Despite the increasing downward pressure caused by interest rate hikes in main capital markets, the falling crypto prices are further hampered by retained liquidity.

The crypto market is in one of its most stable periods ever, both in terms of price and volatility. However, as bearish sentiment dominates the derivatives market, the probability that the price will continue to decline in the future remains high.

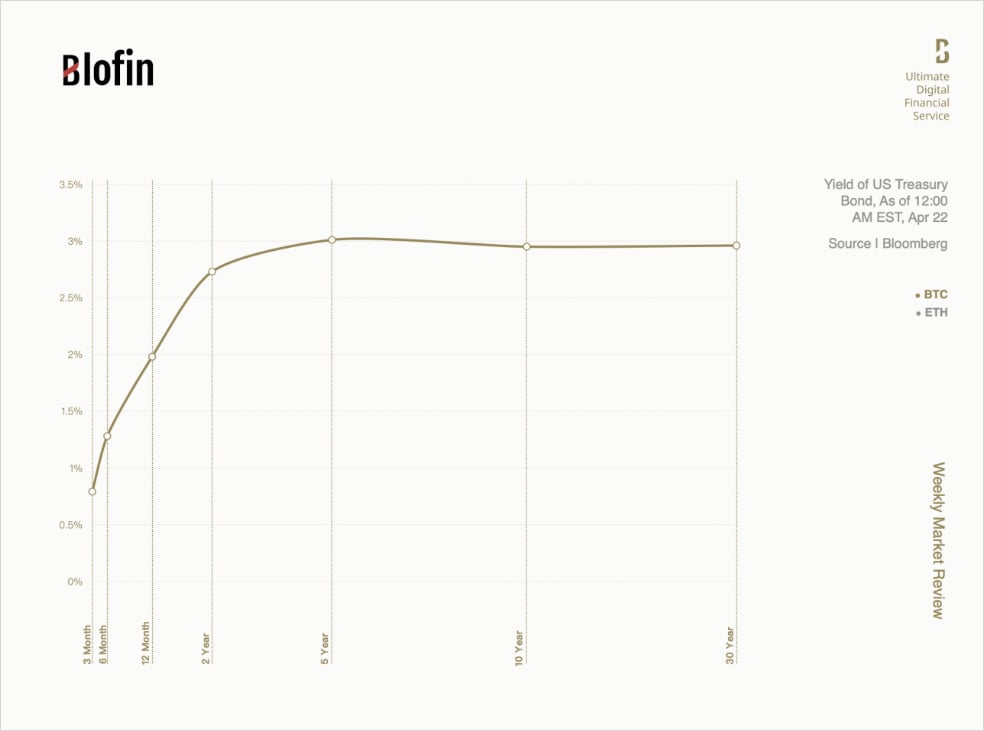

As the prices of low-risk assets such as bonds move into the desired range, the reallocation of liquidity will be an essential factor in the performance of crypto assets after April.

