April saw the successful conclusion to a potentially high-volatility event mid-month in Ethereum’s Shapella upgrade, which has since seen nearly 2 million leave the Beacon chain without a significant sell off in spot price.

The next month promises to bring further uncertainty, beginning with a week full of macroeconomic events whose previous editions have had significant effects on crypto’s derivatives markets.

Post Shapella Vol

Figure 1 Hourly mark price of BTC (yellow) and ETH (purple) perpetual swap contracts as traded on Deribit. Source: Block Scholes

ETH’s spot price enjoyed a significant rally in the days following the unlock of staked ETH on the 12th April, lagging the positive sentiment in BTC markets a few days prior. The delayed reaction to the event was possibly due to positive market sentiment regarding the lack of sell pressure that materialised as a result of the unlock.

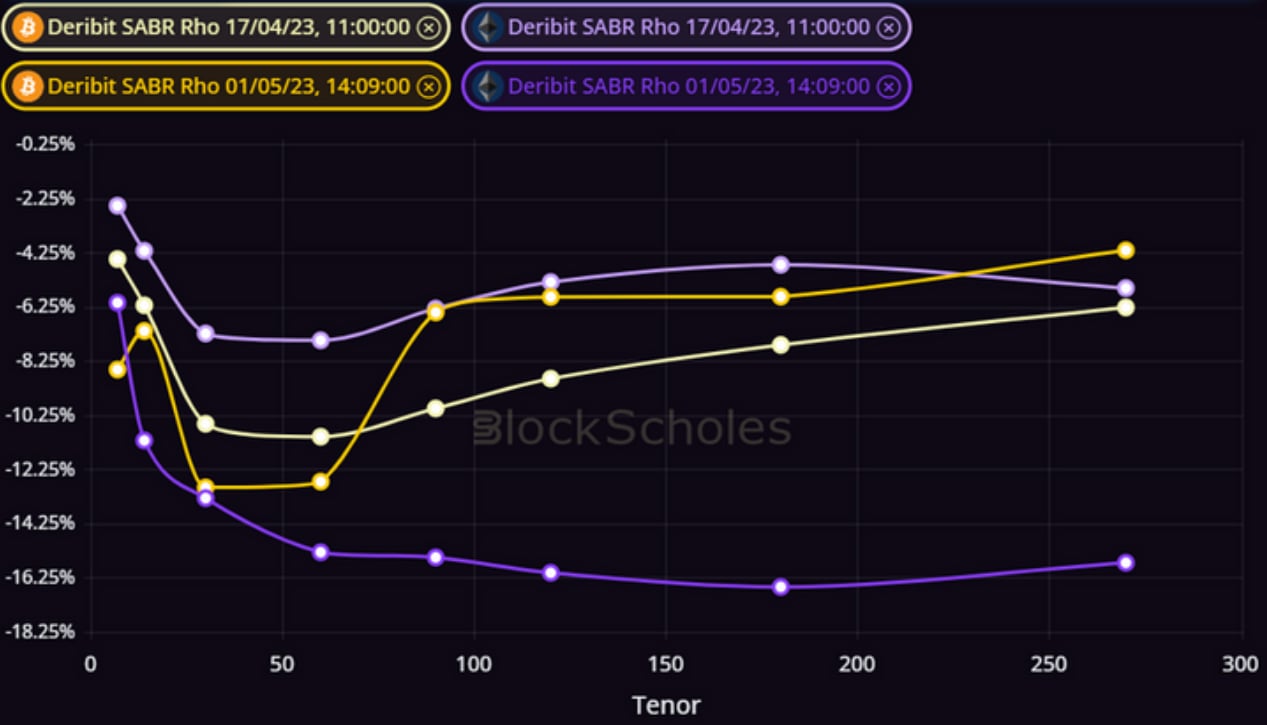

Figure 2 Term structures of BTC (yellow) and ETH (purple) SABR Rho parameter at 1/5/23 14:09 UTC (darker colours) and 17/4/23 11:00 UTC (lighter colours) snapshots. Source: Block Scholes

Derivatives markets saw ETH’s volatility surface skew less strongly towards OTM puts. Whilst it did not see a return to a completely neutral pricing, it saw options markets price ETH’s volatility with a more optimistic tilt than BTC’s, briefly reversing the behaviour of the regime of the previous 3 months.

