In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

Near $1bn ETF inflows lift BTC within a whisker of ATH ahead of the US election. But this surge was not convincingly matched by Option flows, with every sort of trade imaginable printing:

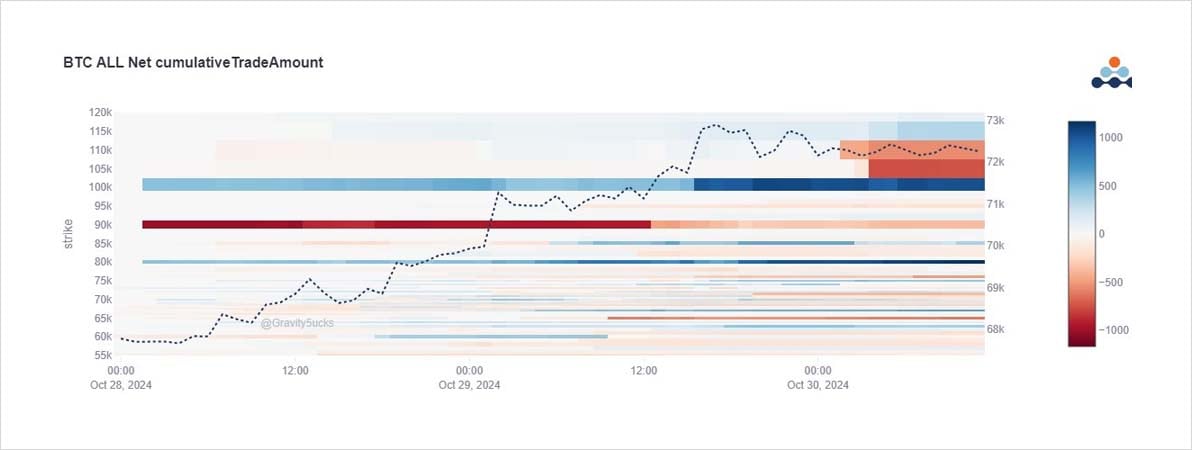

ITM Dec+Mar Calls TPd, Dec OTMs sold, fresh Dec+Mar 85k Call buying, Risk-reversals 2way.

2) The data shows: A large Dec+Mar 80k,90k,100k restructure in bold, Dec+Mar 85k Calls bought, Dec+Mar 60+65k Calls TPd, Dec 105+110k Calls sold, risk-reversals protecting downside, and Puts sold to fund upside; Fast money TPing Nov ITM 68+72k Calls and buying Nov1 74+75k Calls.

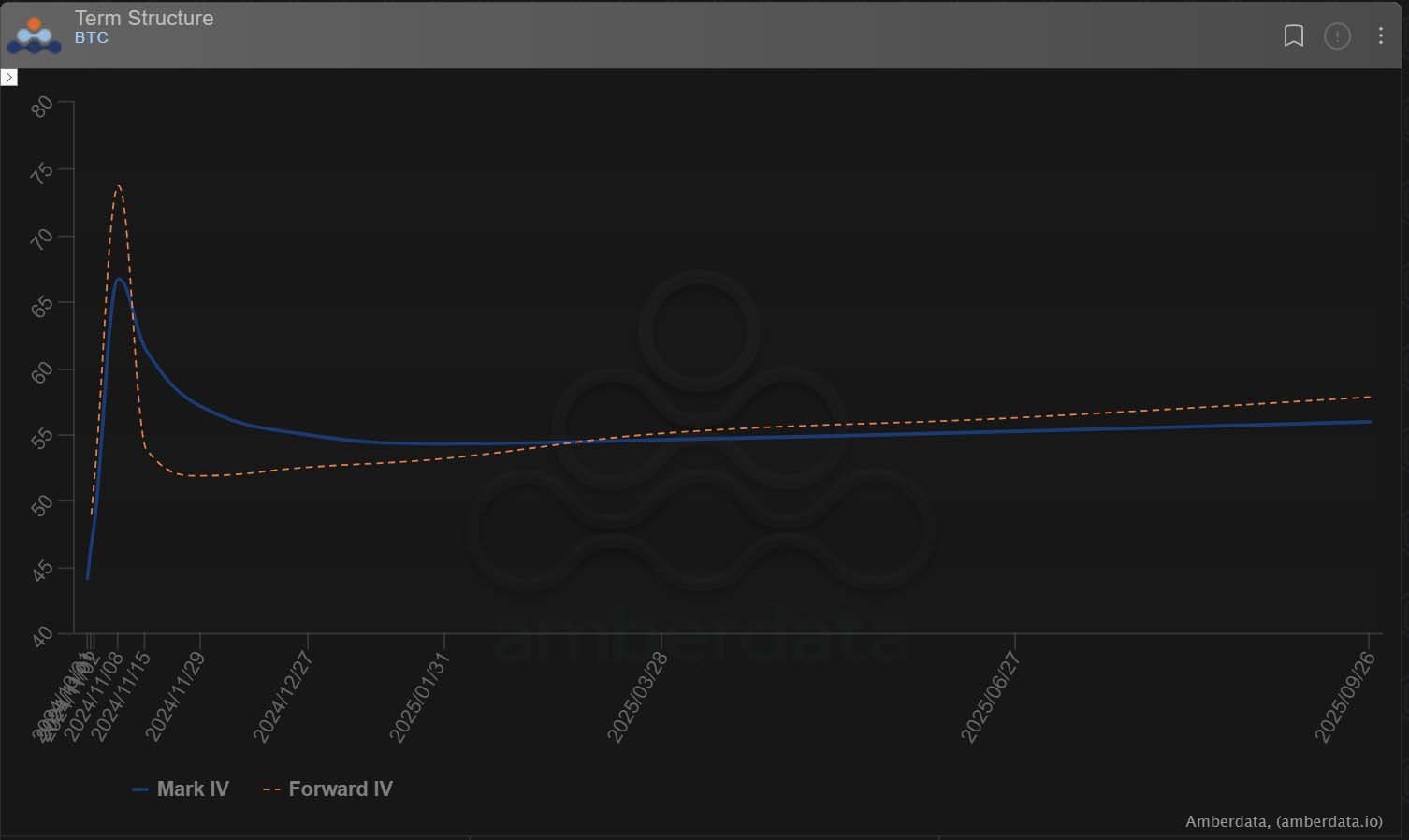

3) Skew is Call positive, but normal; vol has been solid, with a short gamma blip higher on large moves as the heavily discounted Nov1 expiry is exploited.

Ofc the main bump on the structure remains Nov8 Election expiry, only a few days away.

But remember Jan is the inauguration.

View Twitter thread.

AUTHOR(S)