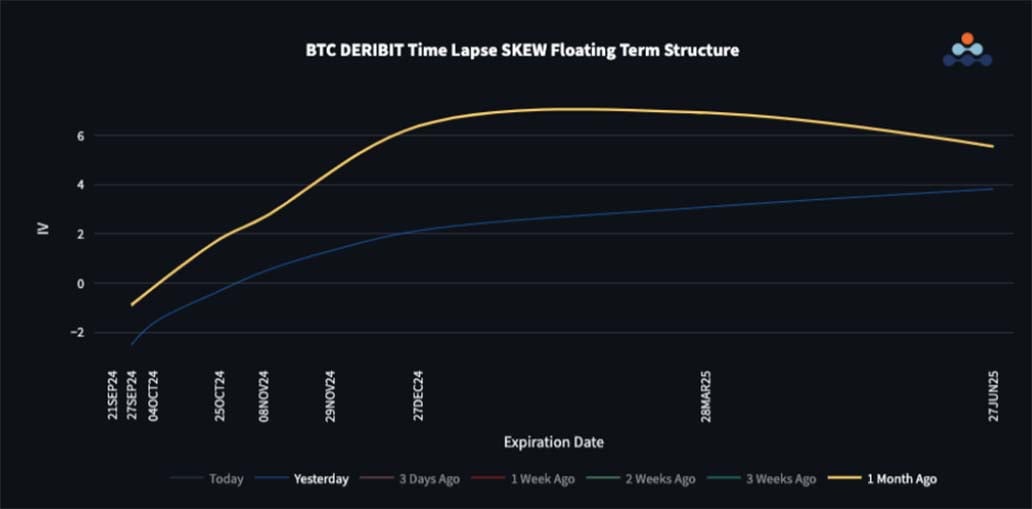

Skew: Front-End Puts Hold A Premium Still

The contango term structure remains steady as cautious sentiment drives short-term put demand in crypto markets. Despite a dovish outlook on rates, crypto has struggled to regain upward momentum. Call premiums have decreased as investors hesitate to pay for upside without stronger momentum. Front-end skew for puts has converged to 2-4 vols, transitioning to a call premium around the election period, reaching 4 vols by the back end.

ETH/BTC Breaks Below 0.04

ETC/BTC spot broke below 0.04 and could test 0.03. With both assets stuck in ranges, volatility spreads narrowed by 1-2 vols across most of the curve. The weekly spread holds at 6 points, as FOMC impacts are expected to be equal for both assets. Traders are willing to pay more for ETH volatility starting in October. The skew term structure is flattening, signaling a market led by macro factors with high correlation.

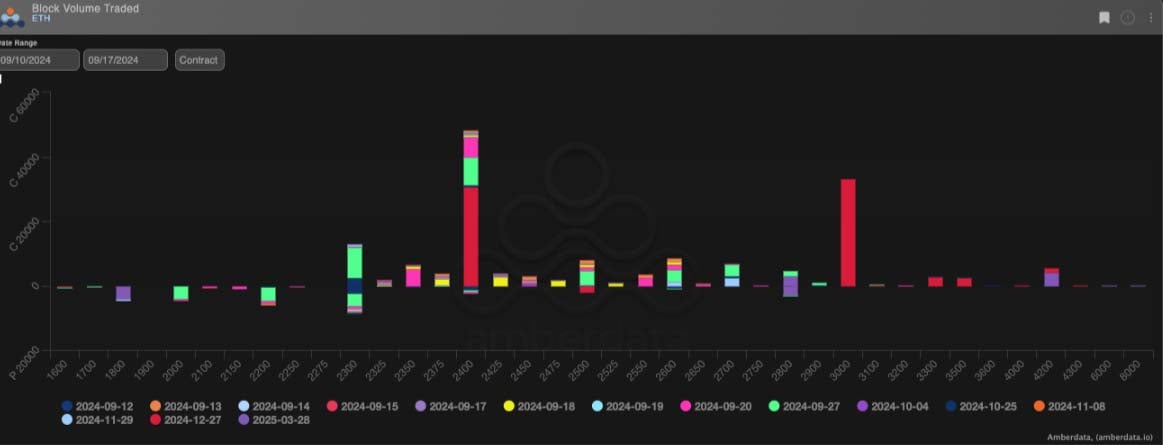

Option Flows

BTC volumes held steady at $6.8 billion, with a 55/45 call-to-put ratio. After a lackluster election debate, March 25 110k calls were liquidated, while September and October 50k puts were sold as the market rebounded post-CPI. ETH volumes dropped 35% to $1.4 billion, with an 80/20 call-to-put ratio. The dominant ETH trade is a December 27 2400/3000 call spread in 30k lots.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)