Early on Sunday morning, Bitcoin’s price crashed by 12% within minutes. Along with it, the prices of most other crypto assets experienced even more significant drops, with Ether falling by over 25% within 15 minutes. Prices of most crypto assets recovered shortly after and have continued increasing since.

Sudden price movements like these are often attributed to whales selling. While this may be the case, the trading activity causing this crash was likely due to high leverage on spot and derivatives markets. We can determine that this is the case by analyzing on-chain transactions over $100,000.

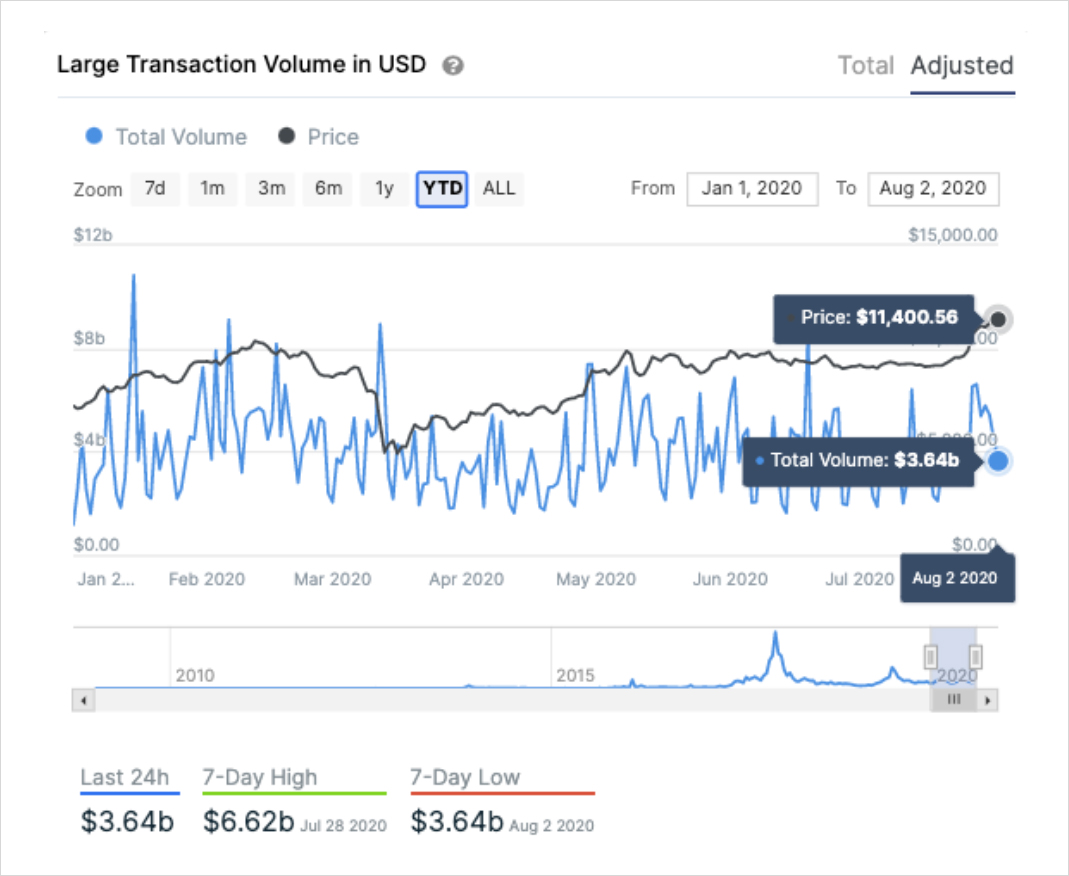

IntoTheBlock’s large transaction volume indicator aggregates the total amount transferred in transactions over $100,000 in a 24-hour period and acts as a proxy to whale trading activity. As can be seen in the graph below, the large transaction volume experienced during the flash crash was relatively underwhelming at $3.64 billion, a seven-day low.