Figure 3 Hourly at-the-money implied volatility of BTC (yellow) and ETH (purple) options at a 1M tenor from 1st April 2023. Source: Block Scholes

However, poor performance by both headline crypto-assets has since seen the volatility smiles of BTC and ETH skew back towards OTM puts at month-long low levels. In addition, the skew of ETH did dip significantly back below BTC’s before both settled to trade between -0.1 and -0.15.

LIDO Staked ETH

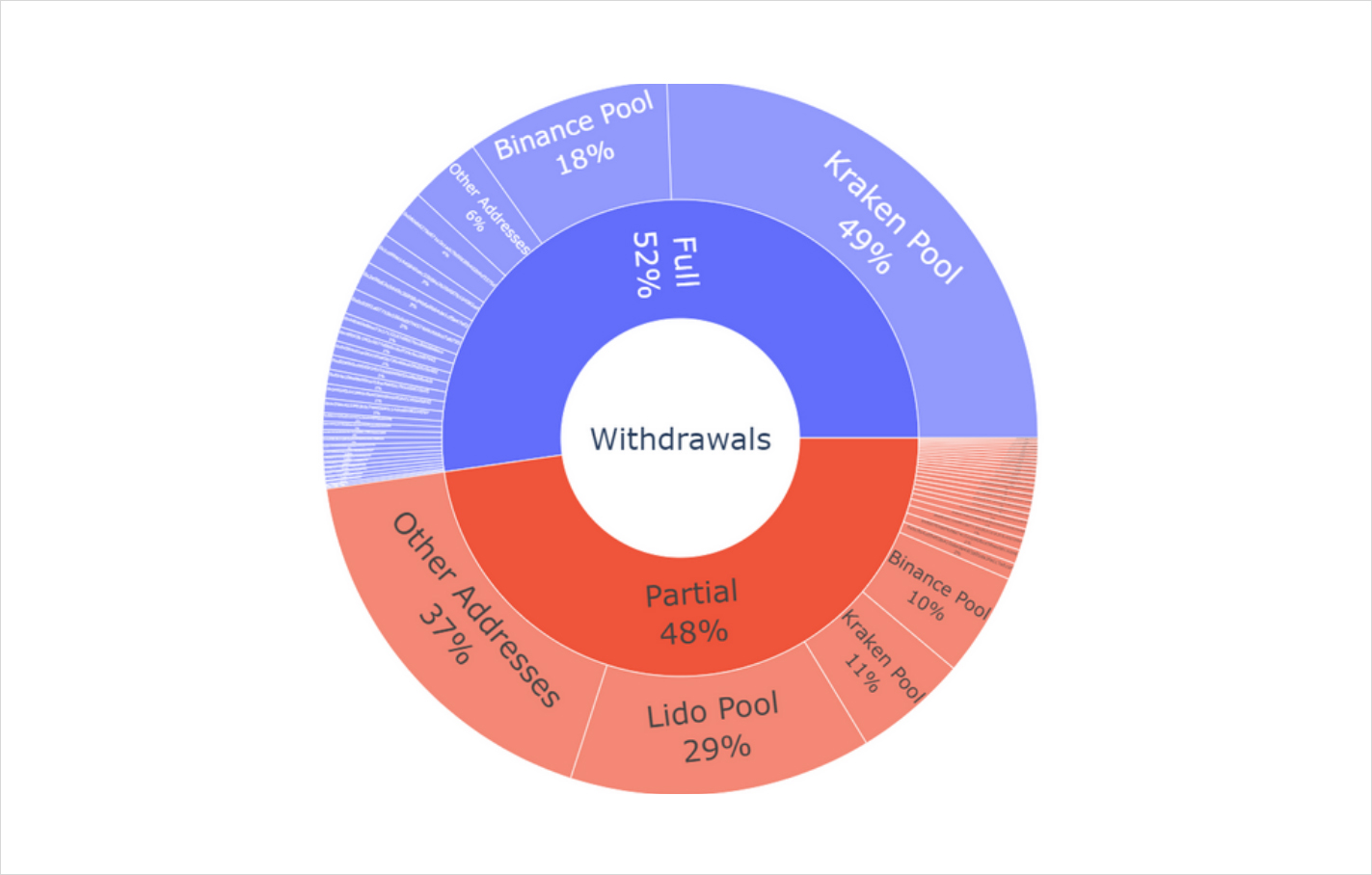

Figure 4 Distribution of ETH withdrawn from the Beacon chain as of 1/5/23, with several key addresses labelled. Source: Block Scholes

A significant amount of the ETH that has been withdrawn was originally staked through third-party, liquid staking services, such as Lido. Accounting for 29% of partial withdrawals (withdrawals of the staking rewards earned on top of the 32 ETH required to maintain a validating node), this liquid-staking provider has not yet made the withdrawn ETH available to its customers for redemptions.