Prices Stabilized With Bearish Expectations

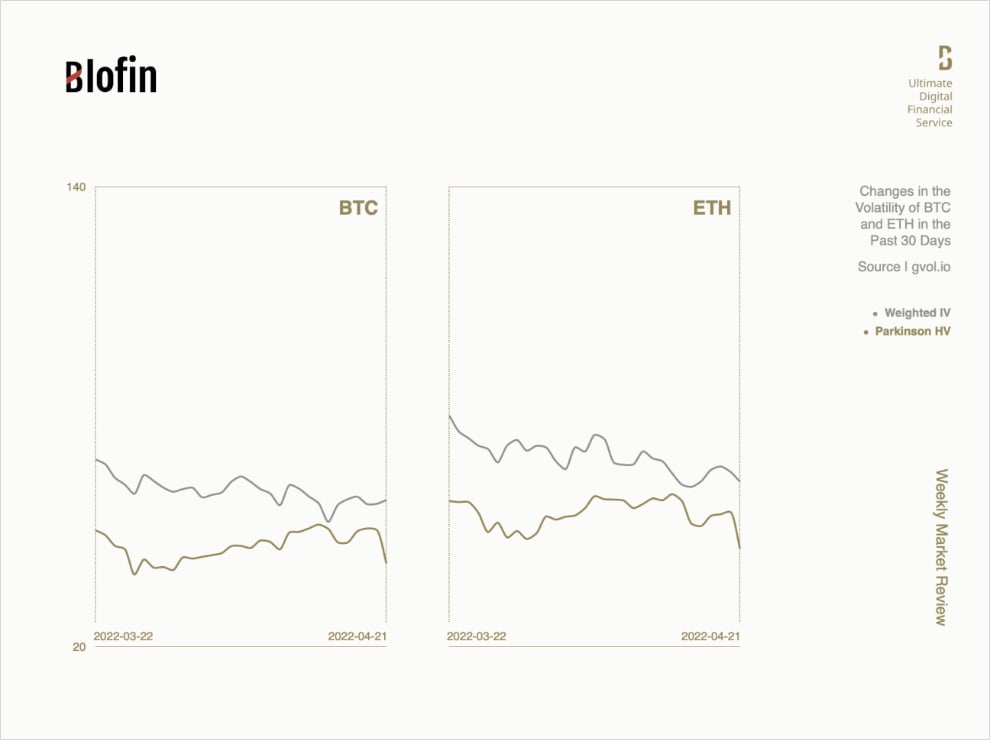

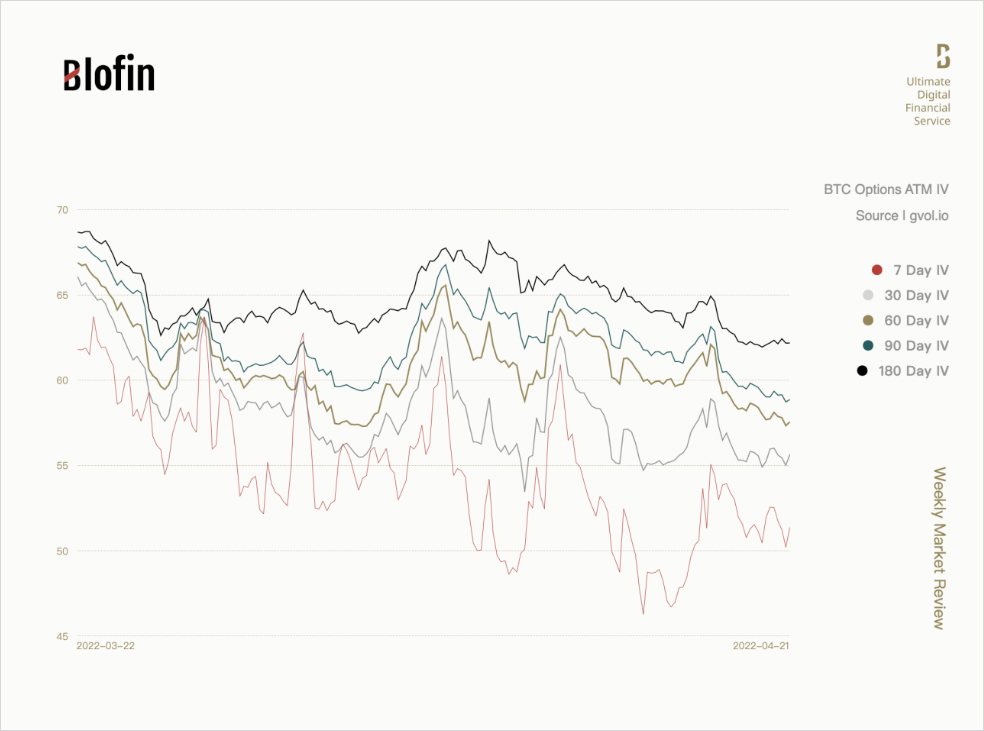

For recent crypto investors, $40,000 and $3,000 are two all-too-familiar prices: the price of BTC and ETH have oscillated around them for over a week. The steady price movement has kept historical volatility at its lowest point since April 2021, while implied volatility is at record lows as investors continue to lower their expectations of price movement. It seems that the “turbulent times” when IVs were often above 100 are gradually leaving us.

Many investors traded on volatility in April, and most took long positions. However, volatility has not returned to its high level as expected, and investors are still waiting for volatility to rise. In contrast, those who took the risk of selling volatility got more profit from the time value (the “theta”).

However, it seems that volatility cannot be further down. Volatility in the crypto market has shown signs of recovery since April 16, but the volatility curve has remained relatively stable and even “motionless” for a few days. For investors who bought volatility earlier, there seems to be a long way to go from making profits.

