In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

A combination of Mt Gox distribution, ETHE outflows and NDQ fall was too much for the collective Crypto hopium over last couple days.

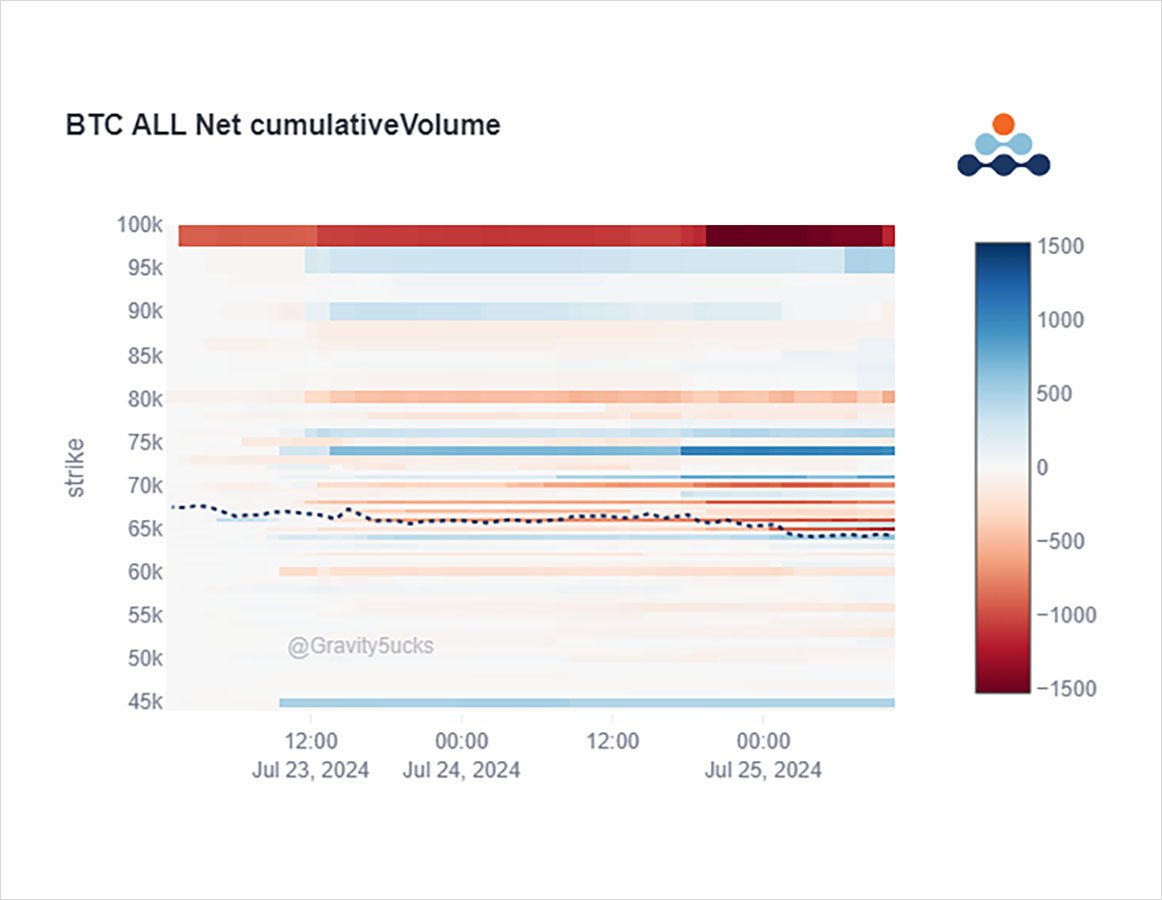

At first BTC held strong; Aug2 Calls bought ahead of the BTC conference.

But then the onslaught.

BTC Option exposure sold. ETH Puts bought.

