In this week’s edition of Option Flows, Tony Stewart is commenting on the recent market movements.

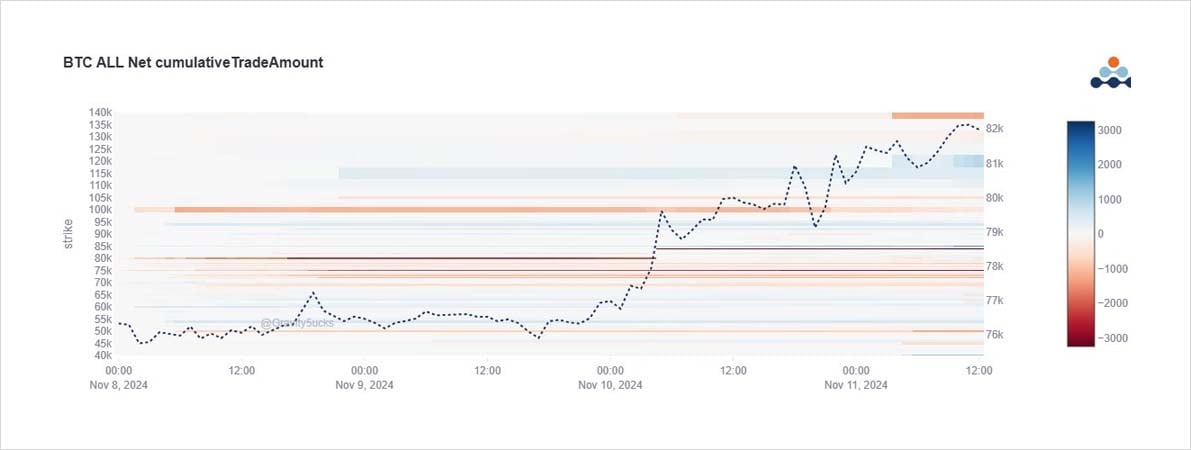

Pre-weekend (BTC 76.5k) saw clips of Nov ITM 68-75k Calls being sold on DSOB, ~2.5k notional; large delta. Later came TP blocks of ~2k Nov29 75-78k Calls.

But then BTC surged on Sat/Sun>80k.

This time, exposure rolled up: Nov29 80k to 1.5x 84k, Nov29 70k Calls to Dec 85k Call.

2) Can observe the ITM ‘red’ Calls sold. Looking closely, overshadowed is the largest single trade, a roll of 2k Nov29 80k Calls to 3k Nov29 84k Calls, flatish premium, increased notional.

Dec 85k Calls have been added.

And today, Jun 85k Straddles and Mar+Jun OTM Call spreads.

