Since its inception over 11 years ago, Bitcoin’s use cases and narratives have shifted significantly, from peer-to-peer cash to anonymous darknet currency to digital gold just to name a few. Throughout this journey, one core piece arguably has not changed: its decentralized approach to finance. As Satoshi Nakamoto alludes to in the introduction of the original Bitcoin whitepaper.

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust-based model.

The whitepaper carries on proposing a system for decentralized electronic transactions, introducing the concepts of blockchain and proof of work. While Bitcoin has made remarkable progress since then, it still has not been able to gain traction as a trustless tool for financial services. This is evident by the lightning network’s low adoption and increasing concentration, where 10% of nodes hold 80% of the Bitcoin staked, according to a research paper from the University of Zurich. Similarly, the declining transactions and supply of Tether (USDT) on Bitcoin’s Omni layer highlight the issues to conduct financial services in the Bitcoin blockchain. This is not to discredit Bitcoin—which I personally believe to have high potential as a store of value—but rather to emphasize the opportunity to expand its strong decentralization and security beyond its current use cases.

In parallel, Ethereum and other smart contract protocols have grown ecosystems around the concept of programmable money. Inspired by Bitcoin’s original ethos, a wave of new decentralized services are taking Bitcoin’s disruption of financial services a step further. Being open-source and permissionless, Ethereum has enabled an ecosystem of decentralized applications to flourish on top of it. While the term DeFi may be relatively new, I would argue the space has been led by, and would not have been made possible without Bitcoin. As these protocols reinvent finance, Bitcoin’s role within them has the potential to grow in a symbiotic relationship pushing crypto forward.

Bitcoin’s Journey on Ethereum Starts with Incentives

Since Bitcoin cannot be easily moved cross-chain, tokenized versions of Bitcoin are available on the Ethereum blockchain. These ERC-20s are pegged 1:1 to the price of BTC being backed by the equivalent amount of Bitcoin. The first recognized Bitcoin ERC-20 to launch was Wrapped Bitcoin (wBTC), which was released in January 2019. Wrapped Bitcoin is led by a consortium akin to USDC’s Circle. While using wBTC does require trust in the custodians backing the token, trustless alternatives are emerging and growing quickly such as renBTC and tBTC.

At the beginning of 2020, the market capitalization of wBTC was under $5 million despite launching a year earlier. The low adoption during its first year was likely due to the lack of integrations and functionality thus, offering no clear benefit over Bitcoin at the time. This started to change as DeFi protocols integrated tokenized Bitcoin ERC-20s and provided user services on top of it. MakerDAO’s acceptance of wBTC as collateral for DAI loans in May was a breakthrough for Bitcoin on Ethereum with several protocols proceeding to offer financial services on tokenized Bitcoin. These integrations have been mutually beneficial as they increase the liquidity of DeFi protocols while locking Bitcoin supply.

