The funding rate of ETH’s perpetual swap contract, an indicator of the excess demand for long or short exposure through the derivative contract relative to the spot price, has been significantly positive over much of the last seven days. This is in contrast to BTC’s rate, which has remained close to zero throughout. The large positive value has not come at a time of strong ETH spot price performance, nor do we see similar demand for long exposure reflected in it’s future-implied yields.

Positive ETH Funding Rate

Figure 1 Hourly BTC (yellow) and ETH (pink) perpetual swap funding rate over the last 7 days. Source: Block Scholes

- The funding rate of ETH’s perpetual swap contract has been strongly positive over the last seven days.

- The funding rate is paid from long positions to short positions, and is designed to incentivise traders to keep the price of the perpetual swap close to the underlying spot price.

- Positive values indicate that the perpetual swap contract is trading above the spot price, and suggests outsized long exposure from the derivative.

- ETH’s strong positive funding rate is in stark contrast to that of BTC’s, which has remained close to zero throughout the same period.

Spot Price Performance

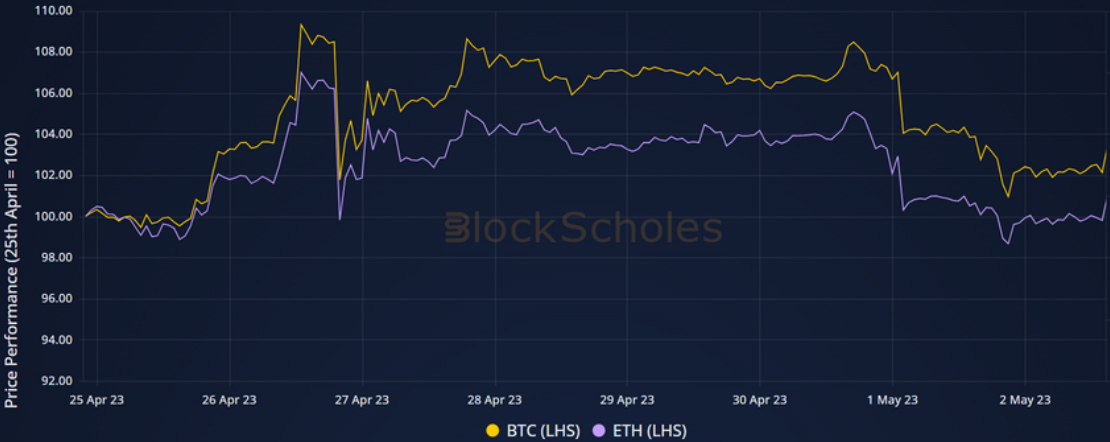

Figure 2 BTC (yellow) and ETH (pale purple) perpetual swap price performances over the last week, normalised to the price of each asset recorded on 25/4/23. Source: Block Scholes

- We have not seen an outsized performance by ETH’s spot price when compared to BTC’s.

- This suggests that there is a reason for that excess long exposure other than participating in a rally in spot prices.

- It could also indicate that Beacon chain stakers are not taking short positions in the perpetual swap contract in order to “early-exit” staking positions without waiting for the mandatory waiting period.

Similar Term Structures

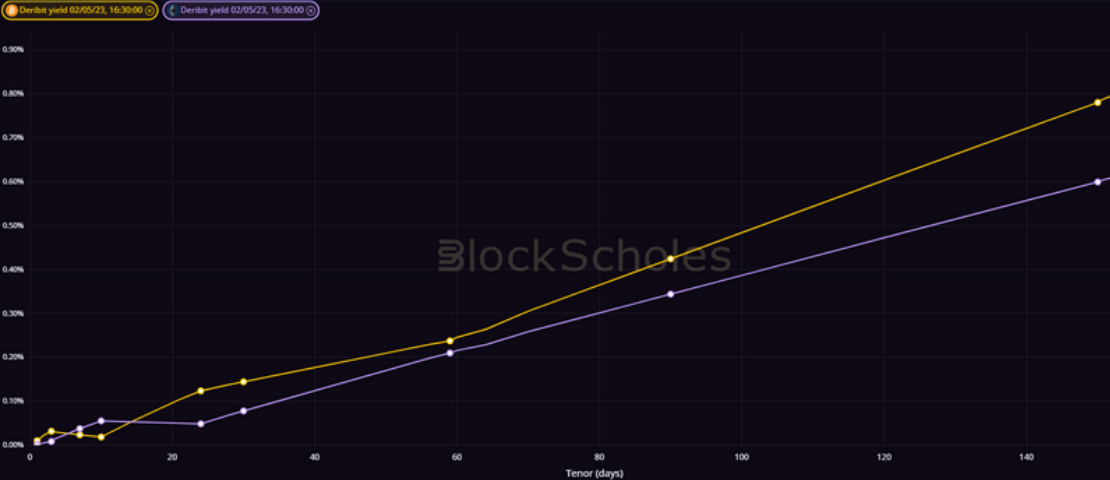

Figure 3 Term structure of the future-implied yields to spot for BTC (yellow) and ETH (purple) at a 2/5/23 16:30 UTC snapshot. Source: Block Scholes

- We also do not observe a drastic divergence between the future-implied yields of both crypto-assets, which are both low and flat across the term structure.

- If the divergence in ETH were attributable to the hedging activities of options traders, then we would expect to see similar price pressures on futures contracts.

AUTHOR(S)