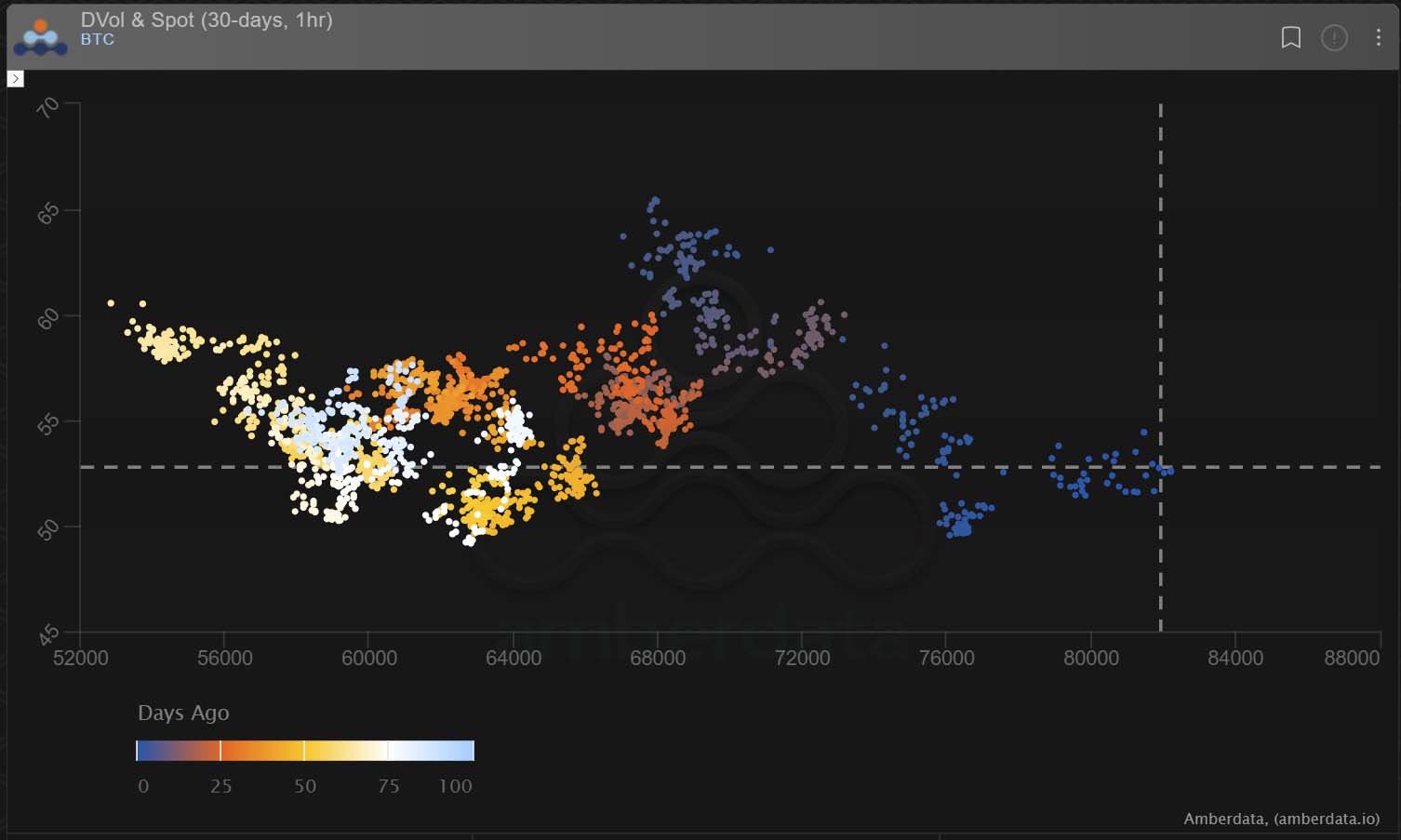

3) Somewhat out of character at an ATH (now >82k), the IVs are still very modest: Dvol 52%.

MMs have and continue to be given enough Gamma to play with. Some US-hour funds have stepped in to buy Mar+Jun, but for the moment the supply has dominated and no large buyer has swept.

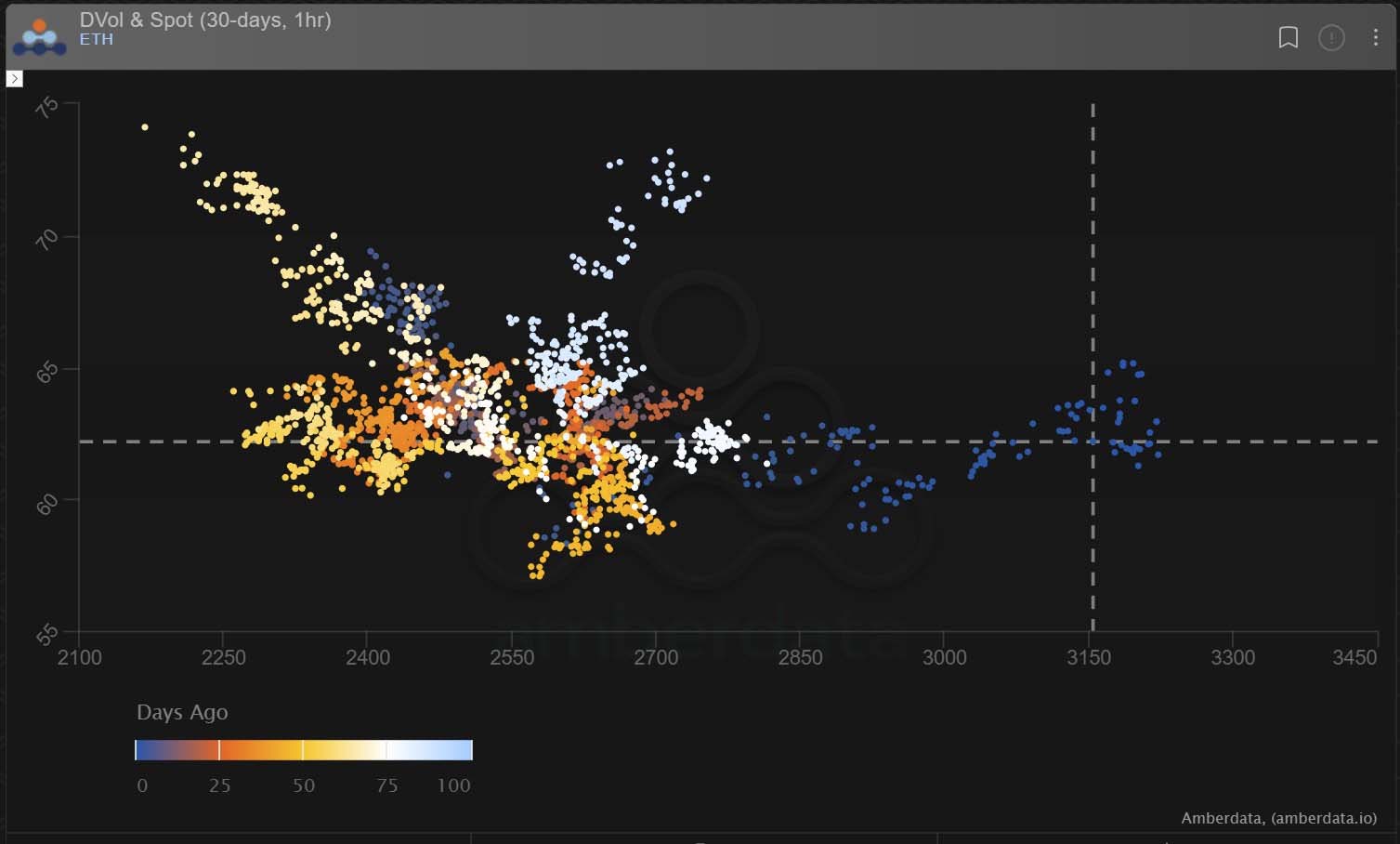

4) ETH IV bounced off the lows during last week’s large Call (+spread) Option buying flows.

Dvol now 62%.

ETH flows were much quieter over the weekend, despite also a large move up in Spot.

The trades put on last week were Dec+Mar, and so early to unwind; certainly no signs yet.

View Twitter thread.

AUTHOR(S)