The implied volatility of both headline crypto-assets – BTC and ETH – has fallen to new all-time lows across the term structure, as delivered volatility continues to trend downwards. Despite the low expectation of volatility over the next few months, traders in the perpetual swap markets of both assets have been consistently willing to pay for long exposure via the derivative contract (a sentiment we see repeated in the listed-futures markets also). We find it unusual that long exposure would be in such persistently high demand whilst volatility explores new, lower lows.

Demand for Long Exposure

Figure 1 8-hour perpetual swap contract funding rate for BTC (yellow) and ETH (purple) denominated in USD (dark colours) and USDC (light colours) over the last 3 months. Source: Block Scholes

- The funding rate of perpetual swaps ensures that the contract remains close to the spot price.

- When the perp is more expensive than spot, long positions must pay the rate to shorts, incentivising them to close their positions (and shorts to open new positions).

- The funding rate of ETH and BTC perpetual swap contracts has been consistently positive since late April of this year.

- This means that traders have been willing to pay short positions for long exposure throughout this period.

Implied Volatility Falls to New Atls

Figure 2 Implied volatility of a 1-month tenor, constant maturity option written on BTC (yellow) and ETH (purple) with their most recent levels drawn as horizontal lines. Source: Block Scholes

- Whilst matching the recent level of realised volatility (as noted in last week’s commentary), implied volatility has passed below previous lows to trade at all-time lows.

- This is at odds with the strong and consistent demand for perp long exposure.

Positivity at the Lows

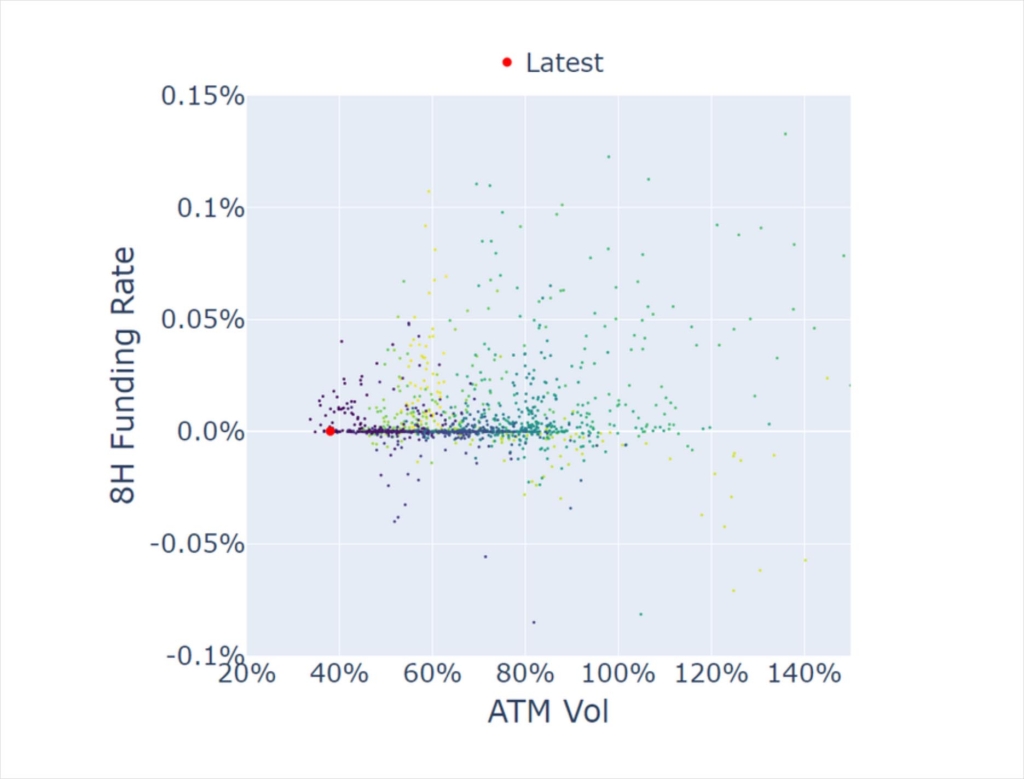

Figure 3 BTC 1-month, at-the-money implied volatility (x-axis) against BTC perpetual 8-hour funding rate (y-axis), with data points coloured by date (darker colours more recent). Source: Block Scholes

- Now is the first time that we have seen volatility levels trade at such low levels.

- At the same time, we have seen funding rate remain consistently positive (note the dark points above 0 on the y-axis on the left side of Figure 3).

- We find it somewhat odd that traders are willing to pay such a consistently high rate for long exposure despite such low expectations of volatility.

AUTHOR(S)