However, users that have staked with Lido hold stETH. This is a tokenised position in the pool of ETH that Lido has staked on the Beacon chain. Those users have been able to sell out of that position into ETH throughout Lido’s operation. If a stETH holder wants to exit their position today (without waiting for Lido to enable redemptions to users), they can easily swap their stETH tokens for ETH without a significant loss of value before off-ramping into fiat currency on an exchange.

The exchange rate of stETH to ETH is the closest to par it has been since May last year at 0.9938 ETH per stETH, indicating that there is not a huge pressure to sell that will be unleashed by Lido’s upgrade. The ETH already withdrawn by the protocol remains in a Lido-controlled address and will not be made available for stETH redemptions until May at the earliest. It is likely that this sum will form a capital buffer that will allow Lido to redeem a large number of withdrawals without being limited by the Beacon chain withdrawal process, at the cost of a slightly lower yield earned on the committed ETH.

Full Withdrawals

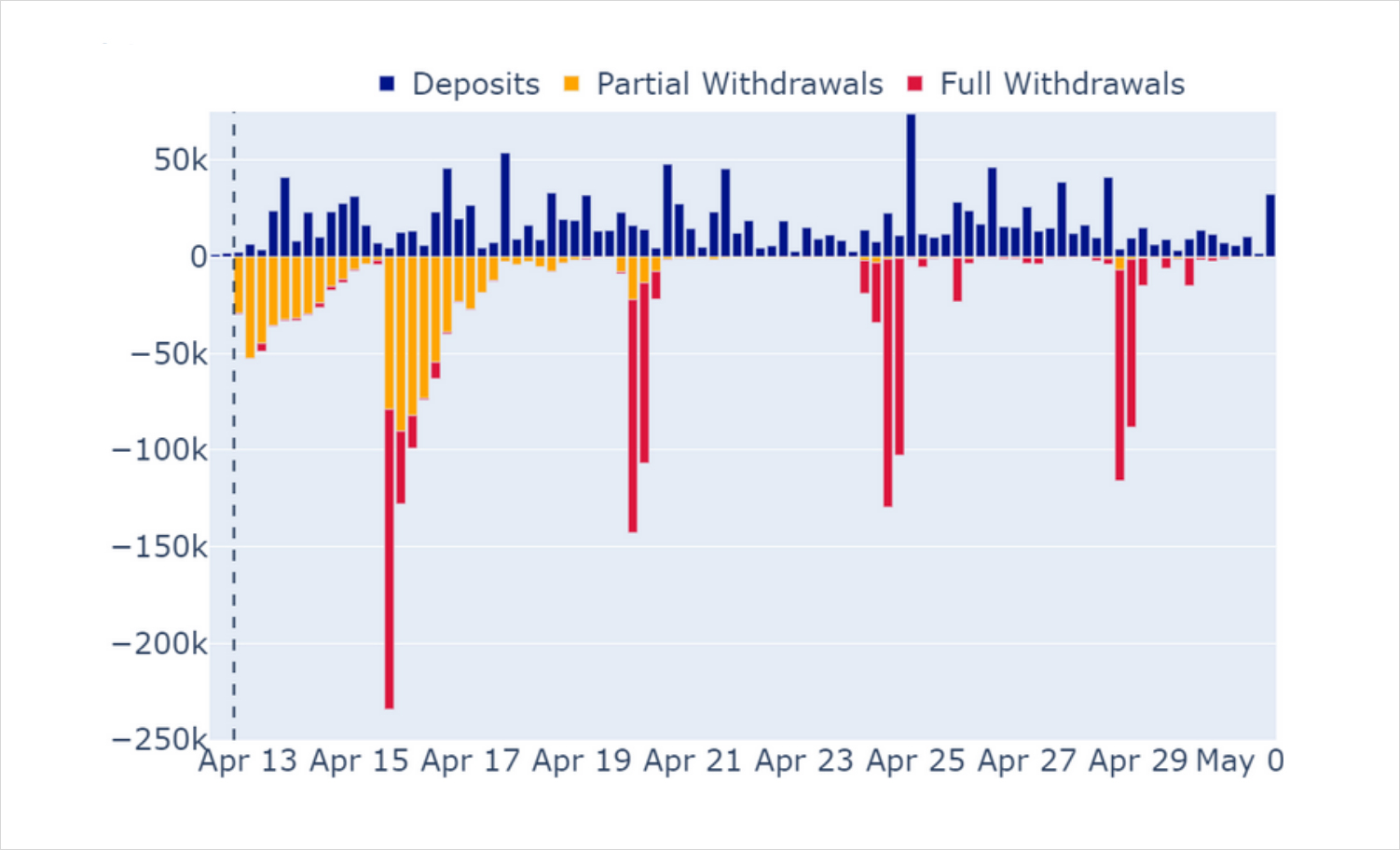

Figure 5 ETH deposited to (blue, positive) and withdrawn from the Beacon chain since the April 12th unlock, with the latter distinguished by full (red) and partial (yellow) withdrawals. Source: Block Scholes

More than 50% of the ETH withdrawn so far from the Beacon chain has been via “full” withdrawals, wherein the validator removes the entirety of their ETH and halts validating on the Beacon chain. However, this large figure also needs context. The overwhelming majority of the full withdrawals processed so far can be attributed to centralised staking services, such as Kraken and Celsius, that have been forced (for reasons spanning SEC orders and bankruptcies respectively) to halt their staking services.

