After a seemingly never-ending barrage of bearish news throughout the month of March, not limited to Wells notices, bank closures, and a drastically changing macro environment, we’ve started off the month of April in a bit of a consolidatory lull. BTC’s valiant efforts of breakout above $30,000 to close the month of March fell just short with a local high of around $29,100 on Thursday before a slight retracement to current levels after spot selling pressure stepped up.

The massive open interest in the March 31st tenor has rolled off as trader interest focuses on the weekly and monthly expiries of 7APR23 and 28APR23 with OI at 1.01B and 2.37B respectively, and from a high level perspective, the current spot/vol correlation continues to persist although the recent consolidation at these higher levels have driven implieds across the board down.

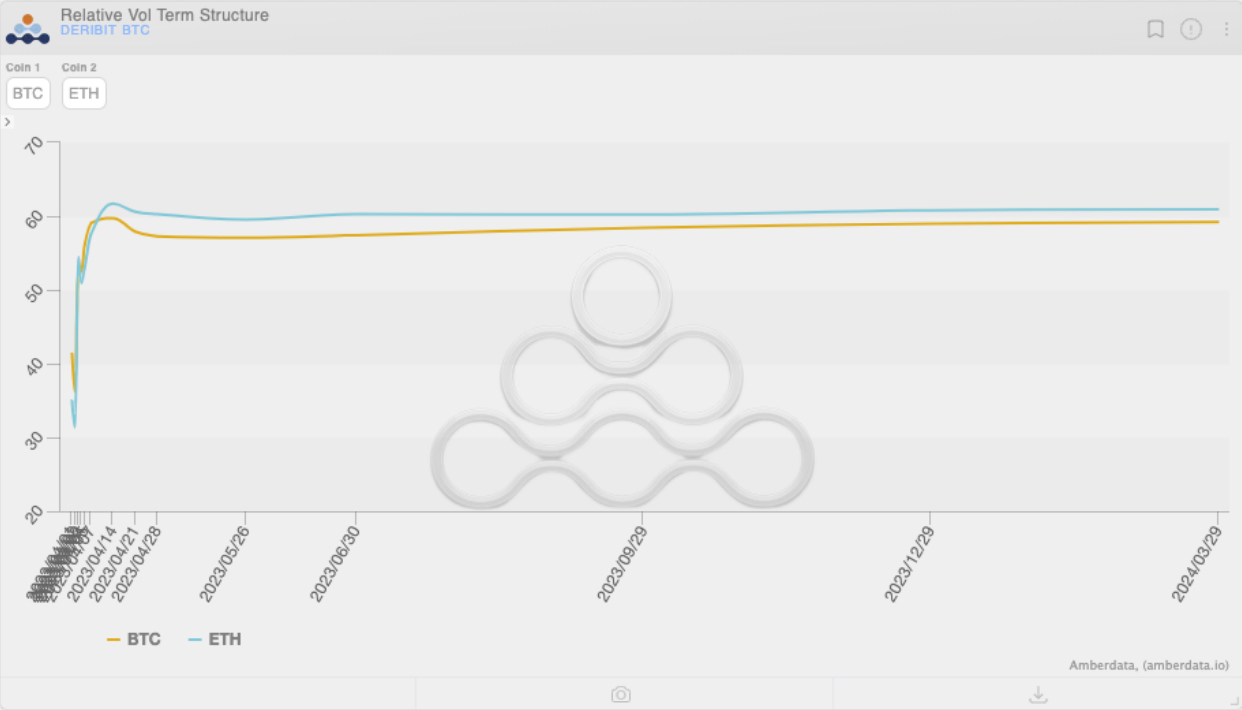

Term Structure for BTC and ETH

The persistent consolidation over the past few weeks has flattened term structure with the chart below and AmberData’s term-structure richness graph showing this as well. Longer dated taker flows have come in as discussed further on, but with the recent rally losing steam and realized trending lower, a slow drift downward across the board seems likely – especially on a steady decline further back into the trading range.

Spot/Vol correlation remains strong, and with current price levels close to $30K – especially after a move above $29K last week – implieds could certainly see a large bid step in on a move higher. On a relative basis, ETH is back to trading above BTC from an IV perspective as that bullish exuberance and BTC driven move over the past few weeks started to settle down and demand for BTC optionality declined.