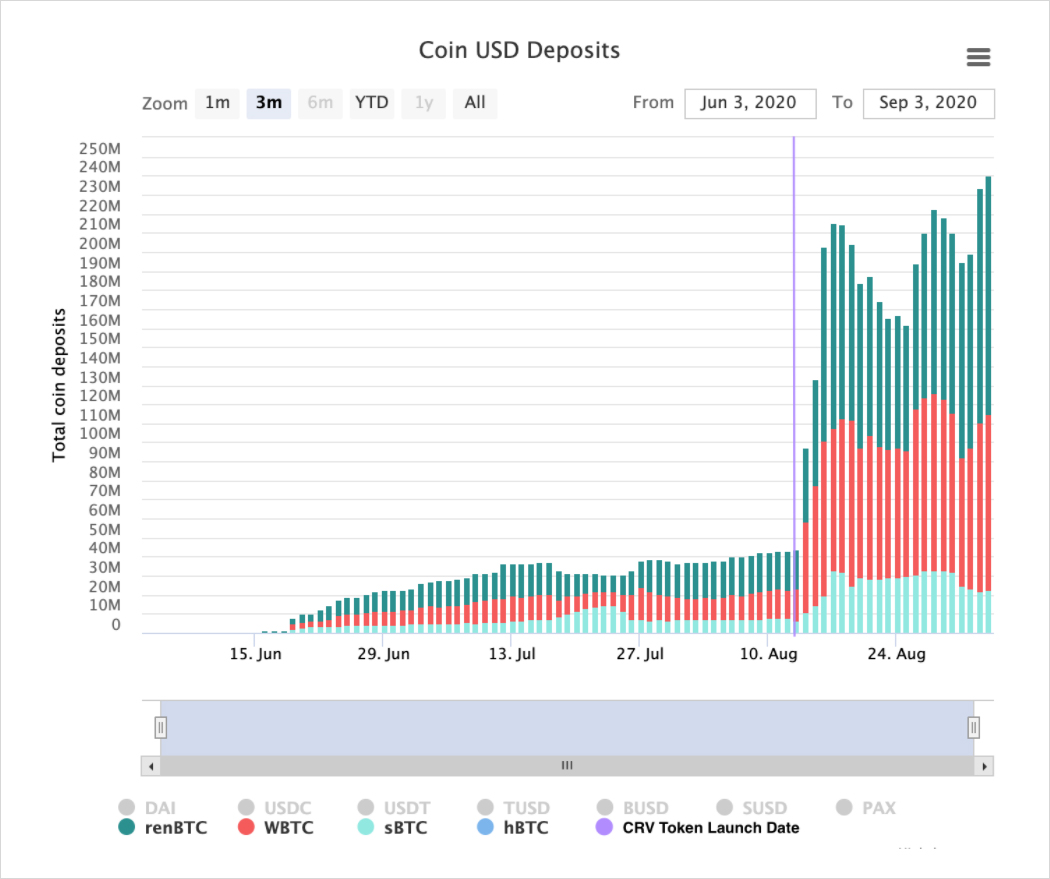

While being able to get loans with your Bitcoin drove some demand for wBTC, being able to earn compound interest on top of it is what ignited its parabolic growth throughout the last few months. In particular, the sBTC/renBTC/wBTC Curve pool drove a substantial amount of Bitcoin onto Ethereum especially following the unexpected CRV token release. Within four days the Bitcoin supplied to Curve quadrupled from $45 million to over $200 million.

Source: Curve.fi Stats

This is particularly remarkable when considering that tokenized Bitcoin deposits grew at a faster rate than stablecoins deposited to Curve. As a result of this and other similar incentives, the amount of tokenized Bitcoin locked on Ethereum has reached $800 million, or roughly 0.38% of the circulating supply.

While the sustainability of Curve’s 50%+ APY on tokenized Bitcoin is still up for debate, the protocol has successfully generated a positive feedback loop. This starts with users supplying liquidity seeking CRV liquidity mining rewards, thus growing the value locked in Curve. By doing so, the potential value accrued by CRV governance tokens increases, in turn incentivizing more liquidity to be supplied. Additionally, this theoretically drives demand for the assets earning such yields. Bitcoin, therefore, should also stand to benefit as investors that pursue these rewards are also locking their tokenized Bitcoin, making it less likely to be sold.

Expanding Tokenized Bitcoin Beyond Whales & Early Adopters

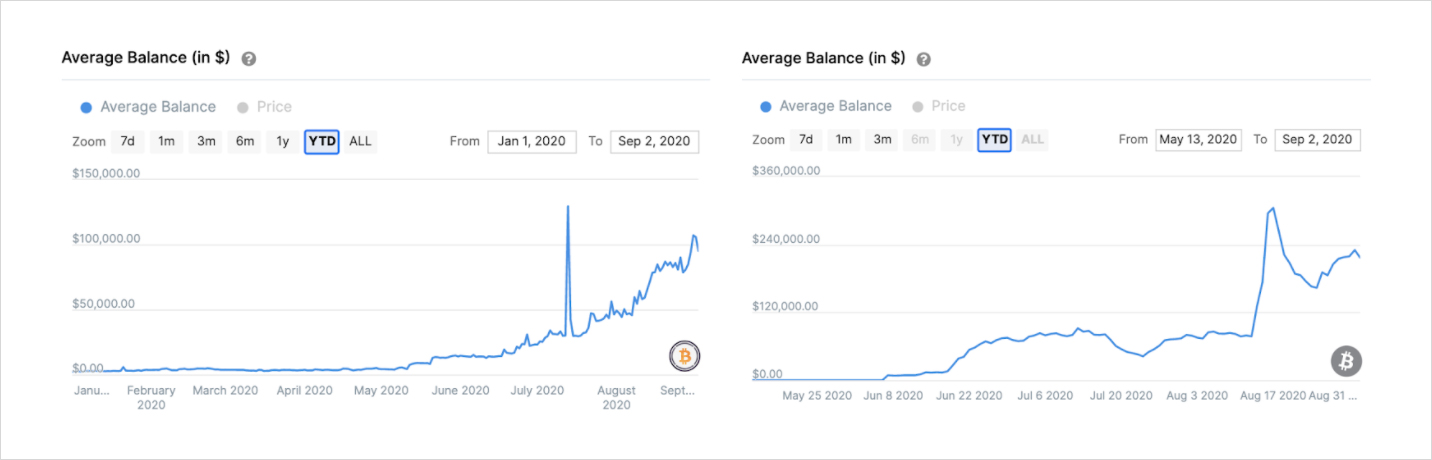

By analyzing key on-chain metrics from IntoTheBlock, we can determine that the growth in tokenized Bitcoin has largely been driven by whales and institutional investors. This is reflected in the average balance of a wBTC and renBTC holder reaching $95,000 and $217,000 respectively.

The adoption by large players may come as no surprise given the high gas fees users have to incur to tokenize their Bitcoin and deposit into DeFi protocols. Partly because of this, the total number of addresses holding these tokens has not grown as significantly, with only 4,600 and 750 addresses holding wBTC and renBTC respectively. Another potential reason is that aside from early adopters, the average retail user, in general, takes longer to trust and learn how to use these yield-generating Bitcoin alternatives.

