Implied volatility continued its sensitivity to macroeconomic uncertainty as traders unloaded optionality in the minutes after the announcement of a 25bps rate hike on Wednesday. The days since have seen a fall in both realised and implied volatility, with the latter not limited to the ATM strike level. The skew of the volatility smile has trended negative once more, owing to a sharper fall in the implied volatility of OTM calls relative to the fall of OTM puts in the last few days.

Volatility near to FOMC meeting

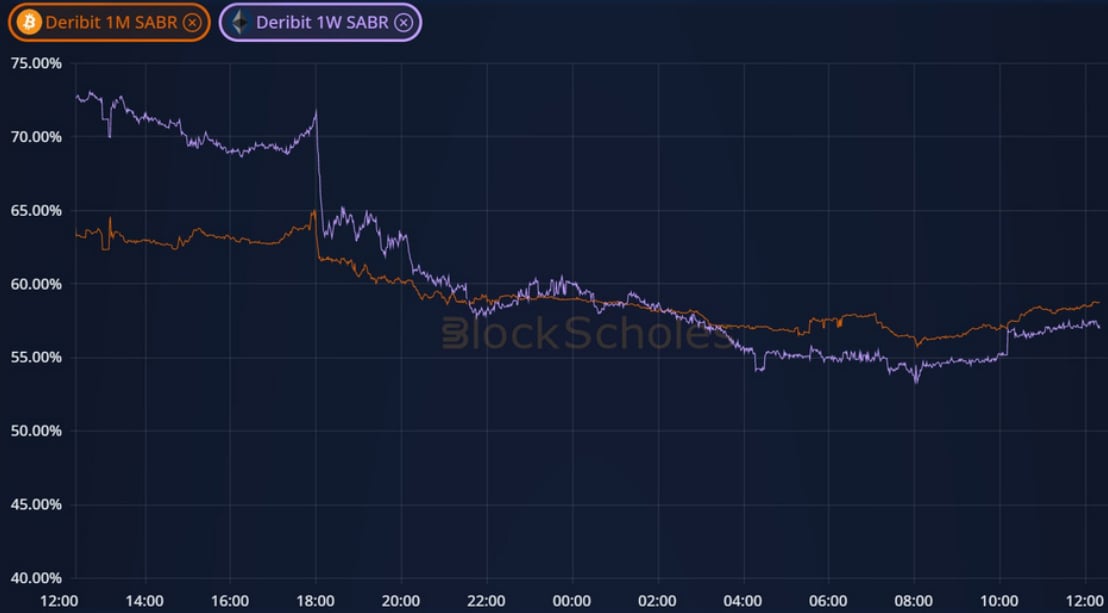

Figure 1 At-the-money implied volatility at a 1 week tenor for BTC (orange) and ETH (purple) from 12:00 UTC 22nd Mar 23 to 12:00 UTC 23 Mar 23. Source: Block Scholes

- The at-the-money (ATM) implied volatility of BTC and ETH options fell sharply near to the announcement of a 25bps rate hike by the FOMC at 18:00 UTC on the 22nd March.

- This continues a trend of elevated volatility expectations before a monetary policy announcement falling in the hours that follow it.

Realised Vol is trending downwards

Figure 2 Hourly BTC standard deviation of log-returns with a 7-day lookback window (grey) and 1-week tenor atthe-money implied volatility (orange). Source: Block Scholes

- The fall in implied volatility is matched by a similar fall in realised volatility.

- Over the last 7-days, BTC’s spot price has moved with a similar volatility to its behaviour during the periods between the three rallies in the first quarter of this year.

Skew positioning

Figure 3 Hourly BTC 25-delta risk reversal (orange), 25-detla put implied volatility (pink), and 25-delta call implied volatility each at a 1-week tenor over the last two weeks. Source: Block Scholes

- BTC’s risk-reversal has trended negative over the last couple of days, with a small recovery in the early hours of this morning.

- This downwards trend was due to the implied vol of OTM puts rising faster and selling off slower than OTM calls with the same delta.

- Both wings of the volatility smile have dropped during the same period in conjunction with the movements of the ATM level of implied volatility.

AUTHOR(S)