In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

APAC-Euro flow: 1.5k Nov 72+75k Calls bought.

At US open, as BTC peaked at 69.3k, Nov29 60k Put bought x1k funded by Nov29 80k Call, and Nov15 64k Put bought 1.5k.

ETF outflow. BTC to 66.8k

CME Whale pounced+lifted Nov29 70k Calls.

69K.

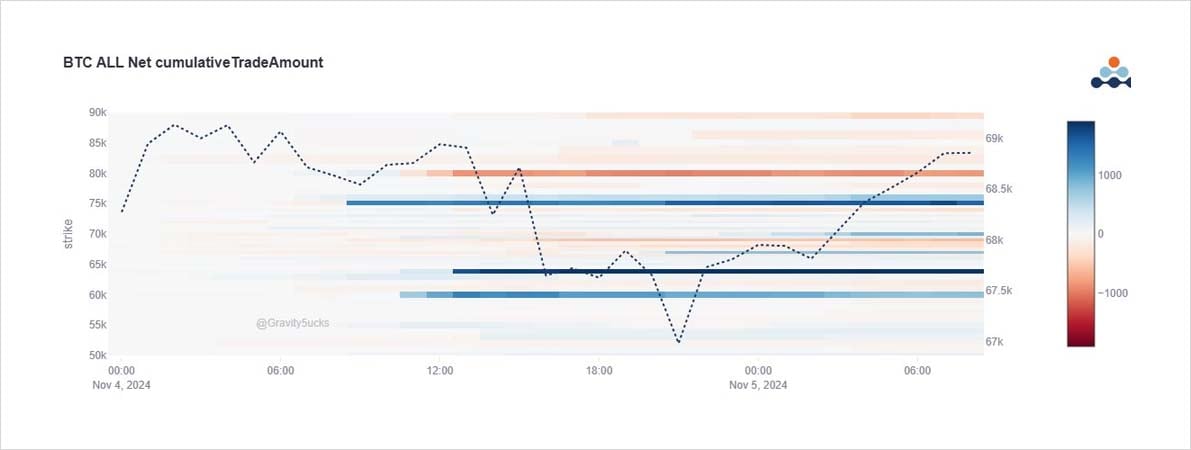

2) Chart shows the Deribit block flows:

Nov15/29 72+75k Call buying $3.5m spent

Nov29 60k Puts funded by selling Nov29 80k Calls.

And Nov15 64k Puts 1.5k ($2.5m spent).

We need deeper blue for CME Nov29 70k x 3.6k [$14.5m spent].

Possible subsequent risk covering Dec 70k Calls.

3) Using Dvol 1month proxy can observe the large lift to the right of the chart from yesterday’s flows.

Interestingly, there was little noticeable covering of the short-vega risk (other than perhaps Dec 70k Calls x500).

An IV drift in last few hours benefitting Short bravery.

View Twitter thread.

AUTHOR(S)