In this week’s edition of Option Flows, Tony Stewart is commenting on the latest ETH trading development.

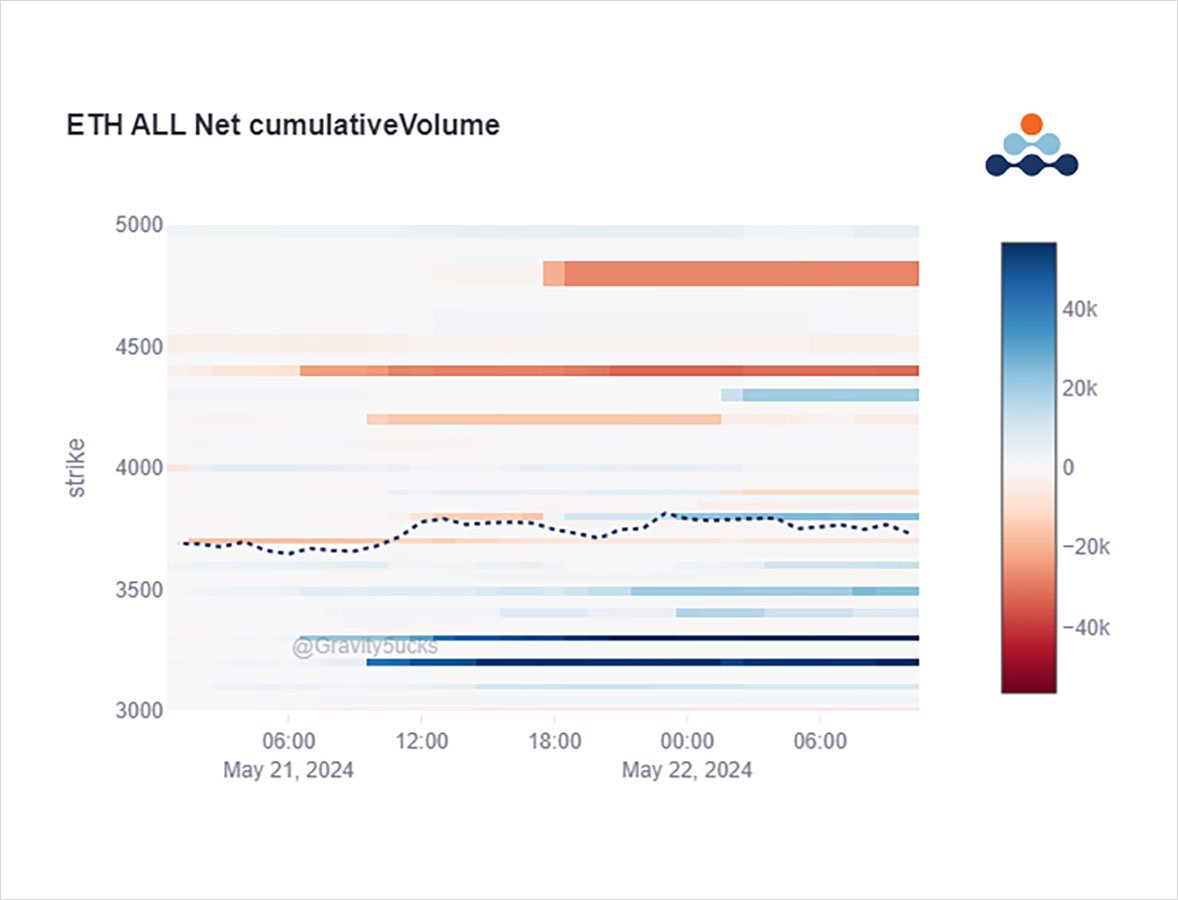

Three separate ETH ETF Fund plays in the last 12hrs:

a) Jun28th 3.8k-4.8k Call spread bought ($6.7m cost)

b) May31st 3.4k Puts bought ($1.6m)

c) May31st 3.8k Straddle bought ($2.6m)

On face value, a) bullish, b) bearish, c) volatility

Clear outcome not transparent.

2) The Jun 3.8k-4.8k Call spread was bought x26k, total spend $6.7m, with a 4:1 payout.

The spread was bought in small clips so as not to impact Vol or Delta, and furthermore the use of the upper Call (4.8k) to fund the primary Call (3.8k) mitigated some Theta+Vega.

3) In the opposite direction, the May31st 3.4k Puts were bought x20k, with $1.6m premium spent.