While large transaction volumes do tend to drop in the weekends, this is remarkably low volume taking into account the large intra-day volatility experienced. This points to the likelihood that the actors causing the flash crash were leveraged within a spot exchange rather than transacting on-chain since there was barely any effect on blockchain large transaction data.

Most other crypto assets were hit even harder by the flash crash, despite recovering a significant percentage of the losses shortly after. This is a result of the high correlation between Bitcoin and most crypto assets. In ETH’s case, for instance, the 30-day correlation is currently at 0.96. For context, a correlation coefficient of 0.5 already implies a high positive correlation, meaning that Ethereum’s 0.96 30-day correlation indicates a very strong statistical relationship between the prices of the two.

As can be seen from the image above, the correlation between ETH and BTC has been on an upward trend since mid-July, pointing to both moving increasingly in tandem with each other. Since most traders are aware of these correlations, the impact of flash crashes such as the one seen on Sunday tends to be exacerbated in altcoins, especially in those that are less liquid and have lower market caps.

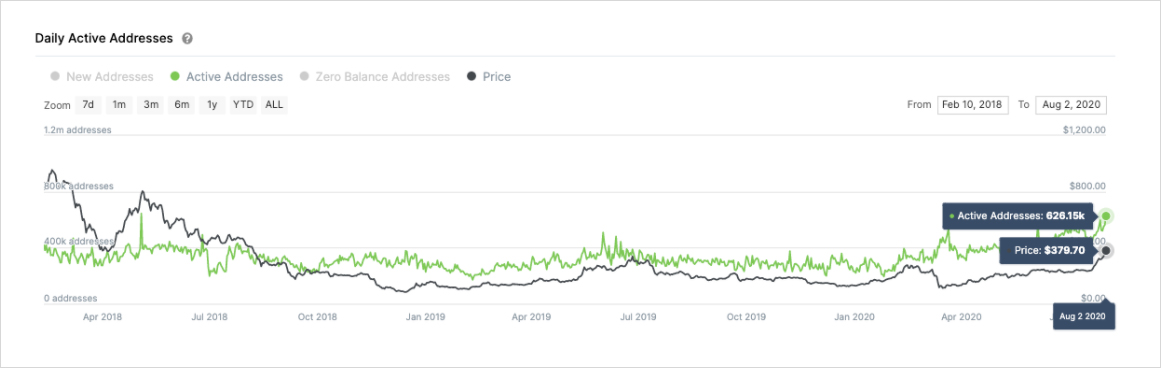

While on-chain metrics for Bitcoin were not severely affected by the flash crash, Ethereum did see a noticeable upsurge on its blockchain activity. As reported by Decrypt, Coinbase experienced delays in Ethereum and ERC-20 deposits and withdrawals following the sudden drop in price. This was a result of a spike in network activity causing fees to more than double within minutes. As a result, daily active addresses in Ethereum reached a two-year high of over 620,000 unique addresses.

While part of this growth in active addresses can be attributed partly to trading activity throughout the flash crash, it is also important to note the increased demand to use dapps built on top of Ethereum as discussed in this piece.

