With Trump making his announcement a day earlier than most expected, implied volatility has fallen precipitously, suggesting that traders don’t see additional catalysts that will push prices out of the current range.

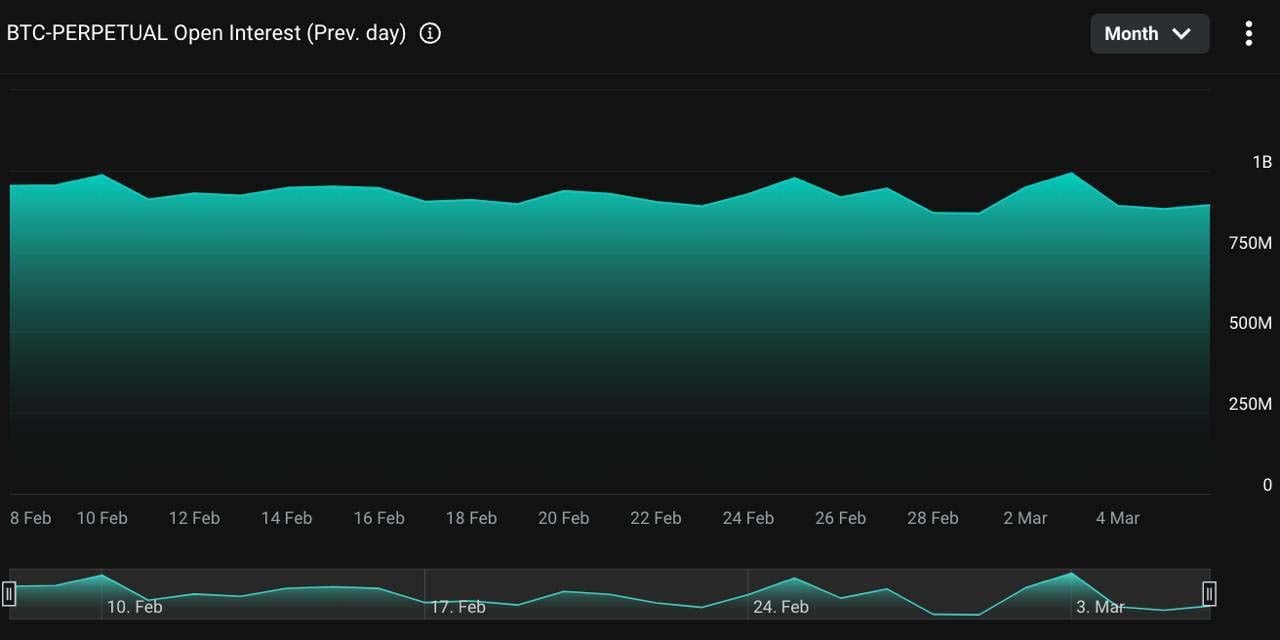

Open interest on BTC-Perpetual Futures has remained largely unchanged. with bitcoin investors unwilling to make outsized directional bets into these binary events. For perspective, perp OI was about 55% higher in January, peaking at nearly 1.4B contracts on Jan 19th.

