In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Quite a day.

BTC breaches 100k asserting 103.6k ATH.

Call buyers at first add, anticipating further upside, but as Spot stalls, sellers of Dec 95k+110ks hit the tape.

Retrace below 100k remains controlled+orderly, funding+IV drifts lower.

Sudden cascade flush <90k and bounce.

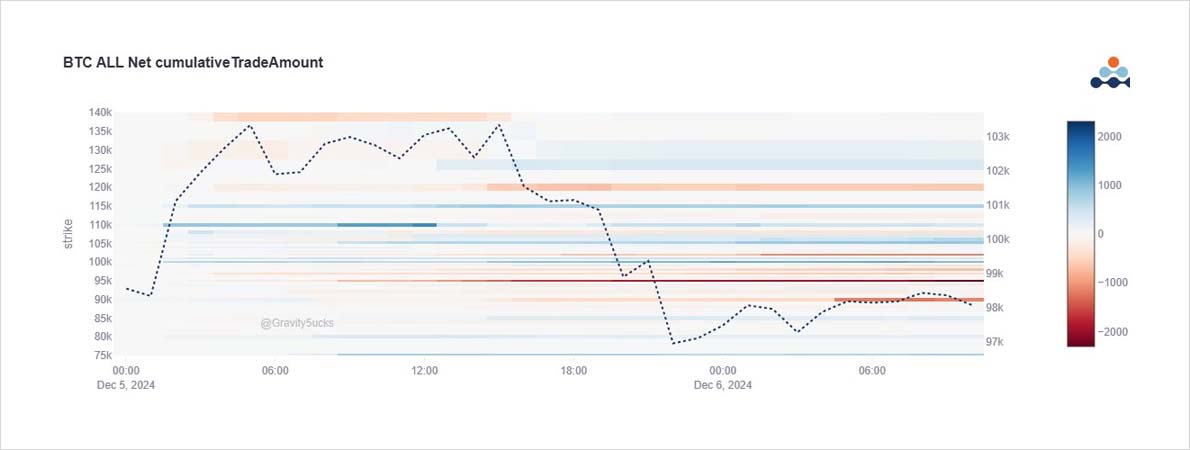

2) Chart shows:

Initial buying of Dec 100+105+110k Calls on the breach of 100k.

Followed by Jan 110-160k Call spreads.

But as Spot stalls >103k, a seller of 95k Calls (odd data shows not a TP), and roll of 95k to 105ks, and then a fresh seller of Dec 110k Calls dominate the size.

3) IV and funding firmed as Spot pushed up, then drifted back as 100k didn’t hold.

A rumored OKEX whale sold BTC post-US hours into a lower liquidity window which set off a violent cascade <90k.

Option engines briefly turned off, IV raised higher, and little traded; BTC bounced.

4) BTC now knows its current bounds: 89k-103.6k.

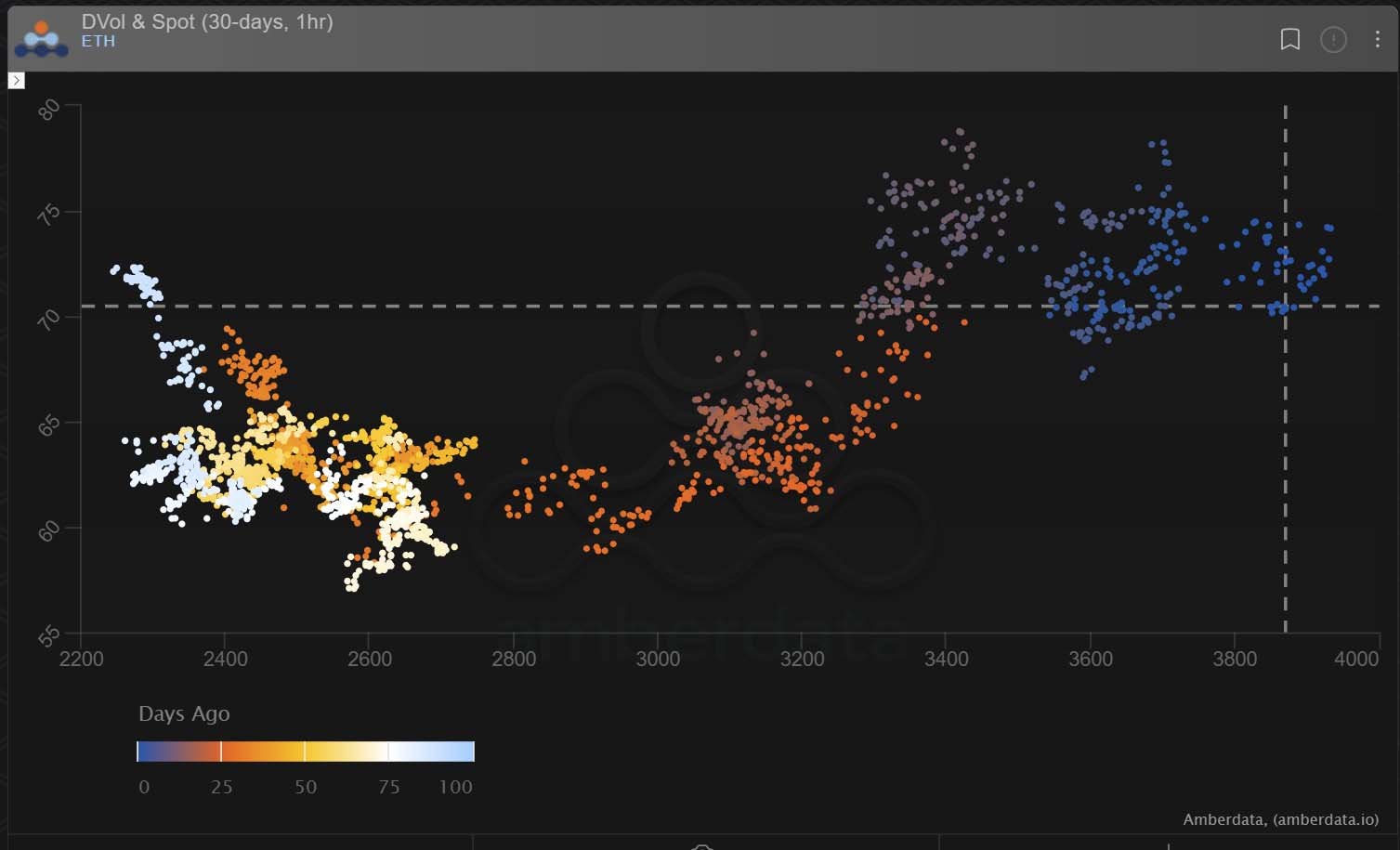

ETH doesn’t arguably yet -within its short-term range- being obviously well below ATHs.

ETH Option Funds are still long Calls (+spreads), and ETH IV has been firming relative to Spot on this rally and sits at >10% premium to BTC.

View Twitter thread.

AUTHOR(S)