In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Another week of conflict:

– Further seized BTC moved, Gox distribution closer; but more Dec+Mar 85k+ Calls bought.

– BTC questioned 60k, and despite the mid-term buying, IVs continue to drift.

– Multiple Fund buyers of July Calls, only to discover ETF delayed a week+. IV down.

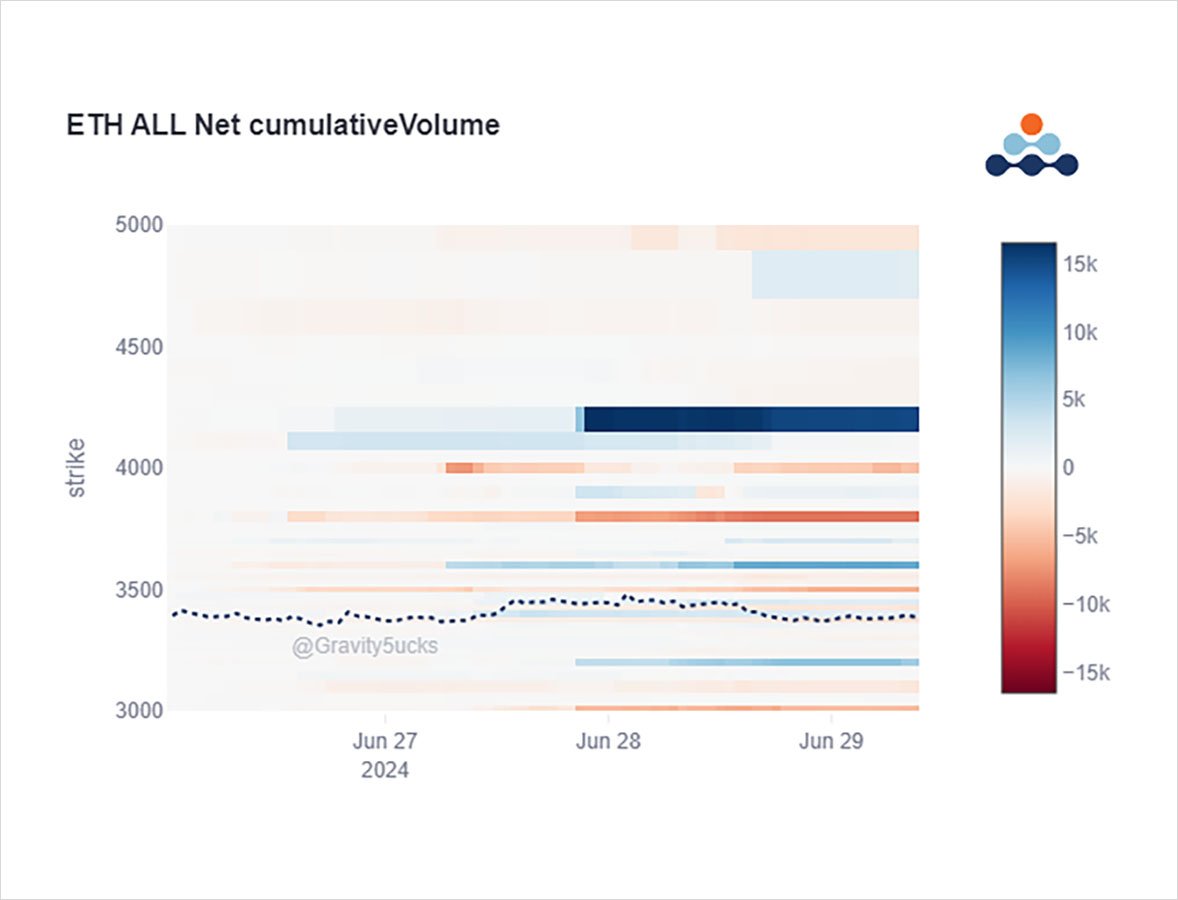

2) Previous expectations from ETH ETF S1 submissions signaled a 4th July Independence Day freedom to trade, and some Funds appeared to target this buying 15k July 4.2k, & July 3.6-4k Calls (+spreads).

But a late SEC admission, while productive, implies 8th July week.

Now Theta.

3) As the mkt awaits the quantum of seized coin sales & Gox distros starting July, making way for possible lower BTC price there has been small Sep Put buying.

But premium+vega weighs heavily towards additional buying Dec+now Mar 85k-120k Calls.

Sellers just laugh at it, for now.

View Twitter thread.

AUTHOR(S)