The most recent rally in spot prices has spiked the funding rate of both BTC’s and ETH’s perpetual swap funding rates. At the same time, we observe a sharp and distinct increase in the open interest of ETH’s contract, whilst BTC’s outstanding notional remained level. We saw a similar pick up in the sentiment expressed by future-implied yields over the same period, with BTC’s 2 week tenor future rising to 2% above its spot price at an annualised rate.

Perpetual Swap Funding Rates

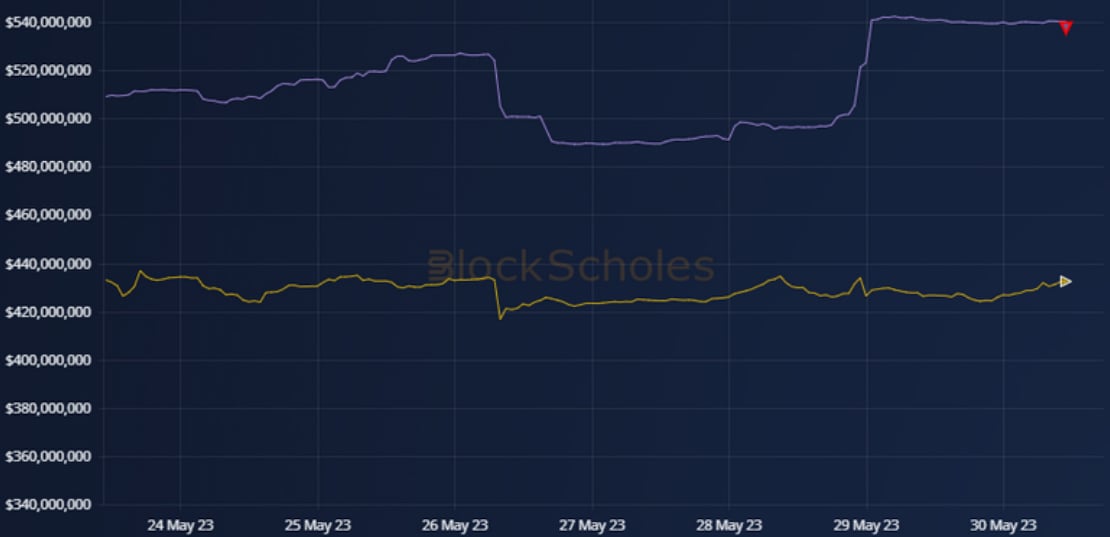

Figure 1 BTC (yellow) and ETH (purple) perpetual swap funding rates as recorded on Deribit over the last 7 days Source: Block Scholes

- The rally in spot prices that began on the 25th May has been followed by a positive spike in the funding rate paid by holders of BTC and ETH perpetual swaps.

- A positive spike in funding rate means that the price of the perpetual swap contract is above that of the spot value of the underlying asset.

- This indicates a higher demand for new long exposure through the derivative contract than the underlying asset.

Perpetual Swap Open Interest

Figure 2 Hourly BTC (yellow) and ETH (pale purple) perpetual swap open interest, measured in US dollars, over the past 7 days. Source: Block Scholes

- Despite an increase in demand for long exposure in both BTC and ETH perpetual swaps, it was ETH that saw an increase of nearly $50M in open interest over the same period.

- The price rally of the BTC contract did not result in an increase in the open interest of the contract.

- This could suggest that the demand of new buyers of the contract was matched by demand for existing holders to take profit at higher price levels.

Positive Sentiment in Yields

Figure 3 Future-implied spot-yields at a 2 week tenor for BTC (yellow) and ETH (purple) over the past 30 days. Source: Block Scholes

- The positive sentiment expressed by spot prices had a similar effect on the spot-yields implied by listed futures prices.

- Both assets saw a reversal of the drop to yields near zero that began just before the rally in spot prices on the 25th May.

AUTHOR(S)