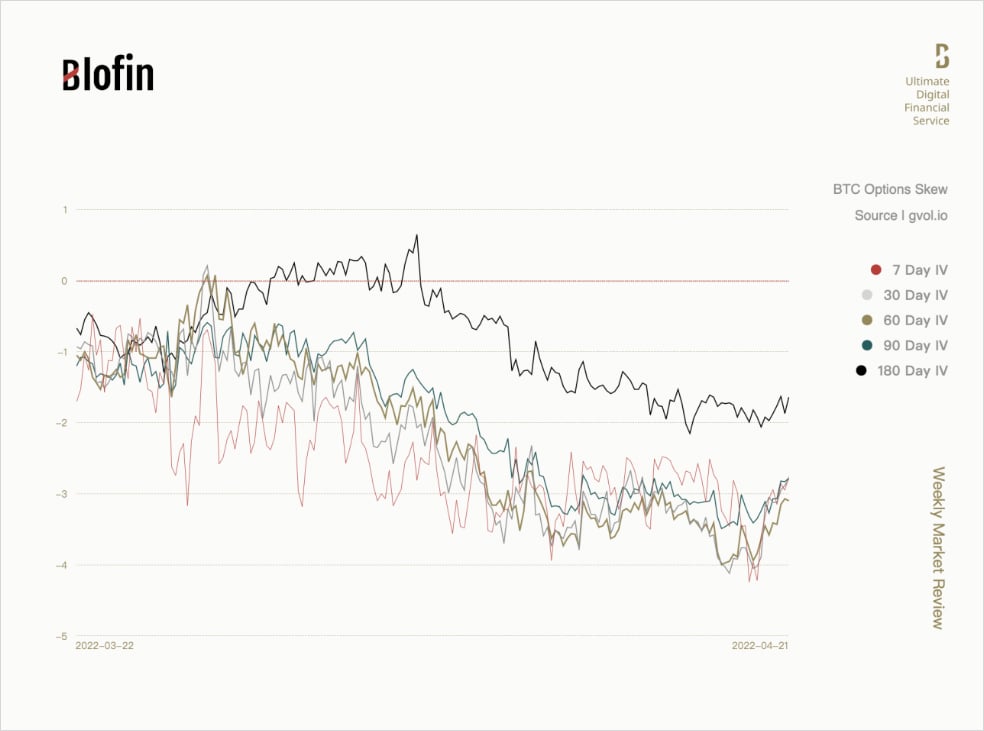

The derivatives market remains strongly bearish. Since the beginning of April, options skew has been declining for almost two weeks, both for front-month and far-month options, with puts maintaining a significant positive premium to calls. Far-month futures premiums have also moved down significantly compared to the beginning of April. Macroeconomic pressures are making it difficult for crypto investors to remain optimistic.

May Preview: Is the ‘’Powell Shock’’ in the Crypto Market Coming?

The “Volcker Shock” of the late 1970s and early 1980s still haunts the capital markets. Under the influence of Fed Chairman Volcker’s massive interest rate hikes, DJIA fell by approximately 30% in just 15 months. Forty years later, the Fed faces a similar dilemma to the Volcker era: inflation is about to “explode”, and the existing modest interventions have limited effects.

For current Fed Chairman Jerome Powell, the only choice is to continue to raise rates more aggressively. New Zealand and Canada have already raised rates by 50 basis points, and interest rate traders are almost done pricing in a 50 basis point hike by U.S Federal Reserve. Even the dovish ECB and the Australian Fed have moved up their plan to hike rates. It is not difficult to foresee that the major capital markets will complete at least two rate hikes in 2022, and the Fed may even raise rates consecutively.

Judging by the movements in the crypto market before and after the first rate hike, investors in the crypto market can be said to be relatively well prepared for liquidity contraction. Considering that short-term crypto holders and speculators are already largely out of the market from November 2021 to January 2022, the majority of investors in the spot market today are long-term holders. The presence of many long-term holders allows retained liquidity to support the current price level, thus weakening the negative impact of the rate hike.

It is worth noting that while institutional investors in the spot market remained relatively silent in April, the retail investors were one of the key drivers of price increases and decreases. During the trial of the Coinbase NFT market on April 20 supports this claim: just around the market’s opening, many retail investors traded and exchanged a large number of BTC, ETH and other cryptos in exchanges like FTX for buying NFTs. The large-scale small transactions pushed prices up but did not significantly affect sentiment in the derivatives market, especially options markets.

