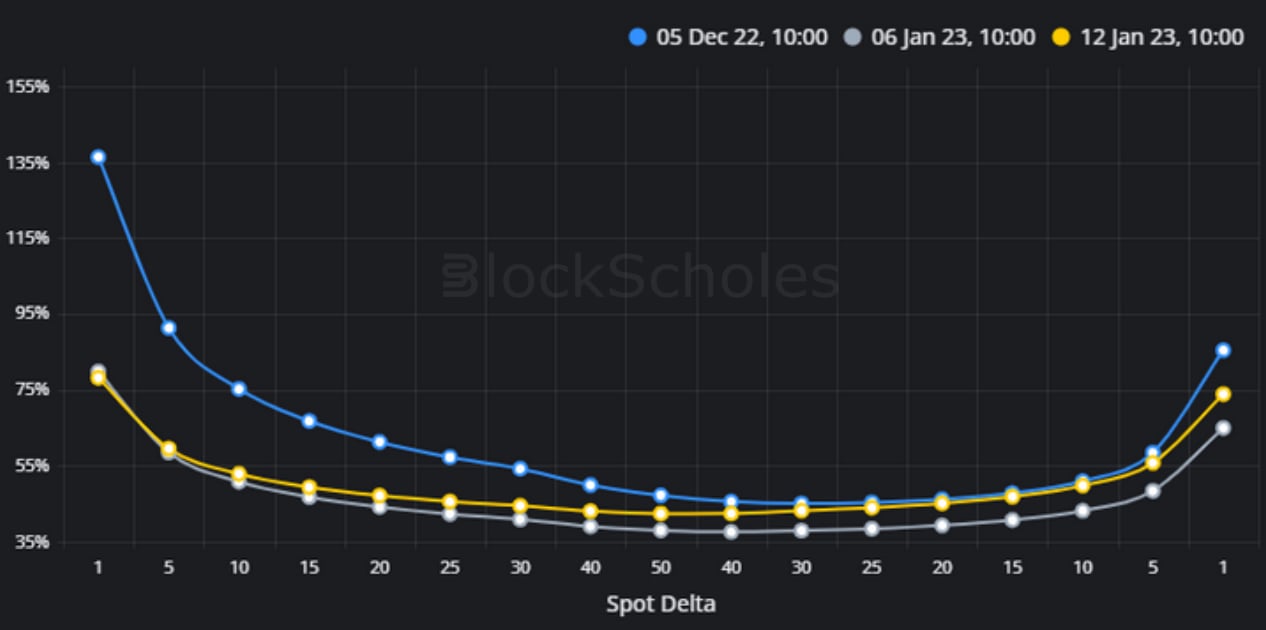

BTC’s short-dated, OTM calls have seen an increase in implied vol compared to OTM puts.

This continues the trend of the volatility smile towards a more neutral smile, which was previously driven by a falling demand for downside protection throughout December. This indicates that BTC’s derivatives market is now not only pricing for a drop in bearish sentiment, but is reflecting an increase in demand for exposure to upwards movements.

Reshaping Volatility Smile

Figure 1 BTC’s 30-day SABR volatility smile generated on 5th Dec (blue), 6th Jan (grey), and 12th Jan (yellow). Source: Block Scholes

- Last week we reported that the move towards a more neutral vol smile for BTC was due to a drop in the IV of OTM puts, rather than an increase in the IV of OTM calls.

- At the same time we noted that a fall in implied vol across all strikes saw the implied volatility of the entire smile drop.

- Since then we have seen a rise in the IV of OTM calls to the same levels they recorded at the beginning of December.

- However, OTM puts have remained at their lower levels, resulting in a reduction in the smile’s skew.

Less Skew towards OTM Puts

Figure 2 Hourly SABR calibrated rho at several constant tenors (legend top right) from 1st Dec 2022. Source: Block Scholes

The SABR Rho parameter corresponds to the correlation between the underlying asset and its implied volatility parameter in the SABR calibration used to model the volatility smile. It also controls the skew of that calibration towards OTM puts or calls. Positive values indicate a premium of OTM calls relative to puts, whilst a negative value indicates the market’s preference for OTM puts.

- The rise in the implied vol of OTM calls has continued the move towards a neutral smile that began last week with a drop in the implied vol of OTM puts.

- The SABR calibrated volatility smile is now reflecting similar levels of vol for puts and calls with similar deltas at 1W and 1M tenors.

- This indicates that the drop in bearish sentiment has begun to translate into an increase in demand for upside exposure.

ATM Implied Vol climbs

Figure 3 BTC hourly ATM implied volatility at 1W (blue), 1M (grey), and 3M (yellow) tenors from the 1st Dec Source: Block Scholes

- We have also seen a sustained increase in the volatility implied by ATM options at 1W and 1M tenors.

- Whilst only trading at 41%, this climb upwards marks a move the 1W ATM implied volatility away from its all-time lows.

- This is likely in response to BTC’s recent sharp move upwards above $18K, which also corroborates the new-found desire for upside exposure.

- It is unclear whether either the move in spot or ATM implied vol will be sustained, but we highlight this week’s release of December’s CPI reading as a possible driver of sentiment in both spot and vol markets.

AUTHOR(S)