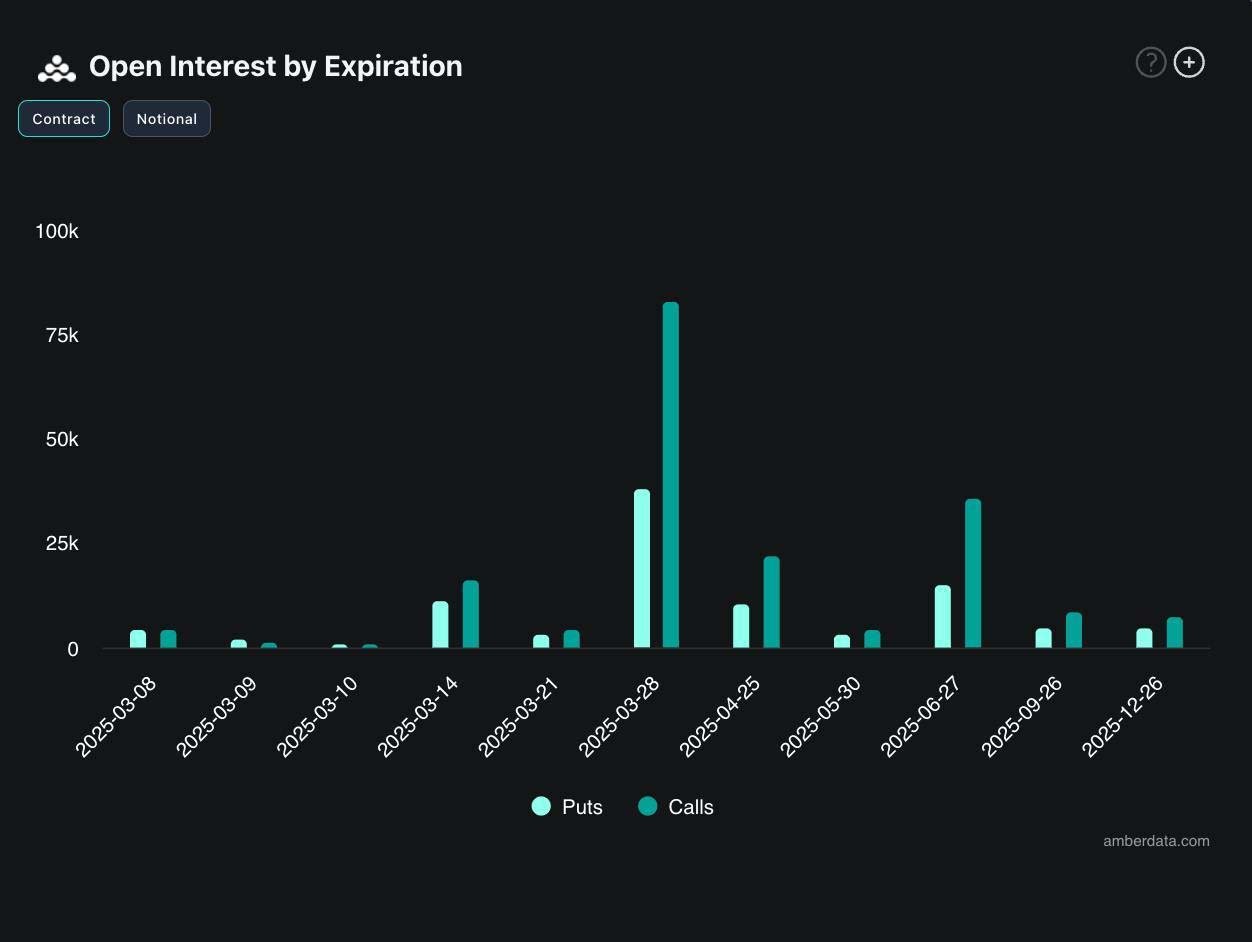

Open interest on options contracts remains focused on the large quarterly March expiry, which is expected given the anticipation most traders had for the BSR announcement in Q1. Following an enthusiastic rally into the January 20th inauguration, Trump has left investors feeling mostly unfulfilled, with each successive crypto announcement having diminishing impact on spot prices.