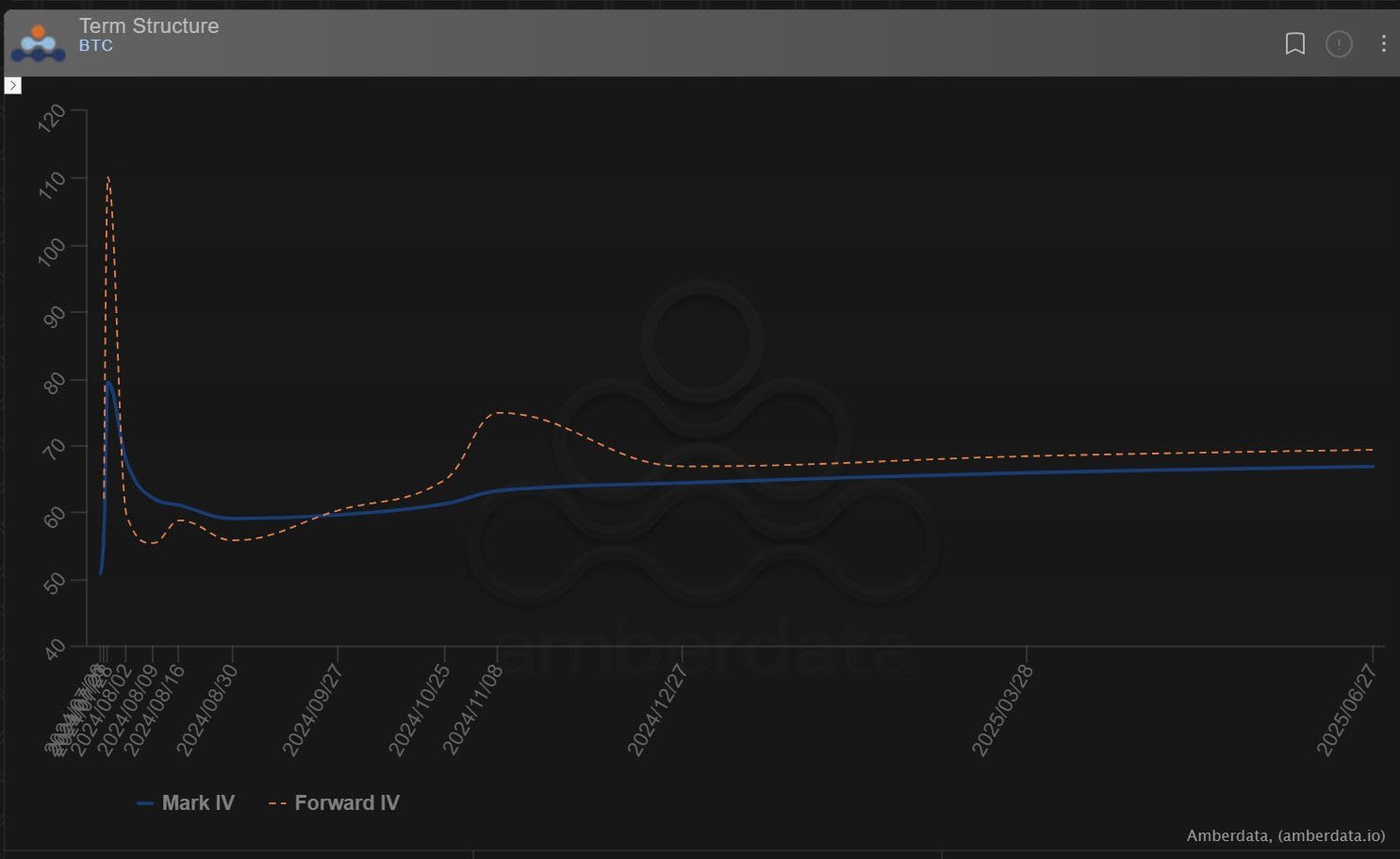

2) Community hope that Trump will signal BTC as a US strategic asset at his anticipated upcoming BTC conference speech has created a blip at the front end of the curve for Aug2 and end of July wknd expiries.

Predominantly Calls bought.

[Nov8 blip centers around the US election.]

3) The long-awaited Mt Gox BTC distributions are being released to creditors. On day1 BTC held strong despite 47k BTC being paid back in kind.

Whether selling of these picked up, or the Biden nominee withdrawal reduced pro-crypto Trump winning chances, or NDQ fall – BTC plunged.