This fact has two implications. The first is that the “true” number of intentional full withdrawals from validators is up to 2 times smaller than the total figure reported, a vote of confidence in the network from the 500,000+ validators that are still validating on the Beacon chain. The second implication is that we should expect most of this ETH to be restaked through alternative staking providers as the stakers have not withdrawn their ETH by choice. As a result, the sum that actually comes to market is expected to be less than that of the total figure of partial withdrawals.

Pressures specific to Ethereum

The new supply of ETH released by the Shapell upgrade did not cause an immediate selloff. Instead, a large proportion of the withdrawn ETH can be attributed to forced withdrawals that we do not expect to have a significant market impact.

April’s event marks the second successful upgrade to the network and the completion of the switch to Proof of Stake, but Ether’s extra skew towards puts persists and volatility expectations for the asset carry a near 10 vol point premium to BTC’s across the term structure. As noted in our volatility review for March, the risks for the Ethereum network are more endemic to Ethereum and span longer time horizons. In addition to facing renewed regulatory attention from key US government institutions, Ethereum may not be enjoying the emerging “store-of-value” narrative to the same extent as Bitcoin.

Macroeconomic Volatility

US CPI Mid Month

Figure 6 Hourly SABR calibrated skew parameter of BTC (yellow) and ETH (purple) options at a 2W tenor from April 1st. Source: Block Scholes

Despite the Shapella event dominating headlines, it was the release of inflation data in the US that had the starkest impact on volatility expectations on the date of the unlock itself (April 12th). As has been the case with many releases of economic data relevant to monetary policy decisions and the inflation outlook, the release of March’s CPI reading saw elevated implied vol in the days before the event, followed by a fall in volatility expectations during or soon after the announcement.