As Ethereum 2.0 approaches and DeFi protocols start integrating layer 2 solutions, gas costs are likely to decrease, enabling users to tokenize smaller amounts of Bitcoin. Additionally, innovations like the new USDC “meta-transactions” feature—which allow users to transfer ERC-20 tokens without having to own ETH—are expected to reduce friction points for new users. While it is unclear how long these two will take to become implemented, they will certainly streamline the onboarding of Bitcoin into Ethereum.

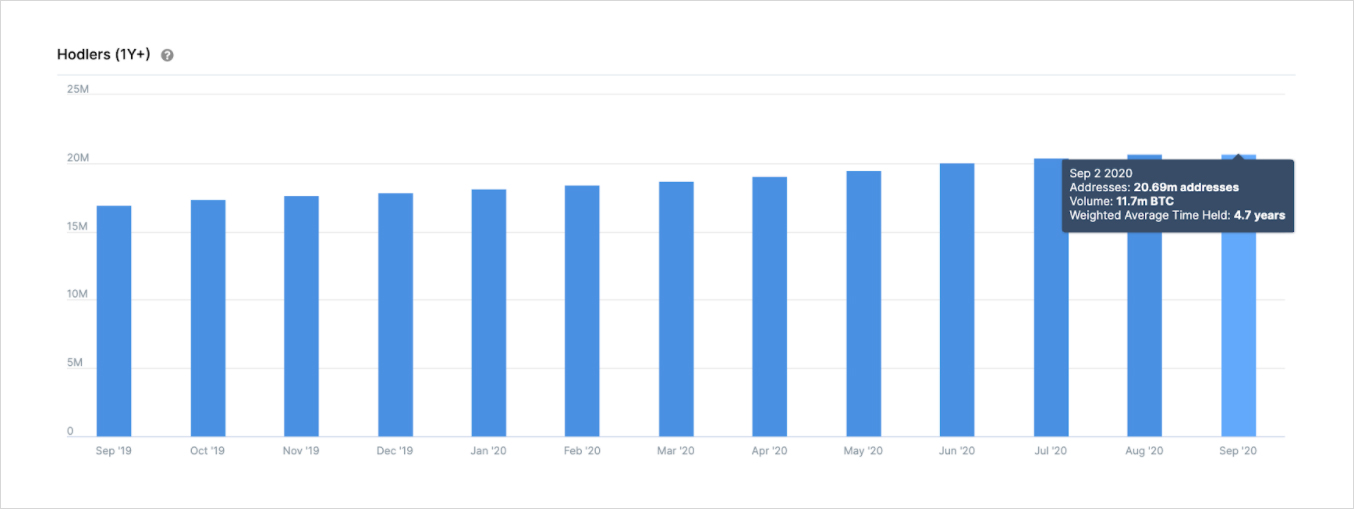

With the crypto space increasingly shifting its focus into high yield opportunities, I suspect that a large percentage of Bitcoin hodlers will join the trend. By looking at Hodlers indicator, we can observe that 20.69 million addresses have been holding a total of 11.7 million Bitcoin for over one year. Most of these are unlikely to be earning on their positions as interest-bearing DeFi and CeFi solutions are still relatively new.

Source: IntoTheBlock’s Bitcoin Ownership Metrics

This indicates that nearly two-thirds of all Bitcoin holders of the circulating supply have not moved it over a year. I expect this number to decrease in proportion to the total as more long-term holders are enticed by DeFi’s high yields. Of course, there are risks and learning curves associated with these protocols so I still foresee the majority of Bitcoin users simply hodling over the next few years. This, however, is likely to be a multi-year trend as the industry and its use cases for Bitcoin evolve.

Final Thoughts on the Road Ahead

Aside from existing DeFi protocols, demand for tokenized Bitcoin over the next decade is likely to come from projects that do not yet exist given the fast-pace of innovation. Due to DeFi’s permissionless nature, it will become easier for protocols to offer financial services supporting Bitcoin ERC-20s. Along with this, though, the risks of using Bitcoin on Ethereum are likely to increase in the short-term, especially if we continue to see protocols deploy unaudited smart contracts that manage to attract millions in capital overnight. Unfortunately, I’m inclined to believe that sooner or later there will be a hack exploiting access to tokenized Bitcoin that may halt its progress for at least a few months.

Beyond DeFi, I expect other sectors within Ethereum to come up with different reward schemes to kickstart hyper-growth cycles like the one we are currently experiencing with yield farming. Within these, tokenized Bitcoin should emerge as a potential incentive, rewarding users for providing value-added services that ideally set up positive feedback loops for these protocols. As explained earlier, these would be mutually beneficial, bringing Bitcoin demand while encouraging adoption for protocols on Ethereum.

Overall, Bitcoin has come a long way since Satoshi’s original whitepaper, sprouting many previously-unimaginable use cases. With DeFi being the driver for Bitcoin on Ethereum, I expect this trend to accelerate as costs are lowered and friction points are removed. As Ethereum takes the lead as the main platform where these protocols are built on, I would suggest the Bitcoin community to embrace them rather than sticking to zero-sum tribalism. After all, decentralizing finance has been a key objective since Bitcoin’s inception.

Lucas Outumuro

Senior Analyst at IntoTheBlock

AUTHOR(S)