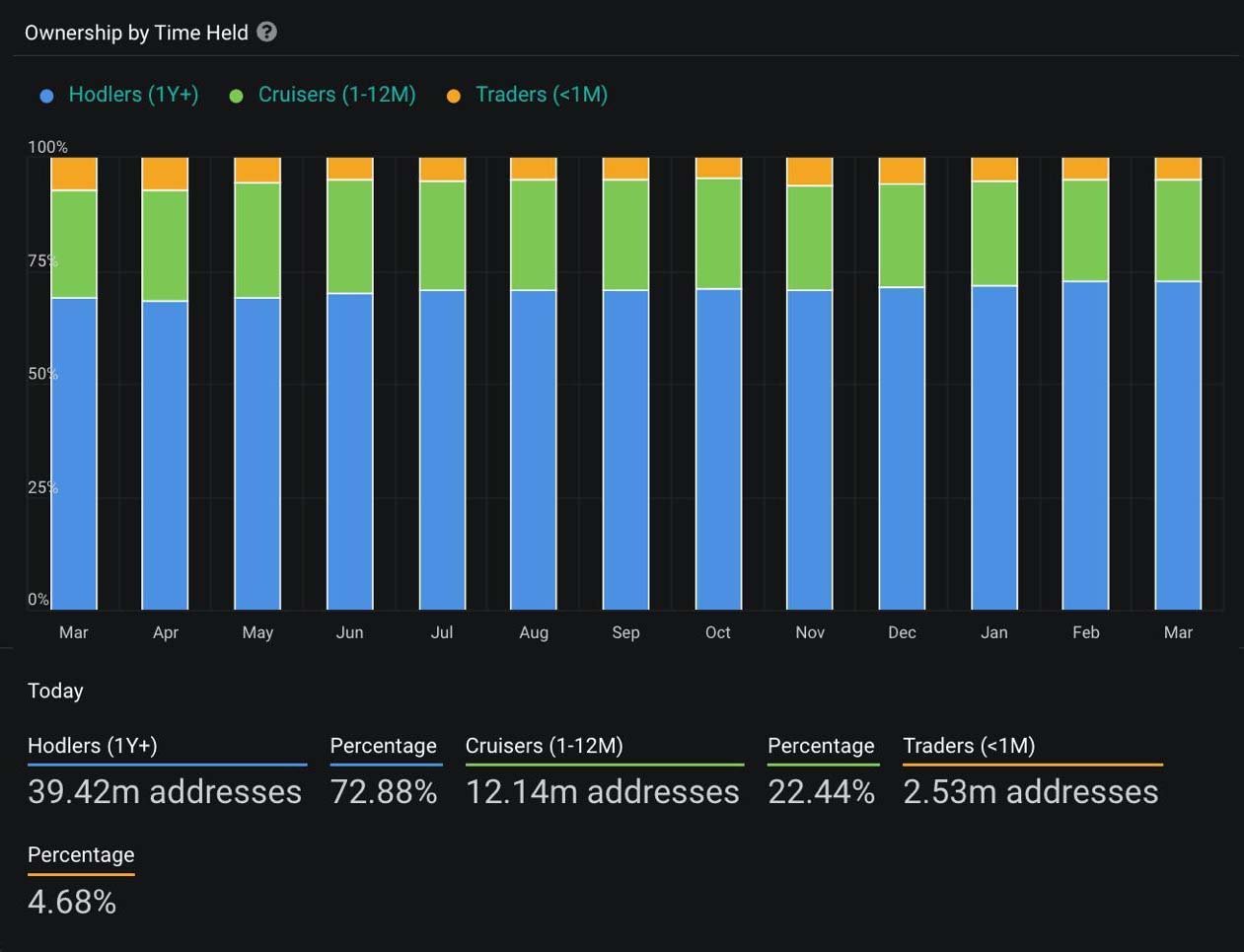

We can see also that long-term hodlers continue to tick up each month, with about a 3.5% increase in this category over the past year. This suggests a maturing asset class that isn’t easily shaken out by short term volatility. I would expect this number to continue as ETF investors and sovereign’s purchases mature past the 1 year mark.

In short, what is surprising is that not much is surprising. The SBR announcement has come and gone with relatively little market impact. Derivatives positioning remains relatively steady as well as OI on options and futures. What we can be sure of is more unexpected volatility will come under Trump’s administration, but right now, the market seems to be in a wait and see mode. This may be a result of macro headwinds pushing against crypto tailwinds or just simple uncertainty, but I suspect it won’t last long past the March expiry. The next catalyst’s will likely come from announcements from other nations as to their own strategic reserves as well as US plans on acquiring more BTC. Other narratives that can drive price in the medium-term include corporate treasury growth as well as macro recovery and global liquidity changes. For those with conviction that prices won’t remain rangebound, current market conditions could be a compelling opportunity to own longer dated volatility structures with convex payouts.

View original post on X here.

AUTHOR(S)