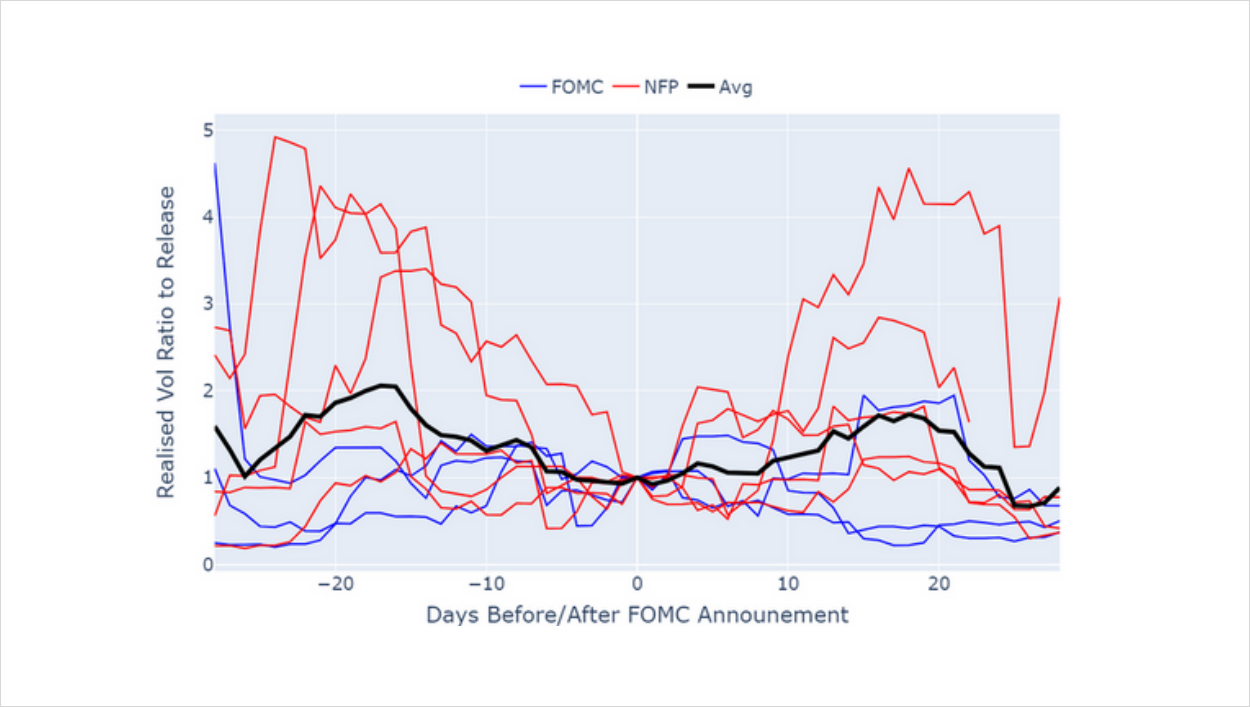

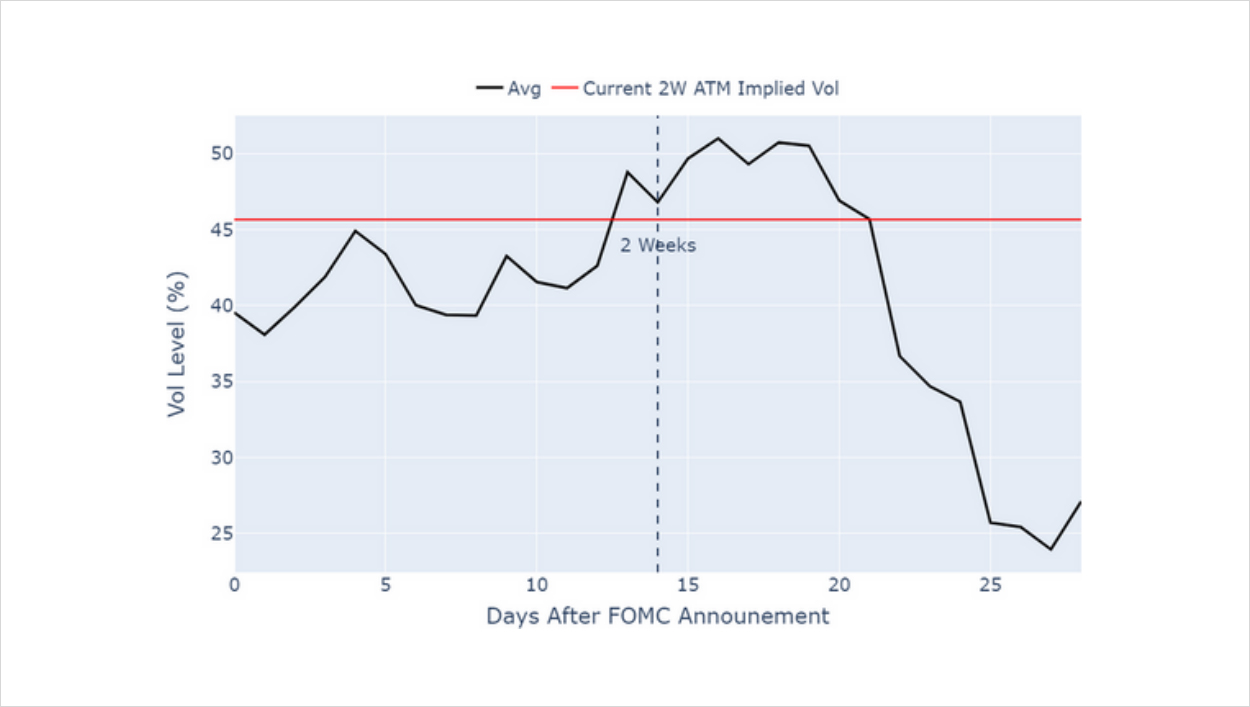

The response of realised volatility has historically been mixed, with some variance in its response to both FOMC meeting announcements and Non-Farm Payroll releases. However, the average response shows larger realised volatility in the two weeks after an announcement when compared to the value recorded contemporaneously.