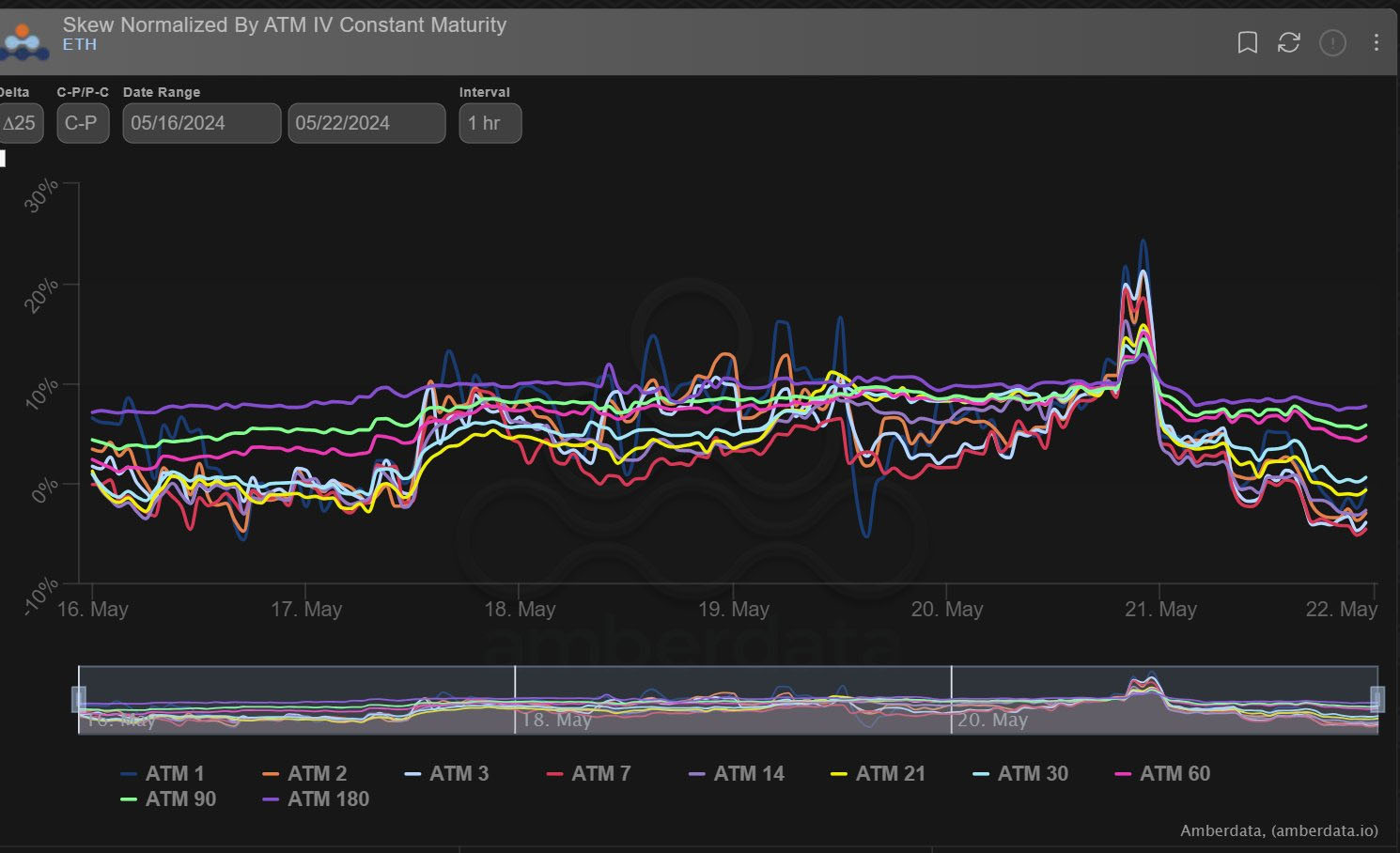

With IV so elevated (the 3.4k Puts currently marked at 95%), there is required a severe shock to the underlying for these to capture value.

This acquisition assisted Put Skew higher.

4) A purchase of the May31st 3.8k Straddle x6k ($2.6m premium) simplistically manifests as an anticipated directional move in either direction.

Again due to elevated IV (88% May31st 3.8k Strike), the move needs to exceed $425 just to break even, but there is a Gamma path ahead.

5) All three trades have acquired optionality ahead of the ETH-ETF clarification.

ETH Dvol is now at a 22% premium to BTC Dvol.

View Twitter thread.

AUTHOR(S)