The future-implied yields of both majors have fallen from the leveraged-long driven highs that we saw in the weeks before the approval of the spot BTC ETF was announced, but still remain high – above 10% across the term structure. While open interest in BTC’s perp has continued to slide to pre-ETF hype levels, ETH’s jumped on the announcement alongside its spot rally. It also dominates in volatility space, trading around 5 vols higher despite both markets resolving the inversion in the vol term structure.

Yield down, but remain high

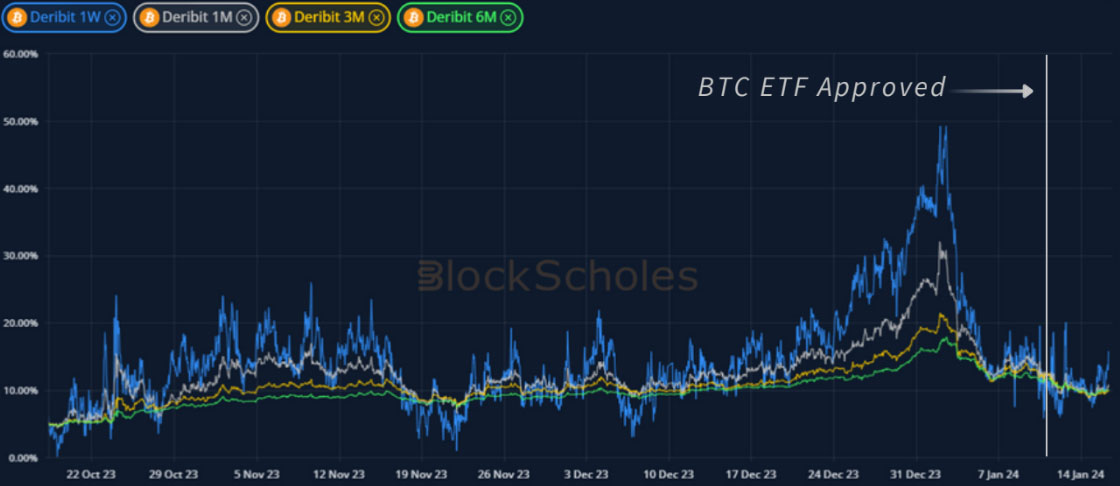

Figure 1 Hourly annualised yields implied by BTC futures prices over spot prices at several constant maturities. Source: Block Scholes

- BTC’s future-implied yields fell drastically in the days ahead of the announcement of an ETF during a spate of liquidations.

- Despite spot prices selling off by close to 8% following the confirmation of approval, yields remain high at all maturities, above 10% (at an annualised rate) across the term structure.

- Short-tenor yields are also climbing faster, inverting the term structure once again.

Perpetual Open Interest switches tokens

Figure 2 Hourly BTC (yellow) and ETH (purple) perpetual swap contract open interest (in US Dollars) over the last 6 months. Source: Block Scholes

- Focus has turned decisively to ETH’s chances of an ETF after last week’s BTC approval.

- BTC open interest continues to fall, after peaking in early December ahead of a spate of liquidations.

- While at its lows before the event, ETH open interest has since risen closer to early December levels.

- The rotation from BTC into ETH following the approval of a spot BTC ETF suggests that traders are betting on a similar approval for ETH.

- Like their future-implied yields, the funding rates of BTC and ETH perps remain strongly positive.

Inversions resolved. but ETH Vol dominates

Figure 3 Hourly SABR ATM implied volatility for BTC options at several key tenors over the last month. Source: Block Scholes

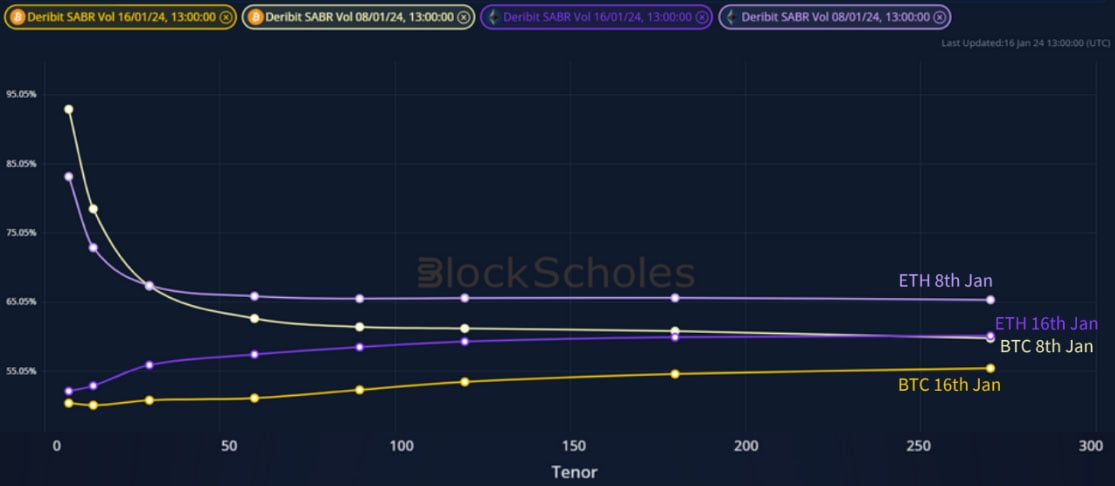

Figure 4 Term structure of SABR ATM volatility for BTC (yellow) and ETH (purple) at 2024-01-08 13:00 UTC (lighter colours) and 2024-01-16 13:00 UTC (darker colours) snapshots. Source: Block Scholes

- The inversions in the term structure of ATM volatility have now been resolved.

- But this is a fall of short-tenor volatility back to the “normal” levels at longer tenors above 50%.

- This reflects the passing of the event risk that had caused a kink to travel along the term structure as the announcement date drew closer.

- However, ETH volatility remains higher than BTC’s in the aftermath, a resurgent theme that we have seen since late in 2023.

AUTHOR(S)