“Take it Easyyyyy” – The Eagles

We saw a strong recovery in bitcoin price over the past two weeks, with a sharp rally up from the bleak depths of sub 80k to the joy of 97K this morning.

The price has been buoyed by a major buying spree from Strategy of nearly $2 billion and positive tariff news over the past few days, especially around a scheduled meeting between China and the US later this week in Switzerland.

Yet, despite the tough talk from China, the US, and others on fiscal strength, we’ve seen various methods of adding liquidity into the economy.

At least in the United States, quantitative easing is anathema to responsible government. So we can’t call it that. But, as Juliet knows about Romeo, a rose by any other name is just as sweet. Despite what we call things, they are what they are. With attention on rate cuts as the barometer of FED action, other methods must be used.

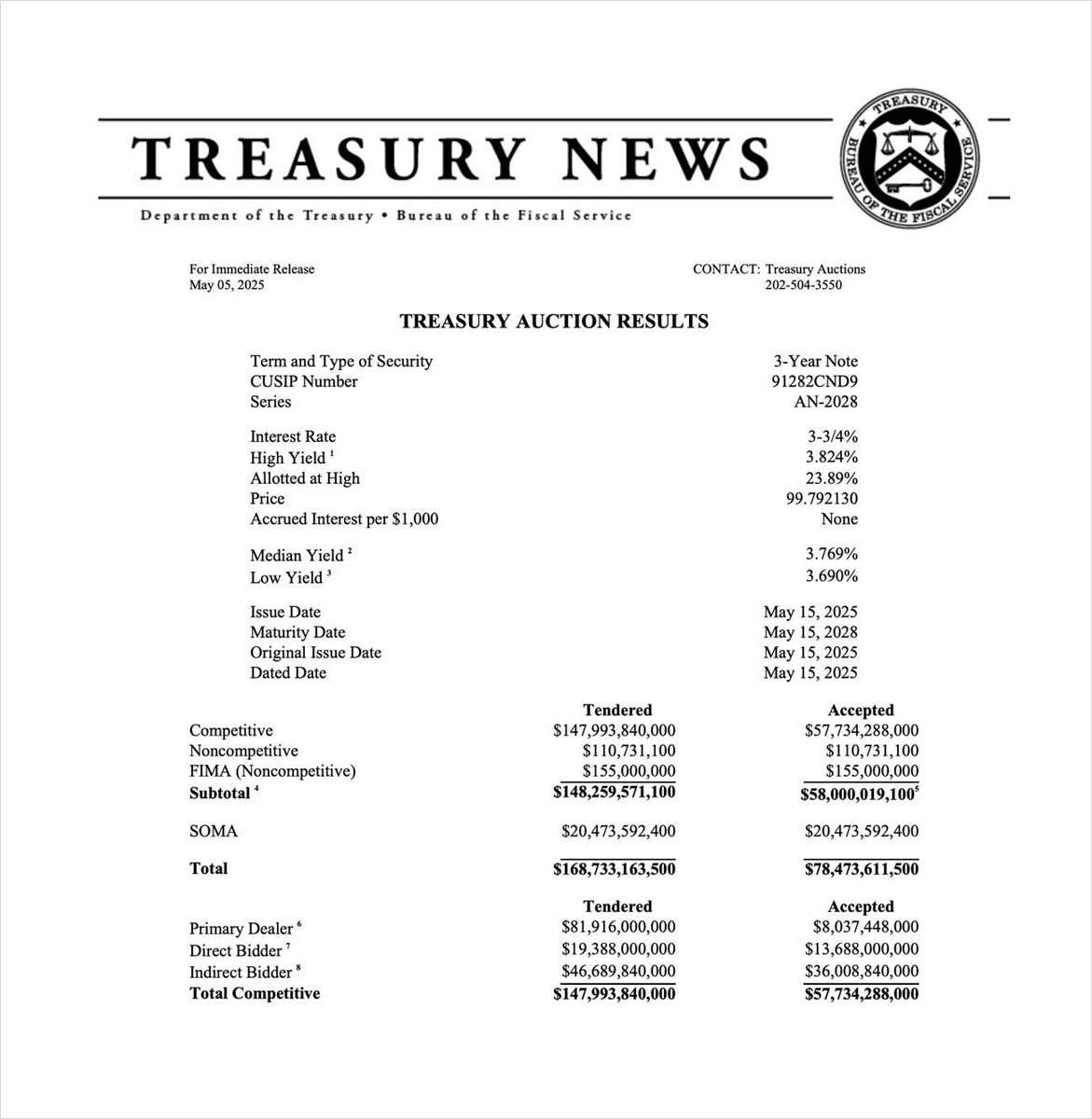

Instead, they have started buying bonds from the treasury, with over $34.8B of bond purchases over the past two days. The most purchased since 2021, at the height of COVID money printing. Of $78B in bonds sold on Monday, $20B came from the FED. “SOMA” on the document below stands for “System Open Market Account,” which the Federal Reserve manages.

In China, quantitative easing is not a politically fraught issue. As such, today, the head of China’s central bank, PBOC, rolled out a package of changes to reserve and lending requirements of banks, essentially freeing up more money and forcing the banks to dish it out – Source.

As a result of expectations of a trade deal being reached between the US and China and perceptions of a weakening dollar, asian currencies, most notably the HK dollar, have rallied.

As a result, the Hong Kong government has had to inject liquidity to keep the price peg within targets, printing $73.3B $HK (~$12B USD) the past two days. These second-order effects are often what defy expectation and create unpredictable results of seemingly straightforward interventions.

I’m reminded here of Taleb’s books, Black Swan and Antifragile. He describes how centralized economies essentially sweep financial issues under the rug with changes in policy rather than let the system adjust via free markets. As a result, you get a gradual buildup of little risks that eventually cascade into a major blowup.

The issue becomes that of incentives. It’s hard for leadership to allow for short and medium-term suffering and uncertainty in the name of an abstract ideal of resilience, while the negative consequences of policy changes may not emerge for decades.

I’m also reminded of the writing and speaking of Daniel Schmachtenberger. He thinks about how nation-state game theory puts us on existentially destructive, sociopathic paths that no one wants, but no one can stop. Nuclear weapons, certain aspects of AI, and fiscal policy all fall prey to this inescapable force – Source.

Money printing papers over fractures in financial systems. We saw that the US treasury market is potentially weaker than we thought over the past few weeks, so now the FED is buying.

China is suffering due to tariffs, so now they are loosening monetary conditions. Somewhere in all that is a fatal issue that will eventually come to light. Regular people will suffer as a result.

Despite all this, conditions, though volatile, have been pretty ideal for bitcoin. BTC has shown resilience as a hedge asset amidst declines in equities, faith in centralized currencies has degraded, global liquidity is on the rise, and positive tariff news is imminent. I worry for the instability of the planet, but am glad I at least own some bitcoin amidst it all.

View original post on X here.

AUTHOR(S)