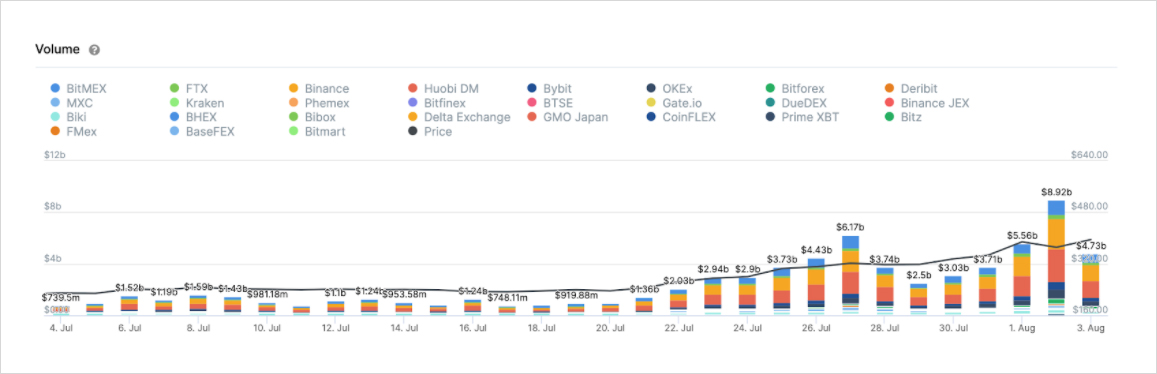

Similarly, Ethereum derivatives had a significant uptick in activity throughout the flash crash. Perpetual swaps — which have quickly become the industry’s leading type of derivative contract — recorded an all-time high in volume on Sunday.

As can be seen in the graph above, ETH perpetual swaps volume almost reached $9 billion on August 2. This amount is remarkably high when considering that the aggregate daily volume for ETH perpetuals was almost $1 billion less than two weeks ago. Similarly, the volume of Bitcoin perpetual swaps increased significantly during the flash crash.

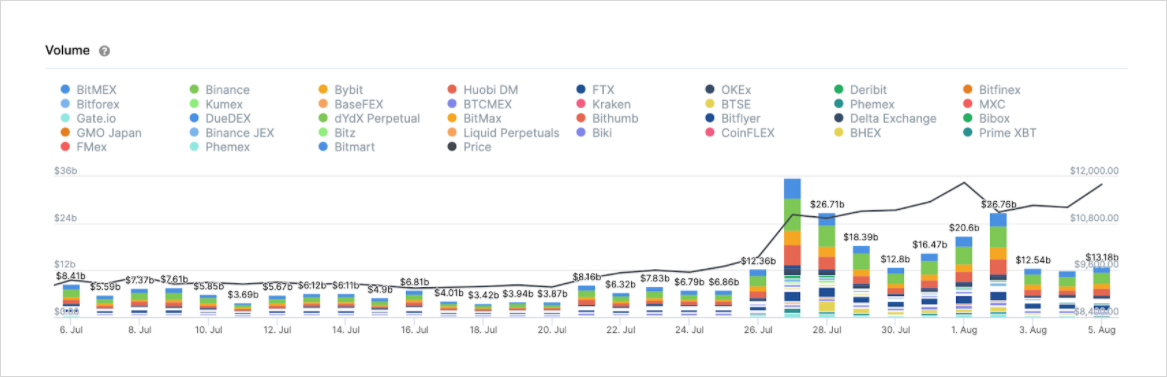

As shown above, Bitcoin perpetual swaps hit the second-highest volume traded in the last month on past Sunday, following only the volume observed on July 27 when the price had spiked by over 10%. Moreover, this is the third-highest volume observed this year, with the volume seen on Black Thursday still being the largest at $29.92 billion.

While it is likely that several traders got liquidated due to the volatility experienced on March 12 and last Sunday, derivatives volumes have been especially growing since late July. This upward trend in derivatives volume points to large investors being more risk-seeking and attracted to crypto derivatives in general.

Overall, analyzing the flash crash, we can establish that most crypto assets are still highly correlated to Bitcoin. The lack of impact in on-chain Bitcoin transactions points to the likelihood of the culprit being leveraged positions in spot exchanges rather than whales selling their positions. And while Ethereum did see a spike in daily active addresses, the impact felt in its perpetual swaps volume was much stronger, pointing to the high appetite for risk and leverage in the derivatives market.

To dive deeper into Bitcoin make sure to check out the 60+ indicators and signals we have at IntoTheBlock. Finally, to trade Bitcoin derivatives and analyze market data, make sure to check out Deribit’s Market Data.

AUTHOR(S)