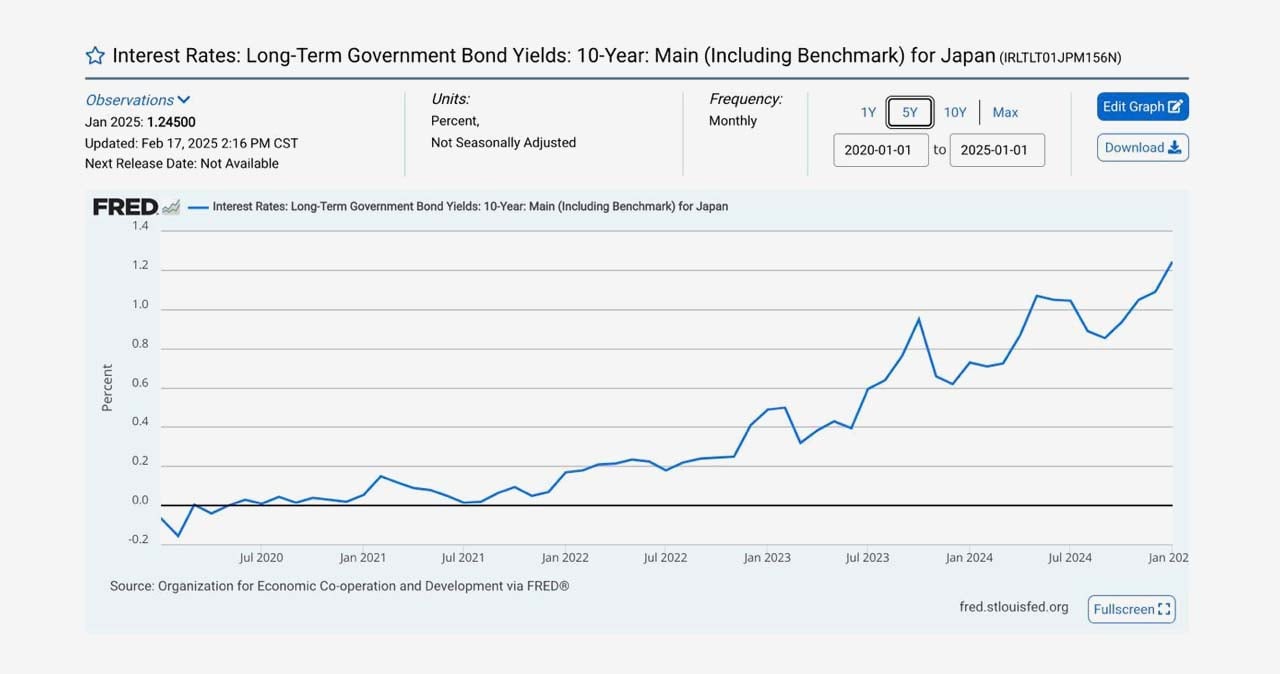

Amidst crypto volatility, government strategic reserve announcements, and liquidation cascades, the chart attached may have more impact on the future of crypto than anything else. Since the 1970s, the Yen “carry trade,” whereby investors borrowed yen for 0% or very low interest and then used the liquidity to purchase higher-returning assets, has fueled global liquidity, peaking at over $1 trillion before the 2008 financial crisis.

As we can see in the chart, the 10Y rate has increased over the past 5 years from 0% to ~2.5%. This stems from tightening monetary policy by Japan’s Central Bank (lessening yield curve control intervention), growing inflation in Japan (like everywhere), and rising yields on bonds from other central banks.

As the gap between US bond rates and Yen rates narrows, the trade becomes less attractive to investors as they seek to maximize returns with as little risk as possible. As a result, global liquidity for risk assets shrinks. And what’s everyone’s favorite risk-on asset LARPing as a store of value…bitcoin!

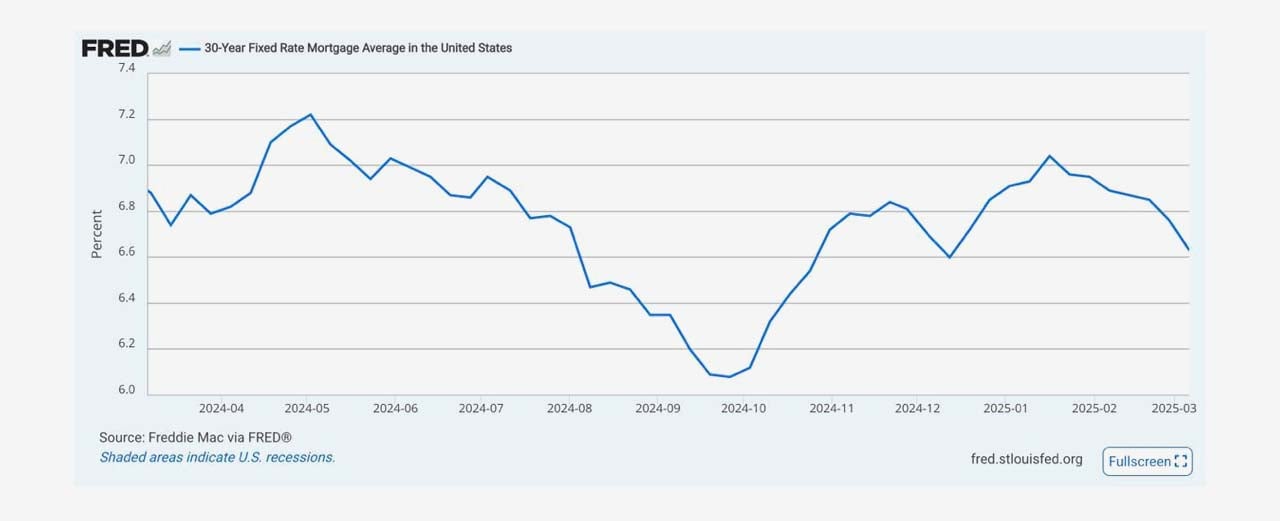

On the flip-side, net global liquidity, largely due to China and the US, is increasing. This may counteract some of the effects of the Yen trade’s unwind. In addition, as the US gets its own rates and inflation under better control, which has already started to incrementally trend down over the past few months (see chart below), it will reduce pressure on other central bank bonds and slow rate growth on Yen borrow.

In addition, this morning’s CPI print fell slightly under expectations, showing CPI at 2.8% v 2.9% expected. This suggests taming inflation and increased the likelihood of FED rate cuts. The market has repriced expectations of rate cuts this year from 1 to 4 in recent weeks.

In the short-term, reduction of the Yen carry-trade in size and an increase in BoJ Bond rates is a good proxy for risk asset appetite (and it doesn’t look to be trending in our favor). However, we may have likely reached the short-term peak of this trend and it may be a good time for a risk reversal trade. With a lot of uncertainty in the markets, we don’t see it as a great time to make outsized bets, but prefer a wait-and-see approach.

View original post on X here.

AUTHOR(S)