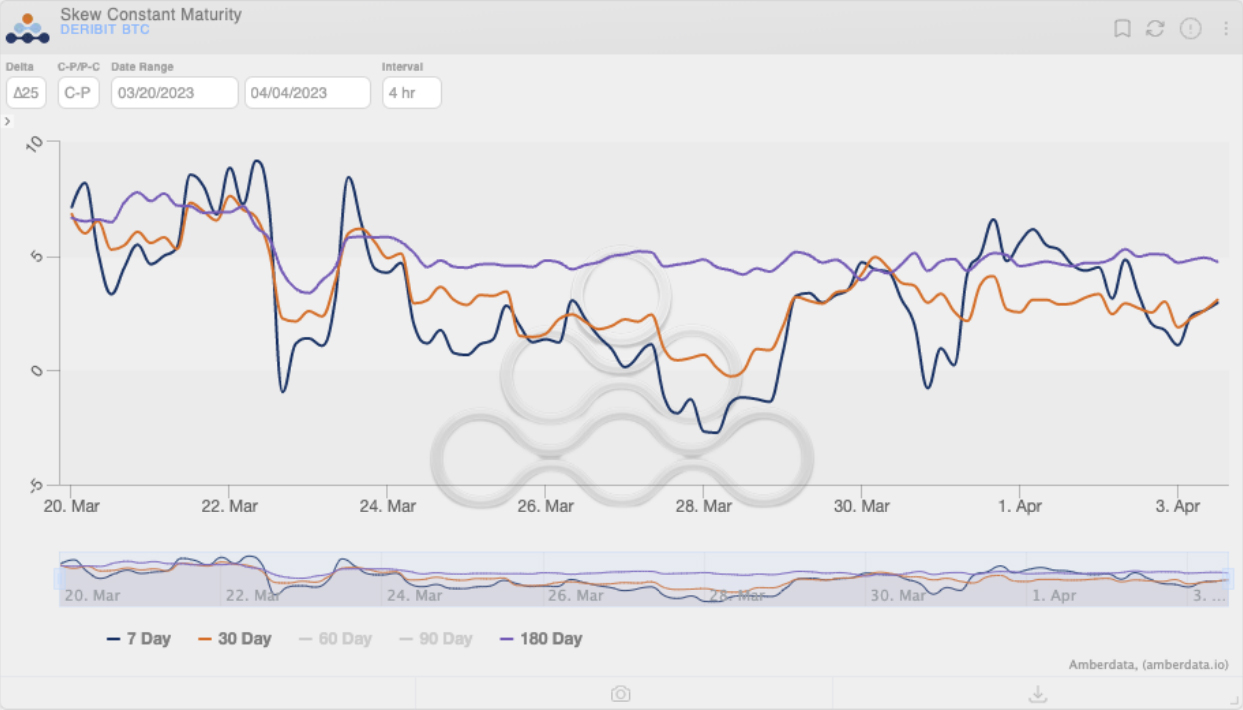

Skew for BTC and ETH

From a skew perspective, longer dated skew has continued its trend throughout the week with calls trading at a relative 5 vol premium in the 25 delta range compared to puts. Short dated skew heading into the weekend was slightly bearish and any bid for weekly call skew quickly reversed before the Asia session opened.

ETH has followed BTC trend wise, with more of a sharp decline in weekly skew seen over the weekend, but noticeably ETH skew shows weekly (and almost monthly) 25 delta calls continuing to trade at a deficit to the 25 delta puts. As the Shanghai upgrade is scheduled to take place on April 12th so it will be interesting to see how weekly skew reacts then.

However, it is to be noted that CPI and FOMC meeting minutes also occur on Wednesday, April 12th, so I’m heavily biased in leaning toward those events being more impactful on the short-term price action of both BTC/ETH than the Shanghai narrative.

Liquidations

Liquidations to close the year off have been relatively quiet as we continue to consolidate. Recent liquidations over the past 24 hours seem to be concentrated on OKX according to Coinalyze, and the aggregated funding rate average has flipped from positive to negative.

Noticeable Flows Throughout the Week

With traded option volumes at all time highs and the month of March leading to multiple record days over at Paradigm, the sizable flows coming in have certainly been interesting to take note of. A couple of the most interesting and noticeable blocks that came to mind last week were: The buyer of 3000x BTC 29MAR24 50K/65K Call Spreads (around $60K vega notional on day of listing), bullish June call spreads blocked in two sets of 1.5K lots in the 29, 35, and 40K strikes, and some big calendar spreads that finally look to potentially be trading the ETH merge.

Check out Paradigm’s recent tweet for a more thorough description of some of the noticeable flows last week.

A Look Ahead

Given how dire the markets looked heading into the weekend of USDC’s depegging and how the banking catastrophe has played out, I’d say I’m surprised at the strength and resilience of BTC to close out March.

However, there are other factors at play here that make me a bit less skeptical of prices at current levels. Some of the factors I’m considering at play here are, spot demand and liquidations after the sharp reversal of price near $20K as new vol sellers and perp shorters stepped in only to get blown out in the huge run in the subsequent days, the continued liquidity provision of the Fed to help support the banking system, and lastly the flows from stables and USD into BTC on the back of the banking failures.

Heading into April, short-term focus is on the upcoming NFPs this week and CPI the week after, with all eyes on the $30,000 upper bound of the range we’re currently trading in.

AUTHOR(S)