“Don’t Tell ‘Em” – Jeremih

Although the economic headlines we have read recently revolve around Trump’s frustration with Powell and the Fed not cutting rates more quickly, other measures already underway have started to produce the same effect. Specifically, two changing policies are adding liquidity to the market.

First, on June 25th, the FED approved a plan to reduce the “enhanced supplementary ratio.” In essence, the reserve requirements banks must meet against low-risk assets, namely Treasuries, have been reduced from a fixed % to a lower percentage depending on the size of the bank. This essentially frees up money for banks to buy treasuries.

These limits were previously imposed after the 2008 banking crisis to ensure banks could not get overleveraged. Now, the FED is easing these restrictions, acknowledging that some aspects may be overly restrictive without much benefit.

Additionally, the Treasury Department has expanded its Treasury buyback program. These purchases inject additional capital into the economy without significantly disrupting markets.

In essence, the Treasury Department is becoming the buyer of last resort. Demand for treasuries at auction has been on the decline, especially for longer-dated notes. Groups are losing faith in the long-term stability of the dollar and the ability to tame inflation.

What we are seeing is headline rates staying unchanged by the Fed, but more subtle actions being taken to ease conditions by both the Fed and the Treasury Department. I suspect this is an intentional compromise struck by the FED and the executive branch.

Trump can rail against Powell for his political benefit, while both groups do what they can to keep the economy vibrant, waiting for greater stability to enact rate cuts.

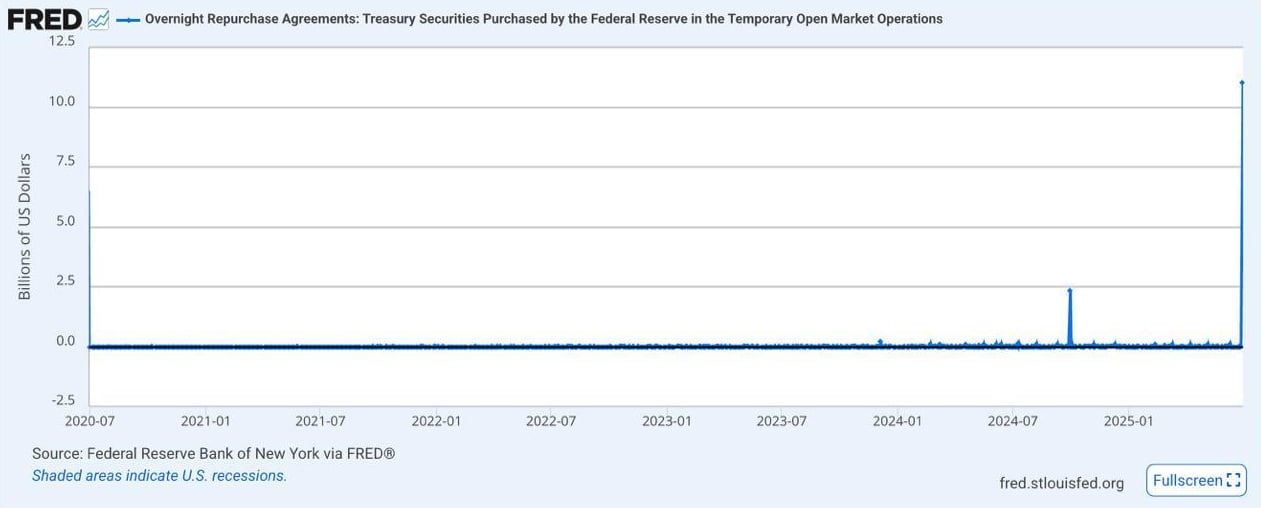

We also observed an unusual spike in the reverse repo facility leading into quarter-end. There was high demand for short-term liquidity. This is not entirely unusual, but, as you can see from the chart below, the scale was quite large compared to the past few years.

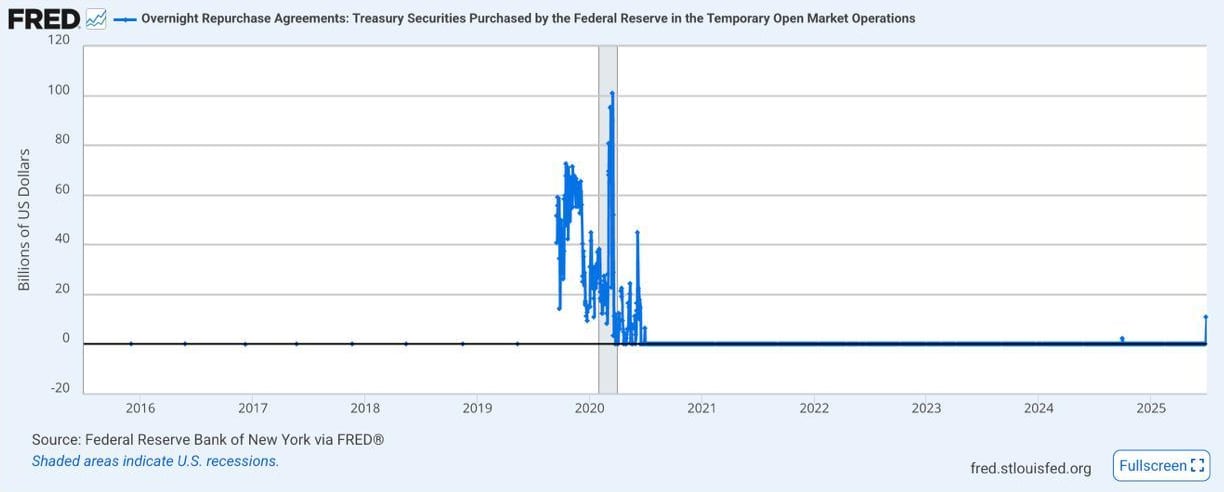

However, it’s still a blip on the radar compared to the COVID era, as shown in the graph below.

I take this to mean somewhere in the system, liquidity conditions are getting too tight, though we haven’t seen this entirely surface in the markets yet.

A new FED chair will be named in the near term. Without a doubt, they will be more dovish on rate cuts. I see this dynamic as a bullish headwind. All roads lead to money printing, which is sure to benefit Bitcoin.

View original post on X here.

AUTHOR(S)