In this week’s edition of Option Flows, Tony Stewart is commenting on the market movement from the front to the back end of the curve.

September 21

DSOB action dominates again.

The Long Sep 25.5k Calls TP’d for another $500k, Spot BTC 27150.

Then from the front to back end of the curve where we saw an aggressive buyer of June 2024 65k+85k Calls x2k, the most simplistic explanation being BTC Spot ETF + halving narrative.

2) We highlighted the Sep 25.5k buyer in a previous piece, having bought the Calls when BTC Spot was 25.5k, taking profit at 26.5, re-entering at 26.3 and finally exiting at 27.15k.

With Spot 26.8 as I write this; another great ‘Call’.

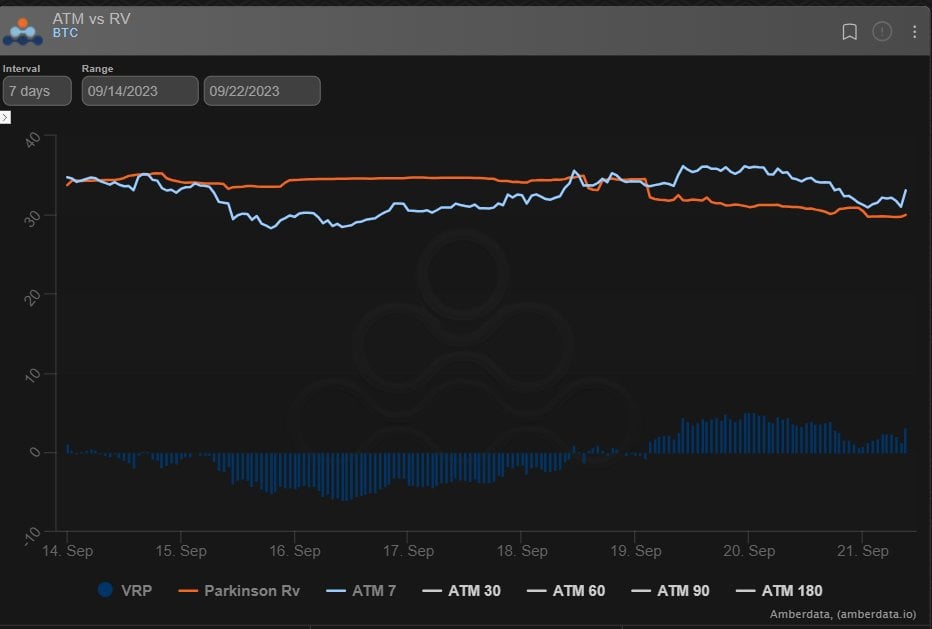

MMs happy to take on Gamma with RV decent.

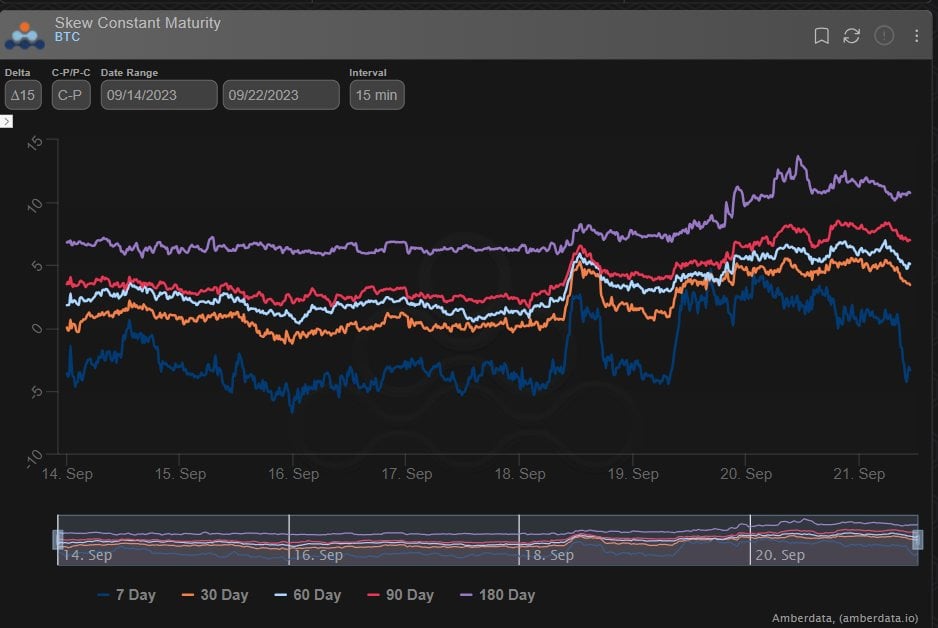

3) Biggest talking point are June 2024 upside Calls.

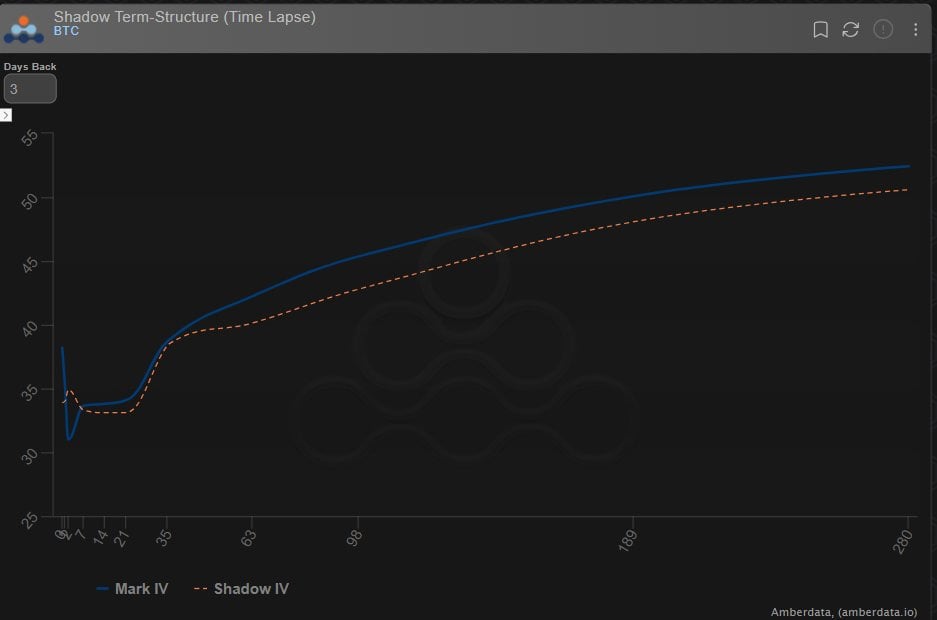

While not huge in size, just 2k total Jun65k+85k Calls, the effective market-order clips into the DSOB lifted the Strikes ~10% from low-to-high, which was perhaps unnecessary; at one point IV retraced 5%.

This lifted Dec+Mar.

4) Speculation could be that this is Spot BTC ETF + Halving related, and that makes the most sense due to the Expiry and high Strikes, but performance can be attained from several methodologies such as convexity and other path dependencies.

Long-term Call-Skew naturally firmed.

5) Despite the buyer of ETH Dec Call Vega in the last published thread, ETH IV has languished.

Now, due to this BTC June Call buyer, and not a deal of mid-term selling (which has been the MM choice to cover) BTC Dvol trades 5% over ETH Dvol (42/37), having just bounced from -7%.

View Twitter thread.

AUTHOR(S)