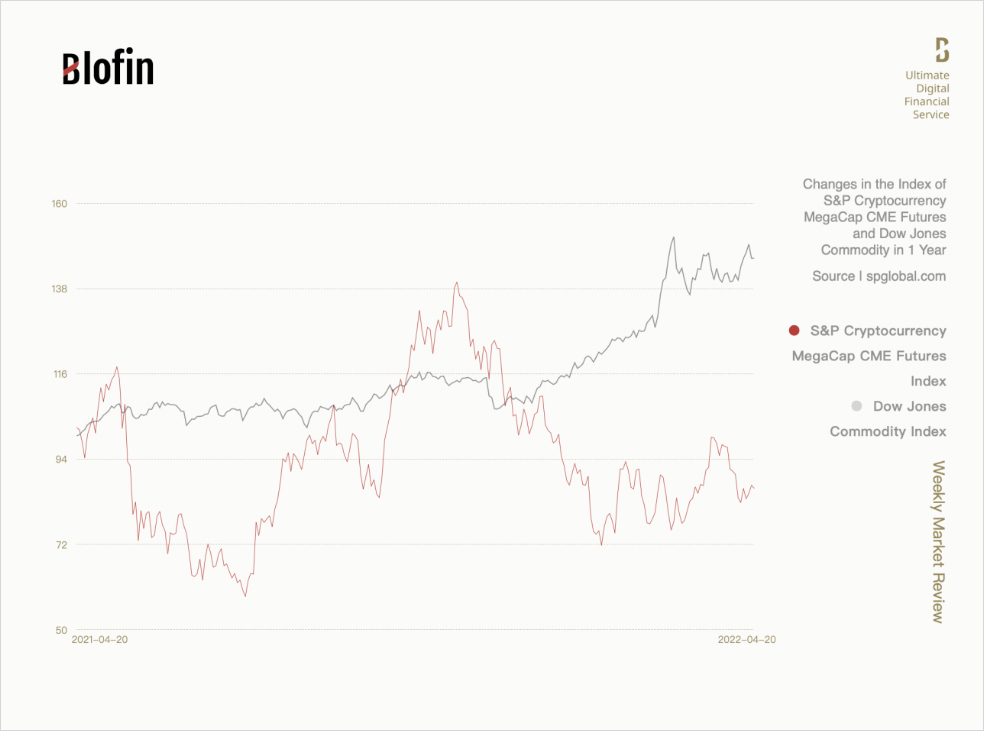

The high yield of the crypto market compared to traditional markets is one of the reasons why institutional investors are not taking action. For early entrants, today’s spot prices can still allow them to maintain considerable profits. At the same time, for speculators, the high volatility and liquidity of the crypto market create many investment opportunities that are superior to traditional risk assets such as stocks and offer relatively good returns.

However, the rate hike in May, the subsequent successive rate hikes, and the possible shrinking of the balance sheet may cause some institutional investors to consider whether to continue to lock up liquidity in crypto assets. Several potential factors are driving this.

The potential returns of other major asset classes are rising. Since 2021 the commodity markets have entered a bull market due to international turmoil and economic uncertainty, while the prices of necessities, such as petroleum and food, have continued to rise and will continue to do so. This means that passive investments in commodities can also yield some excess returns and provide more choices for institutional investors.

Potential yields on risk-free assets are rising. With the 10-year U.S. Treasury yield topping 3% for the first time, the timing for buying at the bottom of U.S. bonds has begun to appear. With the orderly implementation of the Fed’s policies, investors’ confidence in the Fed’s ability to control inflation is increasing and is reflected in the real yield on U.S. bonds (i.e., the TIPS yield). Once risk-free returns reach a relatively reasonable level, some institutional investors may readjust their risk appetite and invest the liquidity stored in risky assets into risk-free assets.

The possibility of buying at the bottom of high-quality risky assets cannot be ruled out either. Due to the continuous decline of US stocks, the attractiveness of undervalued stocks to investors has begun to increase. Although the likelihood of such an event is low in the near term, investors’ choices between risk assets will gradually have a significant impact on the crypto market as the Fed continues to tighten its policy.

Regulatory risk. As a result of the conflict in Eastern Europe, some crypto-related companies and individuals in Russia, and something like this will continue to happen. Although crypto assets are highly resistant to regulation, the additional cost due to the regulation will also have a negative impact on the market.

Once Powell takes more aggressive action in May, the likelihood of institutional investors leaving the crypto market and moving to other markets increases. For crypto market, a significant reduction in retained liquidity may lead to a significant increase in volatility again–This is the “Powell shock” that we may be facing. For long-term holders of crypto assets, this might be a good time to enter the market and buy the dip. But for derivatives investors, it’s time to prepare for the impact.

In late April, inflation-related data from the major capital markets will be released. Before that, the statements of the Federal Reserve, European Central Bank, and Bank of England governors will reveal some clues about the liquidity contraction that will be implemented in May. It is unlikely that this information will have a significant impact on the crypto market in April, but there is no doubt that the “plateau” of the crypto market is coming to an end.

AUTHOR(S)