4) As BTC spot fell, one or more Funds reduced their Option exposure in Aug+Sep via selling Aug ATM Strangles and Sep 65k-70k Calls.

At the same time, some of these receipts were swapped into a Dec 65-100k Call spread.

This sold Gamma and kept Dec upside reversing a recent trade.

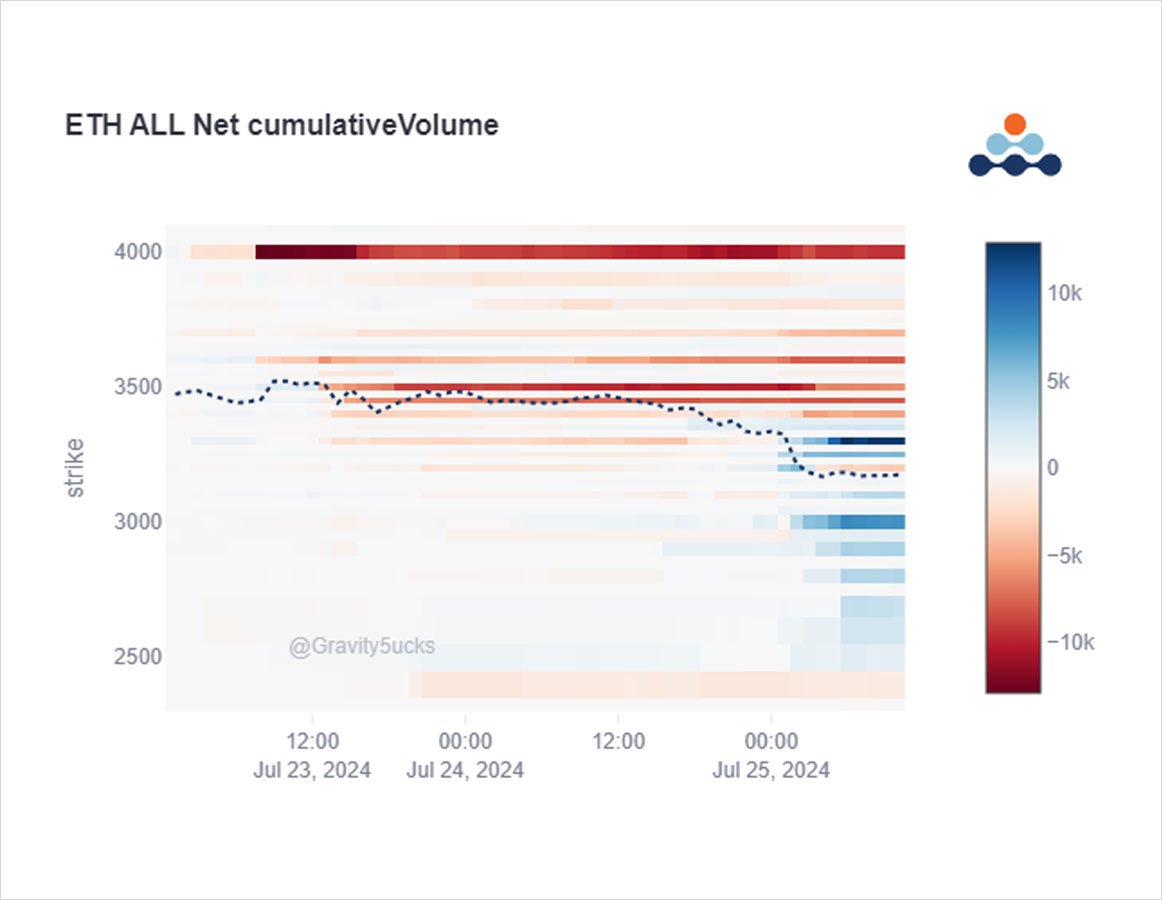

5) At the same time as Gox released, the ETH ETF started trading.

The playbook to follow was similar to what happened when the BTC ETF commenced – ie holders of GBTC coins would sell aggressively.

Strong demand offsetting.

In Options we have seen accumulation of 2dte 3-3.3k Puts.

