A divergence between the skews of BTC’s and ETH’s volatility smiles towards OTM calls or puts has grown more pronounced, following news of BlackRock’s application to the SEC for a BTC spot ETF. BTC option markets now price the implied vol of up- and down- side protection at much closer levels than ETH’s. This is largely due to an underperformance by ETH calls relative to both it’s own puts and to BTC calls. Whilst we observe this divergence across the term structure, we note that both assets continue to price OTM puts at a higher implied volatility than similarly OTM calls.

Divergence in BTC and ETH risk reversals

Figure 1 1-week tenor, 25-delta Risk Reversal of BTC (yellow) and ETH (purple) options over the past 30 days. Source: Block Scholes

- The 25-delta Risk Reversal of BTC options has returned to levels last see on the 7th June.

- Whilst ETH’s RR has also abated somewhat, it has traded sideways for the last 48 hours.

- As a result, the difference in skew between the volatility smiles of both assets is more than 4.5% in favour of BTC neutrality.

- Both smiles continue to price downside protection at higher levels of implied volatility than similarly OTM calls.

Call & Put IVS

Figure 2 4-Hourly BTC (yellow) and ETH (purple) implied volatility of 25-delta puts (light colours) and calls (darker colours) at a 2-week tenor throughout June 2023. Source: Block Scholes.

- The harsher skew towards OTM puts for ETH’s volatility smile is due to the under-performance of it’s OTM calls since the fall in outright vol expectations at the end of last week.

- ETH’s OTM puts have remained near the highest levels of implied volatility whilst calls have traded sideways nearly 5 points lower.

- The implied vols of BTC OTM calls and puts have converged slightly – resulting in its reduction in skew towards puts following the bullish news of BlackRock’s ETF application.

Skew along the surface

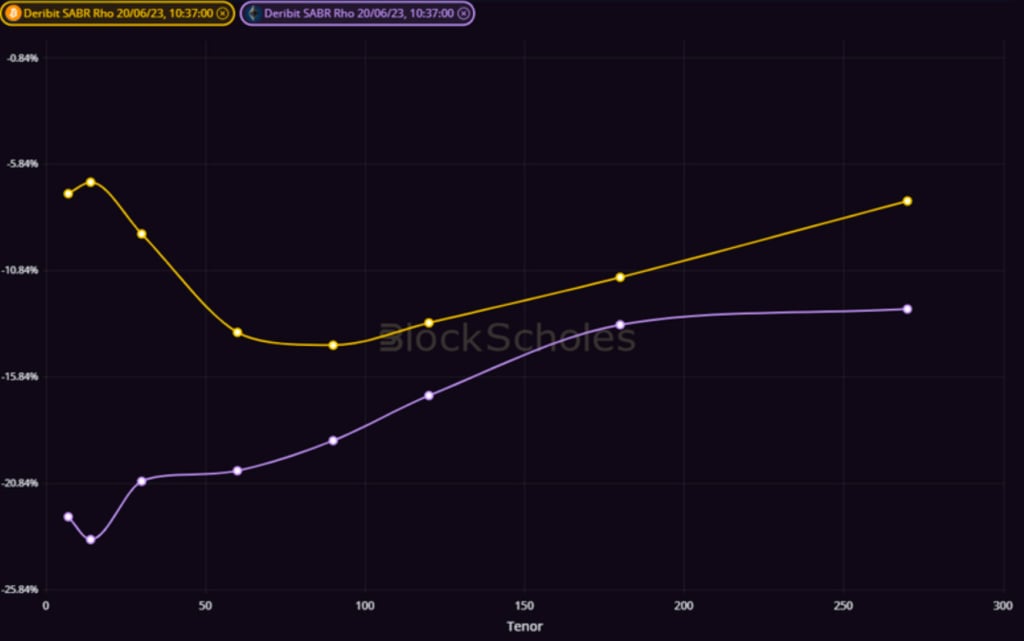

Figure 3 Term structures of BTC (yellow) and ETH (purple) SABR Rho parameters at a 10:37 UTC 20/6/23 snapshot. Source: Block Scholes.

- The SABR Rho parameter is a measure of the skew across the volatility smile, rather than the skew at a single delta.

- The term structure of that parameter tells us the relative pricing of up- and down-side volatility at each tenor along the full volatility surface.

- ETH’s options market is pricing for a much more pessimistic performance than BTC’s, particularly in the short term.

- BTC’s skew is less pronounced (though still towards puts) at short and long tenors, with 2- and 3- month tenors reporting the strongest preference for downside protection.

A divergence between the skews of BTC’s and ETH’s volatility smiles towards OTM calls or puts has grown more pronounced, following news of BlackRock’s application to the SEC for a BTC spot ETF. BTC option markets now price the implied vol of up- and down-side protection at much closer levels than ETH’s. This is largely due to an underperformance by ETH calls relative to both it’s own puts and to BTC calls. Whilst we observe this divergence across the term structure, we note that both assets continue to price OTM puts at a higher implied volatility than similarly OTM calls.

AUTHOR(S)