Figure 7 BTC 7d realised volatility as a ratio to the realised volatility recorded on the date of an FOMC (blue) or NFP (red) announcement, with the average response in black. Source: Block Scholes

Macro in May

We expect that the triple header of an FOMC meeting, ECB meeting, and US Non-Farm Payroll in the first week of May to similarly dominate narratives and positioning in crypto-asset derivatives markets. Previous editions of each event have been key in determining the developing path of monetary policy and its effect on risky assets, and both BTC and ETH volatility markets have reflected that.

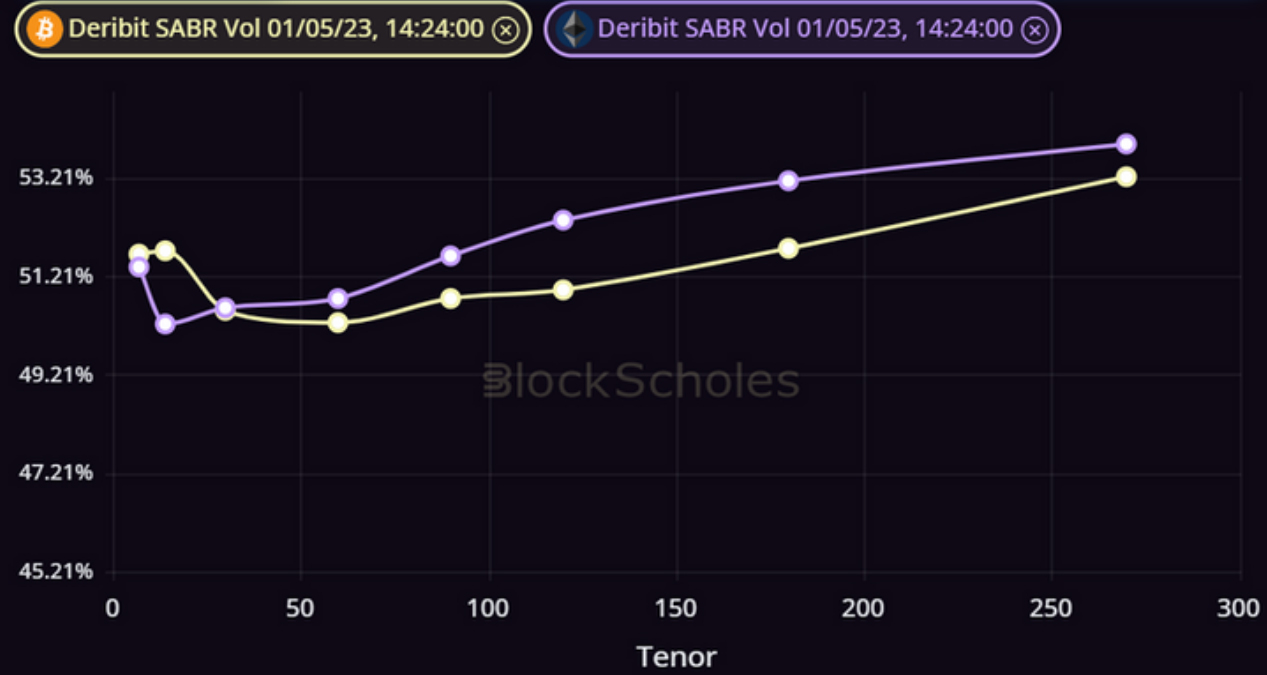

Figure 8 Term structures of BTC (yellow) and ETH (purple) implied volatility recorded at a 1/5/23 14:24 UTC snapshot. Source: Block Scholes

However, outright levels of implied volatility are currently incredibly low for both assets, and their term structures are relatively flat having recovered from the late-April inversion that saw short term vols trade higher than the vols implied by longer-dated options. We also notice a small kink in the term structure of both assets’ implied volatility at the 2 week and 1 month tenors, which could suggest that traders have begun to take positions for the next week of price action.

Figure 9 Average absolute 7d realised volatility after an FOMC announcement (black) with the current level of 2W ATM implied volatility (red). Source: Block Scholes

AUTHOR(S)