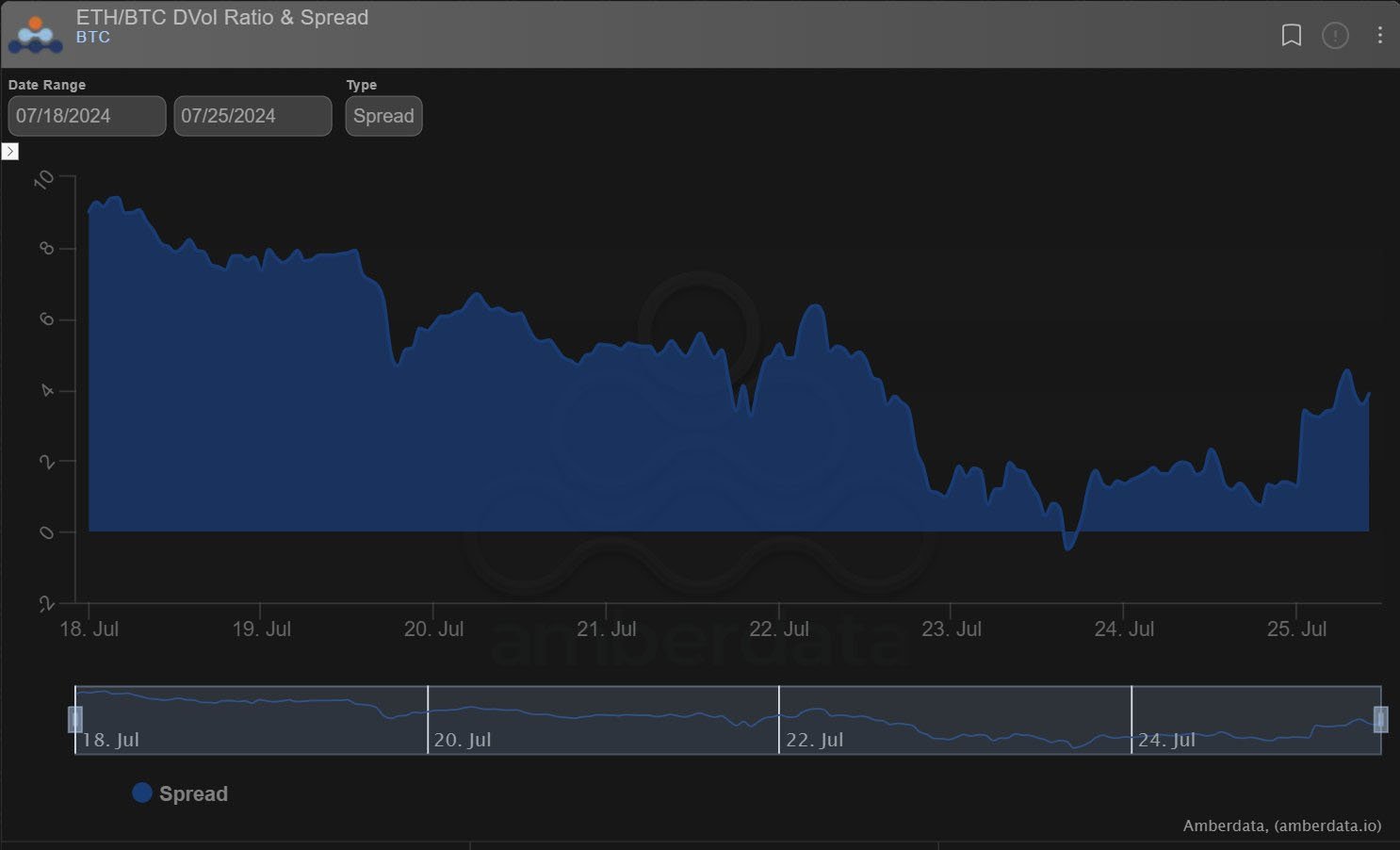

6) Spot-Vol correlation has held on the way down, with the added supply of BTC Aug Strangles+Sep Calls dampening BTC Dvol from 68%-61% on the retrace.

Prior to that BTC optimism had surged BTC Dvol to match a reserved ETH Dvol, but while BTC Dvol has fallen back, ETH has held 65%.

View Twitter thread.

AUTHOR(S)