BTC’s derivatives market is not yet expressing a strong conviction in a continuation of last week’s upwards swing.

That is displayed by the deeper fall in the implied vol of OTM calls than OTM puts that nonetheless leaves both above their pre-rally levels. The low realised volatility experienced since reaching the $21K price point, combined with a neutral skew could indicate that traders expect yet more sideways movement. However, if the skew continues to trend downwards we could see a return to the preference for downside protection that we saw throughout a similar low-volatility environment in December.

Put Call Skew is near zero again

Figure 1 Implied volatility of a 25-delta BTC call divided by the implied volatility of a 25-delta BTC put at a 1 week (orange), 1 month (blue), and 3 month (red) tenor. Source: Block Scholes

- Last week’s rally in OTM calls has been reversed, with the implied volatility of OTM calls now trading below the levels of OTM puts with similar deltas.

- That leaves the put-call skew just below 1 for short-dated tenors, meaning that options traders are assigning a slight premium to downside protection once again.

- It also leaves the “risk-reversal” (the IV of an OTM call minus the IV of an OTM put) negative but near zero, with both up- and down-side protection priced similarly.

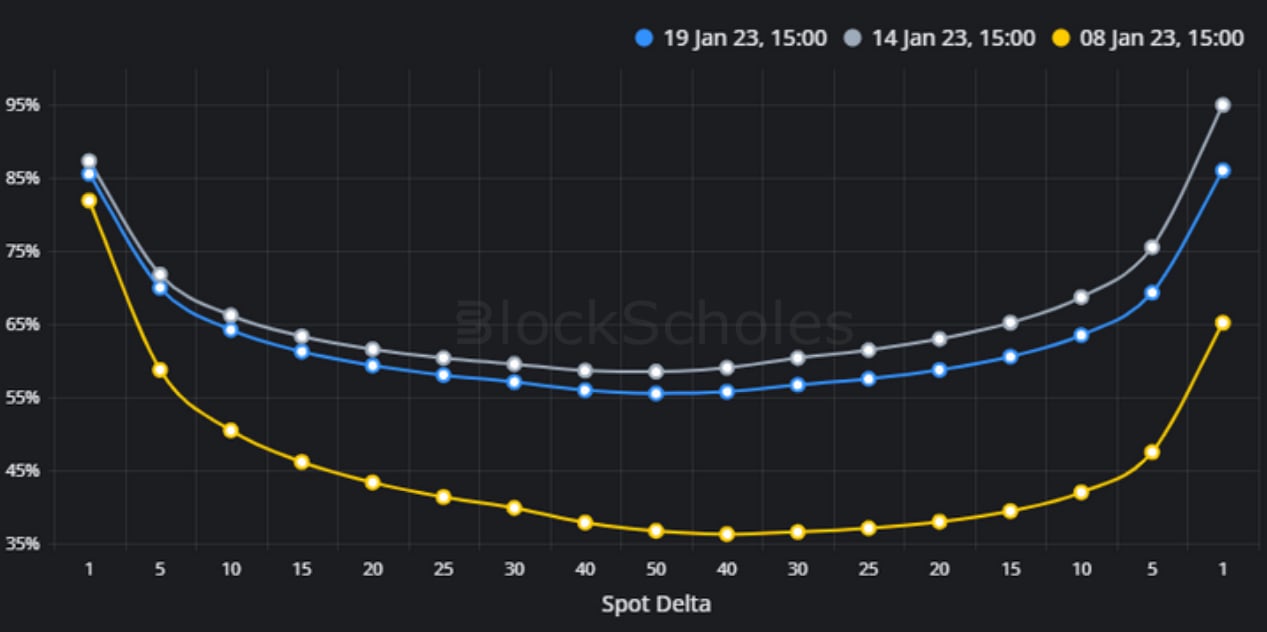

Volatility Smile remains high

Figure 2 BTC’s 30-day SABR volatility smile generated on 19th Dec (blue), 16th Jan (grey), and 8th Jan (yellow). Source: Block Scholes

- Whilst now near or below that of OTM puts, the IV of OTM calls remains well above the levels it traded at before the rally (on the 8th of Jan).

- That is true of all points on the smile, which saw a rise across all strikes by between 15 and 25 vol points as a result of last week’s spot rally.

Realised Volatility halts

Figure 3 Hourly BTC spot price (orange), alongside the rolling standard deviation of BTC’s log returns calculated on a look back of 7 days (blue) and 14 days (grey) of hourly data from the 1st Dec 22. Source: Block Scholes

- The pick up in volatility reflects the rush towards the $21K price point last seen before the FTX crash.

- However, since reaching that price level BTC’s spot price has resumed it’s sideways movement, with the smile falling most severely in deep OTM calls.

BTC’s derivatives market is not yet expressing a strong conviction in a continuation of last week’s upwards swing. That is displayed by the deeper fall in the implied vol of OTM calls than OTM puts that nonetheless leaves both above their pre-rally levels. The low realised volatility experienced since reaching the $21K price point, combined with a neutral skew could indicate that traders expect yet more sideways movement. However, if the skew continues to trend downwards we could see a return to the preference for downside protection that we saw throughout a similar low-volatility environment in December.

AUTHOR(S)